Dec 14, 2020 | Live Compliance, Medical Billing Software Blog, Partner, Support and Training

There are a few HIPAA items to focus on RIGHT NOW—before the end of 2020!

The U.S. Department of Health and Human Services (HHS) has designated the “Health Insurance Portability and Accountability Act” (HIPAA) as the national standard for protecting the privacy and security of health information (in 1996). This led to the Health Information Technology for Economic and Clinical Health Act (HITECH), which has a provision in it for audits, and the HHS Office for Civil Rights is responsible for carrying out HIPAA audits, and responding to complaints and breaches. Ignoring them is not an option!

A Risk Assessment IS NOT Enough

A risk assessment is only one element of the compliance process. You must also “implement security updates as necessary and correct identified security deficiencies.” In other words, you must act via a Corrective Action Plan (CAP) and follow the required risk assessment process.

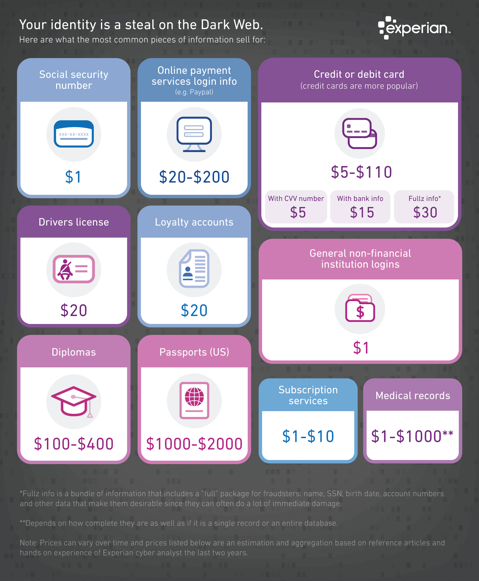

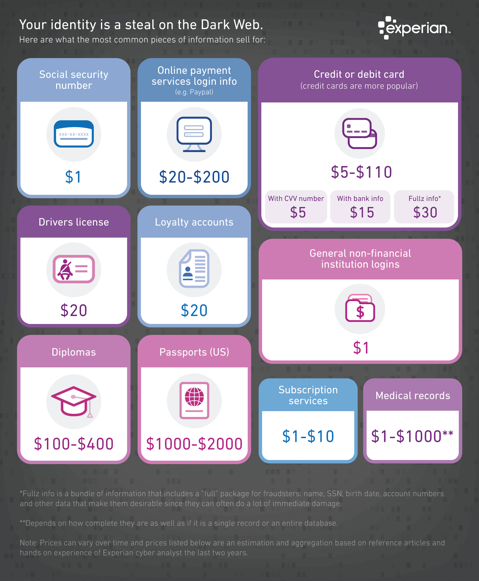

Dark Web

It is no secret that the “Dark Web” is a scary place to lose your information. So, what if it did happen and affected your entire company? Identity thieves get anywhere from $1-$1,000 for medical records, for each instance! So, how can you protect yourself and/or your organization?

Well, data breaches are becoming more common—sometimes which are out of your control—so carefully monitoring where you store and enter your passwords can be extremely beneficial to help minimize the risk of a hack and keeping personal or patient information protected.

One solution for this is the automatic Dark Web monitoring built into the portal of one of EZClaim’s partners, Live Compliance. Their solution helps keep an ‘eye’ on employees whose information was involved in a breach, and suggests next steps to take where the breach was found. Then, it allows your to conduct an accurate and thorough Security Risk Assessment. This is not only required, but is a useful tool to expose potential vulnerabilities, including those that involve password protection.

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

● Reliable and effective compliance

● Completely online, our role-based courses make training easy for remote or in-office employees

● Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location.

● Policies and procedures are curated to fit your organization, ensuring employees are updated on all workstation use and security safeguards in the office, or out. It is updated in real time.

● An electronic document is sent to employees and business associates

So, don’t risk your company’s future, especially when Live Compliance offers a FREE Organization Assessment to help determine your company’s status.

For additional details, call them at 980.999.1585, e-mail them, or visit their website at LiveCompliance.com

[ Article provided by Jim Johnson of Live Compliance ].

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call a representative today at 877.650.0904.

Nov 10, 2020 | Medical Billing Software Blog, Partner, Revenue, Support and Training, Waystar

There are five ‘phases’ in the life cycle of a medical bill: Pre-appointment; Point of care; Claim submission; Insurance payment or denial; and Patient payment. This post will overview each of these phases, and could even be considered to be a “101-level” course on Revenue Cycle Management.

There are five ‘phases’ in the life cycle of a medical bill: Pre-appointment; Point of care; Claim submission; Insurance payment or denial; and Patient payment. This post will overview each of these phases, and could even be considered to be a “101-level” course on Revenue Cycle Management.

With high deductible health plans on the rise, the recent explosion of telehealth appointments due to COVID-19, and many other factors in play, it’s more important than ever for everyone to understand the life cycle of a medical bill, and how the process works. The healthcare revenue cycle is relevant not only to those who work in healthcare, but to the patient, too.

The revenue cycle is the series of processes around healthcare payments—from the time a patient makes an appointment to the time a provider is paid—and everything in between. One way to think of it is in terms of the life cycle of a medical bill. Although there are many ways this process can play out, this post will lay out a common example below:

1. Pre-appointment

For most general care, the first stage of the revenue cycle begins when a patient contacts a provider to set up their appointment. Generally this is when relevant patient information will begin to be collected for the eventual bill, referred to on the financial side of healthcare as a claim.

At this point a provider will determine whether the appointment and procedure will need prior authorization from an insurance company (referred to as the payer). Also, the electronic health record (EHR) used to help generate the claim is created, and will begin to accumulate further detail as the provider sends an eligibility inquiry to check into the patient’s insurance coverage.

2. Point of care

The next step in the process begins when the patient arrives for their appointment. This could include when a patient arrives for an initial consultation, an outpatient procedure, or for a follow-up exam. This could also include a Telehealth appointment.

At any of these events, the provider may charge an up-front cost. One example of this is a co-pay, which is the set amount patients pay after their deductible (if they are insured), however, there are other kinds of payments that fall into this category, too.

3. Claim submission

After the point of care, the provider completes and submits a claim with the appropriate codes to the payer. In order to accomplish that, billing staff must collect all necessary documentation and attach it to the claim. After submitting the claim to the payer, the provider’s team will monitor whether a claim has been been accepted, rejected, or denied.

[ Note: Medical coding refers to the clerical process of translating steps in the patient experience with reference numbers. The codes are normally based on medical documentation, such as a doctor’s notes or laboratory results. These explain to a payer how a patient was diagnosed and treated, and why. This information helps the payer decide how much of an encounter is covered under any given insurance plan, and therefore how much the payer will pay. ]

4. Insurance payment or denial

Once the payer receives the claim, they ensure it contains complete information and agrees with provider and patient records. If there is an error, the claim will be rejected outright and the provider will have to submit a corrected claim.

The payer then begins the review process, referred to as adjudication. Payers evaluate claims for accurate coding and documentation, medical necessity, appropriate authorization, and more. Through this process, the payer decides their financial obligation. Any factor could cause the payer to deny the claim.

If the claim is approved, the payer submits payment to the provider with information explaining details of their decision. If the claim is denied, the provider will need to determine if the original needs to be corrected, or if it makes more sense to appeal the payer’s decision.

Following adjudication, the payer will send an explanation of benefits (EOB) to the patient. This EOB will provide a breakdown of how the patient’s coverage matched up to the charges attached to their care. It is not a billing statement, but it does show what the provider charged the payer, what portion insurance covers, and how much the patient is responsible for.

5. Patient payment

The next phase occurs when the provider sends the patient a statement for their portion of financial responsibility. This stage occurs once the provider and payer have agreed on the details of the claim, what has been paid, and what is still owed.

The last step occurs when a patient pays the balance that they owe the provider for their care. Depending on the amount, the patient may be able pay it all at once, or they might need to work with the provider on a payment plan.

The above example represents one way the lie cycle of a medical bill can play out. Some of the ‘phases’ are often repeated. Because of the complexity of healthcare payments and the parties involved, there is not always a ‘straight line’ from patient care to complete payment. That’s why we call it the revenue cycle, and there are companies that provide systems for its management.

One of EZClaim’s partners, Waystar, aims to simplify and unify healthcare payments. Their technology automates many parts of the billing process laid out above, so it takes less time and energy for providers and their teams, and is more transparent for patients (Click here to learn more about how Waystar automates manual tasks and streamlines workflows.) When the revenue cycle is operating at its most efficient, providers can focus their resources on improving patient care—and that’s a better way forward for everyone!

For more information of how Waystar works together with EZClaim, click here.

[ Article and image provided by Waystar ]

———————————-

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support, and can help improve medical billing revenues. To learn more, visit their website, e-mail them at sales@ezclaim.com, or call a representative today at 877.650.0904.

Nov 10, 2020 | Alpha II, BillFlash, Claims, collections, Denied Claims, EZClaim Premier, HIPAA, Medical Billing Software Blog, Revenue, Support and Training

It IS POSSIBLE to improve medical billing revenues, and here are a few ways to do just that.

Healthcare practitioners, whether established or just starting out, have many overwhelming tasks: Managing a practice; Seeing patients; Working to staying up-to-date on administrative tasks; The whole host of compliance at the federal, state, and local level; and Overseeing the billing.

One of these that can lead to loss of revenue is not properly managing the medical billing, which can also lead to HIPAA fines and rejected claims. However, there is a solution: a medical billing system that balances the budget and optimizes revenues of medical practice.

EZClaim, an expert in the medical billing software market since 1997, provides a solution that improves the efficiency of an office’s billing process in many ways. The following are the primary reasons.

Reduce Coding Errors

Medical procedures become codes, codes become claims, and claims become revenue. Any error in this process can make claims to be denied, your workload can be increased, and revenue can be lost. To help in avoiding errors, it is essential to use billing software that offers the easiest implementation and access to descriptive diagnosis and treatment codes. EZClaim’s medical billing solution offers ease-of-use in coding, billing, and strong partnerships with Clearinghouses which act as an additional ‘safety net’ for catching errors.

Administrative Support

Most medical practices are a small team of people tackling a wide range of tasks, so when one cannot understand the function of the billing software, accessing reliable support is very important. EZClaim prides itself on having dedicated support experts available, and that was how the company was established. Founder and President Al Nagy has said, since day one, “We are a support company that happens to sell medical billing software.”

Maintain Industry Compliance

It is important to recognize that industry compliance and a practice’s revenue go hand-in-hand. Filing and batching inaccurate and non-HIPAA compliant claims can often be traced back to an outdated healthcare revenue management system. Conquering these tasks requires a focus on multiple fronts: A properly trained billing team, clear office procedures, patient payment policies, and a reliable medical billing company. These are all ways to help buttress against non-compliance and rejected claims.

Streamline Workflow

Recently, a study was done that showed almost 80% of medical bills contain errors. These incorrect medical claims often end up as lost revenue originally, not to mention the additional cost of resubmissions and collections. One of the best ways to resolve this problem for your practice is to make use of both well-trained, experienced billers and coders, combined with a competent medical billing solution that aids in catching these errors. EZClaim software features a library of standard validation, the ability to add custom validation, and integrates with Alpha II for full claim scrubbing.

Follow up

Errors will and do occur, so establishing a system for follow-up on all denials will close the loop and protect against lost revenue. Being consistent with the follow-up process, and having a medical billing solution that tracks these things will help close that gap.

Collections

Finally, probably the most important aspect that optimizes a practice’s revenue is to get paid. Portals and payment collection systems definitely help with this, but having collections integrated into the medical billing system is, of course, the best. EZClaim has pain-free payment processing integrated into their solution, called EZClaimPay. It solves all the problems associated with payment processing: Bank deposits, reconciliation, statements, changing fees, and ‘finger-pointing’ when there is a problem. EZClaimPay’s robust platform will greatly increase a practice’s collections success, and improve their revenue.

———————————-

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support, and can help improve medical billing revenues. To learn more, visit their website, e-mail them at sales@ezclaim.com, or call a representative today at 877.650.0904.

[ Photo credit: Studioarz ]

Sep 10, 2020 | AMBA National Conference, Medical Billing Software Blog, Support and Training

EZClaim is always looking for ways to help our medical billing clients improve. In an effort to further that mission, this month we are kicking off the first in a series called, “What’s Current in Coding.” In this series, we will highlight coding topics, events, webinars, and more, all with the aim of keeping you current in medical billing and coding.

This month our focus came from two articles on coding sourced from the AMBA Newsletter that we feel are hot topics of the industry: “Coding for Group Visits” and the “Telehealth Coding Guide.”

Below you will find full articles and source links.

ARTICLE 1: “Coding for Group Visits”

Many physicians are interested in providing group medical visits. Whether the drop-in group medical appointment (DIGMA), chronic care health clinic (CCHC) or other model is delivered, the coding and billing of these services raise questions about codes and payment policies.

While past instruction on coding for group visits often indicated that physicians should report code 99499 for unlisted evaluation and management services, using this code requires that documentation is sent with the claim to identify the service(s) provided and leaves valuing of the service in the hands of the payer.

No official payment or coding rules have been published by Medicare. However, the question of “the most appropriate CPT code to submit when billing for a documented face-to-face evaluation and management (E/M) service performed in the course of a shared medical appointment, the context of which is educational”, was sent to the Centers for Medicare and Medicaid Services (CMS) with a request for an official response. The request further clarified, “In other words, is Medicare payment for CPT code 99213, or other similar evaluation and management codes, dependent upon the service being provided in a private exam room or can these codes be billed if the identical service is provided in front of other patients in the course of a shared medical appointment?”

The response from CMS was, “…under existing CPT codes and Medicare rules, a physician could furnish a medically necessary face-to-face E/M visit (CPT code 99213 or similar code depending on level of complexity) to a patient that is observed by other patients. From a payment perspective, there is no prohibition on group members observing while a physician provides a service to another beneficiary.” The letter went on to state that any activities of the group (including group counseling activities) should not impact the level of code reported for the individual patient.

Some private payers have instructed physicians to bill an office visit (99201-99215) based on the entire group visit. For compliance purposes, we recommend that you ask for these instructions in writing and keep them on file as you would any other advice from a payer.

Where each individual patient is provided a medically necessary, one-on-one encounter, in addition to the time in the group discussions, there should be no problem in billing for the visit based solely on the documented services provided in a direct one-on-one encounter.

If your group visits include the services of nutritionists or a behavioral health specialist, contact payers to determine if that portion of the group visit can be directly billed by the non-physician provider. This typically would include codes for medical nutrition therapy (97804) or health and behavior intervention (96153).

Other codes that may be applicable are the codes for education and training for patient self-management involving a standardized curriculum (98961-98962). Neither these codes nor medical nutrition or behavioral health therapy are billed by physicians. Physicians must use evaluation and management codes to report these services.

Code 99078 describes physician educational services in a group. Again, it is necessary to contact the payer to verify that coverage of this service is a payable benefit.

As with many services, coding for group visits requires that billing and coding staff do preliminary work with payers to identify desired coding applications.

Source: https://www.aafp.org/family-physician/practice-and-career/getting-paid/coding/group-visits.html

ARTICLE 2: “Telehealth Coding Guide”

There’s nothing more frustrating than rendering a service and not being paid. Nuanced coding rules are difficult to understand, and physicians aren’t taught this information in medical school.

Still, health care is a business. As business owners, physicians need to know how they’re paid, including what codes to use, what modifiers to append, and what details to document. Brushing up on common coding mistakes helps avoid costly recoupments and denials. We’ve asked several coding experts to provide their best advice on how physicians can maintain compliance and collect all of the revenue to which they’re entitled.

In part 1 of our two-part coding guide, we focused on coding for Telehealth and other forms of remote patient care — important codes for physician practices’ short-term survival as the U.S. continues to grapple with the COVID-19 pandemic.

Telephone services

In times of social distancing, telephone services have become a practical way to improve patient access and prevent the spread of COVID-19. Telephone services are ideal for straightforward problems (e.g., simple rash, asymptomatic cough, medication refills) that require a minimum of five minutes of medical discussion, says Toni Elhoms, CCS, CPC, chief executive officer of Alpha Coding Experts, LLC, in Orlando, Florida. Consider the following codes that Medicare accepts during the current public health emergency (PHE). Commercial payers may accept these codes, as well. Note that once the PHE has concluded, Medicare may only accept G2012 (virtual check-in) for telephone services.

Elhoms provides these tips to ensure compliance:

- Document verbal consent, including patient acknowledgment and acceptance of any copayments or coinsurance amounts due.

- Only count time spent on the phone engaging in medical discussion with the patient or caregiver. Do not report these codes for conversations lasting less than five minutes.

- Clearly document what was discussed, as well as the outcome of the conversation (e.g., medications prescribed, referrals to specialists, additional steps for the patient to take).

- Don’t report these codes when the telephone service ends with a decision to see the patient in 24 hours or the next available appointment.

- Don’t report these codes when the telephone service relates to a related E/M service performed within the previous seven days or within the postoperative period of a previously completed procedure.

- Only provide 99441-99443 and 98966-98968 for established patients. During the PHE, Medicare permits providers to bill G2012 for new and established patients.

‘The best way to operationalize these codes is to set up an edit in the practice management system that pends claims for a manual review to determine whether and which services are ultimately billable, Elhoms says.

Telehealth services

In the last few months, providers have adopted Telehealth to improve patient access and generate revenue during COVID-19. Among the services physicians can render via Telehealth to patients with Medicare during the current PHE are Medicare annual wellness visits, new and established patient office visits, prolonged services, smoking, and tobacco cessation counseling, annual depression and alcohol screenings, advanced care planning, and more. Medicare covers more than 200 services via Telehealth, many of which were added for temporary coverage during the current PHE. Commercial payer coverage of these services may vary, and it’s best to check with individual payers, Elhoms says.

Elhoms provides these tips for billing Telehealth services:

- Pay attention to audio-only vs. audio-visual requirements. Medicare requires the use of audio-visual technology for certain Telehealth services and permits audio-only for others. Commercial payers also may have specific requirements. For example, physicians can render a Telehealth visit for advanced care planning using audio-only, but they must use audio-visual technology for a new patient telehealth office visit.

- Don’t render Medicare’s Initial Preventive Physical Exam via Telehealth. Medicare does not permit it.

- Document verbal consent for Telehealth, including patient acceptance of any copayments or coinsurance amounts due.

- Use place of service (POS) code 11 and modifier -95 when billing Medicare. Note that commercial payers may require a different POS code (e.g., POS 2 or POS “other”) and modifier.

- Document, document, document. Physicians need to prove they met all of the code requirements even when rendering the service via Telehealth, Elhoms says. “Don’t pull in a problem list if you didn’t treat or manage all of those problems,” she adds. “Physicians need to link the diagnosis with the assessment and treatment plan. That’s imperative.” One caveat is that during the current PHE, physicians can bill 99201-99215 rendered via Telehealth based on time or medical decision-making. “The total time in direct medical discussion with the patient is going to be critical,” Elhoms says.

“The best advice I can give anyone doing Telehealth right now is to watch the CMS [Centers for Medicare & Medicaid Services] and commercial payer websites pretty much on a daily basis,” says Rhonda Buckholtz, CPC, CPMA, owner of Coding and Reimbursement Experts in Pittsburgh, Pennsylvania. “The coding of services changes constantly, and practices really need to be careful.”

Online digital E/M services

Though online digital E/M services are relatively new, they also can help practices increase patient access during COVID-19. Here’s how it works: An established patient initiates a conversation through a HIPAA-compliant secure platform (e.g., electronic health record portals, secure email, secure texting). A physician or other qualified health care professional reviews the query, as well as any pertinent data and records. Then they develop a management plan and subsequently communicate that plan to the patient or their caregiver through online, telephone, email or other digitally supported communication.

Elhoms provides these tips to maintain compliance:

- Use these codes when physicians or other qualified health care professionals make a clinical decision that would otherwise occur during an office visit. Do not use them for scheduling appointments or nonevaluative communication of test results.

- Use these codes only for established patients.

- Do not use these codes for fewer than five minutes of E/M services.

- Document verbal consent, including patient acknowledgment and acceptance of any copayments or coinsurance amounts due.

- Do not report these codes when the online digital E/M service ends with a decision to see the patient in 24 hours or the next available urgent visit appointment.

- Do not report these codes when the online digital E/M service relates to a related E/M service performed within the previous seven days or within the postoperative period of a previously completed procedure.

Promoting these services is often the biggest barrier, says Elhoms, who suggests putting up signs letting patients know they can access their provider electronically for non-urgent medical issues.

Remote patient monitoring

Remote patient monitoring (RPM) is a relatively easy way for physicians to keep tabs on patients without requiring them to come into the office. Medicare covers RPM for patients with one or more acute or chronic conditions, and commercial payer coverage may vary. During the PHE, physicians can initiate RPM on new and established patients. Normally, Medicare permits it only for established patients.

RPM consists of two forms: monitoring data through either a non-manual or manual data transfer, says Jim Collins, CPC, CCC, a consultant at CardiologyCoder.com, Inc. in Saratoga Springs, New York.

For example, physicians can remotely monitor a patient’s pulse oximetry, weight, blood pressure or respiratory flow rate using a device that transmits daily recordings or programmed alerts. Physicians can purchase them directly from manufacturers or patients can purchase the devices themselves. Collins says patients should look for Bluetooth-enabled devices or ones that include a built-in Global System for Mobile Communications (GSM) transmitter. The former requires an Internet connection, and the latter automatically transmits data to an internet cloud service through an encrypted bandwidth. Physicians can bill for the initial setup, cost of the device itself (when applicable), and data monitoring.

Another example is the self-measured blood pressure monitoring. When patients supply their own blood pressure device that a physician calibrates, physicians may be able to bill for patient education, device calibration, reviewing the data that the patient provides and communicating a treatment plan to the patient or caregiver.

“Monitoring physiologic data on a regular basis substantially reduces hospitalizations, trips to the emergency room and exacerbations of chronic conditions,” says Collins. “It can also be a huge chunk of revenue.”

Collins provides these tips for compliant RPM billing:

- Document patient consent. Patients must opt-in for these services.

- Document total time spent rendering these services to support time-based requirements.

- Know when these codes are appropriate. It’s unclear whether Medicare will pay physicians for monitoring physiologic data derived from internal devices (devices placed within the patient’s body) or data derived from wearable fitness devices.

- Only bill 99457 when the provider renders at least 20 minutes of live, interactive communication with the patient or caregiver. “It’s not going to be medically necessary to spend 20 minutes every month on every patient,” Collins says. “Patients could go for several months without physicians needing to do anything for them.”

Source: https://www.medicaleconomics.com/view/telehealth-coding-guide

“What’s Current in Coding?” is brought to you by EZClaim, a medical billing solution. To find out if it may work for you, either schedule a one-on-one consultation with their sales team, or download a FREE TRIAL to check it out the software yourself. For additional information right now, view their web site, send an e-mail to sales@ezclaim.com, or contact the sales team at 877.650.0904.

Jun 10, 2020 | Partner, Support and Training

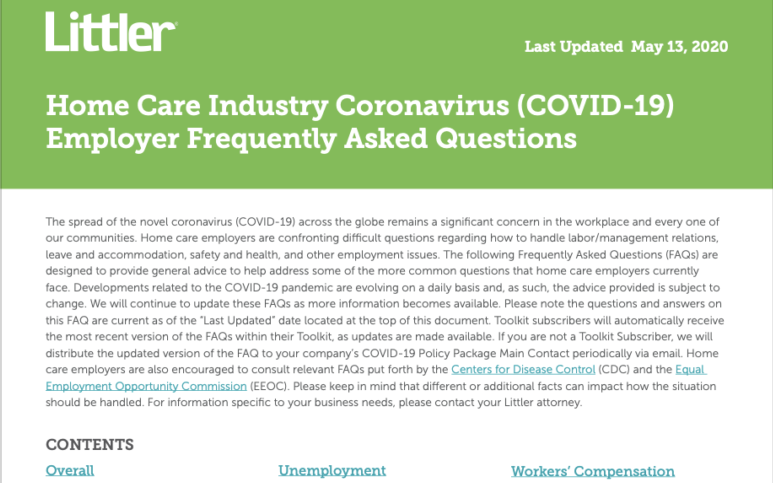

Home care employers are confronting difficult questions regarding how to handle labor and management relations, leave and accommodation, safety and health, and other employment issues.

Littler, a law firm that focuses on labor and employment law, has produced an extensive home care industry FAQ document (41 pages) called “Home Care Industry Coronavirus (COVID-19) Employer Frequently Asked Questions.“ It provides general advice to help address some of the more common questions that home care employers currently face due to the COVID-19 pandemic.

CONTENTS:

• Client/Patient Privacy/HIPAA

• FFCRA

• CARES Act (Including PPP)

• Unemployment

• ADA Considerations

• Leaves of Absence

• Wage & Hour

• WARN Act

• Workers’ Compensation

• Health and Safety

• Labor/Management Relations

• Employee Relations

Litter also has a specific page on their website that provides a useful resource for employers to learn how COVID-19 is affecting various aspects of employment law, and how different jurisdictions are addressing the outbreak. Because the COVID-19 situation is dynamic, with new governmental measures each day, Litter suggests that employers consult with counsel for the latest developments and updated guidance on this topic. Click here to view their resource page.

This information was sent to us by one of EZClaim’s premier partners, AxisCare, who provides a home care system designed with the workflow of a private duty agency in mind. AxisCare provides a scheduling software solution that features a GPS mobile app, automatic invoicing, billing and payroll integrations, custom forms, custom reporting, and more. For more details about their all-in-one home care software solution, view their website.

Since developments related to the COVID-19 pandemic are evolving on a daily basis, EZClaim is continuing to discover resources that will assist its clients in understanding these developments. As always, we are here to support your medical billing needs and hope you are safe and well in this challenging time.

For general information about EZClaim, or details about the features of our medical billing software, visit our website.

Click here to download the PDF

Jan 13, 2020 | Live Compliance, Partner, Support and Training

Lost laptop = $65,000 fine. Have you ever read such headlines and doubted whether a small billing company or independent physician practice would ever face such seemingly insurmountable penalties?

What happened? Most recently, an ambulance company out of Georgia paid $65,000 for a lost laptop that happened to be unencrypted. More often, small businesses and practices are taking work outside of the office, so this kind of violation is one that can occur to anyone.

The laptop contained 500 individual’s Protected Health Information. As a result of the investigation, the ambulance company will undergo a Technical Security Risk Assessment and is required to adopt a Corrective Action Plan. This is a great example of why it is important and mandatory to conduct a Technical and Objective Security Risk Assessment at least annually on all devices.

Following the investigation, it was uncovered that West Georgia Ambulance never provided a security awareness and training program for its employees! You and your workforce are your first line of defense. This reinforces the importance that both you, and your employees must understand what a breach is and the breach notification requirements! It was later revealed that West Georgia Ambulance failed to implement HIPAA Security Rule policies and procedures as well.

What can you do? As we have stressed before, it is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, the Billing Company or independent physician practice, suspects a breach or complaint you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action. Again, if you haven’t completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

What we do is keep this from ever being a worry for you! In fact, we have a 100% audit pass rate since 2010! For example, Live Compliance has easy to understand HIPAA breach notification training. We perform your security risk assessment and manage all your requirements, including business associates, in a clean, organized cloud-based portal.

Don’t risk your company’s future, especially when we are offering a FREE Organization Assessment to help determine your company’s status.

It’s easy, call us at (980) 999-1585, email me or visit LiveCompliance.com

Keep in mind, a business associate is a ‘person’ or ‘entity’. This means there is no billing company too small or too large to comply with the Federal HIPAA regulations.

LEARN MORE

If you are enjoyed this article about the lost laptop as well as the informative content we’re providing and have a specific topic you would like to see covered, we would love to hear from you! Please feel free to send along your ideas via email to sales@ezclaim.com.

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing: