Sep 10, 2020 | Live Compliance, Medical Billing Software Blog, Partner

So, what’s the best path for HIPAA Compliance? It’s risk analysis.

The HIPAA Security Rule requires covered entities and business associates to ensure the confidentiality, integrity, and availability of all electronic protected health information (ePHI) that it creates, receives, maintains, or transmits.

Conducting a risk analysis—which is an accurate and thorough assessment of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of the ePHI held by an organization—is not only a Security Rule requirement, but is also fundamental to identifying and implementing safeguards that comply with and carry out the Security Rule standards and implementation specifications.

However, despite this long-standing HIPAA requirement, OCR investigations frequently find that organizations lack sufficient understanding of where all of the ePHI entrusted to their care is located.

Although the Security Rule does not require it, creating and maintaining an up-to-date, information technology (IT) asset inventory could be a useful tool in assisting in the development of a comprehensive, enterprise-wide risk analysis, to help organizations understand all of the places that ePHI may be stored within their environment, and improve their HIPAA Security Rule compliance.

How Can You Manage This at Your Organization?

You can try to manage this by yourself, but it would probably be more efficient and superior in implementation if you used an expert. A partner of EZClaim, Live Compliance, is one of those experts. They can help you easily manage, maintain, and assign your hardware and technical inventory to remote or in-office employees.

Do You Have Additional Questions?

If you have any questions about the best path for HIPPA compliance, contact Jim Johnson at Live Compliance (E-mail: jim@livecompliance.com; Phone: (980) 999-1585).

For more on EZClaim’s products, either schedule a one-on-one consultation with their sales team, or download a FREE TRIAL to check it out the software yourself. For additional information right now, view their web site, send an e-mail to sales@ezclaim.com, or contact the sales team at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance ]

Sep 10, 2020 | AMBA National Conference, Medical Billing Software Blog, Support and Training

EZClaim is always looking for ways to help our medical billing clients improve. In an effort to further that mission, this month we are kicking off the first in a series called, “What’s Current in Coding.” In this series, we will highlight coding topics, events, webinars, and more, all with the aim of keeping you current in medical billing and coding.

This month our focus came from two articles on coding sourced from the AMBA Newsletter that we feel are hot topics of the industry: “Coding for Group Visits” and the “Telehealth Coding Guide.”

Below you will find full articles and source links.

ARTICLE 1: “Coding for Group Visits”

Many physicians are interested in providing group medical visits. Whether the drop-in group medical appointment (DIGMA), chronic care health clinic (CCHC) or other model is delivered, the coding and billing of these services raise questions about codes and payment policies.

While past instruction on coding for group visits often indicated that physicians should report code 99499 for unlisted evaluation and management services, using this code requires that documentation is sent with the claim to identify the service(s) provided and leaves valuing of the service in the hands of the payer.

No official payment or coding rules have been published by Medicare. However, the question of “the most appropriate CPT code to submit when billing for a documented face-to-face evaluation and management (E/M) service performed in the course of a shared medical appointment, the context of which is educational”, was sent to the Centers for Medicare and Medicaid Services (CMS) with a request for an official response. The request further clarified, “In other words, is Medicare payment for CPT code 99213, or other similar evaluation and management codes, dependent upon the service being provided in a private exam room or can these codes be billed if the identical service is provided in front of other patients in the course of a shared medical appointment?”

The response from CMS was, “…under existing CPT codes and Medicare rules, a physician could furnish a medically necessary face-to-face E/M visit (CPT code 99213 or similar code depending on level of complexity) to a patient that is observed by other patients. From a payment perspective, there is no prohibition on group members observing while a physician provides a service to another beneficiary.” The letter went on to state that any activities of the group (including group counseling activities) should not impact the level of code reported for the individual patient.

Some private payers have instructed physicians to bill an office visit (99201-99215) based on the entire group visit. For compliance purposes, we recommend that you ask for these instructions in writing and keep them on file as you would any other advice from a payer.

Where each individual patient is provided a medically necessary, one-on-one encounter, in addition to the time in the group discussions, there should be no problem in billing for the visit based solely on the documented services provided in a direct one-on-one encounter.

If your group visits include the services of nutritionists or a behavioral health specialist, contact payers to determine if that portion of the group visit can be directly billed by the non-physician provider. This typically would include codes for medical nutrition therapy (97804) or health and behavior intervention (96153).

Other codes that may be applicable are the codes for education and training for patient self-management involving a standardized curriculum (98961-98962). Neither these codes nor medical nutrition or behavioral health therapy are billed by physicians. Physicians must use evaluation and management codes to report these services.

Code 99078 describes physician educational services in a group. Again, it is necessary to contact the payer to verify that coverage of this service is a payable benefit.

As with many services, coding for group visits requires that billing and coding staff do preliminary work with payers to identify desired coding applications.

Source: https://www.aafp.org/family-physician/practice-and-career/getting-paid/coding/group-visits.html

ARTICLE 2: “Telehealth Coding Guide”

There’s nothing more frustrating than rendering a service and not being paid. Nuanced coding rules are difficult to understand, and physicians aren’t taught this information in medical school.

Still, health care is a business. As business owners, physicians need to know how they’re paid, including what codes to use, what modifiers to append, and what details to document. Brushing up on common coding mistakes helps avoid costly recoupments and denials. We’ve asked several coding experts to provide their best advice on how physicians can maintain compliance and collect all of the revenue to which they’re entitled.

In part 1 of our two-part coding guide, we focused on coding for Telehealth and other forms of remote patient care — important codes for physician practices’ short-term survival as the U.S. continues to grapple with the COVID-19 pandemic.

Telephone services

In times of social distancing, telephone services have become a practical way to improve patient access and prevent the spread of COVID-19. Telephone services are ideal for straightforward problems (e.g., simple rash, asymptomatic cough, medication refills) that require a minimum of five minutes of medical discussion, says Toni Elhoms, CCS, CPC, chief executive officer of Alpha Coding Experts, LLC, in Orlando, Florida. Consider the following codes that Medicare accepts during the current public health emergency (PHE). Commercial payers may accept these codes, as well. Note that once the PHE has concluded, Medicare may only accept G2012 (virtual check-in) for telephone services.

Elhoms provides these tips to ensure compliance:

- Document verbal consent, including patient acknowledgment and acceptance of any copayments or coinsurance amounts due.

- Only count time spent on the phone engaging in medical discussion with the patient or caregiver. Do not report these codes for conversations lasting less than five minutes.

- Clearly document what was discussed, as well as the outcome of the conversation (e.g., medications prescribed, referrals to specialists, additional steps for the patient to take).

- Don’t report these codes when the telephone service ends with a decision to see the patient in 24 hours or the next available appointment.

- Don’t report these codes when the telephone service relates to a related E/M service performed within the previous seven days or within the postoperative period of a previously completed procedure.

- Only provide 99441-99443 and 98966-98968 for established patients. During the PHE, Medicare permits providers to bill G2012 for new and established patients.

‘The best way to operationalize these codes is to set up an edit in the practice management system that pends claims for a manual review to determine whether and which services are ultimately billable, Elhoms says.

Telehealth services

In the last few months, providers have adopted Telehealth to improve patient access and generate revenue during COVID-19. Among the services physicians can render via Telehealth to patients with Medicare during the current PHE are Medicare annual wellness visits, new and established patient office visits, prolonged services, smoking, and tobacco cessation counseling, annual depression and alcohol screenings, advanced care planning, and more. Medicare covers more than 200 services via Telehealth, many of which were added for temporary coverage during the current PHE. Commercial payer coverage of these services may vary, and it’s best to check with individual payers, Elhoms says.

Elhoms provides these tips for billing Telehealth services:

- Pay attention to audio-only vs. audio-visual requirements. Medicare requires the use of audio-visual technology for certain Telehealth services and permits audio-only for others. Commercial payers also may have specific requirements. For example, physicians can render a Telehealth visit for advanced care planning using audio-only, but they must use audio-visual technology for a new patient telehealth office visit.

- Don’t render Medicare’s Initial Preventive Physical Exam via Telehealth. Medicare does not permit it.

- Document verbal consent for Telehealth, including patient acceptance of any copayments or coinsurance amounts due.

- Use place of service (POS) code 11 and modifier -95 when billing Medicare. Note that commercial payers may require a different POS code (e.g., POS 2 or POS “other”) and modifier.

- Document, document, document. Physicians need to prove they met all of the code requirements even when rendering the service via Telehealth, Elhoms says. “Don’t pull in a problem list if you didn’t treat or manage all of those problems,” she adds. “Physicians need to link the diagnosis with the assessment and treatment plan. That’s imperative.” One caveat is that during the current PHE, physicians can bill 99201-99215 rendered via Telehealth based on time or medical decision-making. “The total time in direct medical discussion with the patient is going to be critical,” Elhoms says.

“The best advice I can give anyone doing Telehealth right now is to watch the CMS [Centers for Medicare & Medicaid Services] and commercial payer websites pretty much on a daily basis,” says Rhonda Buckholtz, CPC, CPMA, owner of Coding and Reimbursement Experts in Pittsburgh, Pennsylvania. “The coding of services changes constantly, and practices really need to be careful.”

Online digital E/M services

Though online digital E/M services are relatively new, they also can help practices increase patient access during COVID-19. Here’s how it works: An established patient initiates a conversation through a HIPAA-compliant secure platform (e.g., electronic health record portals, secure email, secure texting). A physician or other qualified health care professional reviews the query, as well as any pertinent data and records. Then they develop a management plan and subsequently communicate that plan to the patient or their caregiver through online, telephone, email or other digitally supported communication.

Elhoms provides these tips to maintain compliance:

- Use these codes when physicians or other qualified health care professionals make a clinical decision that would otherwise occur during an office visit. Do not use them for scheduling appointments or nonevaluative communication of test results.

- Use these codes only for established patients.

- Do not use these codes for fewer than five minutes of E/M services.

- Document verbal consent, including patient acknowledgment and acceptance of any copayments or coinsurance amounts due.

- Do not report these codes when the online digital E/M service ends with a decision to see the patient in 24 hours or the next available urgent visit appointment.

- Do not report these codes when the online digital E/M service relates to a related E/M service performed within the previous seven days or within the postoperative period of a previously completed procedure.

Promoting these services is often the biggest barrier, says Elhoms, who suggests putting up signs letting patients know they can access their provider electronically for non-urgent medical issues.

Remote patient monitoring

Remote patient monitoring (RPM) is a relatively easy way for physicians to keep tabs on patients without requiring them to come into the office. Medicare covers RPM for patients with one or more acute or chronic conditions, and commercial payer coverage may vary. During the PHE, physicians can initiate RPM on new and established patients. Normally, Medicare permits it only for established patients.

RPM consists of two forms: monitoring data through either a non-manual or manual data transfer, says Jim Collins, CPC, CCC, a consultant at CardiologyCoder.com, Inc. in Saratoga Springs, New York.

For example, physicians can remotely monitor a patient’s pulse oximetry, weight, blood pressure or respiratory flow rate using a device that transmits daily recordings or programmed alerts. Physicians can purchase them directly from manufacturers or patients can purchase the devices themselves. Collins says patients should look for Bluetooth-enabled devices or ones that include a built-in Global System for Mobile Communications (GSM) transmitter. The former requires an Internet connection, and the latter automatically transmits data to an internet cloud service through an encrypted bandwidth. Physicians can bill for the initial setup, cost of the device itself (when applicable), and data monitoring.

Another example is the self-measured blood pressure monitoring. When patients supply their own blood pressure device that a physician calibrates, physicians may be able to bill for patient education, device calibration, reviewing the data that the patient provides and communicating a treatment plan to the patient or caregiver.

“Monitoring physiologic data on a regular basis substantially reduces hospitalizations, trips to the emergency room and exacerbations of chronic conditions,” says Collins. “It can also be a huge chunk of revenue.”

Collins provides these tips for compliant RPM billing:

- Document patient consent. Patients must opt-in for these services.

- Document total time spent rendering these services to support time-based requirements.

- Know when these codes are appropriate. It’s unclear whether Medicare will pay physicians for monitoring physiologic data derived from internal devices (devices placed within the patient’s body) or data derived from wearable fitness devices.

- Only bill 99457 when the provider renders at least 20 minutes of live, interactive communication with the patient or caregiver. “It’s not going to be medically necessary to spend 20 minutes every month on every patient,” Collins says. “Patients could go for several months without physicians needing to do anything for them.”

Source: https://www.medicaleconomics.com/view/telehealth-coding-guide

“What’s Current in Coding?” is brought to you by EZClaim, a medical billing solution. To find out if it may work for you, either schedule a one-on-one consultation with their sales team, or download a FREE TRIAL to check it out the software yourself. For additional information right now, view their web site, send an e-mail to sales@ezclaim.com, or contact the sales team at 877.650.0904.

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner

In the wake of the COVID-19 pandemic, Telehealth adoption has exploded, and there are six revenue cycle metrics to track.

Many patients are prohibited or reluctant to venture out for on-site care. The combination of relaxed regulations and expanded payment parity for appointments has made virtual meetings easier and more attractive for providers, who are turning to these technologies to stay engaged with patients—and maintain cashflow. Dr. Robert McLean, a former president of the American College of Physicians, recently said, “this crisis has forced us to change how we deliver health care more in 20 days than we had in 20 years.”

A new industry report predicts that the number of Telehealth visits in the US will surpass one billion by the end of the year, and speculates that nearly half of those visits will be related to COVID-19. At Waystar, we have been closely monitoring claim trends and are seeing this growth firsthand. In fact, the volume of Telehealth claims on the Waystar platform has grown by more than 100 times since mid-March. On two particular days in late April, they accounted for more than 15% of our total daily claim volume. Before COVID-19, they would have accounted for less than one percent!

For many providers, this shift will require new revenue cycle strategies to meet growing patient demand without overwhelming clinicians and administrative teams—or already strained operating budgets. It’s important to remember this is still very much an evolving care delivery model with the opportunity for errors on the part of both payers, providers, and administrative staff. For this reason, revenue cycle professionals should diligently monitor claims to ensure proper adjudication, identify learning opportunities, and uncover areas for operational improvement.

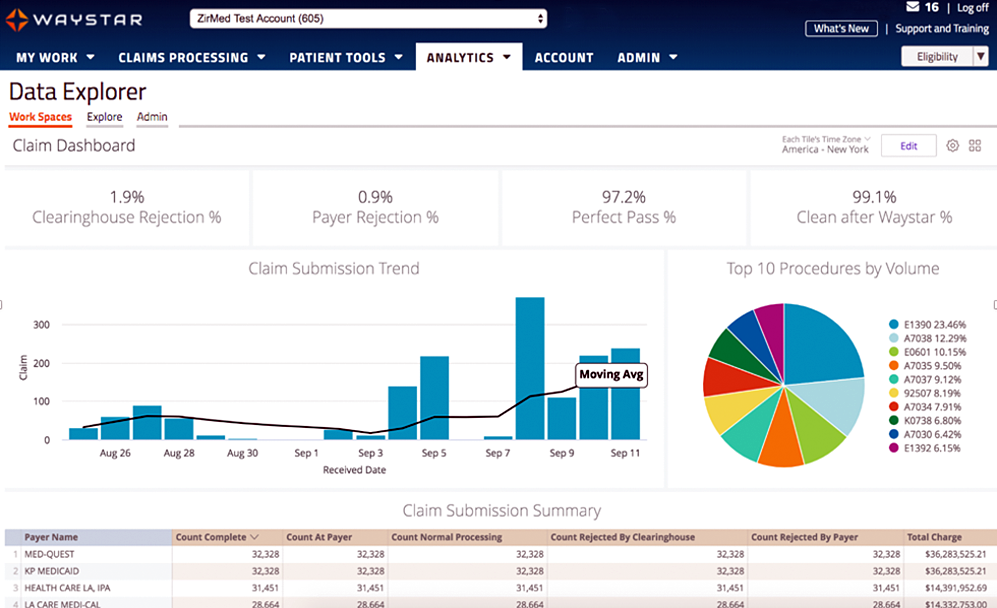

Below, we’ve listed six core Telehealth-related metrics you should regularly track to ensure billing accuracy, maximize payer reimbursement, and reduce claim rejections and denials. For more on how to best navigate the evolving telemedicine landscape, check out our resource hub here.

To report on Telehealth-related claims, you’ll first need to identify and isolate claims containing Telehealth procedure codes. See CMS’ Telehealth code list to identify the specific procedure codes and modifiers that apply to your organization.

Payer Analysis:

1. Payer Telehealth claim rejections by volume and/or billed amount

2. Payer Telehealth claim denials by volume and/or billed amount

If your Telehealth claims are being denied or rejected, do you know which specific payers are doing so at the highest rate? Drill down to discover the specific reason codes payers are attaching to rejections and denials so you can better understand payer-specific rules and avoid these oversights in the future. In some cases, you may identify trends that warrant a call to the payer to correct.

Provider Analysis:

3. Telehealth claim volume by the provider

Review this claim volume by individual provider. If you notice providers within your organization generating a much lower volume of Telehealth claims than peers, perhaps they could benefit from additional training on Telehealth technology and use cases.

Ensuring Billing Accuracy:

4. Telehealth claim rejections by biller/team

5. Telehealth claim denials by biller/team

Are certain billing personnel or teams producing higher denial or rejection rates than others? Keep a close eye on these trends and remember most of this is new for everyone. If some team members are seeing more rejections or denials than they should, it could be a great opportunity to hold training and collaborate on strategies for success.

Maximizing Reimbursement:

6. Telehealth claim volume by procedure code

Which Telehealth codes are you using? Each code reimburses at a different rate, so choosing the wrong ones could leave money on the table. Be sure to read up on CMS’ requirements (check out their fact sheet and code list) to ensure you’re choosing the appropriate code(s) on each Telehealth claim.

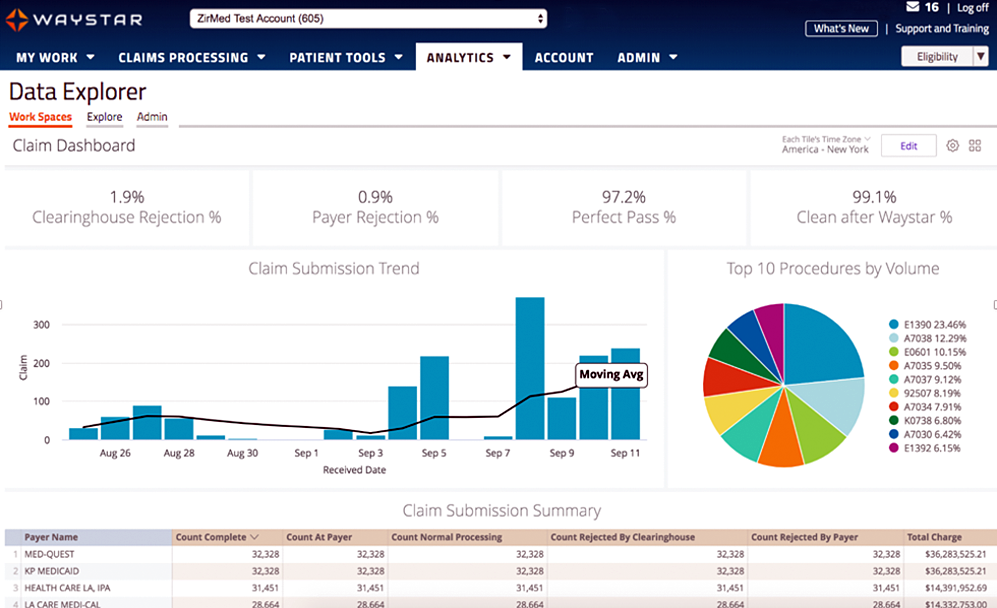

Waystar Analytics

You have all the data you need to drive informed decision making and improve financial performance—you just need the right analytics tool in your corner. Our new Waystar Analytics solution offers a pre-built Telehealth dashboard that can help you easily interpret, share all the metrics above, and track these revenue cycle metrics. Click here to learn more about Waystar Analytics and how it can deliver the insights you need during this time of transition.

[ By Waystar ]

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner, Trizetto Partner Solutions

A group of senators introduced the “Health Care PRICE Transparency Act” in a move to empower patients to lower their healthcare costs.

On a basic level, the Act will require all medical facilities to post payer-negotiated rates for all shoppable services, so the patient can find the most inexpensive way to take care of their medical needs. This legislation will give Americans the chance to see the actual costs of their healthcare visits, which in theory, will increase competition and lower healthcare costs for everyone.

The added transparency of the Act will bring more accountability and competition to the healthcare industry, and gives American’s more control over their healthcare costs. However, if you are a medical practice, a hospital, or a member of the medical billing community, you need to know how you can best respond.

• “What is this procedure going to cost?”: There is going to be mounting pressure on practitioners, medical billers, and hospitals to have answers for the cost of procedures. Jeff Leibach, a director of Guidehouse’s healthcare strategic solutions team, says that “regardless of the legal fate of the final rule, hospitals need to be prepared for more price transparency in the future.” So, to get in front of this—and help you compete against your competitors—you should be prepared with both what it will cost for individual services and procedures, as well as, a ‘value statement’ on why it will cost what you are charging.

• Prepare to Comply or Cover the Costs: As it stands now, the legislation is moving towards technology assisting with the billing transparency. This will aid the patients to better understand the cost of services. This is a ‘clarion call’ for you to begin preparing for this reality or you will struggle with being fined and potentially publicly shamed in publications for being offenders. We recommend starting to comply NOW before the deadline ‘sneaks up’ on you.

• Use It To Improve: Currently, healthcare practices are, in many cases, already working at capacity. The added effort of defining cost and selling procedures are enough to make some healthcare facilities put this off until it is too late. Yet, while many may be considering accepting the fines and fees associated with non-compliance, we advise using this as an opportunity to improve—to better establish your medical practice’s services and promote your ability to be proactive to change. Getting ahead of the coming ‘wave’ of consumer expectations of healthcare will be a benefit.

• Seek Out Vendors That Can Assist: The changes that are coming for individual practices and healthcare providers can be overwhelming, and potentially it might just be more than what an IT team or private practice can handle. Forward-thinking billing departments should be investing in software vendors that can help fill that gap. EZClaim is a medical billing software company that partners with Trizetto to provide a tool called, Patient Responsibility Estimation (PRE). This tool assists in clarifying costs to consumers by providing a cheap and fast way for them to pay for out-of-pocket costs. [ Click here to learn more about how EZClaim can help you ].

It is clear that the expectations of consumers are changing, and the wave of medical transparency is on its way. Accepting it, preparing for it, and using vendor software to help overcome it, can be the difference of your practice avoiding fines and fees. For those forward-thinking and proactive practices who want to learn about how EZClaim can help, e-mail one of their sales representatives, go to their website for more details, or download a FREE 30-day trial today!

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog

So, it looks that there will be a lot new for E/M coding (Evaluation and Management) in 2021, and practices should start to get ready for it.

Well, it seems the only constant in the world of medical billing changes, and 2020 would only compliment that cliché. While the chaos of COVID-19 forced many unexpected changes—how you see your patients and bill for services—a bigger change is in the works for 2021. This change will complement the “Patients Over Paperwork” initiative from CMS and the AMA, which has been developed to eliminate “Note Bloat.” So, since the new year will roll out changes to E/M visits, now is the time to make sure that all parties are prepared for this long overdue and welcome change to medical billing.

Evaluation and management services have been long overdue for an overhaul. The 1995/1997 guidelines were in place well before electronic medical records, and with the growth of EMR’s, the process to document for a specific level required a lot of tedious, unnecessary documentation. (A cursory look at some of the proposed updates for E/M CPT coding and documentation requirements will verify that!)

PROPOSED CHANGES:

• History and Examination: While the elements of history and examination that are pertinent to a specific visit shall be recorded, they will no longer be used to ‘score’ the level billed

• Code Selection: It will be based on MDM or time

• Medical Decision Making: It will still utilize the CMS Table of Risk. However, the wording and explanations are being updated to provide more concise language. For instance, definitions will now be included to clearly identify subjective wording like “self-limited and stable chronic illness.” The clinical example will likely be removed, and the terms are more clearly defined. We will see this same type of clarification in the MDM table. For example, the 2021 guidelines will specify that the amount and/or complexity of data to be reviewed must also include analysis.

• Time-based Code Selection: It will also be easier. The guidelines will give specific amounts of time rather than the generic estimate that we currently see attached to E/M codes. Another major advantage to the codes selected based on time, they will now include non-face-to-face services. There will also be additional add on codes—in 15-minute increments—if the time has been exceeded for the 99205 or 99215.

While changes are daunting, this change will be rewarding from a documentation standpoint. So, if you need help with training your team on these new updates, there are FREE videos available on the AMA website, or you can enlist the help of an independent consultant like RCM Insight.

One way of keeping up with these changes is to use EZClaim’s medical billing software, which is continually updated. For more details, visit their website, ezclaim.com, contact them, or just give them a call at 877.650.0904.

[ Written by Stephanie Cremeans of EZClaim ]