May 12, 2022 | Health eFilings, Partner

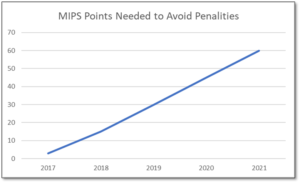

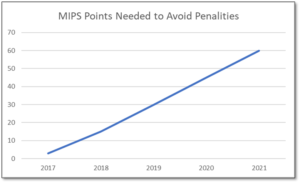

MIPS is a point-based program and understanding how to earn MIPS points is critical to avoid a 9% penalty. The MIPS program continues to change and evolve each year as it meets the goals laid out in the MACRA law and carried out by CMS. Since the program was implemented in 2017 the points threshold to avoid a penalty has grown from 3 to 60 out of a possible 100 MIPS points; the penalty has increased from 3% to 9% of annual Medicare reimbursements; and, the number of patients required to be reported on has increased from 20 patients to all patients for all payors. With the rules changing every year, the strategy you previously used to score MIPS points and report may no longer be optimal. If you want to avoid the 9% penalty in 2021 and beyond, you must think differently and evolve your strategy for MIPS.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your MIPS score. Here are three critical considerations that provide guidance on ensuring you have the right MIPS strategy to optimize your ability to earn MIPS points for the 2021 reporting period.

The Quality Category, worth the most points, is the category to focus most of your effort. Because the Quality category is worth anywhere from 40 to 85 MIPS points, focusing on this category throughout the year is critical. You need to submit a full year’s worth of data so now is the time to ensure that you are capturing all relevant data in your EHR and or billing system so that it can be properly extracted and reported on for your submission.

40% of the MIPS points require you meet stringent timeframe requirements. Two of the MIPS categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform and document activities for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long you will find it impossible to put the right actions in place to complete the activities necessary to earn any of the MIPS points in these categories.

The reporting methodology you choose impacts the points you can earn. Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the MIPS points you could earn. Unless you select a reporting partner that will help you earn the most points available by leveraging technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score, you risk leaving MIPS points on the table and significantly sub-optimizing your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the MIPS points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings’, a CEHRT, is the national leader in automated MIPS reporting and our cloud-based ONC certified software fully automates the MIPS reporting process. And because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes, you will save significant time while maximizing your financial upside.

Contact Sarah Reiter, sreiter@healthefilings.com, or 608.841.1866 to find out how to maximize your reimbursements and protect your bottom line.

About Health eFilings:

Health eFilings, a CEHRT, is the national leader in automated MIPS compliance and quality data analytics. Its services drive improved patient outcomes, optimized quality measures, and stronger financial results for healthcare practices. Their proprietary cloud-based ONC certified software is significantly more efficient and effective than any registry as it does all the work to extract, calculate, benchmark, format, and electronically submit MIPS data to CMS so clients avoid significant penalties and earn maximum reimbursements. And, you can have peace of mind knowing you are working with the best partner because CMS has accepted 100% of Health eFilings’ submissions. Learn more here: https://healthefilings.com/ezclaim

ABOUT EZCLAIM:

EZClaim is a leading medical billing and scheduling software provider that combines a best-in-class product, with correspondingly exceptional service and support. For more inforatmion, schedule a consultation today, email our experts, or call at 877.650.0904.

May 5, 2022 | HIPAA, Live Compliance, Medical Billing Software Blog, Support and Training

Your organization’s annual HIPAA Security Risk Assessment and Analysis are only one element of the compliance process, and whether you’re a Business Associate or Covered Entity, your organization must also “implement security updates as necessary and correct identified security deficiencies”. In other words, you must act via a Corrective Action Plan (CAP) following the required risk assessment process.

Here are a few common Corrective Action Plan steps:

- Implement technical policies and procedures to allow access only to those persons or software programs that have been granted access rights to information systems maintained.

- Implement procedures to regularly review records of information system activity, such as audit logs, access reports, and security incident tracking reports.

- Conduct accurate and thorough assessments of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of ePHI.

- Develop a complete inventory of all its categories of electronic equipment, data systems, and applications that contain or store ePHI, which will then be incorporated into its Risk Analysis, and must complete a Risk Management plan.

What happens if I fail to complete my Security Risk Assessment?

Failing to complete your annual Risk Assessment oftentimes means the organization will be required to complete a “robust” Corrective Action Plan (CAP) and often with at least two years of monitoring activity.

Have you ever doubted whether a small billing company or independent physician practice actually ever face penalties?

Well, keep in mind, a Business Associate is a ‘person’ or ‘entity’. This means that there is no billing company too small to have to comply with the Federal HIPAA regulations. Again, if you have not completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

It is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or another vendor suspects a breach, you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action.

An EZClaim partner, Live Compliance, will help you to make checking off your compliance requirements extremely simple. They provide:

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities.

- Complete set of HIPAA Policies and procedures built directly into your portal. Includes actionability, change management documentation, and Incident Response Policy to assist with your Corrective Action Planning. Easily share policies with staff with one click.

- Built directly into your portal, easily monitor where your workforce may be vulnerable with our Dark Web Breach Searches. Easily expose breach sources with ongoing searching of active employee email or domain ensuring continued awareness of potential breach exposure. Weekly automatic email notifications if new breaches are discovered.

- Short, informative, privacy awareness videos covering technical, administrative, and physical safeguards with topics such as ransomware, phishing, the Dark Web, password protection, and more. All delivered monthly with no logins required, they empower your workforce to make conscious decisions when it comes to your organization’s privacy and security.

So, don’t risk your company’s future, especially when Live Compliance is offering a FREE Organization Assessment to help determine your company’s status. For more information, visit their website, e-mail them, or give them a call at 980.999.1585.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution by Jim Johnson with Live Compliance ]

Apr 19, 2022 | EZClaim

For over two decades, EZClaim’s foremost goal has been to make medical billing easier and more efficient. Let’s look at the features in EZClaim that h.

Templates

Templates are a great way to save time and ensure accuracy by pre-filling fields that will be consistent across patients or claims. EZClaim has two types of templates to choose from

Patient templates

Patient templates can be used to pre-fill patient demographic information. These templates are extremely useful and flexible across a range of scenarios where you know that patient demographic information will be the same.

For example, if your office has one doctor that only serves Medicare patients, you can easily create a template that will pre-fill Medicare as the payer for that doctor. Maybe you have a payer that requires a specific qualifier. This can be quickly loaded from a template with the necessary fields pre-filled.

Claim templates

Claim templates work much the same way that patient templates do. They make it easy to create claims around “standard” visits. In pediatrics, a common usage might be a claim template for a well-visit and immunizations. Standardizing these visits with a template not only saves you time but also helps ensure you are collecting all the applicable charges and that nothing gets left off.

Another common example that we see is using templates for modifiers for tele-health visits. The template gives you a standard foundation to make sure everything is in order.

A similar functionality that many find useful is using the “previous claim” pre-fill functionality. This copies the fields from the previous claim into a new one, which you can then alter as needed.

Both patient and claim templates serve as a flexible tool to standardize your process, reducing repetition and increasing accuracy.

Validation rules

Another great tool to ensure clean claims is by validating inputs. EZClaim comes with several default validation rules, for example, a billing provider must be set before the claim can be submitted. This tool can also be used to create custom rules. Rules can be set around how to validate:

- Patient entries

- Payer entries

- Physician/Facility entries

- Sending claims

Like the templating functionality, validation rules are extremely flexible and can be adapted to your individual needs. As an example, one custom validation rule revolves around Medicare member numbers—because we know that all Medicare member numbers are 11 characters, we can set a validation rule that enforces 11 characters for all claims where Medicare is set as the payer. Maybe for your use case certain CPT codes require extra documentation, or certain types of claims that should be flagged for extra review before being submitted. These rules can all be standardized and enforced with custom validation rules.

It might be the case that certain rules have exceptions. Validation rules can be set up to trigger with an error, so that the claim cannot be submitted, or with a warning, so that the user is made aware that a rule has been broken but it will not prevent the claim from being submitted. Custom rules are a powerful tool and must be used with caution—you don’t want to prevent clean claims from being sent out. However, if you find that you are continually running into a particular issue with a category of claims, it can be a great way to ensure accuracy.

Apr 12, 2022 | Partner, TriZetto Provider Solutions

From the onset of the pandemic, burnout has been one of the biggest challenges facing healthcare workers. Beyond the physical aspect of being overworked and risking one’s own health to help those in need, there is also the toll the jobs takes on mental health. And burnout doesn’t only affect front-line workers. While nurses and doctors may face the brunt of pandemic-related woes, administrative burdens also impacts office staff and C-suite executives. It truly is a top-to-bottom issue.

This burnout, coupled with other issues like employee vaccine mandates and patients behaving badly, has no doubt taken its toll on healthcare workers. And the result? Resignations. Just as The Great Resignation rocked Corporate America, the healthcare industry has also felt the effects. It’s such an issue that industry CEOs ranked personnel shortages as the number one challenge they face, according to new survey results from the American College of Healthcare Executives. And the recent numbers do not lie. Hospitals lost 5,100 jobs in December 2021, according to the U.S. Bureau of Labor Statistics, with nursing and residential care facilities losing 6,100 jobs the same month, respectively. And it’s not just front-line workers that are resigning. The Medical Group Management Association (MGMA) claims 88 percent of medical practices have had difficulties recruiting front office staff.

Much of the operational tasks handled by front office employees are critical to the functioning of a practice – coding, scheduling, bill processing – need to be done regardless of staff limitations. Administrative burnout is real, and when there is an overall decrease in staff, the remaining employees are often left to pick up the slack.

Increasing costs and budgets

According to Mercer’s 2021 External Healthcare Labor Market Analysis, which examined predictive healthcare labor statistics over the next 10 years across all 50 states, labor shortages should be expected as the U.S works through the COVID-19 pandemic. With the issue of resignations and burnout not going away any time soon, leaders need to find ways to adjust. If healthcare employers want to gain and retain workers, money talks. While offering higher-than-usual salaries and additions like sign-on bonuses may not have been originally in the budget, it may be the right route to circumvent staffing issues. And as inflation and the overall cost of living rises, employers are finding that more money than usual may need to be allotted for payment increases too. A MGMA Stat poll found that fifty percent of healthcare practices budgeted more than usual for workers’ cost-of-living increases for 2022. With costs anticipated to rise, practices need to get ahead of their budgetary planning to put themselves in the best position, staffing-wise, to succeed in years to come.

Staffing the Practice of the Future

One way that organizations are trying to navigate staffing issues is though flexibility. A 2022 MGMA poll found that 59% of medical group practices shifted workers to permanent and/or hybrid work in 2021. Said workers included roles like coders, call center representatives and administrative positions. One year after the onset of the pandemic, an MGMA Stat poll showed that one in five practices said that more than 25 percent of their workforce was remote at least half the time. One of the nation’s largest health systems, the Cleveland Clinic, currently has nearly 8,000 administrative employees in at least a partially remote work model. Leadership is seeing the advantages of remote work, including reduced overhead costs, more satisfied employees and the ability to cast a wider recruiting net that is no longer limited to a single geographic region.

Over the last two years or so, organizations witnessed the positive outcome of remote work and decided not to switch back to traditional models. Another, more proactive way to alleviate administrative burnout is to get things right the first time. The key to this is having the right technology in place, like claims management and eligibility verifications, that can increase automation and create the most efficient workflows. Business processing services, including end-to-end billing and credentialing services can alleviate manual work and automate processes. Outsourcing is another logical path to take when there is just not enough hands in-house to manage day-to-day tasks.

With remote work and outsourcing now seen as viable options, organizations must adjust to keep with the times. If the C-Suite wants to retain and recruit talent, finding solutions that are satisfactory for the employee and employer should be a top concern for 2022 and beyond. Overall, organizations need to meet the needs of their employees. These needs may be vast and varied, but most executives would agree that it centers on flexibility, connectivity and technology.

Organizations looking for assistance implementing automation and RCM resources can learn more about ways TriZetto Provider Solutions can help by visiting trizettoprovider.com/ezclaim.

Apr 11, 2022 | Live Compliance, Partner

As we’ve stressed before, your organization’s annual HIPAA Security Risk Assessment and Analysis are only one element of the compliance process.

Whether you’re a Business Associate or Covered Entity, your organization must also “implement security updates as necessary and correct identified security deficiencies”. In other words, you must act via a Corrective Action Plan (CAP) following the required risk assessment process.

Here are a few common Corrective Action Plan steps. These generally include:

- Implement technical policies and procedures to allow access only to those persons or software programs that have been granted access rights to information systems maintained.

- Implement procedures to regularly review records of information system activity, such as audit logs, access reports, and security incident tracking reports.

- Conduct accurate and thorough assessments of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of ePHI.

- Develop a complete inventory of all its categories of electronic equipment, data systems, and applications that contain or store ePHI, which will then be incorporated into its Risk Analysis, and must complete a Risk Management plan.

What happens if I fail to complete my Security Risk Assessment? What happens next?

Failing to complete your annual Risk Assessment oftentimes means the organization will be required to complete a “robust” Corrective Action Plan (CAP) and often with at least two years of monitoring activity.

Have you ever doubted whether a small Billing Company or independent physician practice actually ever face penalties?

Keep in mind, a Business Associate is a ‘person’ or ‘entity’. This means there is no Billing Company too small or too large to comply with the Federal HIPAA regulations. Again, if you haven’t completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

As we have stressed before, it is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or other vendor, suspects a breach you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action.

At Live Compliance, we make checking off your compliance requirements extremely simple.

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required, but is a useful tool to expose potential vulnerabilities.

- Complete set of HIPAA Policies and procedures built directly into your portal. Includes actionability, change management documentation, and Incident Response Policy to assist with your Corrective Action Planning. Easily share policies with staff with one click.

- Built directly into your portal, easily monitor where your workforce may be vulnerable with our Dark Web Breach Searches. Easily expose breach sources with ongoing searching of active employee email or domain ensuring continued awareness of potential breach exposure. Weekly automatic email notifications if new breaches are discovered.

- Short, informative, privacy awareness videos covering technical, administrative, and physical safeguards with topics such as Ransomware, Phishing, the Dark Web, Password Protection, etc. Delivered monthly with no logins required, empower your workforce to make conscious decisions when it comes to your organization’s privacy and security.

Don’t risk your company’s future, especially when we are offering a free Organization Assessment to help determine your company’s status. Call us at (980) 999-1585, or email me, Jim Johnson at Jim@LiveCompliance.com or visit www.LiveCompliance.com For more information please contact us at (980) 999-1585 or email us at support@livecompliance.com

For more information please contact us at (980) 999-1585 or email us at support@livecompliance.com