Upgrading billing software for medical practices isn’t about keeping up with the times. It’s an investment into innovative tools that streamline operations, minimize costly errors, and align your processes with industry regulations. Beyond the benefits to your organization, you’ll also be able to provide patients with a smoother, more convenient experience.

In this blog, we’ll show you the must-have features to look for when upgrading your medical billing software.

Why Upgrading Your Software Matters

Outdated billing software is slow to process insurance claims, which delays your reimbursements and disrupts cash flow. At the same time, it increases the workload for your staff – they wind up spending time fixing old errors instead of working on current tasks. And without programs designed to meet local, state, and federal regulations, your practice is always at risk of non-compliance.

You can take control of these issues by upgrading to modern billing software for medical practices. With faster claim and reimbursement processing, you’ll boost your cash flow and reduce the administrative burden on your team. Fewer errors mean your staff has more time for productivity. Plus, your patients will appreciate a simpler billing experience with clear security features.

Essential Features of Advanced Billing Software for Medical Organizations

1. Automated Claim Management

Automation helps by instantly checking claims for errors (scrubbing), submitting them, and tracking their status. Clean and accurate claims are more likely to be accepted the first time around, which means you’ll get paid faster.

2. Real-Time Eligibility Verification

With real-time verification, you can instantly check a patient’s insurance coverage to see what’s covered and what’s not. Then, you can use the information to help patients understand which charges they’ll be responsible for. Your patients won’t encounter billing surprises, and they’ll be grateful for your guidance.

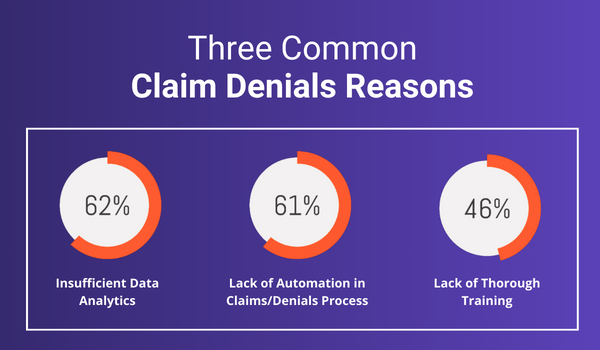

3. Comprehensive Reporting and Analytics

Advanced reporting tools track key metrics like outstanding claims, patient payments, and overall revenue. You can set up reports to spot trends and inefficiencies in specific areas of your practice. For example, you could identify which procedures are reimbursed quickly or which insurance companies are causing delays.

4. Compliance and Security Features

Billing software built with HIPAA compliance and data security protects your patients’ sensitive data. Encryption and access controls allow only authorized users to view or edit information. You’ll keep your practice compliant with healthcare regulations, avoid penalties, and uphold patient trust.

5. Patient Payment Tools

Patient payment tools like online bill pay, automated reminders, and payment plans make it easy for patients to pay their bills. Automated reminders help reduce missed payments, and online bill pay allows patients to pay from anywhere. By offering a way for patients to pay their bills over time, you make health care more accessible and affordable.

6. Integration Capabilities

When you update a patient’s information in your EHR, you’ll see the changes automatically reflected in the billing system. Your practice won’t have to enter the same information multiple times, which means staff can focus more on patient care.

7. Cloud-Based Access

Cloud-based software allows you and your team to access billing information from anywhere, as long as there’s an internet connection. Plus, because the software is cloud-based, IT costs are lower, and updates happen automatically. Your team can work remotely when needed, knowing that data is secure wherever they are.

8. Customizable Workflows

Customizable workflows let you adjust the billing software to fit the unique needs of your practice. For example, you can set rules that automatically route claims to the appropriate staff or assign certain tasks based on the type of patient or service. You’ll boost efficiency, reduce errors, and help your team stay focused on high-priority tasks.

Evaluating Your Billing Software for Medical Needs

When evaluating billing software, start by creating a checklist based on the essential features discussed in this article.

Key features to include:

- Automated claim management

- Real-time eligibility verification

- Comprehensive reporting and analytics

- Compliance and security features

- Patient payment tools

- Integration capabilities

- Could-based access

- Customizable workflows

Prioritize features based on your practice’s specific needs. If you’re focused on reducing errors, look for software with robust claim scrubbing and compliance tools.

You should also assess the vendor’s reliability, compare cost vs. ROI, and test the software in a demo.

Vendor Reliability

Look for customer reviews and testimonials to see how other practices use the software and what they think of it. Check what support and training are available to ensure your team can quickly get up to speed. Ideally, a vendor will have transparent pricing with no hidden fees, so you know exactly what you’re paying for.

Cost vs ROI

Consider how the software can save time, reduce errors, and improve cash flow. The right billing software should pay for itself through improved efficiency and reduced administrative costs. Additionally, make sure the software can grow with your practice without excessive additional costs.

Demo or Free Trial

A demo or trial is the best way to determine whether the software is a good fit for your practice. Pay close attention to key features like claim management, reporting, and patient payment tools. Assess whether the features meet your expectations and will integrate smoothly with your practice’s workflow.