Sep 5, 2022 | Partner, Waystar

Switching to Electronic Claim Attachments

One of the biggest strains on the healthcare industry remains its reliance on paper and manual processes. The combination often adds up to human errors and costly denials, which require exponentially more time and resources to resolve, if left unchecked.

Among the manual processes most challenging to manage is claim attachments, which demand considerable time for teams to review requirements, collect and send necessary documentation, and complete follow-up procedures. According to the CAQH Index, the medical industry spent $590M annually exchanging attachments, with some providers spending anywhere between 10-30 minutes manually submitting an attachment to a payer.

An electronic claim attachments solution bolsters efficiency, strengthens cash flow, and significantly reduces AR days. If you’re considering how such a solution could benefit your healthcare organization, read on to learn about three key areas it can improve.

- Simplify document + data exchange with payers

Despite technological advancements, providers still face a complex, manual environment for payer document and data exchange. Electronic claim attachments can help ease long-standing friction points between providers and payers by automating supporting documentation submission. It’s a win-win for providers and payers as workflow efficiency can be maximized and claims adjudicated more swiftly and correctly.

- Support frictionless and remote workflow

Processing claim attachments becomes exponentially more time-consuming and expensive because of its paper-based nature and the need to keep up with ever-changing payer rules and requirements. Shifting to electronic claim attachments can provide flexibility to ensure your billing team can continue to operate effectively even in disruptive times. It not only saves time and money each day but it’s also proved critical during events like Covid-19, allowing a divided workforce to still get the job done.

- Reduce cost to collect

Not all clearinghouses are created equal—the right partner fervently seeks opportunities for staff to work smarter, not harder. Automation and scale are key elements to not only maximize efficiency and accuracy but also reduce a provider’s cost to collect.

Although electronic attachment adoption remains low, there’s considerable benefit to implementation. While electronic transaction for claim attachments has not yet been federally mandated, the 2020 CAQH Index found the medical industry could save over $377M per year, helping organizations protect their bottom lines and provide more affordable care to their patients and communities.

Wrapping it up: taking the smarter approach to submitting attachments

Providers are all under cost and reimbursement pressure and the need for smarter, purpose-built automation is the secret ingredient for remaining in the black. Electronic claim attachments are a simple way to take the administrative waste out of your processes, prevent costly denials and accelerate cash flow, all the while supporting a remote workforce.

Looking for a smarter, simpler way to manage claim attachments and streamline workflows? Find out how Waystar can help automate the process, reduce denials and accelerate reimbursement. Visit Waystar.com.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Jun 12, 2022 | Partner, Waystar

A version of this guide to reducing back-office denials originally appeared on Waystar’s blog.

The last few years have been hard for just about everyone involved in healthcare, and not just because the revenue cycle has grown more complex. According to data from the Bureau of Labor Statistics, people on average now hold 12.4 jobs from age 18 to 54—nearly half of which are held before the age of 25. And that equates to just as many changes in their insurance coverage. Providers in turn must struggle to keep up with their patients’ seemingly ever-changing eligibility status, along with the details of what coverage is offered per level for a variety of payer plans. All that means it’s more challenging than ever to manage just about every aspect of the revenue cycle, and denials are no exception.

A recent MGMA poll found 69% of respondents had seen a noticeable increase in denials in 2021. Among those respondents, the average increase in denials was about 17%. And while there are plenty of reasons to explain the increase, we took the opportunity with our upcoming white paper, “Supercharge eligibility + estimates with a better payer intelligence engine,” to assess how eligibility-related denials factor into the equation.

How eligibility issues stir up more denials

Some of the results produced while developing that white paper were striking. When benchmarking denials for two similarly sized health institutions (both with similar patient populations and payer mix) we discovered a sizable difference in denial rates, one that indicated the first provider had processed millions less in denials. Further analysis revealed this provider dealt with roughly 35% fewer denials, which ultimately helped contribute to an additional $3-4M in revenue.

Generally, we expect such a discrepancy to be explained by a handful of familiar factors: a low clean-claims rate, an abundance of late filing or an escalating number of appeals left unattended to—issues normally associated with back-office management. But in this case those common factors did not dominate the narrative. Instead, the following stood out as the top drivers and differences between the two:

- A $39M difference in denials for patients identified as “not eligible”

- A $34M difference in denials related to coordination of benefits

- A $4M difference related to benefit maximums being exceeded

When we began to examine those discrepancies more closely, it became clear that there really wasn’t a back-office problem at all. In fact, client processes were considered quite lean and operated with consistent accuracy. Instead, problems were being generated much earlier in the rev cycle. By the time registration, scheduling and services had been rendered, there had not been notable mitigation to denial risks that should’ve been flagged. And with ever growing payer payment adjudication cycles, it seemed a steadily increasing denial rate was inevitable.

Looking for a root cause

In a study of Waystar clients, we found more than 10% of all registrants selected the wrong plan, and up to 35% of accounts triggered some kind of eligibility alert that indicated a potential denial risk. In other words, a significant portion of denials are caused by eligibility issues, one that could have been identified well in advance of them becoming problems. Finding other payers on file, replacement plans, CHIP, dental-only coverage and many other risk categories were simply not captured or flagged, which would have allowed end users to remediate the risk before a patient had even arrived for their appointment.

But what makes identifying these risks such a challenge? Ultimately there’s more to the problem than administrative oversight. The electronic data interchange (EDI) that makes modern eligibility solutions possible often includes message segments, plan codes and other critical identifying data that needs to be normalized and extracted. But that’s not possible without the right tools. If your front-end solution is not effectively crawling eligibility responses for risks like these, it’s time to upgrade your toolset and update your strategy.

Eligibility related denials are not always caused by issues in the coverage detection process, either. When it comes to common, multi-payer scenarios, benefit levels and coordination regularly cause problems in the claims adjudication process and ultimately have a significant impact on denial rates.

Older EDI solutions do not fully comprehend payer logic and often have a hard time identifying levels of coverage across different services. It’s no longer possible to rely on something like a ‘single STC 30’ EDI call to yield the benefit it (literally) once did. Now these benefits must be presented in a manner that lets staff easily interpret coverage and realistically determine when to expect payment from the patient and payer.

Wrapping it up: developing a comprehensive approach

You could be missing your single largest opportunity to strengthen your revenue cycle without a comprehensive approach to patient access eligibility. And one of the most important aspects of a truly comprehensive approach is shoring up your front-end processes to reduce the number of issues a claim might encounter as it moves downstream through the revenue cycle. Not only does this enhance the patient experience, it steadies revenue flow as it cuts down on the sort of trouble that would otherwise further drain staff time and resources.

Check out our most recent whitepaper, “Supercharge eligibility + estimates with a better payer intelligence engine,” for a more comprehensive look at what we’ve covered here. If you’re ready to tackle the challenges afflicting your front office, check out Waystar’s Financial Clearance solutions, which offer a smarter, simpler way to streamline areas like eligibility verification and prior authorization.

Join Waystar + EZClaim on July 14th to learn how to outsmart your denials.

Aug 26, 2021 | Partner, Waystar

Waystar’s newest guide investigates the state of denials and appeals in today’s healthcare landscape and explores how today’s most successful providers are redefining the core components of their denial and appeal process to grow revenue, streamline workflows and revitalize their approach to the process.

Denial and appeal management today

Like many administrative tasks further burdened by the impacts of the COVID-19 pandemic, denial and appeal management workflows dependent on manual processes are experiencing new strains on accuracy and productivity.

Last year a survey investigated how billing and administrative tasks were impacted by COVID-19, with 37% of surveyed providers reporting an increase in workloads due to issues with coding and requirements. An assessment of the general industry outlook found claim denial rates are at an all-time high, with 33% of surveyed hospital execs reporting concerns they are entering a “denials danger zone,” where rates grow to 10% or more.

Estimates put the cost of reworking denials as high as 20% of rev cycle expenses because on average they cost 4x as much to process than the initial claim. With so much strain already present on providers’ resources, many are turning to automation to ease the burden.

How automation elevates the process

Once a provider has been notified of a denied claim, steps are taken to identify whether or not it can be appealed. Many of the errors that cause denials come down to administrative issues that took place at the start of the claim lifecycle.

A recent analysis found 86% of the denials processed between July 2019 and June 2020 were avoidable. Analysis indicated that many of those issues stemmed from front-end errors related to benefit information, coverage detail, and shortcoming related to missing or invalid claim data.

While there’s a wide mix of problems that could cause a denial, with different providers experiencing a diversity of challenges depending on their location and patient population, they all face a common hurdle: the burden of manual denial management and appeal procedures put on administrative staff.

Like many other administrative processes, providers for the most part rely on a mix of manual and electronic procedures to handle denial and appeal management. But the industry’s continued reliance on manual procedures is beginning to have a negative effect.

How providers are transforming their approach to denial + appeal management

Studies have found that it costs about $118 in reworking fees to appeal a denied claim. These costs are exacerbated by the industry’s overall reliance on manual processes—a systemic issue many recognize yet fail to capitalize on. Indeed, while many providers see the promise automation can deliver on, they still face a number of considerations before pushing forward with implementing an automated solution.

And automation is a hot topic for providers for a very good reason—studies have demonstrated the US healthcare system could save as much as $16.3B by automating old or outdated processes. When it comes to denial and appeal management, the benefits are far-reaching, from improvements to productivity and a reduced strain on resources to huge boosts to claim accuracy and revenue recovery.

What to look for in a denial + appeal management solution

Leading-class solutions offer a wide selection of tools to provide a comprehensive approach to denial and appeal management, using customized, exception-based workflows to streamline the entire process and overturn a sizable increase in denials.

The appeal toolset a solution offers should make it easier to coordinate and use the info and data necessary to automatically process appeals and recover cash that would otherwise create productivity issues or unnecessary fees.

The solution’s ability to prioritize appeals based on cash value automatically lets staff concentrate on tasks that actually demand their attention, supporting them with additional tools like automatically generated payer-specific appeal forms and robust analytics capabilities that allow you to track and measure progress and problem areas.

Keeping disruptions at a minimum is key when considering your solution as well, so consider its ability to work efficiently with your existing systems and look for a partner that can demonstrate a strong history of seamless integrations.

Wrapping it up: why denial + appeal management solutions matters

A recent Waystar survey found 76% of providers categorized denials as their biggest RCM challenge. And the wider picture of healthcare reflects an industry struggling to solve a long-standing problem with manual processes and few answers.

Implementing an automated denial and appeal management solution is quickly becoming the optimal path forward for most providers, even if many have apprehensions about committing to the switch. But as new innovations cut down on the resources and time needed to implement the tech, the time is quickly approaching where the switch will be easier, and more vital, than ever before.

Click here to find out how Waystar can help fully automate the process and help you recover more revenue while reducing the burden on staff.

Heading to AMBA in October? Visit Waystar and EZClaim while you’re there! Stay tuned for more event details.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

[ Contribution from the marketing team at Waystar ]

Jul 29, 2021 | Medical Billing Software Blog, Partner, Waystar

As patients return to doctor’s offices and health systems around the country, healthcare organizations find themselves in uncharted waters, with a greater need than ever to make data-driven decisions that grow revenue. Per a recent report from KLAS, 63% of hospitals found themselves struggling with real-time data analytics.

It should come as no surprise then that investments in new analytics tech and training are on the rise. According to a report from the Society of Actuaries (SOA), 42% of surveyed healthcare executives reported an improvement in patient satisfaction since implementing predictive analytics, while 39% said they had cut costs. Since 2011, over $39B has been invested in digital health tech, including $7.48B in 2019 alone. It’s estimated that roughly 20% of that has been funneled into the development of technology-focused on managing health records and analytics. Furthermore, some models have estimated improving available data collection and analysis tech could save the healthcare industry roughly 25% of its total costs.

The question is, what can you do to unlock that potential within your own organization? There’s a deep well of data that each revenue cycle feeds into, which if properly analyzed, can help organizations operate at their most efficient and effective. Here are the four stages of data analytics workflows that are key to developing those actionable insights.

1. A trigger, or the point in your revenue cycle that sets up the call for deeper analysis

2. Interpretation of data to determine root causes and identify appropriate next steps

3. Intervention to improve specific metrics

4. Tracking of said metrics to chart success in achieving desired outcomes

Let’s examine what a successful version of each stage looks like.

1. Trigger

The trigger occurs when you notice something that needs further investigation. With the right analytics tool, you can easily access all of your key performance indicators, financial goals, and more, providing the visibility you need into your rev cycle. When something looks amiss or needs improving, you can drill down to the level that shows what’s really going on.

2. Interpretation

Even a wealth of data amounts to nothing without an efficient way to process and communicate key takeaways. You’ll need to equip your team with access to concise reports, smart visualizations, and relevant historical data in order to get them to the insights that drive action.

3. Intervention

Now is the time to take action. Intervention is ultimately tied directly to your ability to drill down into the data underlying problematic areas of your revenue cycle and clearly communicate takeaways with your team. Success at this stage depends on designing a plan based on your best understanding of underlying issues and the most effective way to address them.

4. Tracking

Your intervention plan is built on KPIs that naturally intertwine with the way you measure success across your revenue cycle. With proper implementation and tracking, running with the analytics cycle can become a simple addition to your everyday workflow. More than delivering on your initial goals, the true power of analytics is the ability to deliver repeat value on your initial investment.

A strong analytics solution does more than deliver a more fully developed picture of your rev cycle performance. It provides actionable business intelligence, cuts down on time between analysis and action, and lessens the strain on your IT department.

Beyond the actionable internal insights it can provide, analytics is also a key tool for helping you benchmark performance in comparison to peers in the industry. And with the right analytics solution, competitive analysis is a simple task, using automation that reviews customizable benchmarks for a tailored review of the claim, payment, and denial performance.

Looking for a truly comprehensive analytics solution to help improve performance and enhance your benchmarking capabilities? Find out how Waystar can help you harness the power of your data through analytics. Visit Waystar.com

Heading to AMBA in October? Visit Waystar and EZClaim while you’re there! Stay tuned for more event details.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

[ Contribution from the marketing team at WayStar ]

Apr 5, 2021 | Medical Billing Software Blog, Waystar

For many providers, medical claim denials are one of the single biggest drains on revenue. When you consider that working just one denial costs about $25, knowing why claims are being denied and how to prevent them in the future isn’t a luxury—it’s a necessity.

Automation and advanced analytics can take much of the burden off your billing team by helping you identify potential denial triggers, adapt to constantly changing payer guidelines, and uncover actionable trends in your claim data.

Waystar’s Denials by the Numbers:

- 5-10% average denial rate amount physician practices

- 90% of denials are preventable

- 76% of providers say denials are their biggest RCM challenge

[ Note: View or download Waystar’s “Defeat Denials with Data” white paper here ]

Waystar, a partner of EZClaim, integrates easily with its medical billing software, creating a seamless exchange of claim, remit, and eligibility information. To learn more about defeating medical claim denials, or to add Waystar as your clearinghouse, visit this page.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article and white paper contributed by Waystar ]

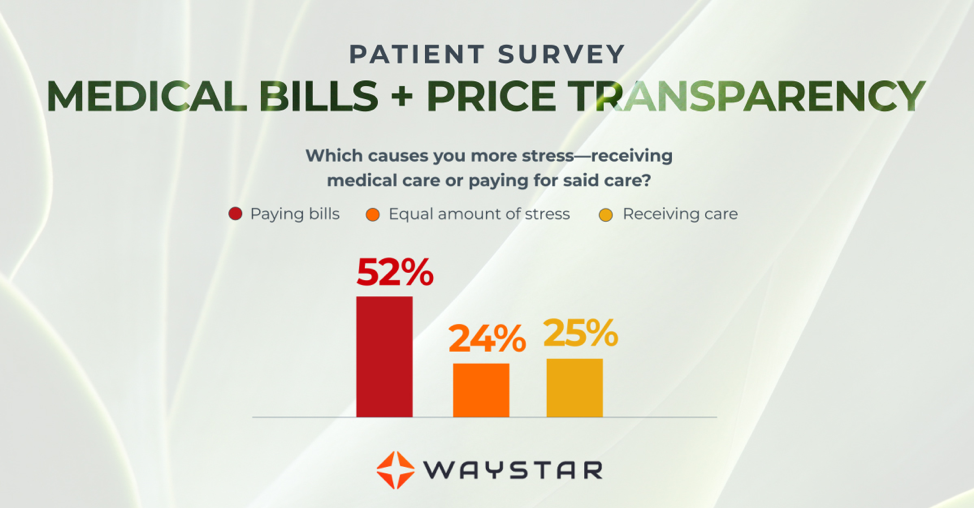

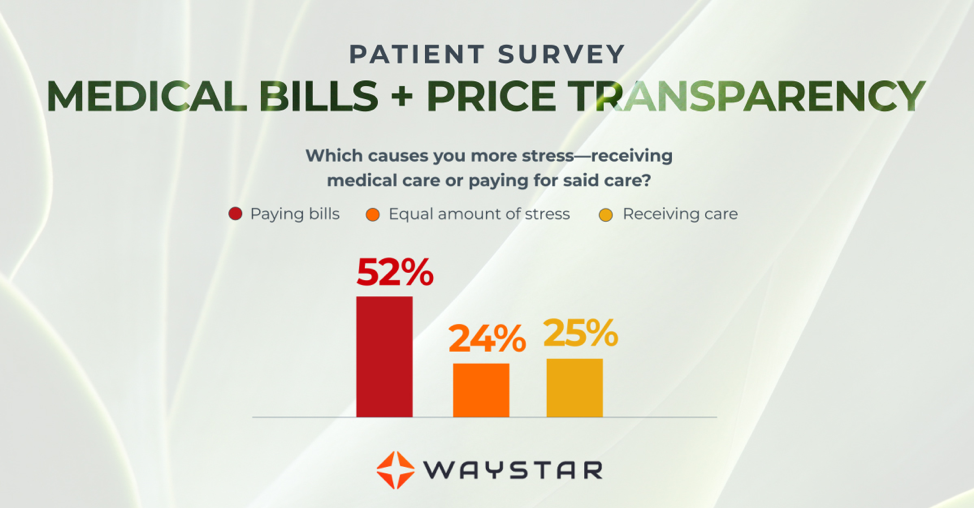

Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

New Patient Survey About Price Transparency Rule

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]