Feb 9, 2021 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

The COVID-19 pandemic has put a spotlight on the need for mental health resources as illness, job losses, and isolation continues to create unprecedented stress levels. According to recent surveys conducted by the Larry A. Green Center, more than half of clinicians reported declining health among patients due to closed facilities and delayed care, and more than one-third noted that patients with chronic conditions were in noticeably worse health as a result. Even more striking, over 85 percent reported a decline in inpatient mental health with 31 percent seeing a rise in addiction.

With mental health access at the forefront of our minds, there is no doubt a demand for qualified professionals that can handle these complex patient needs. While the sense of urgency for these services exists, especially as more and more healthcare consumers are resuming in-person appointments, unfortunately, there are processes in place that can create unnecessary roadblocks for practitioners.

Complying with the Council for Affordable Quality Healthcare’s (CAQH) behavioral health credentialing requirements are especially challenging. Unlike traditional medicine, treatments and therapies for conditions such as addiction are not as well understood by payers. This makes it more difficult to gain or maintain the credentials necessary to submit claims for therapy services.

Ninety percent of the time counselors and therapists apply for network status are denied! That’s a striking statistic, even for seasoned professionals, and everyone can agree that appealing denials and requesting payers review credentials in greater depth are a time consuming and expensive burden. On average, the time required for behavioral health credentialing of professionals is up to five times greater than for medical professionals because of nuances specific to the industry. The turnaround for completed enrollments is slower too, on average 180 days versus 120 days. In addition, some payers will only allow certain therapies for providers without advanced degrees. Because denials for behavioral health are common, therapists must understand which therapies a network will accept and focus on therapy-specific credentialing. In the current environment, practitioners should also ensure that Telehealth or virtual appointments will be covered for the safety of all.

So how can mental health providers stay ahead of enrollments and avoid credentialing-related denials? Outside assistance from experts like those at TriZetto Provider Solutions offers an end-to-end credentialing service that ensures continuous payer follow up and insight into enrollment status. Our credentialing professionals are devoted to helping providers gain and maintain their credentials. We understand the nuances associated with behavioral health credentialing and have direct relationships with all major payers. TPS allows you to do what you do best – manage patient care – by alleviating the burden of credentialing and making sure you never miss quarterly re-attestation deadlines.

If your mental health services are being denied, we are here to help. Learn how solutions from TriZetto Provider Solutions can help your practice simplify credentialing.

TriZetto Provider Solutions is a partner of EZClaim and can assist you with all your coding needs. For more details about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: The TriZetto Provider Solutions editorial team ]

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner

In the wake of the COVID-19 pandemic, Telehealth adoption has exploded, and there are six revenue cycle metrics to track.

Many patients are prohibited or reluctant to venture out for on-site care. The combination of relaxed regulations and expanded payment parity for appointments has made virtual meetings easier and more attractive for providers, who are turning to these technologies to stay engaged with patients—and maintain cashflow. Dr. Robert McLean, a former president of the American College of Physicians, recently said, “this crisis has forced us to change how we deliver health care more in 20 days than we had in 20 years.”

A new industry report predicts that the number of Telehealth visits in the US will surpass one billion by the end of the year, and speculates that nearly half of those visits will be related to COVID-19. At Waystar, we have been closely monitoring claim trends and are seeing this growth firsthand. In fact, the volume of Telehealth claims on the Waystar platform has grown by more than 100 times since mid-March. On two particular days in late April, they accounted for more than 15% of our total daily claim volume. Before COVID-19, they would have accounted for less than one percent!

For many providers, this shift will require new revenue cycle strategies to meet growing patient demand without overwhelming clinicians and administrative teams—or already strained operating budgets. It’s important to remember this is still very much an evolving care delivery model with the opportunity for errors on the part of both payers, providers, and administrative staff. For this reason, revenue cycle professionals should diligently monitor claims to ensure proper adjudication, identify learning opportunities, and uncover areas for operational improvement.

Below, we’ve listed six core Telehealth-related metrics you should regularly track to ensure billing accuracy, maximize payer reimbursement, and reduce claim rejections and denials. For more on how to best navigate the evolving telemedicine landscape, check out our resource hub here.

To report on Telehealth-related claims, you’ll first need to identify and isolate claims containing Telehealth procedure codes. See CMS’ Telehealth code list to identify the specific procedure codes and modifiers that apply to your organization.

Payer Analysis:

1. Payer Telehealth claim rejections by volume and/or billed amount

2. Payer Telehealth claim denials by volume and/or billed amount

If your Telehealth claims are being denied or rejected, do you know which specific payers are doing so at the highest rate? Drill down to discover the specific reason codes payers are attaching to rejections and denials so you can better understand payer-specific rules and avoid these oversights in the future. In some cases, you may identify trends that warrant a call to the payer to correct.

Provider Analysis:

3. Telehealth claim volume by the provider

Review this claim volume by individual provider. If you notice providers within your organization generating a much lower volume of Telehealth claims than peers, perhaps they could benefit from additional training on Telehealth technology and use cases.

Ensuring Billing Accuracy:

4. Telehealth claim rejections by biller/team

5. Telehealth claim denials by biller/team

Are certain billing personnel or teams producing higher denial or rejection rates than others? Keep a close eye on these trends and remember most of this is new for everyone. If some team members are seeing more rejections or denials than they should, it could be a great opportunity to hold training and collaborate on strategies for success.

Maximizing Reimbursement:

6. Telehealth claim volume by procedure code

Which Telehealth codes are you using? Each code reimburses at a different rate, so choosing the wrong ones could leave money on the table. Be sure to read up on CMS’ requirements (check out their fact sheet and code list) to ensure you’re choosing the appropriate code(s) on each Telehealth claim.

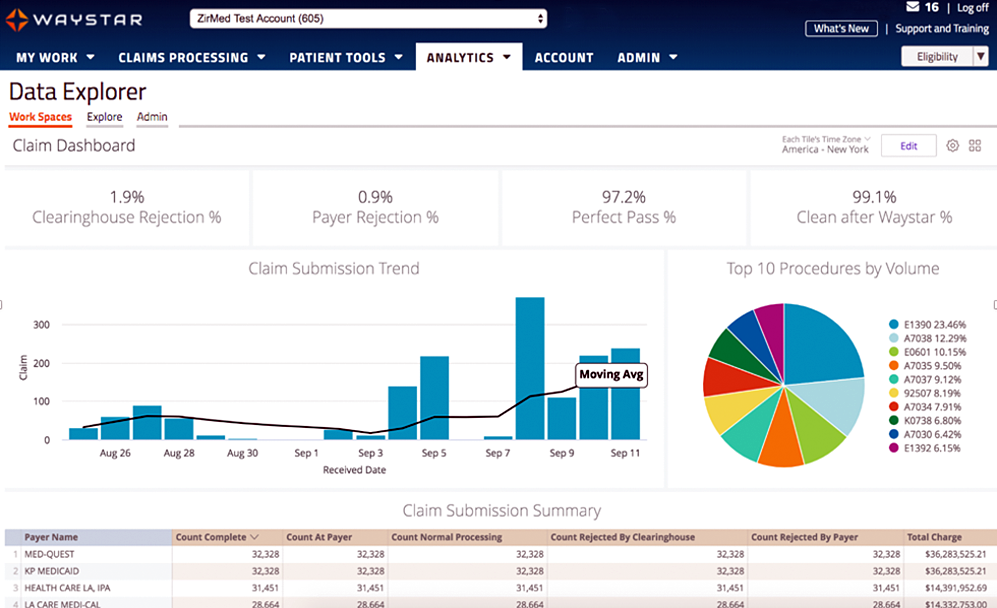

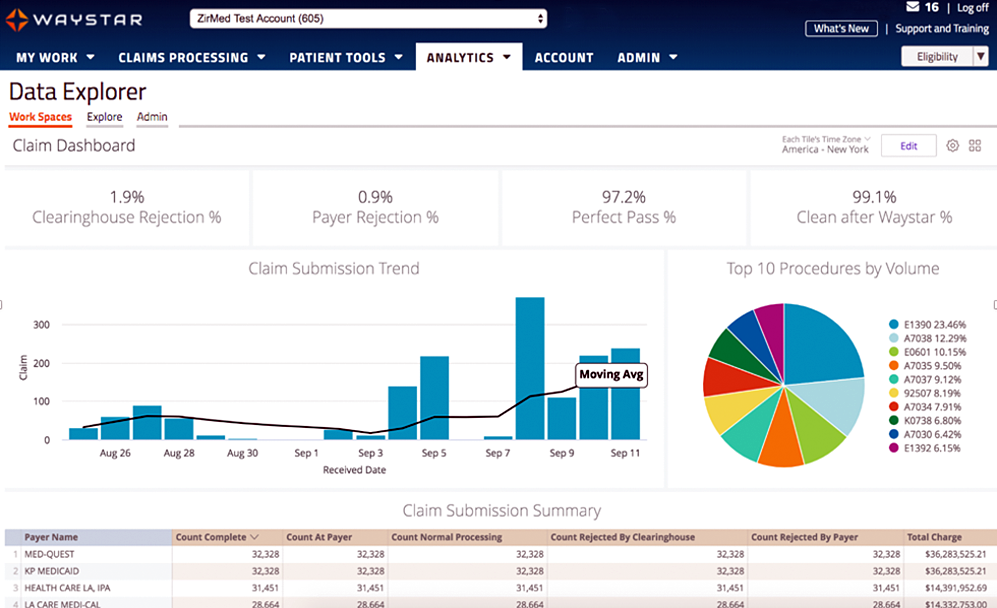

Waystar Analytics

You have all the data you need to drive informed decision making and improve financial performance—you just need the right analytics tool in your corner. Our new Waystar Analytics solution offers a pre-built Telehealth dashboard that can help you easily interpret, share all the metrics above, and track these revenue cycle metrics. Click here to learn more about Waystar Analytics and how it can deliver the insights you need during this time of transition.

[ By Waystar ]

Apr 13, 2020 | Health eFilings, Partner

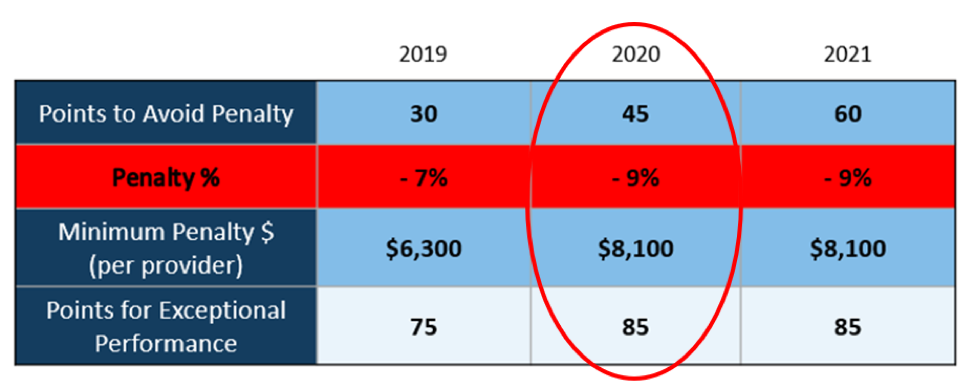

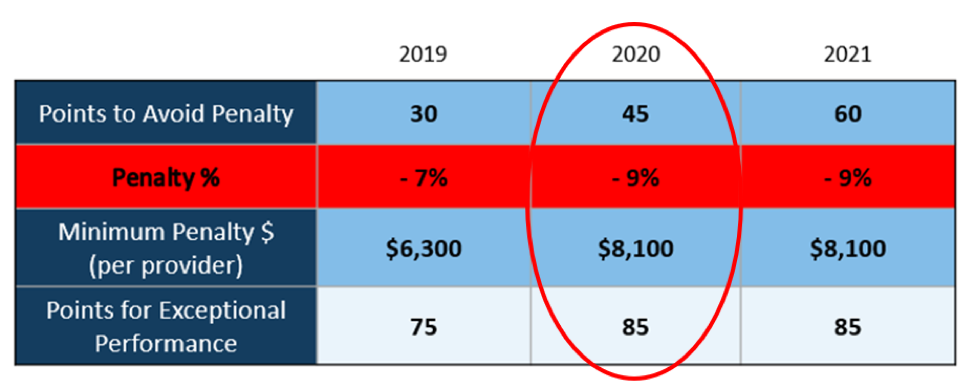

There WILL NOT be any changes to the MIPS Program in 2020, so all payers must be submitted and a minimum of 45 points must be earned to avoid the 9% penalty.

On March 23, 2020, CMS made it perfectly clear that MIPS Program is not going away in 2020. It also reiterated that the data requirements and thresholds in place for the 2020 program have not changed. Additionally, Promoting Interoperability and Improvement Activities must be done for the required durations, or no points will be earned for those categories.

To put this in context, while the stakes have been raised every year, the final ruling for the 2020 reporting period is the most complex to-date, further increasing the stress, burden, and financial risk for over 900,000 clinicians who bill Medicare Part B. Failure to comply or earn enough points for the 2020 reporting period will result in an automatic 9% penalty on every Medicare Part B claim paid for an entire year. This equates to a minimum of a $8,100 per provider hit to the bottom line.

Given the unprecedented time when everyone’s bottom line is at risk, now is the time to get a handle on what’s at risk with the MIPS program and proactively engage to ensure your bottom line is not further jeopardized by being assessed a 9% penalty. It can be challenging to know exactly what you need to do to earn points, optimize your score, and protect your Medicare reimbursements, as there are many commonly misunderstood aspects and nuances with the MIPS program.

So, with what is at stake and the inherent complexity in earning points, it is critical that you select the right methodology and partner who can help you maximize reimbursements and protect your bottom line. Not all reporting methodologies are the same.

Health eFilings‘ CEHRT is the best choice for a reporting partner. Their cloud-based ONC-certified software fully automates the process and does all the work without any IT resources, administrative support, and workflow changes from the practice. Health eFilings service is an end-to-end electronic solution that will save significant time, be a turn-key submission process, and maximize the financial upside for providers.

As more than 25% of the 2020 reporting period is behind us, now is the time to act while there is still plenty of time to positively impact your results and points earned.

Health eFiling provides the nation’s only fully automated solution for MIPS compliance and is integrated with EZclaim’s billing solution. Click on the following link for more details: https://healthefilings.com/ezclaim

[Contribution by Sarah Reiter with the Senior VP of Strategic Partnerships]