Nov 11, 2021 | Health eFilings, Partner

MIPS Strategic Guide – How to Choose the Right Reporting Partner

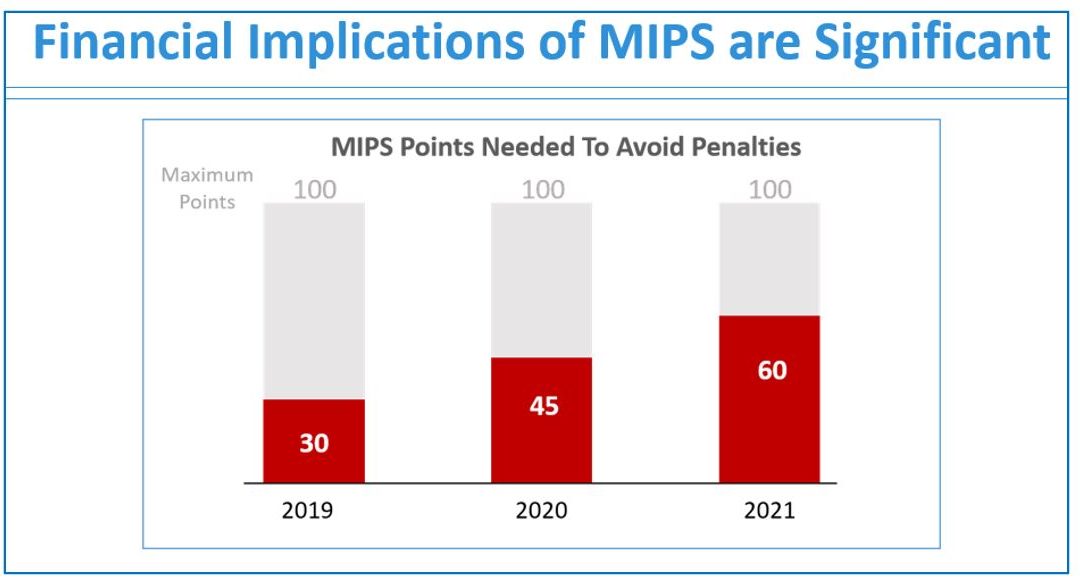

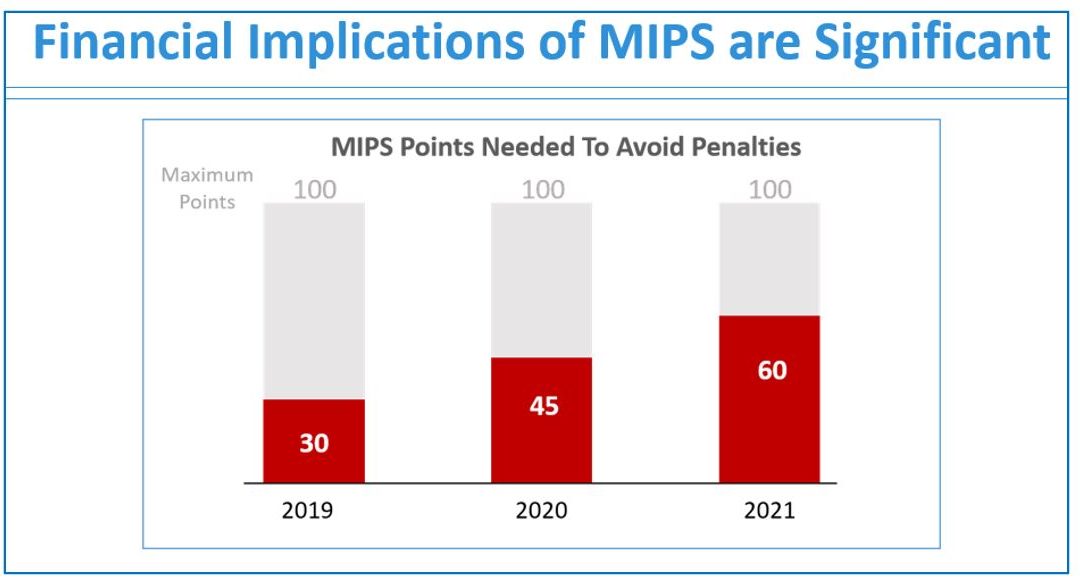

Given the way the MIPS program has evolved, all healthcare practices regardless of size or specialty must evolve their approach to MIPS reporting to assure their success with the program. However, most clinicians do not understand or don’t have awareness of, the different reporting methods available to them and the impact the reporting method can have on their success with MIPS. With what is at stake financially, it is critical that you understand and select the right methodology and partner to maximize your MIPS points and protect your bottom line.

Many clinicians erroneously think that a registry is the only reporting option available to them or that they are required to use a registry. Or, they think that their EHR handles reporting for them. These misperceptions and general lack of awareness of the other reporting methodology will be detrimental to your ability to be successful with MIPS. And, given that 50% of all clinicians will be penalized annually by next year, the legacy reporting methods (registry or EHR) will not be able to fulfill enough of the reporting criteria to earn the minimum MIPS points needed to avoid the 9% reduction in Medicare reimbursements.

To help you determine if you are choosing the right reporting method and partner, we’ve identified the five most important factors to consider in order to increase your probability of avoiding the 9% penalty.

- Reporting Classification – is the reporting partner a CEHRT?

- Service Approach — Does the reporting partner use ONC certified software to do all the work with no IT resources, administrative support, or workflow changes?

- Quality Measures — Is the reporting partner certified by CMS to calculate all eCQMs, which earn significantly more points than registry measures?

- Benchmarking — Are proprietary algorithms used to assess the 9 million possible combinations of Quality measures to maximize earning MIPS points?

- Submission Method — Does the reporting partner submit a comprehensive electronic file directly to CMS to comply with reporting for all MIPS categories?

If you answer “no” to any of these questions, then the reporting partner you are working with will not be able to maximize the MIPS points you can earn. Given every MIPS point matters, because MIPS points determine your reimbursements and impact your bottom line, it’s time to consider a new strategy with a new reporting partner.

Health eFilings, a CEHRT, is the national leader in automated MIPS reporting. They utilize ONC-certified software to handle 100% of the tracking and reporting of the required data to CMS. And because their service is classified as an end-to-end electronic solution, you’ll also earn additional bonus points toward your MIPS score even though they are doing all the work. Health eFilings as your partner is the more effective and efficient reporting method so you will earn more points and, ultimately, receive higher reimbursements.

Learn more about how Health eFilings can help your practice here: https://healthefilings.com/ezclaim. Contact Sarah Reiter, sreiter@healthefilings.com, or 608.841.1866 to find out how to maximize your Medicare reimbursements and protect your bottom line.

About Health eFilings:

Health eFilings, a CEHRT, is the national leader in automated MIPS compliance and quality data analytics. Its services drive improved patient outcomes, optimized quality measures, and stronger financial results for healthcare practices. Their proprietary cloud-based ONC certified software is significantly more efficient and effective than any registry as it does all the work to extract, calculate, benchmark, format, and electronically submit MIPS data to CMS so clients avoid significant penalties and earn maximum reimbursements. And, you can have peace of mind knowing you are working with the best partner because CMS has accepted 100% of Health eFilings’ submissions. Learn more here: https://healthefilings.com/ezclaim

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Mar 10, 2021 | Credit Card Processing, Medical Billing Customer Service, Medical Billing Software Blog, Trizetto Partner Solutions

What is Price Transparency?

It’s a story we hear too often. A person visits a hospital for a medical issue—whether it be a trip to the emergency room for a broken arm or a pre-scheduled appointment for a headache that just won’t go away—and receives a myriad of services and tests. Then comes the dreaded bill in the mail a few weeks later. Although they may inquire about an estimate at the time of service or have an idea of their coverage, the exact financial responsibility is often a mystery until that bill arrives. While the changes vary greatly, one thing that is certain: many people have trouble with their out-of-pocket costs. So much so that a recent survey from The Commonwealth Fund found that 72 million Americans have some sort of trouble with medical debt.

So, on January 1, 2021, the price transparency rule was put into effect—from the Centers for Medicare and Medicaid Services (CMS)—requiring all hospitals within the United States hospitals to publish the prices of various medical procedures. In particular, standard charges for services and items must be published online, available for patients to access. Until now, these prices were hard to find. The timing of this change—the beginning of the calendar year—comes at a time when healthcare pricing is top of mind since many customers most likely renewed or changed insurance carriers and coverage on January 1, 2021. With this comes a focus on out-of-pocket costs, deductibles, and more.

What Brought About This Radical Change?

Part of this change can be attributed to the consumers themselves. With the increase in high deductible health plans and increased out-of-pocket costs, finances are top of mind. In addition to these factors, today’s consumers demand a better overall patient experience. With the prevalence of online shopping, patients expect the same seamless transaction at the hospital that they receive with companies like Amazon, Walmart, and Home Depot. Just as consumers read product reviews before placing an item in their online shopping cart, patients research services and access peer reviews of physicians before they go to the office. In short, they want to be knowledgeable about their healthcare and crave tailored services with exceptional customer service.

Many believe this change will be well received, with Forbes calling the ruling a “gift to all Americans.” From the consumer’s standpoint, it will now be easier to make educated decisions based on cost. This will then cut down on the “unknown”—hopefully eliminating those hefty surprise bills—and opens the door to comparison shopping. Advocates are hoping this newfound transparency will eventually lower costs, with the competition eventually driving down the prices.

How Can Healthcare Organizations Navigate This Change?

This will not only promote transparency but will also increase convenience. By enabling patients to access and pay their bills on their own schedule with easy-to-implement solutions, organizations are meeting them halfway, so to speak. With easy-to-understand statements, integrated credit card processing, and 24/7 payment portals, it is no longer a hassle to manage medical financials. For healthcare organizations, facilitating proactive management of a person’s cost of care accelerates revenue collections and patient satisfaction improves.

In the larger sense, executives recognize that patients are taking more stock in their personal care. In order to thrive, hospitals and health systems must work toward creating the optimal patient experience, beyond just price transparency. With this, providers should aim to be more engaged and C-suite executives should try to provide additional benefits to their patients.

What Will This Mean for the Future of the Industry?

Only time will tell what the price transparency will mean for the industry. However, it is safe to say that this concept has the possibility to shape healthcare policies and processes for years to come.

So, for more information on solutions that equip you to have informed conversations about eligibility and financial responsibility, contact one of EZClaim’s partners, TriZetto Provider Solutions, to talk with one of their representatives today.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by TriZetto Provider Solutions Editorial Team ]

Jan 11, 2021 | Electronic Billing, Partner, Waystar

With Medicare Advantage enrollment continuing to rise and more plans offering more benefits than ever, big changes are coming in 2021. This post will discuss the key changes to Medicare Advantage plans in the next year, program updates due to the COVID-19 public health emergency, and advice on how to navigate billing and reimbursement concerns.

For the first time in history, Medicare Advantage (MA) penetration has reached 40% of the total Medicare-eligible population. Currently, 25.4 million people are enrolled in Medicare Advantage (MA) plans, with a total Medicare-eligible population of 62.4 million, according to the Centers for Medicare and Medicaid Services (CMS). [ Link to report ]

With an aging population, enrollment in Medicare Advantage plans will only continue to grow (The Congressional Budget Office projects enrollment in these plans to rise to about 51% by 2030).

Medicare Advantage is an alternative to traditional Medicare that acts as an all-in-one health plan and is sold by private insurers. All Medicare Advantage plans must provide at least the same level of coverage as original Medicare, but they may impose different rules, restrictions, and costs. Most Advantage plans offer the same A and B coverage for the same monthly premium as regular Medicare plans, but also often include Part D prescription drug coverage, limited vision, and dental care, broader coverage, lower premiums, maximum out-of-pocket limits, and extra benefits—all of which expanded in 2020.

While this represents a distinct opportunity for many providers to be more profitable, growing enrollment also poses challenges. Medicare beneficiaries have more choice than ever before when it comes to selecting an MA plan.

According to the Kaiser Family Foundation (KFF), there are 3,148 Medicare Advantage plans available for individual enrollment for the 2020 plan year—an increase of 414 plans since 2019. The average beneficiary could choose among 28 plans in 2020. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycles, who need to navigate hurdles that vary by the plan in order to get reimbursed.

MA plans also tend to be more transient, meaning patients may switch often, even yearly if they choose through the open enrollment period. Providers must better manage every patient accordingly so they can maximize plan benefits. Doing so takes more effort, but the payoff can lead to profit.

CMS has clearly stated a goal to move from the current fee-for-service models toward value-based care. While the Medicare Advantage population grew by 60% from 2013 to 2019, the fee-for-service Medicare population only grew by 5%. The progress Medicare Advantage plans have achieved essentially creates an idea marketplace for beneficiaries. Enrollment costs are down and more plans than ever are offering new, innovative benefits. But what does this mean for providers?

So, how has COVID-19 affected Medicare Advantage plans? Well, the COVID-19 stimulus package, the Coronavirus Aid, Relief and Economic Security (CARES) Act, includes $100 billion in new funds for hospitals and other healthcare entities. The Centers for Medicare and Medicaid Services (CMS) made $30 billion of these funds available to healthcare providers based on their share of total Medicare fee-for-service (FFS) reimbursements in 2019, resulting in higher payments to hospitals in some states than others, according to KFF. Hospitals in states with higher shares of Medicare Advantage enrollees may have lower FFS reimbursement overall. As a result, some hospitals and other healthcare entities may be reimbursed less than they would if the allocation of funds considered payments received on behalf of Medicare Advantage enrollees.

In response to the COVID-19 emergency, many Medicare Advantage insurers waived cost-sharing requirements for COVID-19 treatment, meaning that Medicare Advantage beneficiaries will not have to pay cost-sharing if they require hospitalization due to COVID-19 (though they would if they are hospitalized for other reasons).

If a vaccine for COVID-19 becomes available to the public, Medicare is required to cover it under Part B with no cost-sharing for traditional Medicare or Medicare Advantage plan beneficiaries, based on a provision in the Coronavirus Aid Relief, and Economic Security (CARES) Act.

A Spotlight on Prior Authorization

Medicare Advantage plans can require enrollees to receive prior authorization before service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2020, according to KFF. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, and is infrequently required for preventive services. Prior authorization can create barriers for providers and beneficiaries, but it’s meant to prevent patients from getting services that are not medically necessary, thus reducing costs for beneficiaries and insurers.

In a 2018 analysis, KFF found that four out of five MA enrollees—or 80%—are in plans that require prior authorization for at least one Medicare-covered service. More than 60% of MA plan enrollees require prior authorization before receiving home health services, and that percentage increases to more than 70% for skilled nursing facility and inpatient hospital stays.

The Families First Coronavirus Response Act (FFCRA) prohibits the use of prior authorization or other utilization management requirements for these services. A significant number of Medicare Advantage plans have waived prior authorization requirements for individuals needing treatment for COVID-19.

How Providers Can Prepare for a Medicare Advantage Boom

Medicare beneficiaries have more choice than ever before when it comes to selecting a MA plan. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycle. Healthcare providers will need to navigate new hurdles that vary by the MA plan in order to get reimbursed.

When beneficiaries change plans, it creates another challenge for providers. Historically, about 10% of MA enrollees change plans during open enrollment. Although this number seems low, even a small change in coverage can cause big problems for a healthcare provider’s revenue and cash flow. Billing the wrong insurance company leads to costly denials and appeals. Becker’s Hospital Review estimates that healthcare providers spend about $118 per claim on appeals. A study by the Medical Group Management Association found that the cost to rework a denied claim is approximately $25, and more than 50% of denied claims are never reworked.

Despite the challenges, providers don’t want to be left out of the MA boom. But how can they best prepare? Well, first off, healthcare providers need to ensure they are capturing accurate patient information. Next, they need to reevaluate workflows, so they are prepared to handle time-consuming prior authorizations. Additionally, healthcare organizations must consider how frequently they are re-running eligibility on patient rosters to make certain they do not miss a change in insurance coverage for patients under their care. Providers should re-run patient rosters monthly, so they have the most accurate benefit information. This will help them avoid unnecessary claim denials.

As MA continues to ramp up, the most successful providers will be those who work with a revenue cycle management partner that understands the nuances of Medicare reimbursement as well as the added complexities of MA.

With the acquisition of eSolutions, a leader in revenue cycle technology with Medicare-specific solutions, EZClaim’s ‘partner’, Waystar, so happens to be the first technology to unite commercial, government, and patient payments into a single platform, solving a major challenge and creating meaningful efficiencies. Billing Medicare, Medicare Advantage, and commercial claims from a single platform eliminates the hassle of managing multiple revenue cycle platforms and allows providers to get deeper AI-generated insights for faster reimbursement and increased value—for their organizations and their patients.

For more information about Waystar‘s platform, visit their website, or give them a call at 844.492.9782. To find out more about EZClaim‘s medical billing software, visit their website, e-mail their support team, or call them at 877.650-0904.

[ Article contributed by Waystar ]

Jan 11, 2021 | Electronic Billing, Health eFilings, Medical Billing Software Blog, Partner

If you are not a MIPS expert (Merit-based Incentive System), your Medicare reimbursements may be decreased by 9% in the next year. However, it’s not too late to avoid the penalty for the 2020 reporting period, but you need to act now!

One of EZClaim’s partners, Health eFilings’ has ONC-certified software that completely automates the MIPS compliance process for you. The software will automatically extract the required data directly from EZClaim (and/or your EHR), and then proprietary algorithms will process the 9,000,000 possible combinations of quality measures for each clinician to identify which measures should be submitted to CMS (Centers for Medicare and Medicaid Services) to earn you the most points.

Need a MIPS expert? Well, Health eFilings is one of the best, and CMS has accepted 100% of their submissions on behalf of their clients. If you have completed your 2020 reporting, reach out to them, and learn how you can earn even more points in 2021.

For more information about EZClaim’s medical billing software, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Sarah Reiter, SVP Strategic Partnerships, Health eFilings]

Jan 11, 2021 | Electronic Billing, Medical Billing Software Blog, Partner, Trizetto Partner Solutions

With a new year comes new medical coding changes.

After the examinations, x-rays, and surgeries, lives another major part of a physician’s day that happens behind the scenes. All the hard work needs to be processed through a successful claim submission, meaning that ultimately earning payment all boils down to one thing – coding. Evaluation and management codes, or E/M codes, are codes a physician uses to report a patient visit. This administrative task – a necessity for any physician – is often cumbersome and prone to errors. Most importantly, it uses up valuable time that could be better spent.

How many of us have experienced the “hurry up and wait” scenario? The type of appointment where you wait in a waiting room, then wait a little more in the exam room, then eventually get 10 minutes with your doctor…only to be rushed out so the next patient can be shuttled in. Unfortunately, it’s all too common. It’s safe to say that many patients could benefit from more face-to-face interaction with their providers.

Many people claim that payment for evaluation and management services is undervalued, specifically when it comes to ambulatory services. Additionally, it’s been argued that the fee schedule itself is not well-designed to support primary care, which requires ongoing care coordination for patients. Pressure existed to increase payment rates for ambulatory E/M services while reducing payment rates for other services. Thankfully, The Centers for Medicare and Medicaid Services (CMS) took notice. With the goal of increasing efficiencies to reduce unnecessary burdens, the “Patients over Paperwork” initiative was established. Per CMS, E/M codes make up 20% of total spending under the physician fee schedule. Part of this initiative aims to reduce the coding and documentation requirements for E/M codes, in turn giving physicians more time to spend with patients. In partnership with The American Medical Society (AMA), CMS worked to revise the rules for evaluation and management coding requirements. These changes were finalized in the 2020 Physician Fee Schedule (PFS) with an effective date of January 1, 2021.

So what exactly was revised? The E/M updates affect codes 99201 through 99215 and include the deletion of code 99201 along with revisions to the code selection for 99202 – 99215. Below is a summary of the revisions to E/M codes:

- Elimination of code 99201

- Decrease the burden of coding requirements

- Decreases the burden of documentation

- Decreases the need for audits

- Revises the definitions for Medical Decision Making (MDM)

- Revises the definition of time spent with the patient to total time including non-face-to-face for E/M services by a physician and other QHP

- Requires a history and/or examination when medically< necessary

- Offers a clear time ranges for each code for time spent with the patient

- Addition of a new 15-minute prolonged service code

- Clinicians will choose a code based on MDM or total time

These changes apply to office visits and other outpatient services. It’s noteworthy that these changes represent the first changes to the E/M codes in over 25 years! More importantly, the changes streamline the coding process, reduce clinician burden, and will allow physicians to put the focus back on patient care.

Billing and coding should always be top of mind, but it can be hard to keep up. This is why it’s critical for physicians, clinicians, coders, and billers to completely understand these changes. To help comprehension, the AMA released a checklist identifying ten steps to help the practices prepare for the upcoming changes that can be accessed here. To learn more about the medical coding changes and the summary of revisions, visit the AMA website.

TriZetto Provider Solutions is a partner of EZClaim, and can assist you with all your coding needs. For more details about the EZClaim medical billing solution, visit their website, e-mail their support team, or call them at 877.650.0904.

———————–

Note: This article is not a comprehensive overview and is NOT intended to provide coding advice, rather it is intended to highlight the new changes in effect and the need for physicians to ensure they have received the proper training for the upcoming changes.

[ Contributed by TriZetto Provider Solutions Editorial Team ]