Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

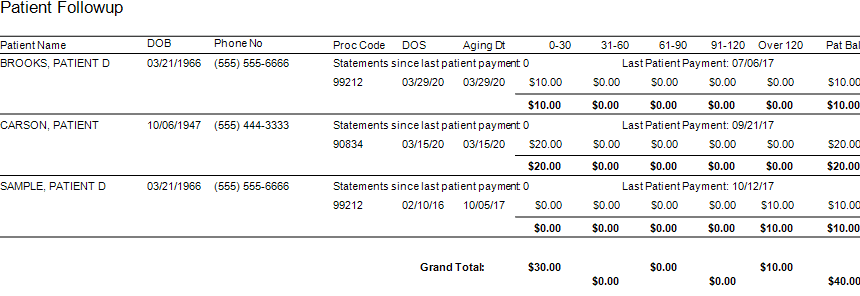

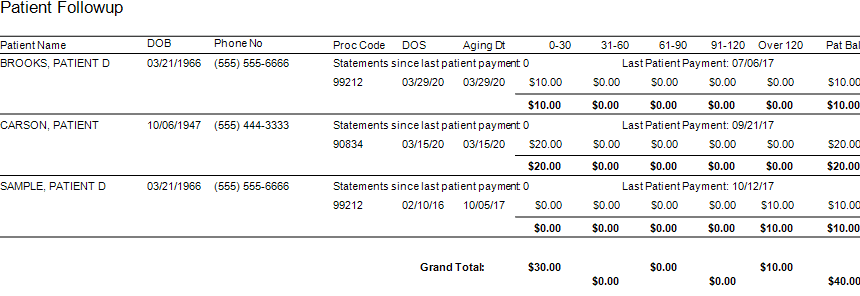

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]

Apr 13, 2020 | Health eFilings, Partner

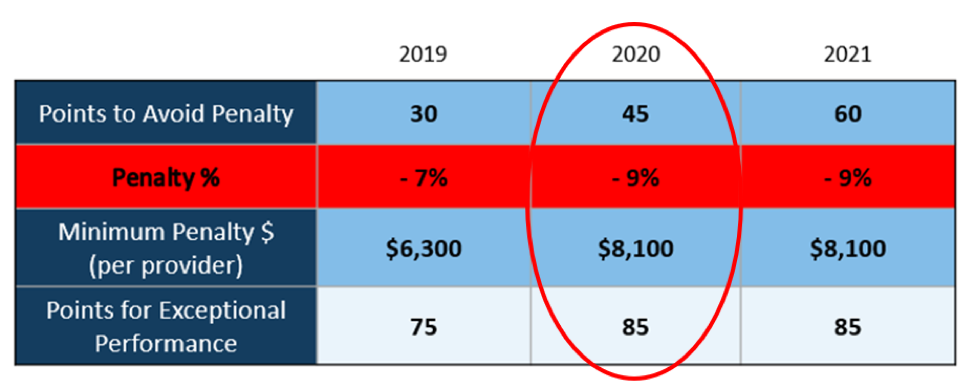

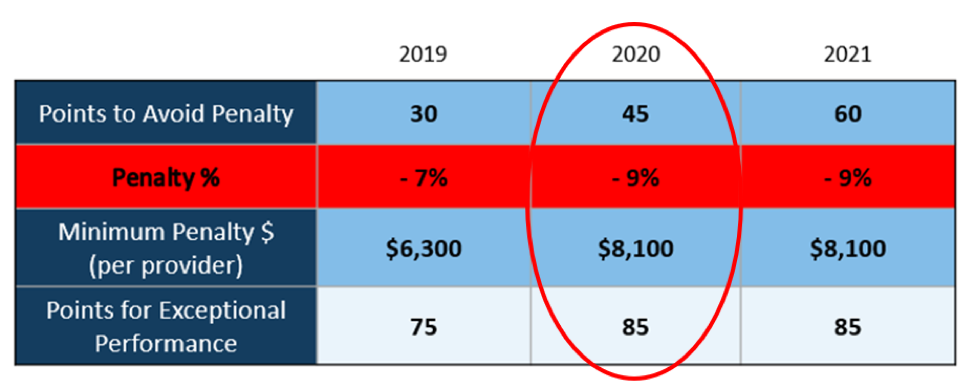

There WILL NOT be any changes to the MIPS Program in 2020, so all payers must be submitted and a minimum of 45 points must be earned to avoid the 9% penalty.

On March 23, 2020, CMS made it perfectly clear that MIPS Program is not going away in 2020. It also reiterated that the data requirements and thresholds in place for the 2020 program have not changed. Additionally, Promoting Interoperability and Improvement Activities must be done for the required durations, or no points will be earned for those categories.

To put this in context, while the stakes have been raised every year, the final ruling for the 2020 reporting period is the most complex to-date, further increasing the stress, burden, and financial risk for over 900,000 clinicians who bill Medicare Part B. Failure to comply or earn enough points for the 2020 reporting period will result in an automatic 9% penalty on every Medicare Part B claim paid for an entire year. This equates to a minimum of a $8,100 per provider hit to the bottom line.

Given the unprecedented time when everyone’s bottom line is at risk, now is the time to get a handle on what’s at risk with the MIPS program and proactively engage to ensure your bottom line is not further jeopardized by being assessed a 9% penalty. It can be challenging to know exactly what you need to do to earn points, optimize your score, and protect your Medicare reimbursements, as there are many commonly misunderstood aspects and nuances with the MIPS program.

So, with what is at stake and the inherent complexity in earning points, it is critical that you select the right methodology and partner who can help you maximize reimbursements and protect your bottom line. Not all reporting methodologies are the same.

Health eFilings‘ CEHRT is the best choice for a reporting partner. Their cloud-based ONC-certified software fully automates the process and does all the work without any IT resources, administrative support, and workflow changes from the practice. Health eFilings service is an end-to-end electronic solution that will save significant time, be a turn-key submission process, and maximize the financial upside for providers.

As more than 25% of the 2020 reporting period is behind us, now is the time to act while there is still plenty of time to positively impact your results and points earned.

Health eFiling provides the nation’s only fully automated solution for MIPS compliance and is integrated with EZclaim’s billing solution. Click on the following link for more details: https://healthefilings.com/ezclaim

[Contribution by Sarah Reiter with the Senior VP of Strategic Partnerships]

Mar 10, 2020 | Live Compliance, Partner

An independent physician gastroenterology practice in Utah had to report a breach related to a dispute with a Business Associate to the Office for Civil Rights Department of HHS.

After the investigation into the breach, it was determined that the practice of Steven A. Porter, MD “had failed to complete an accurate and thorough risk analysis, and failed to implement security measures sufficient to reduce risks and vulnerabilities to a reasonable and appropriate level” and therefore, has agreed to pay a $100,000 fine.

In addition to the monetary penalty, the practice is required to implement a Corrective Action Plan (CAP). According to the investigation resolution agreement, the practice agreed to conduct a thorough Risk Analysis, the Practice must develop a complete inventory of all its categories of electronic equipment, data systems, and applications that contain or store ePHI, which will then be incorporated into its Risk Analysis and must complete a Risk Management plan. They must also revise and implement actionable policies and procedures, all of which should have been in place prior to the breach incident.

Have you ever read such headlines and doubted whether a small Billing Company or independent physician practice actually ever face penalties?

According to the Resolution Agreement, the practice must also completely reinvent its Business Associate process, and implement a strict protocol to ensure it’s Business Associates are HIPAA Compliant. In addition to ensuring their Business Associate relationships are accurate, the entire staff must undergo security and privacy training that stresses the use of Business Associate services and applications, disclosures to Business Associates that require a Business Associates agreement, or other reasonable assurances in place to ensure that the Business Associate will and can safeguard the PHI and/or the ePHI. This puts immense pressure on the Business Associates, such as Billing Companies, to ensure that they are HIPAA Compliant, but also independent physician practices to ensure their Business Associates, “down the chain” are also compliant. This is also known as gaining Satisfactory Assurance of vendor HIPAA compliance.

What can you do?

As we have stressed before, it is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or another vendor, suspect a breach you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action. Keep in mind, a business associate is a ‘person’ or ‘entity’. This means there is no Billing Company too small or too large to comply with the Federal HIPAA regulations. Again, if you haven’t completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

What we do is keep this from ever being a worry for you! In fact, we have a 100% audit pass rate! For example, Live Compliance has easy to understand HIPAA breach notification training. We perform your security risk assessment and manage all your requirements, including business associates, in a clean, organized cloud-based portal. Don’t risk your company’s future, especially when we are offering a FREE Organization Assessment to help determine your company’s status. It’s easy, call us at (980) 999-1585, email me jim@LiveCompliance.com or visit LiveCompliance.com

[ Contributed by Jim Johnson, President of Live Compliance ].

Nov 11, 2019 | AMBA National Conference, Uncategorized

AMBA National Conference Overview – Written by Stephanie Cremeans and Dan Loch of EZClaim

EZClaim, represented by Stephanie Cremeans and Dan Loch, was proud to exhibit at the American Medical Billing Association’s AMBA National Conference last week in Las Vegas at Planet Hollywood. The AMBA team had things ready to go when we got there and made sure we had what we needed throughout the event.

The AMBA National Conference attendees seemed to have fun and were fully engaged with the exhibitors. Many thanked us for our support of the event as well. The attendees supplied the vendors with good traffic from start to finish. Stephanie and Dan were able to spend some quality time with the attendees speaking about their struggles, needs, and ideal functionality to help improve their billing service.

During slower times EZClaim was able to interact with some of the other exhibitors and sponsors of the event for an added benefit. This is a conference that EZClaim will be returning to in October of 2020 at Caesars Palace in Las Vegas.

Stephanie was able to attend a few of the sessions as well. There was a wide variety of topics covered including specialty-specific information for Acupuncture and Chiropractic billing, coding and billing compliance, and the importance of conducting internal coding audits. These topics were informative and presented by dynamic speakers that made the information relatable. Stay tuned as we bring you our key takeaways from these very informative sessions.

Click here to stay up to date with the most recent happenings and articles from EZClaim!