Jun 17, 2022 | Partner, Trizetto Partner Solutions

We already know the trend toward automation in healthcare continues to grow each year. As technology continuously improves and the financial bar to entry lowers, the opportunities for healthcare providers and health plans to enhance operational processes grow as well. But even with the radical progress and the easier-to-use-than-ever healthcare operations software, many organizations fail to implement the solutions. It may be a lack of organizational enthusiasm or a simple need for more skilled internal technological expertise.

And while this is likely common knowledge at your organization, the amount of money wasted each year – driven by the absence of process automation – may not. Billions of dollars that could otherwise be spent on improving patient care and satisfaction, on building and rolling out new service lines, and generally improving healthcare operations are wasted every year. Billions.

The most recent CAQH Index reports $372 billion is spent yearly on administrative tasks throughout the US healthcare system. Of that amount, $39 billion of those administrative transactions are specifically tracked by the CAQH Index. “Of the $39 billion, the industry can save $16.3 billion, or 42 percent of existing annual spend, by transitioning to fully electronic transactions,” according to CAQH.

$16 billion in savings.

The current opportunity for savings driven by automated, electronic transactions within the healthcare industry is tremendous. That’s not to say the healthcare industry is doing nothing. CAQH found that healthcare organizations already save $122 billion annually thanks to process automation.

Even with the apparent success of automation, however, CAQH found the utilization, adoption, and growth of fully-automated processes year-over-year was stagnant or modest at best:

-

-

- Eligibility and benefit verification remained steady at 84%

- Prior authorizations increased to 21% from 13%

- Claim status inquiry grew slightly to 72% from 70%

- Claim payment automation increased marginally to 71% to 70%

With the small and slow shift to the use of automated transaction processes in the healthcare industry, there’s a decided advantage–in time and money–to not automating many, if not all, backend operations. Doing so allows staff to focus on strategic initiatives, like building out new programs or service lines, rather than plodding through everyday tasks better tackled through repeatable processes supported by technology.

“The industry continues to make progress towards a more automated administrative workflow as transaction volume increases, new business needs and technology emerge, and health insurance benefit and payment models evolve,” CAQH explains in the report. Nevertheless, as mentioned earlier, the “progress” remains slow, like a river choked with debris.

Ironically, even as automated solutions become more abundant and easier to use, CAQH reports healthcare providers to perform more manual tasks today than in the past. With today’s technology-rich environment, there’s little reason for healthcare providers to input any type of care-related documentation by hand. That time can and should be better spent improving the healthcare experience for patients and their families.

It’s far past time to clear the detritus from the river. With the advantage of today’s technology, it’s easier to make the change when each of us plays a part in the cleanup.

Contact a TriZetto Provider Solutions representative today to learn more about automation-enabled technologies that can help drive efficiencies and increase revenue.

EZClaim is a leading medical billing and scheduling software provider that combines a best-in-class product with exceptional service and support. For more information, schedule a consultation today, email our experts, or call at 877.650.0904.

[ Contribution from the marketing team at TriZetto ]

Jun 12, 2022 | Partner, Waystar

A version of this guide to reducing back-office denials originally appeared on Waystar’s blog.

The last few years have been hard for just about everyone involved in healthcare, and not just because the revenue cycle has grown more complex. According to data from the Bureau of Labor Statistics, people on average now hold 12.4 jobs from age 18 to 54—nearly half of which are held before the age of 25. And that equates to just as many changes in their insurance coverage. Providers in turn must struggle to keep up with their patients’ seemingly ever-changing eligibility status, along with the details of what coverage is offered per level for a variety of payer plans. All that means it’s more challenging than ever to manage just about every aspect of the revenue cycle, and denials are no exception.

A recent MGMA poll found 69% of respondents had seen a noticeable increase in denials in 2021. Among those respondents, the average increase in denials was about 17%. And while there are plenty of reasons to explain the increase, we took the opportunity with our upcoming white paper, “Supercharge eligibility + estimates with a better payer intelligence engine,” to assess how eligibility-related denials factor into the equation.

How eligibility issues stir up more denials

Some of the results produced while developing that white paper were striking. When benchmarking denials for two similarly sized health institutions (both with similar patient populations and payer mix) we discovered a sizable difference in denial rates, one that indicated the first provider had processed millions less in denials. Further analysis revealed this provider dealt with roughly 35% fewer denials, which ultimately helped contribute to an additional $3-4M in revenue.

Generally, we expect such a discrepancy to be explained by a handful of familiar factors: a low clean-claims rate, an abundance of late filing or an escalating number of appeals left unattended to—issues normally associated with back-office management. But in this case those common factors did not dominate the narrative. Instead, the following stood out as the top drivers and differences between the two:

- A $39M difference in denials for patients identified as “not eligible”

- A $34M difference in denials related to coordination of benefits

- A $4M difference related to benefit maximums being exceeded

When we began to examine those discrepancies more closely, it became clear that there really wasn’t a back-office problem at all. In fact, client processes were considered quite lean and operated with consistent accuracy. Instead, problems were being generated much earlier in the rev cycle. By the time registration, scheduling and services had been rendered, there had not been notable mitigation to denial risks that should’ve been flagged. And with ever growing payer payment adjudication cycles, it seemed a steadily increasing denial rate was inevitable.

Looking for a root cause

In a study of Waystar clients, we found more than 10% of all registrants selected the wrong plan, and up to 35% of accounts triggered some kind of eligibility alert that indicated a potential denial risk. In other words, a significant portion of denials are caused by eligibility issues, one that could have been identified well in advance of them becoming problems. Finding other payers on file, replacement plans, CHIP, dental-only coverage and many other risk categories were simply not captured or flagged, which would have allowed end users to remediate the risk before a patient had even arrived for their appointment.

But what makes identifying these risks such a challenge? Ultimately there’s more to the problem than administrative oversight. The electronic data interchange (EDI) that makes modern eligibility solutions possible often includes message segments, plan codes and other critical identifying data that needs to be normalized and extracted. But that’s not possible without the right tools. If your front-end solution is not effectively crawling eligibility responses for risks like these, it’s time to upgrade your toolset and update your strategy.

Eligibility related denials are not always caused by issues in the coverage detection process, either. When it comes to common, multi-payer scenarios, benefit levels and coordination regularly cause problems in the claims adjudication process and ultimately have a significant impact on denial rates.

Older EDI solutions do not fully comprehend payer logic and often have a hard time identifying levels of coverage across different services. It’s no longer possible to rely on something like a ‘single STC 30’ EDI call to yield the benefit it (literally) once did. Now these benefits must be presented in a manner that lets staff easily interpret coverage and realistically determine when to expect payment from the patient and payer.

Wrapping it up: developing a comprehensive approach

You could be missing your single largest opportunity to strengthen your revenue cycle without a comprehensive approach to patient access eligibility. And one of the most important aspects of a truly comprehensive approach is shoring up your front-end processes to reduce the number of issues a claim might encounter as it moves downstream through the revenue cycle. Not only does this enhance the patient experience, it steadies revenue flow as it cuts down on the sort of trouble that would otherwise further drain staff time and resources.

Check out our most recent whitepaper, “Supercharge eligibility + estimates with a better payer intelligence engine,” for a more comprehensive look at what we’ve covered here. If you’re ready to tackle the challenges afflicting your front office, check out Waystar’s Financial Clearance solutions, which offer a smarter, simpler way to streamline areas like eligibility verification and prior authorization.

Join Waystar + EZClaim on July 14th to learn how to outsmart your denials.

May 12, 2022 | Health eFilings, Partner

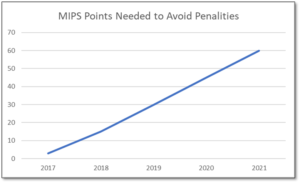

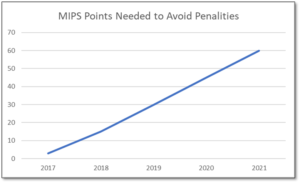

MIPS is a point-based program and understanding how to earn MIPS points is critical to avoid a 9% penalty. The MIPS program continues to change and evolve each year as it meets the goals laid out in the MACRA law and carried out by CMS. Since the program was implemented in 2017 the points threshold to avoid a penalty has grown from 3 to 60 out of a possible 100 MIPS points; the penalty has increased from 3% to 9% of annual Medicare reimbursements; and, the number of patients required to be reported on has increased from 20 patients to all patients for all payors. With the rules changing every year, the strategy you previously used to score MIPS points and report may no longer be optimal. If you want to avoid the 9% penalty in 2021 and beyond, you must think differently and evolve your strategy for MIPS.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your MIPS score. Here are three critical considerations that provide guidance on ensuring you have the right MIPS strategy to optimize your ability to earn MIPS points for the 2021 reporting period.

The Quality Category, worth the most points, is the category to focus most of your effort. Because the Quality category is worth anywhere from 40 to 85 MIPS points, focusing on this category throughout the year is critical. You need to submit a full year’s worth of data so now is the time to ensure that you are capturing all relevant data in your EHR and or billing system so that it can be properly extracted and reported on for your submission.

40% of the MIPS points require you meet stringent timeframe requirements. Two of the MIPS categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform and document activities for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long you will find it impossible to put the right actions in place to complete the activities necessary to earn any of the MIPS points in these categories.

The reporting methodology you choose impacts the points you can earn. Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the MIPS points you could earn. Unless you select a reporting partner that will help you earn the most points available by leveraging technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score, you risk leaving MIPS points on the table and significantly sub-optimizing your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the MIPS points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings’, a CEHRT, is the national leader in automated MIPS reporting and our cloud-based ONC certified software fully automates the MIPS reporting process. And because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes, you will save significant time while maximizing your financial upside.

Contact Sarah Reiter, sreiter@healthefilings.com, or 608.841.1866 to find out how to maximize your reimbursements and protect your bottom line.

About Health eFilings:

Health eFilings, a CEHRT, is the national leader in automated MIPS compliance and quality data analytics. Its services drive improved patient outcomes, optimized quality measures, and stronger financial results for healthcare practices. Their proprietary cloud-based ONC certified software is significantly more efficient and effective than any registry as it does all the work to extract, calculate, benchmark, format, and electronically submit MIPS data to CMS so clients avoid significant penalties and earn maximum reimbursements. And, you can have peace of mind knowing you are working with the best partner because CMS has accepted 100% of Health eFilings’ submissions. Learn more here: https://healthefilings.com/ezclaim

ABOUT EZCLAIM:

EZClaim is a leading medical billing and scheduling software provider that combines a best-in-class product, with correspondingly exceptional service and support. For more inforatmion, schedule a consultation today, email our experts, or call at 877.650.0904.

Apr 12, 2022 | Partner, TriZetto Provider Solutions

From the onset of the pandemic, burnout has been one of the biggest challenges facing healthcare workers. Beyond the physical aspect of being overworked and risking one’s own health to help those in need, there is also the toll the jobs takes on mental health. And burnout doesn’t only affect front-line workers. While nurses and doctors may face the brunt of pandemic-related woes, administrative burdens also impacts office staff and C-suite executives. It truly is a top-to-bottom issue.

This burnout, coupled with other issues like employee vaccine mandates and patients behaving badly, has no doubt taken its toll on healthcare workers. And the result? Resignations. Just as The Great Resignation rocked Corporate America, the healthcare industry has also felt the effects. It’s such an issue that industry CEOs ranked personnel shortages as the number one challenge they face, according to new survey results from the American College of Healthcare Executives. And the recent numbers do not lie. Hospitals lost 5,100 jobs in December 2021, according to the U.S. Bureau of Labor Statistics, with nursing and residential care facilities losing 6,100 jobs the same month, respectively. And it’s not just front-line workers that are resigning. The Medical Group Management Association (MGMA) claims 88 percent of medical practices have had difficulties recruiting front office staff.

Much of the operational tasks handled by front office employees are critical to the functioning of a practice – coding, scheduling, bill processing – need to be done regardless of staff limitations. Administrative burnout is real, and when there is an overall decrease in staff, the remaining employees are often left to pick up the slack.

Increasing costs and budgets

According to Mercer’s 2021 External Healthcare Labor Market Analysis, which examined predictive healthcare labor statistics over the next 10 years across all 50 states, labor shortages should be expected as the U.S works through the COVID-19 pandemic. With the issue of resignations and burnout not going away any time soon, leaders need to find ways to adjust. If healthcare employers want to gain and retain workers, money talks. While offering higher-than-usual salaries and additions like sign-on bonuses may not have been originally in the budget, it may be the right route to circumvent staffing issues. And as inflation and the overall cost of living rises, employers are finding that more money than usual may need to be allotted for payment increases too. A MGMA Stat poll found that fifty percent of healthcare practices budgeted more than usual for workers’ cost-of-living increases for 2022. With costs anticipated to rise, practices need to get ahead of their budgetary planning to put themselves in the best position, staffing-wise, to succeed in years to come.

Staffing the Practice of the Future

One way that organizations are trying to navigate staffing issues is though flexibility. A 2022 MGMA poll found that 59% of medical group practices shifted workers to permanent and/or hybrid work in 2021. Said workers included roles like coders, call center representatives and administrative positions. One year after the onset of the pandemic, an MGMA Stat poll showed that one in five practices said that more than 25 percent of their workforce was remote at least half the time. One of the nation’s largest health systems, the Cleveland Clinic, currently has nearly 8,000 administrative employees in at least a partially remote work model. Leadership is seeing the advantages of remote work, including reduced overhead costs, more satisfied employees and the ability to cast a wider recruiting net that is no longer limited to a single geographic region.

Over the last two years or so, organizations witnessed the positive outcome of remote work and decided not to switch back to traditional models. Another, more proactive way to alleviate administrative burnout is to get things right the first time. The key to this is having the right technology in place, like claims management and eligibility verifications, that can increase automation and create the most efficient workflows. Business processing services, including end-to-end billing and credentialing services can alleviate manual work and automate processes. Outsourcing is another logical path to take when there is just not enough hands in-house to manage day-to-day tasks.

With remote work and outsourcing now seen as viable options, organizations must adjust to keep with the times. If the C-Suite wants to retain and recruit talent, finding solutions that are satisfactory for the employee and employer should be a top concern for 2022 and beyond. Overall, organizations need to meet the needs of their employees. These needs may be vast and varied, but most executives would agree that it centers on flexibility, connectivity and technology.

Organizations looking for assistance implementing automation and RCM resources can learn more about ways TriZetto Provider Solutions can help by visiting trizettoprovider.com/ezclaim.

Feb 14, 2022 | Live Compliance, Partner

On January 21, 2021, OCR published a Notice of Proposed Rulemaking (NPRM) to modify the Health Insurance Portability and Accountability Act of 1996 (HIPAA) Privacy Rule. OCR says, the goal is to “support individuals’ engagement in their health care, remove barriers to coordinated care, and decrease regulatory burdens on the health care industry, while continuing to protect individuals’ health information privacy interests.” New regulations under consideration are centered around how substance abuse and mental health information records are protected. In addition, the HITECH Act called for an increase in penalties for non-compliance with the HIPAA.

In this article we will address the most recent changes to HIPAA and discuss which rules may have an impact on 2022 and beyond.

2020 CARES Act

2020 CARES Act aligned 42 CFR Confidentiality of Substance Use Disorder Patient Records (Part 2) regulations more closely with HIPAA as well. The CARES Act improves 42 CFR Part 2 regulations by expanding the ability of healthcare providers to share the records of individuals with substance abuse disorder, but also tightens the requirements in the event of a breach of confidentiality.

In short, rather than having to obtain a consent form for the SUD patient, and state the specific parties of whom information will be shared, patients can now give broad consent. It’s been suggested that HHS is considering changes to 42 CFR Part 2 regulations in 2022 to “to protect the privacy of substance abuse disorder patients who seek treatment at federally assisted programs to improve the level of care that can be provided.”

2021 HIPAA Safe Harbor Law

The HIPAA Safe Harbor Bill now instructs HHS to take into account the cybersecurity best practices that a HIPAA-regulated entity has adopted in the 12 months preceding any data breach.

“The bill also requires the HHS to decrease the length and extent of any audits in response to those breaches if industry security best practices have been implemented” says HHS.

21st Century Cures Act

The Cures Act called for the HHS to create a new Rule that would improve the flow of healthcare data between providers, patients, and developers of Health IT. Implementing reasonable and necessary activities that do not constitute information blocking, the implementation of these provisions will advance interoperability and support the access, exchange, and use of electronic health information.

Final Rule Expected on Proposed Changes to the HIPAA Privacy Rule

According to HHS, “the proposed changes to the HIPAA Privacy Rule include strengthening individuals’ rights to access their own health information, including electronic information; improving information sharing for care coordination and case management for individuals; facilitating greater family and caregiver involvement in the care of individuals experiencing emergencies or health crises; enhancing flexibilities for disclosures in emergency or threatening circumstances, such as the Opioid and COVID-19 public health emergencies; and reducing administrative burdens on HIPAA covered health care providers and health plans, while continuing to protect individuals’ health information privacy interests.”

The proposed new HIPAA regulations announced by OCR in December 2020 are as follows:

- Allowing patients to inspect their PHI in person and take notes or photographs of their PHI.

- Changing the maximum time to provide access to PHI from 30 days to 15 days.

- Requests by individuals to transfer ePHI to a third party will be limited to the ePHI maintained in an EHR.

- Individuals will be permitted to request their PHI be transferred to a personal health application.

- States when individuals should be provided with ePHI at no cost.

- Covered entities will be required to inform individuals that they have the right to obtain or direct copies of their PHI to a third party when a summary of PHI is offered instead of a copy.

- Healthcare providers and health plans will be required to respond to certain records requests from other covered health care providers and health plans, in cases when an individual directs those entities to do so under the HIPAA Right of Access.

…to name a few.

At Live Compliance, we make checking off your compliance requirements extremely simple.

- Reliable and Effective Compliance

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location.

- Policies and Procedures curated to fit your organization ensuring employees are updated on all Workstation Use and Security Safeguards in the office, or out. Update in real time.

- Electronic, prepared document sending and signing to employees and business associates.

Don’t risk your company’s future, especially when we are offering a free Organization Assessment to help determine your company’s status. Call us at (980) 999-1585, or email Support@LiveCompliance.com or visit www.LiveCompliance.com