Jun 20, 2022 | EZClaim

Good medical billing practices and procedures are critical to success, but without the proper solutions in place, they become challenging to get right. Far too often small, independent practices become caught up in a cycle of poor cash flow as—without the right partners or tools—their in-house medical coding and billing team become overworked and overwhelmed.

EZClaim works to bring powerful tools to, and make it easy for, small and mid-sized practices and RCM companies to submit clean claims every time easily and efficiently.

Claims that need to be resubmitted drain resources and delay payment as they have to be researched and corrected. There are two ways that unclean claims make their way back to billers:

Denied claims are claims that are processed but not paid by the payer. There are many reasons why a claim may be denied. These could include duplicate claims, uninsured services, missing information, insufficient authorization, late submissions, and other reasons. Your medical billing team must investigate the reason for denial to appeal it.

Rejected claims lack important information or are not in compliance with formatting or data requirements. The payer may not process these claims if the claim contains missing information or incorrect insurance policy numbers. These can be corrected and then resubmitted for processing.

Regardless of whether a claim was rejected or denied, you have a limited time to determine why the claim was not paid and resubmit it.

EZClaim gives you the tools and structure to submit clean claims the first time to avoid rejection in the first place. Your team can take steps at different points in the patient encounter to decrease the chance of a claim being rejected or denied.

Use custom templates and rules to identify common mistakes immediately

It is likely that there are specific billing and coding issues that your team finds continually—this is common in the industry. While many organizations are aware of common billing, code, and denial trends, they don’t have the tools to manage them. EZClaim allows you to create custom rules that review billing and code data, and flag errors for review. Automating as much of the claim review process as possible will ensure your time is used most efficiently.

Use a checklist before each appointment with the patient

Be sure to engage the patient before the appointment to stop potential claim issues from the very beginning—has their insurance or patient information changed recently? Using a scanner to collect patient information makes this process easier. Running an insurance verification is another important step.

Document coding and billing review criteria in a central knowledge base

RCM directors, coders and billers are experts in their industry, but this knowledge is not always documented. To ensure clean claims, there are many billing and coding guidelines that must be referenced. Training and reviewing claims can be difficult due to the constant changes in billing and coding requirements, information specific to your practice and payers, and staff turnover. Having a central place to document policies, procedures, and best practices will allow you to maintain accurate data and make sure that claims are filed correctly. Our partner, Live Compliance, offers solutions to make this easy.

Catch rejections and denials proactively with PM software

With claim status verification features, EZClaim can help you be proactive and catch new rejections as soon as possible. As payers continue to add rejection and denial reasons, EZClaim helps you find out where rejection and denial reason codes are coming from and determine the best way to respond to them.

EZClaim is a leading medical billing and scheduling software provider that combines a best-in-class product, with correspondingly exceptional service and support. For more information, schedule a consultation today, email our experts, or call at 877.650.0904.

Jun 12, 2022 | Partner, Waystar

A version of this guide to reducing back-office denials originally appeared on Waystar’s blog.

The last few years have been hard for just about everyone involved in healthcare, and not just because the revenue cycle has grown more complex. According to data from the Bureau of Labor Statistics, people on average now hold 12.4 jobs from age 18 to 54—nearly half of which are held before the age of 25. And that equates to just as many changes in their insurance coverage. Providers in turn must struggle to keep up with their patients’ seemingly ever-changing eligibility status, along with the details of what coverage is offered per level for a variety of payer plans. All that means it’s more challenging than ever to manage just about every aspect of the revenue cycle, and denials are no exception.

A recent MGMA poll found 69% of respondents had seen a noticeable increase in denials in 2021. Among those respondents, the average increase in denials was about 17%. And while there are plenty of reasons to explain the increase, we took the opportunity with our upcoming white paper, “Supercharge eligibility + estimates with a better payer intelligence engine,” to assess how eligibility-related denials factor into the equation.

How eligibility issues stir up more denials

Some of the results produced while developing that white paper were striking. When benchmarking denials for two similarly sized health institutions (both with similar patient populations and payer mix) we discovered a sizable difference in denial rates, one that indicated the first provider had processed millions less in denials. Further analysis revealed this provider dealt with roughly 35% fewer denials, which ultimately helped contribute to an additional $3-4M in revenue.

Generally, we expect such a discrepancy to be explained by a handful of familiar factors: a low clean-claims rate, an abundance of late filing or an escalating number of appeals left unattended to—issues normally associated with back-office management. But in this case those common factors did not dominate the narrative. Instead, the following stood out as the top drivers and differences between the two:

- A $39M difference in denials for patients identified as “not eligible”

- A $34M difference in denials related to coordination of benefits

- A $4M difference related to benefit maximums being exceeded

When we began to examine those discrepancies more closely, it became clear that there really wasn’t a back-office problem at all. In fact, client processes were considered quite lean and operated with consistent accuracy. Instead, problems were being generated much earlier in the rev cycle. By the time registration, scheduling and services had been rendered, there had not been notable mitigation to denial risks that should’ve been flagged. And with ever growing payer payment adjudication cycles, it seemed a steadily increasing denial rate was inevitable.

Looking for a root cause

In a study of Waystar clients, we found more than 10% of all registrants selected the wrong plan, and up to 35% of accounts triggered some kind of eligibility alert that indicated a potential denial risk. In other words, a significant portion of denials are caused by eligibility issues, one that could have been identified well in advance of them becoming problems. Finding other payers on file, replacement plans, CHIP, dental-only coverage and many other risk categories were simply not captured or flagged, which would have allowed end users to remediate the risk before a patient had even arrived for their appointment.

But what makes identifying these risks such a challenge? Ultimately there’s more to the problem than administrative oversight. The electronic data interchange (EDI) that makes modern eligibility solutions possible often includes message segments, plan codes and other critical identifying data that needs to be normalized and extracted. But that’s not possible without the right tools. If your front-end solution is not effectively crawling eligibility responses for risks like these, it’s time to upgrade your toolset and update your strategy.

Eligibility related denials are not always caused by issues in the coverage detection process, either. When it comes to common, multi-payer scenarios, benefit levels and coordination regularly cause problems in the claims adjudication process and ultimately have a significant impact on denial rates.

Older EDI solutions do not fully comprehend payer logic and often have a hard time identifying levels of coverage across different services. It’s no longer possible to rely on something like a ‘single STC 30’ EDI call to yield the benefit it (literally) once did. Now these benefits must be presented in a manner that lets staff easily interpret coverage and realistically determine when to expect payment from the patient and payer.

Wrapping it up: developing a comprehensive approach

You could be missing your single largest opportunity to strengthen your revenue cycle without a comprehensive approach to patient access eligibility. And one of the most important aspects of a truly comprehensive approach is shoring up your front-end processes to reduce the number of issues a claim might encounter as it moves downstream through the revenue cycle. Not only does this enhance the patient experience, it steadies revenue flow as it cuts down on the sort of trouble that would otherwise further drain staff time and resources.

Check out our most recent whitepaper, “Supercharge eligibility + estimates with a better payer intelligence engine,” for a more comprehensive look at what we’ve covered here. If you’re ready to tackle the challenges afflicting your front office, check out Waystar’s Financial Clearance solutions, which offer a smarter, simpler way to streamline areas like eligibility verification and prior authorization.

Join Waystar + EZClaim on July 14th to learn how to outsmart your denials.

May 14, 2022 | EZClaim

Reporting is a fundamental tool in EZClaim and key to medical billing success. With EZClaim’s powerful reporting capabilities, your business decisions can be informed by real-time data and not left to chance. From adjustment reports to patient demographics, EZClaim comes with a range of baseline reports that every biller needs to work cleanly and efficiently.

Why these reports are critical for your business

Accurate and timely reporting is crucial to maintain a full awareness of your business and address issues before they become critical. With the right reporting tool in place, you can avoid lost revenue, keep reimbursements high, and decrease denials.

EZClaim provides insight to key revenue cycle metrics and makes it easy to identify month to month trends. Whether it is a payments report that shows a sudden drop in collections or an aging report for claims that have not been paid in a month or longer, these reports allow you to identify problems and take action before it is too late.

The features that set EZClaim reporting apart

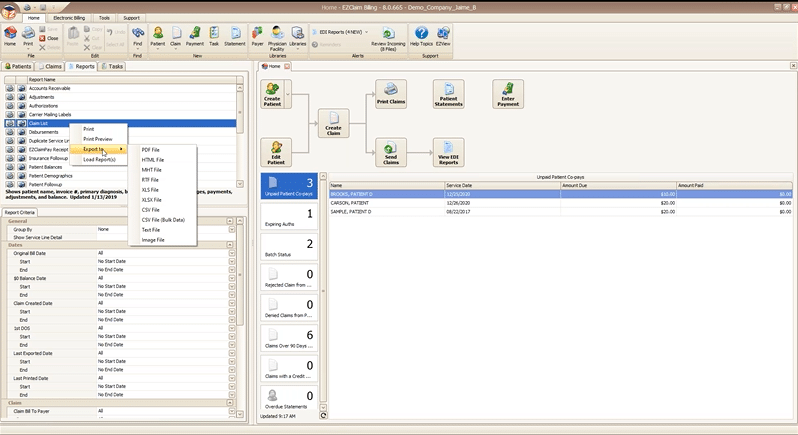

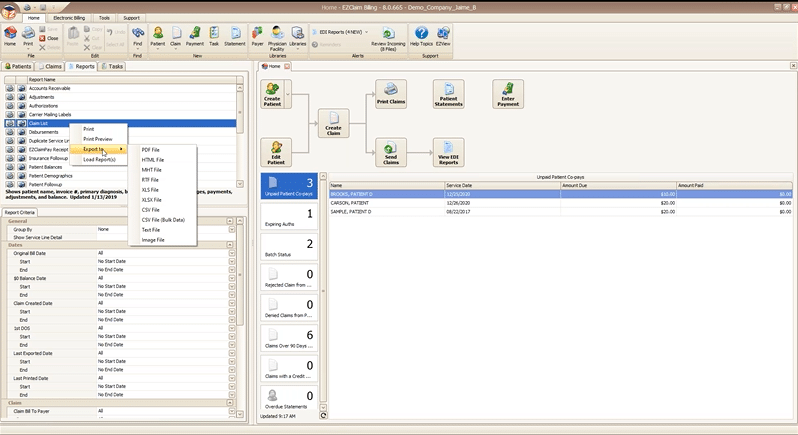

On demand reporting formatted your way

All EZClaim reports can be exported in a variety of formats so that you can open them directly in the format you most prefer. In two clicks you can preview and print a hard copy of any report, or export and open on your desktop.

Reports can be exported as a:

- PDF file

- HTML file

- MHT file

- RTF file

- CSV/XLS/XLXS (Excel) file

- Text file

- Image file

Getting just the data you want with report criteria

Every report in EZClaim can be tailored to show only the data you want by specifying report criteria. Report criteria parameters vary by report but aim to give you full control over what the report returns. For example, the “Claim List” report provides a list of claims and their associated details, such as invoice number, payments, adjustments, and more. This report provides a wide range of criteria options so that you can return only claims that, for example, fall in a particular bill date range, or claims for a specific payer. The best part is that you can combine as many criteria parameters as you need to zoom in on just data that you want.

With these features, EZClaim makes reporting powerful and flexible, by giving you the power to instantly create real time reports that are as focused or broad as needed, and then exported in the exact format that you need them.

If you are ready to learn more about EZClaim reporting or have any questions about our leading medical billing software, schedule a consultation today or get in touch with our experts.

Apr 19, 2022 | EZClaim

For over two decades, EZClaim’s foremost goal has been to make medical billing easier and more efficient. Let’s look at the features in EZClaim that h.

Templates

Templates are a great way to save time and ensure accuracy by pre-filling fields that will be consistent across patients or claims. EZClaim has two types of templates to choose from

Patient templates

Patient templates can be used to pre-fill patient demographic information. These templates are extremely useful and flexible across a range of scenarios where you know that patient demographic information will be the same.

For example, if your office has one doctor that only serves Medicare patients, you can easily create a template that will pre-fill Medicare as the payer for that doctor. Maybe you have a payer that requires a specific qualifier. This can be quickly loaded from a template with the necessary fields pre-filled.

Claim templates

Claim templates work much the same way that patient templates do. They make it easy to create claims around “standard” visits. In pediatrics, a common usage might be a claim template for a well-visit and immunizations. Standardizing these visits with a template not only saves you time but also helps ensure you are collecting all the applicable charges and that nothing gets left off.

Another common example that we see is using templates for modifiers for tele-health visits. The template gives you a standard foundation to make sure everything is in order.

A similar functionality that many find useful is using the “previous claim” pre-fill functionality. This copies the fields from the previous claim into a new one, which you can then alter as needed.

Both patient and claim templates serve as a flexible tool to standardize your process, reducing repetition and increasing accuracy.

Validation rules

Another great tool to ensure clean claims is by validating inputs. EZClaim comes with several default validation rules, for example, a billing provider must be set before the claim can be submitted. This tool can also be used to create custom rules. Rules can be set around how to validate:

- Patient entries

- Payer entries

- Physician/Facility entries

- Sending claims

Like the templating functionality, validation rules are extremely flexible and can be adapted to your individual needs. As an example, one custom validation rule revolves around Medicare member numbers—because we know that all Medicare member numbers are 11 characters, we can set a validation rule that enforces 11 characters for all claims where Medicare is set as the payer. Maybe for your use case certain CPT codes require extra documentation, or certain types of claims that should be flagged for extra review before being submitted. These rules can all be standardized and enforced with custom validation rules.

It might be the case that certain rules have exceptions. Validation rules can be set up to trigger with an error, so that the claim cannot be submitted, or with a warning, so that the user is made aware that a rule has been broken but it will not prevent the claim from being submitted. Custom rules are a powerful tool and must be used with caution—you don’t want to prevent clean claims from being sent out. However, if you find that you are continually running into a particular issue with a category of claims, it can be a great way to ensure accuracy.

Mar 12, 2022 | EZClaim

There is one feature of EZClaimPay that has received universal acclaim from our clients, and that is the ability to send SMS text message-based payment reminders to patients. By reaching patients where they are—on their phones—we’ve seen that billers can increase their payment rates and get paid more quickly. This feature has increased patient satisfaction too, reducing payment friction, and allowing them to make a payment in the EZClaim portal with one tap. One client told us:

“We sent out the first SMS payment requests last week, and within several hours had generated 9 payments for a total of over $2,400 back from the patients! The provider is thrilled. After 2 days we had over 11 payments and more than $2,600! What a testament to how well this payment option is for providers and patients.”

With the average business owed $300,000 in late payments, utilizing a two-pronged payment reminder approach is critical to reducing late payments. EZClaimPay automatically generates a payment portal link which can then be sent out via email or SMS. On average, emails receive a 25% open rate, while SMS messages have an average open rate of 98%. Text messaging has proven very effective, with high open rates and engagement rates. However, email notifications are not going away. In fact, using both mediums is the best way to get paid, as each has pros and cons. With email notifications, you get deliverability to every device that your client has, whether it is their computer or the email app on their phone or tablet. With SMS text messaging, you are only getting deliverability to one device, but it is the device that is most likely to be in their pocket right now. When it comes to time sensitive requests like payment reminders, the ability to use SMS text messaging is critical.

Why choose SMS text message payment reminders for patients?

Invoices get paid faster and are more convenient for patients

Reduce payment friction by making invoice payments seamless for customers. EZClaimPay generates a direct link to include in the email or SMS communication that allows your client to make a payment instantly. Making payments easy for patients is a quick and low-cost way to increase patient satisfaction and results in greater engagement overall.

Reach patients with ease

Patients are used to providing their phone numbers to providers, and it is the one piece of contact information that is most likely to be on file. Stop getting stuck in spam and go straight to notifications.

Time savings & reduced operational costs

It gets expensive having patient statements printed and mailed out multiple times. Don’t waste any more time following up with customers manually and making repeated phone calls they may not answer. Give patients a notification right in their pocket and let them pay in one tap with EZClaimPay.

There are so many benefits to using EZClaimPay, and specifically the SMS text messaging functionality for payment reminders. EZClaimPay allows patients to pay online, increase revenue, and a simplify the payment process. For more information contact us or call directly at 877.650.0904.