Feb 9, 2022 | DocVocate, Partner

Denial management has been a thorn in the side of provider RCM teams forever. And unfortunately, despite expanded EHR use and claim coding improvements, denial rates have continued to rise into the pandemic; from 9% in 2016 to 10.8% mid-pandemic in 2020.

Cost To Rework Claims

To make matters worse, the average cost of reworking denials ranges from $25-$118 per claim. As a result, over 60% of denials are never resubmitted! Here’s why:

- Lack of A/R Specific Software: Payer and EHR variability has forced A/R into manual workflows

- Staff Cost: Cost to retain skilled A/R follow up staff

Keys To Optimizing Denial Management

The good news is, modern software tools are easier to build and here to help provider billing teams. Historically, only large hospitals and payers had access to the most advanced technology, but that’s changing rapidly. Here are a few A/R follow up areas where modern software can help.

Auto-Triage of Claims

The current standard for all billing teams is to assess each claim one-by-one. Typically, it’s an “ERA by ERA” assessment that often requires further digging to really determine the correct action. However, payer claim decisions are pattern-based. With modern tools that combine these patterns with your preferred triaging, the software can triage claims in batches. This both removes the repetitive process of claim triage and optimizes the proper action decision.

100% Digital Appeals

Even after choosing to appeal a claim or send a medical record, the process of building an appeal letter, filling out a payer form, and then submitting it back to the various payers is extremely time consuming. Some teams report that it takes 35 minutes per claim!

Finding the right language to best appeal the denial is challenging on its own. What worked and what didn’t work — and why? Billing agents are often left to themselves to figure this out. From there, actually submitting the appeal via postal mail, fax, or payer portal is both time consuming, costly, and often requires a different team to touch the appeal.

Having a solution that turns this entire build and submission into a single, digital process for all denial types and payers is the only way to solve this major pain.

Team Performance Tracking

Without a digital A/R follow tool, described above, billing team managers are left to track their team’s performance through the use of onerous spreadsheets and difficult to assess reports. Managers rely on their team members to train each other and report back any difficulties they might be experiencing. This leads to real gaps in performance assessment and, ultimately, the ability to help their teams succeed.

Having a digital A/R solution fixes that. The need for a real-time dashboard that provides these KPIs, along with real-time alerts related to individual agent performance, is the way forward.

Real-Time Denial Trends AND Alerts

Finally, as mentioned earlier, denials happen in patterns. The challenge is, those patterns vary by payer, provider, region, and specialty. And they change over time too! So, these patterns are difficult to track manually. Each pattern change has immediate downstream effects that can lead all the way back to the providers themselves, with annoying code corrections and medical records requests.

A modern A/R solution that is dedicated to sharing these patterns via a real-time dashboard is the key. Not just a static dashboard with denial statistics, but in-app and email alerts that indicate an important change in a pattern. That aspect is especially important, because all billing agents are extremely busy and are bogged down by task after task. A smart platform that informs you of the most important information without any effort from you is required.

This is an exciting time for provider billing teams. At DocVocate, our team is passionate about helping provider billing teams. We’ve spent considerable time thoughtfully building our platform, Appealio, just for you. New tools are on the way to help!

If you found this helpful and would like to discuss further, please feel free to reach out to us at info@docvocate.com.

Dec 30, 2021 | Partner, TriZetto Provider Solutions

Are You Getting the Most Out of Your Credentialing?

Enrollment status can greatly affect the dollar amount payers reimburse, and some specialists are opting to go out of network. We weigh the pros and cons of this trend to explain why it may make sense for select providers.

Did you know that reimbursement is directly tied to credentialing? It’s all in the details, and enrollment status can greatly affect the amount payers reimburse. When enrolling as an in-network provider, payers and providers decide on an agreed-upon rate. However, a physician can decide to forgo a traditional contract with a payer and instead choose to be labeled as “out of network”. Of course, they will still be listed as a provider, albeit without the stated reimbursement rates and payment security that comes with having a contract in place.

If you are wondering why this option is appealing to some physicians, just look at common treatments the average healthcare consumer may be familiar with. Every year, most adults and children visit their local eye specialist for an annual exam. An optometrist performing a routine eye exam will most likely receive optimal reimbursement. This service is covered by insurance in the majority of cases and the reimbursement will be within a standard range. However, if this same patient is then referred to an ophthalmologist for advanced cataract surgery, for example, the odds of insurance covering this procedure are less likely. From the standpoint of the ophthalmologist, his credentialing specifics may not matter too much, since he will be paid regardless and the patient is most likely assuming that they will have a large out-of-pocket cost. When all is said and done, the ophthalmologist is set up to take home more than if he was listed as an in-network option. Looking at it through the eyes of the surgeon, it would not make sense financially to be credentialing with payers the traditional way.

The benefit of being in-network boils down to the contracts that determine what providers will be paid. When a provider works with a payer, an agreed-upon rate is determined. If paperwork is filled out correctly and claims are submitted on time, there will not be too many surprises when the time comes to be reimbursed. A provider will know what to expect from a particular service. This process works best for providers that like the security of having a contract in place. However, these contacts with insurance companies often result in providers being paid less than fair market value. The truth of the matter is that fair market value may often be more than payers are willing to pay.

It’s not uncommon for family doctors, or eye care professionals that deliver routine exams like the example mentioned above, to work in-network because the margins are small. For highly specialized services, often considered elective and not covered by insurance, the potential for large reimbursement grows significantly. For instance, let’s say a plastic surgeon performs surgery in their own surgical suite. The procedure may cost $14,000. Through payer reimbursement as an in-network provider, the surgeon receives $4,000. However, if the surgeon is considered out-of-network, they have the ability to negotiate rates, meaning much more could potentially be earned. From the patient’s standpoint, it’s not uncommon for a patient to shop around and expect to use an out-of-network provider anyway for these types of highly specialized services.

When it comes to gaining credentials, an out-of-network provider will not have to go the traditional credentialing route. This question arises: Is it smarter for medical professionals to perform their services as in-network or out-of-network providers? The truth is, a lot of doctors do not actually realize they have the ability to negotiate. It all comes down to how they want to pay, and the power lies with the provider.

Credentialing is complicated, and it helps to have the right partner in place to navigate the path to credentials. TriZetto Provider Solutions (TPS) has experienced credentialing experts in place that can help with every aspect of the process. Visit our TPS partner page to learn more and request a demo.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Nov 18, 2021 | Partner, TriZetto Provider Solutions

With two more states recently joining the list of locations that allow Full Practice Authority, many nurse practitioners are exploring the option of operating independently. As the need for qualified healthcare professionals continues to grow and the ability for NPs to practice independently continues to increase, quickly gaining credentials and navigating compliance challenges becomes more and more important.

Recently, Massachusetts and Delaware became the latest states to enact Full Practice Authority (FPA) for nurse practitioners (NPs), bringing the total number of states to 24. With this new inclusion, nearly half of U.S. states now allow nurse practitioners to operate on their own. Essentially, this means that registered nurses can practice independently from physicians, allowing for more autonomy in their careers and the care they provide.

So why this is significant? This means that registered nurses can practice independently from physicians, allowing for more autonomy in their careers and the care they provide. Nurses are no longer “tied” to physicians, so to speak.

These new laws cannot come at a better time. We know that the amount of practicing medical doctors has dwindled in recent years, due to the pandemic and many providers leaving the field. This has led to a short supply of physicians in the U.S., which has only 2.6 practicing physicians per 1,000 people, compared to 4.3 in Sweden and 3.2 in France. This decrease is driving unprecedented demand for nurse practitioners (NPs), with an expected increase of 52% through 2029.

Traditionally, state practice and licensure laws required NPs to have a career-long collaborating or supervising physician to provide patient care. However, with more and more states allowing Full Practice Authority, now nearly half of U.S. states now allow nurse practitioners to operate on their own. But in order for NPs to move forward with independent practice, credentialing is essential. How can nurse practitioners looking to establish their own practices quickly gain credentials and painlessly navigate the challenges of compliance?

Operating independently means nurses need to establish credentials as a standalone provider to be eligible for in-network status to receive physician-level reimbursements. These tasks, and complying with the Council for Affordable Quality Healthcare’s (CAQH) requirements, can be taxing and time-consuming, even for the most seasoned professional. Creating a new CAQH application is highly manual, and the required quarterly updates for re-attestation can be onerous. Extensive credentials including education, residency, internships, and peer references are also required, which require time to gather information and resources. It’s not an exaggeration to say that many hours must be spent uploading copies of licensing information, board certifications, DEA registration, and insurance certificates.

NPs looking to leave their current situation may need help navigating credentialing challenges. Partnering with a third-party provider to help manage credentialing lightens the load and allows nurses to focus on patient care. TriZetto Provider Solutions (TPS) offers an end-to-end credentialing service that ensures continuous payer follow-up and insight into enrollment status.

Discover the most painless way to gain credentials. Visit our TPS partner page to get started.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Oct 14, 2021 | Partner, TriZetto Provider Solutions

New No Surprise Act Tackles Unexpected Medical Bills

Two-thirds of bankruptcies filed in the United States are a result of medical expenses. It’s an alarming statistic, but probably not surprising. It’s no secret that many people have trouble paying out-of-pocket medical costs, so much so that a recent survey from The Commonwealth Fund found that 72 million Americans have some sort of trouble with medical debt.

It’s a common problem, but why? Let’s say a person visits a hospital, perhaps an emergency room, and receives a myriad of services. Maybe they arrived via ambulance or required treatment from an anesthesiologist. Although they may inquire about an estimate at the time of service or have an idea of their coverage, the exact financial responsibility is often a mystery. But what’s a person to do? They need medical assistance, and they need it at that moment. Then a surprise arrives in the mail in the form of an outrageously high medical bill. It’s something many of us have likely experienced.

What’s the cause of such an expense? Often the charge stems from using an out-of-network provider. Basically, this means that the hospital may have been in-network, but the physicians were not. Additionally, patients are often confused about medical coverage. Even with a good understanding of their benefits, situations may arise that are out of their control, and there may be unintended outcomes. Patients may (falsely) believe that all services rendered will be considered in-network when they go to an in-network facility. However, this isn’t always the case. In some instances, even though their physician is in-network, patients referred to specialists (such as a pathologist or radiologist) may discover the ancillary services were out of network. It is only after the patient receives a bill that they discover the issue. In the case of an emergency visit, patients don’t have the luxury of researching for in-network hospitals and typically go to the nearest hospitals. Patients may also be taken to out-of-network hospitals by ambulance. Researchers estimate that 1 in 6 emergency room visits and inpatient stays involve care from at least one out-of-network provider. The cost of out-of-network visits can have devastating financial consequences for the patient.

A 2019 study by the Government Accountability Office (GAO) found that the cost for air ambulance services clocked in at approximately $40,000. A large portion of this cost (over 70 percent) often fell out-of-network, meaning that the balance usually was placed on the consumer. When such a service is needed, it’s understandable to not have the option to “shop around” for a cheaper, in-network alternative.

Thankfully, help is on the way. Leaders and policymakers at the federal level have taken steps to tackle the issue. On July 1, 2021, the Biden Administration announced a new rule aimed at protecting consumers from surprise medical bills. In conjunction with the Department of Health and Human Services (HHS), together with the Departments of Labor and Treasury and the Office of Personnel Management, debuted “Requirements Related to Surprise Billing; Part I.”

This announcement, the first in a series, will go into effect on January 1, 2022, and protect patients from those all-too-common surprise medical bills. It’s an important step forward in protecting patients.

“No patient should forgo care for fear of surprise billing,” stated HHS Secretary Xavier Becerra. “With this rule, Americans will get the assurance of no surprises.”

Let’s dive into the new regulation. Among other provisions, the rule:

-

- Protects patients from surprise billing in emergency services. These provisions will safeguard patients in emergency care situations from unknowingly accepting out-of-network care and incurring unexpected expenses.

- Limits out-of-network cost-sharing. Patient cost-sharing for emergency and non-emergency services, such as a deductible, cannot be higher than if provided by an in-network provider. Simply put, co-insurance or deductibles must be based on in-network rates.

- Bans out-of-network charges for ancillary care. Previously, out-of-network providers like anesthesiologists could have been assigned, even though the facility or physician was in-network.

- Requires that providers and facilities provide patients with accurate cost information and advance notice of any out-of-network charges for non-emergency services. A consumer notice must explain that patient consent is required to receive care on an out-of-network basis before that provider can bill at the higher out-of-network rate.

- Allows providers and insurers access to a dispute resolution process should reimbursement issues arise around reimbursement.

With the increase in high deductible health plans and increased out-of-pocket costs, finances are top of mind. From the consumer’s standpoint, gaining healthcare services will be less stressful. On the simplest level, this ruling will hopefully eliminate those hefty surprise bills, which can only be seen as a positive. Moving forward, patients can rest assured that they will be more aware of expenses and will avoid out-of-network charges for emergency care.

So can consumers finally say goodbye to surprise medical bills? Hopefully, they become a thing of the past. And how will this bill affect the future of the industry? Advocates are hoping these regulations and newfound transparency will eventually lower costs, for one. More importantly, it shines a light on the need to improve the overall patient experience. It’s a step in the right direction and has the potential to improve healthcare policies going forward for years to come.

For more information on solutions that equip you to have informed conversations about financial responsibility and eligibility, contact a TriZetto Provider Solutions representative today.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

New Patient Survey About Price Transparency Rule

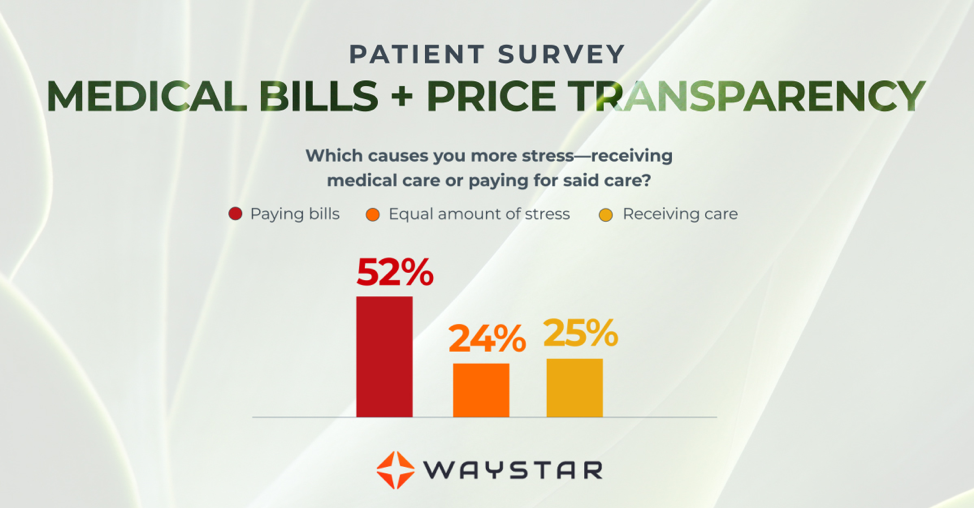

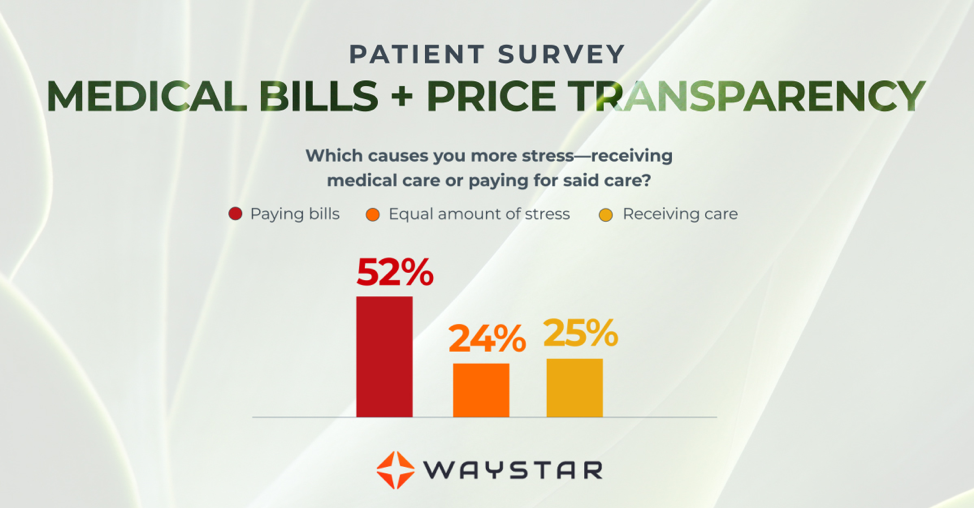

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]