Jul 26, 2021 | Partner, Trizetto Partner Solutions

Medicare is the largest payer for most practitioners, so it’s important that providers maintain current credentials. Medicare requires providers to revalidate every five years to verify credentials and ensure they meet Medicare qualifications. Providers must confirm or update information including the legal entity name, physical address, phone, fax, national provider identifiers, employer identification number, and board certifications and licenses if applicable.

While typically a straightforward process, if not completed correctly and on time, providers will be terminated from the program and required to reapply. Until a new application is processed and approved, which can take anywhere from 90-120 days, reimbursements will stop, disrupting the revenue cycle.

Occasionally, providers may receive off-cycle revalidation requests. These are typically triggered when anomalies are identified such as billing rates that are significantly higher than other providers in the same geography, billing for services not rendered, or billing patients for services that Medicare doesn’t allow.

To comply with Medicare revalidation requirements, providers need to know their revalidation schedule and make sure applications and supporting documentation are submitted through Medicare’s PECOS online application portal. Revalidation dates cannot be extended, so it’s important they’re submitted on time. Using a third party to navigate the nuances of Medicare revalidation and PECOS removes the burden from provider staff and ensures accurate and timely filing.

TriZetto Provider Solutions (TPS) offers an end-to-end credentialing service that includes continuous payer follow-up and insight into enrollment status. Our dedicated team takes provider data, verifies it for accuracy, and submits credentials for revalidation through PECOS. All Medicare-participating providers are subject to revalidation, and mistakes made before or during the process can result in loss of eligibility and other penalties.

Having nearly four decades of experience working with payers and providers, the TPS credentialing experts understand the importance of maintaining current credentials. Contact us to learn more about our Medicare revalidation services.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Feb 9, 2021 | Electronic Billing, Medical Billing Software Blog, Partner

Do you have a fee schedule? If so, do you maintain it on a regular basis?

Well, this is an easy step to skip, but an annual review could put some extra cash in your pocket and help you keep a better handle on how much collectible money you have outstanding. Here are three things you should consider when creating or maintaining your fee schedule:

1. Mark Up the Charge Amount: Did you know that most payers will not pay you more than what you charge, even if you charge less than the allowed amount? They will accept whatever charge amount you have and adjust the difference, but they won’t pay you more than you charge. This can really cost your practice!

2. Allowed Amounts Change: In addition to payers updating the allowed amount for services, many insurances are offering incentive-based programs you may be eligible to collect a percentage over the allowed amount! If you are basing your charge amount on the payer’s allowed amount you may never see the incentive money that you have earned! Even a small percentage can add up quickly!

3. Decide on an Amount: If you aren’t sure where to start, consider setting your charge amounts based on the Medicare allowed amounts. Using 150% of the Medicare allowed amounts is a fairly standard starting point.

In addition to keeping the fee schedule current, make sure to monitor Allowed Amount and Paid Amount on a monthly basis. If you find that you are collecting the full allowed amount, it is time to increase the charge amount so you don’t leave money on the table!

If you need help getting started, consider working with a consultant. At RCM Insight, we offer annual fee schedule reviews. During the month of February 2021, we will be offering four practices a FREE fee schedule review, so visit our website at www.rcminsight.com and visit the CONTACT US page for your chance to win!

RCM Insight uses EZClaim’s medical billing software for their billing services. For more details about EZClaim’s medical billing solutions, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: Stephanie Cremeans with RCM Insight ]

Jan 11, 2021 | Electronic Billing, Partner, Waystar

With Medicare Advantage enrollment continuing to rise and more plans offering more benefits than ever, big changes are coming in 2021. This post will discuss the key changes to Medicare Advantage plans in the next year, program updates due to the COVID-19 public health emergency, and advice on how to navigate billing and reimbursement concerns.

For the first time in history, Medicare Advantage (MA) penetration has reached 40% of the total Medicare-eligible population. Currently, 25.4 million people are enrolled in Medicare Advantage (MA) plans, with a total Medicare-eligible population of 62.4 million, according to the Centers for Medicare and Medicaid Services (CMS). [ Link to report ]

With an aging population, enrollment in Medicare Advantage plans will only continue to grow (The Congressional Budget Office projects enrollment in these plans to rise to about 51% by 2030).

Medicare Advantage is an alternative to traditional Medicare that acts as an all-in-one health plan and is sold by private insurers. All Medicare Advantage plans must provide at least the same level of coverage as original Medicare, but they may impose different rules, restrictions, and costs. Most Advantage plans offer the same A and B coverage for the same monthly premium as regular Medicare plans, but also often include Part D prescription drug coverage, limited vision, and dental care, broader coverage, lower premiums, maximum out-of-pocket limits, and extra benefits—all of which expanded in 2020.

While this represents a distinct opportunity for many providers to be more profitable, growing enrollment also poses challenges. Medicare beneficiaries have more choice than ever before when it comes to selecting an MA plan.

According to the Kaiser Family Foundation (KFF), there are 3,148 Medicare Advantage plans available for individual enrollment for the 2020 plan year—an increase of 414 plans since 2019. The average beneficiary could choose among 28 plans in 2020. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycles, who need to navigate hurdles that vary by the plan in order to get reimbursed.

MA plans also tend to be more transient, meaning patients may switch often, even yearly if they choose through the open enrollment period. Providers must better manage every patient accordingly so they can maximize plan benefits. Doing so takes more effort, but the payoff can lead to profit.

CMS has clearly stated a goal to move from the current fee-for-service models toward value-based care. While the Medicare Advantage population grew by 60% from 2013 to 2019, the fee-for-service Medicare population only grew by 5%. The progress Medicare Advantage plans have achieved essentially creates an idea marketplace for beneficiaries. Enrollment costs are down and more plans than ever are offering new, innovative benefits. But what does this mean for providers?

So, how has COVID-19 affected Medicare Advantage plans? Well, the COVID-19 stimulus package, the Coronavirus Aid, Relief and Economic Security (CARES) Act, includes $100 billion in new funds for hospitals and other healthcare entities. The Centers for Medicare and Medicaid Services (CMS) made $30 billion of these funds available to healthcare providers based on their share of total Medicare fee-for-service (FFS) reimbursements in 2019, resulting in higher payments to hospitals in some states than others, according to KFF. Hospitals in states with higher shares of Medicare Advantage enrollees may have lower FFS reimbursement overall. As a result, some hospitals and other healthcare entities may be reimbursed less than they would if the allocation of funds considered payments received on behalf of Medicare Advantage enrollees.

In response to the COVID-19 emergency, many Medicare Advantage insurers waived cost-sharing requirements for COVID-19 treatment, meaning that Medicare Advantage beneficiaries will not have to pay cost-sharing if they require hospitalization due to COVID-19 (though they would if they are hospitalized for other reasons).

If a vaccine for COVID-19 becomes available to the public, Medicare is required to cover it under Part B with no cost-sharing for traditional Medicare or Medicare Advantage plan beneficiaries, based on a provision in the Coronavirus Aid Relief, and Economic Security (CARES) Act.

A Spotlight on Prior Authorization

Medicare Advantage plans can require enrollees to receive prior authorization before service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2020, according to KFF. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, and is infrequently required for preventive services. Prior authorization can create barriers for providers and beneficiaries, but it’s meant to prevent patients from getting services that are not medically necessary, thus reducing costs for beneficiaries and insurers.

In a 2018 analysis, KFF found that four out of five MA enrollees—or 80%—are in plans that require prior authorization for at least one Medicare-covered service. More than 60% of MA plan enrollees require prior authorization before receiving home health services, and that percentage increases to more than 70% for skilled nursing facility and inpatient hospital stays.

The Families First Coronavirus Response Act (FFCRA) prohibits the use of prior authorization or other utilization management requirements for these services. A significant number of Medicare Advantage plans have waived prior authorization requirements for individuals needing treatment for COVID-19.

How Providers Can Prepare for a Medicare Advantage Boom

Medicare beneficiaries have more choice than ever before when it comes to selecting a MA plan. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycle. Healthcare providers will need to navigate new hurdles that vary by the MA plan in order to get reimbursed.

When beneficiaries change plans, it creates another challenge for providers. Historically, about 10% of MA enrollees change plans during open enrollment. Although this number seems low, even a small change in coverage can cause big problems for a healthcare provider’s revenue and cash flow. Billing the wrong insurance company leads to costly denials and appeals. Becker’s Hospital Review estimates that healthcare providers spend about $118 per claim on appeals. A study by the Medical Group Management Association found that the cost to rework a denied claim is approximately $25, and more than 50% of denied claims are never reworked.

Despite the challenges, providers don’t want to be left out of the MA boom. But how can they best prepare? Well, first off, healthcare providers need to ensure they are capturing accurate patient information. Next, they need to reevaluate workflows, so they are prepared to handle time-consuming prior authorizations. Additionally, healthcare organizations must consider how frequently they are re-running eligibility on patient rosters to make certain they do not miss a change in insurance coverage for patients under their care. Providers should re-run patient rosters monthly, so they have the most accurate benefit information. This will help them avoid unnecessary claim denials.

As MA continues to ramp up, the most successful providers will be those who work with a revenue cycle management partner that understands the nuances of Medicare reimbursement as well as the added complexities of MA.

With the acquisition of eSolutions, a leader in revenue cycle technology with Medicare-specific solutions, EZClaim’s ‘partner’, Waystar, so happens to be the first technology to unite commercial, government, and patient payments into a single platform, solving a major challenge and creating meaningful efficiencies. Billing Medicare, Medicare Advantage, and commercial claims from a single platform eliminates the hassle of managing multiple revenue cycle platforms and allows providers to get deeper AI-generated insights for faster reimbursement and increased value—for their organizations and their patients.

For more information about Waystar‘s platform, visit their website, or give them a call at 844.492.9782. To find out more about EZClaim‘s medical billing software, visit their website, e-mail their support team, or call them at 877.650-0904.

[ Article contributed by Waystar ]

Jan 11, 2021 | Electronic Billing, Health eFilings, Medical Billing Software Blog, Partner

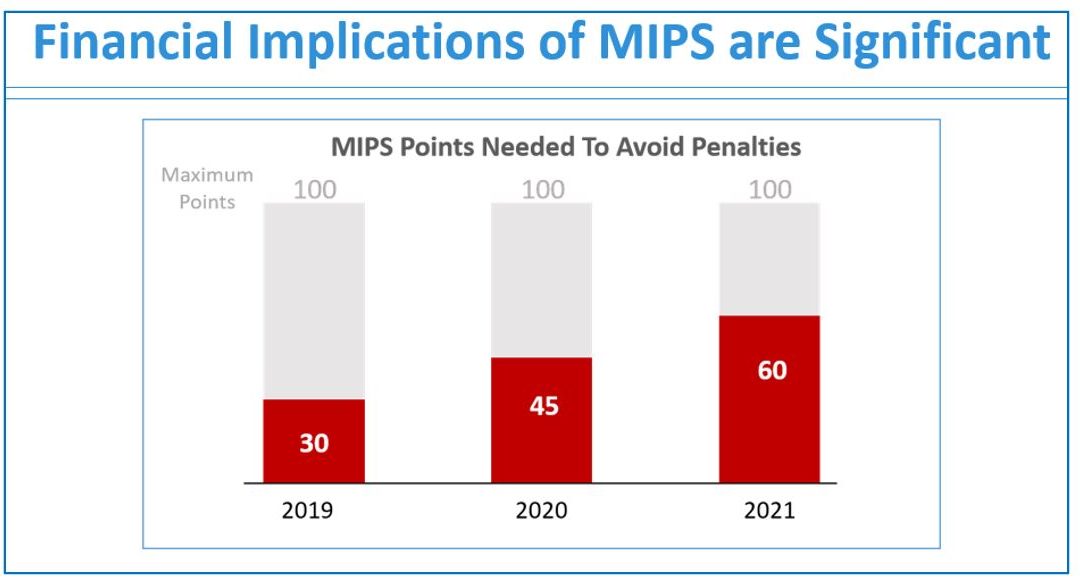

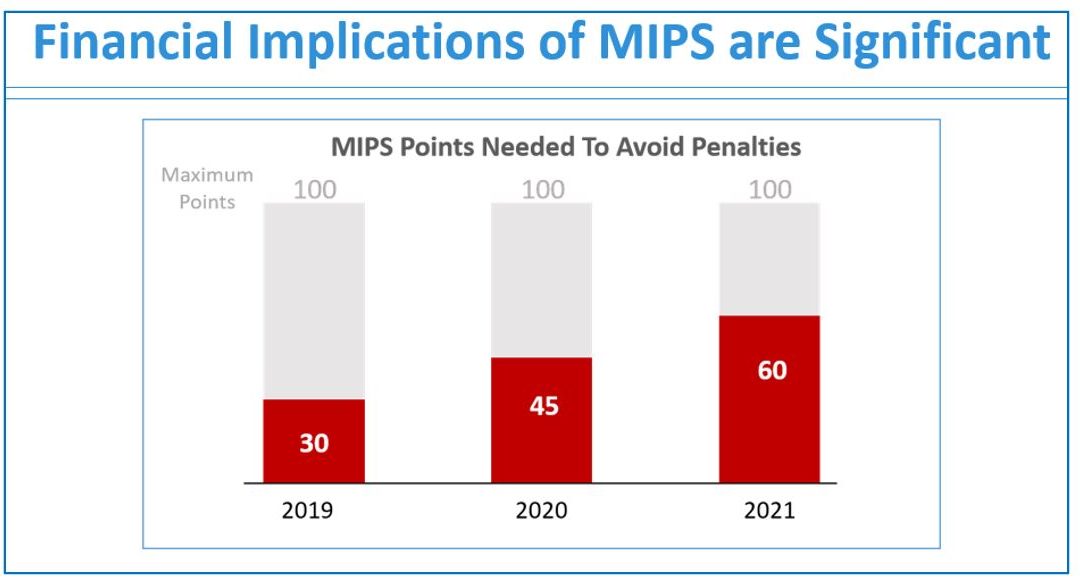

If you are not a MIPS expert (Merit-based Incentive System), your Medicare reimbursements may be decreased by 9% in the next year. However, it’s not too late to avoid the penalty for the 2020 reporting period, but you need to act now!

One of EZClaim’s partners, Health eFilings’ has ONC-certified software that completely automates the MIPS compliance process for you. The software will automatically extract the required data directly from EZClaim (and/or your EHR), and then proprietary algorithms will process the 9,000,000 possible combinations of quality measures for each clinician to identify which measures should be submitted to CMS (Centers for Medicare and Medicaid Services) to earn you the most points.

Need a MIPS expert? Well, Health eFilings is one of the best, and CMS has accepted 100% of their submissions on behalf of their clients. If you have completed your 2020 reporting, reach out to them, and learn how you can earn even more points in 2021.

For more information about EZClaim’s medical billing software, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Sarah Reiter, SVP Strategic Partnerships, Health eFilings]

Sep 10, 2020 | AMBA National Conference, Medical Billing Software Blog, Support and Training

EZClaim is always looking for ways to help our medical billing clients improve. In an effort to further that mission, this month we are kicking off the first in a series called, “What’s Current in Coding.” In this series, we will highlight coding topics, events, webinars, and more, all with the aim of keeping you current in medical billing and coding.

This month our focus came from two articles on coding sourced from the AMBA Newsletter that we feel are hot topics of the industry: “Coding for Group Visits” and the “Telehealth Coding Guide.”

Below you will find full articles and source links.

ARTICLE 1: “Coding for Group Visits”

Many physicians are interested in providing group medical visits. Whether the drop-in group medical appointment (DIGMA), chronic care health clinic (CCHC) or other model is delivered, the coding and billing of these services raise questions about codes and payment policies.

While past instruction on coding for group visits often indicated that physicians should report code 99499 for unlisted evaluation and management services, using this code requires that documentation is sent with the claim to identify the service(s) provided and leaves valuing of the service in the hands of the payer.

No official payment or coding rules have been published by Medicare. However, the question of “the most appropriate CPT code to submit when billing for a documented face-to-face evaluation and management (E/M) service performed in the course of a shared medical appointment, the context of which is educational”, was sent to the Centers for Medicare and Medicaid Services (CMS) with a request for an official response. The request further clarified, “In other words, is Medicare payment for CPT code 99213, or other similar evaluation and management codes, dependent upon the service being provided in a private exam room or can these codes be billed if the identical service is provided in front of other patients in the course of a shared medical appointment?”

The response from CMS was, “…under existing CPT codes and Medicare rules, a physician could furnish a medically necessary face-to-face E/M visit (CPT code 99213 or similar code depending on level of complexity) to a patient that is observed by other patients. From a payment perspective, there is no prohibition on group members observing while a physician provides a service to another beneficiary.” The letter went on to state that any activities of the group (including group counseling activities) should not impact the level of code reported for the individual patient.

Some private payers have instructed physicians to bill an office visit (99201-99215) based on the entire group visit. For compliance purposes, we recommend that you ask for these instructions in writing and keep them on file as you would any other advice from a payer.

Where each individual patient is provided a medically necessary, one-on-one encounter, in addition to the time in the group discussions, there should be no problem in billing for the visit based solely on the documented services provided in a direct one-on-one encounter.

If your group visits include the services of nutritionists or a behavioral health specialist, contact payers to determine if that portion of the group visit can be directly billed by the non-physician provider. This typically would include codes for medical nutrition therapy (97804) or health and behavior intervention (96153).

Other codes that may be applicable are the codes for education and training for patient self-management involving a standardized curriculum (98961-98962). Neither these codes nor medical nutrition or behavioral health therapy are billed by physicians. Physicians must use evaluation and management codes to report these services.

Code 99078 describes physician educational services in a group. Again, it is necessary to contact the payer to verify that coverage of this service is a payable benefit.

As with many services, coding for group visits requires that billing and coding staff do preliminary work with payers to identify desired coding applications.

Source: https://www.aafp.org/family-physician/practice-and-career/getting-paid/coding/group-visits.html

ARTICLE 2: “Telehealth Coding Guide”

There’s nothing more frustrating than rendering a service and not being paid. Nuanced coding rules are difficult to understand, and physicians aren’t taught this information in medical school.

Still, health care is a business. As business owners, physicians need to know how they’re paid, including what codes to use, what modifiers to append, and what details to document. Brushing up on common coding mistakes helps avoid costly recoupments and denials. We’ve asked several coding experts to provide their best advice on how physicians can maintain compliance and collect all of the revenue to which they’re entitled.

In part 1 of our two-part coding guide, we focused on coding for Telehealth and other forms of remote patient care — important codes for physician practices’ short-term survival as the U.S. continues to grapple with the COVID-19 pandemic.

Telephone services

In times of social distancing, telephone services have become a practical way to improve patient access and prevent the spread of COVID-19. Telephone services are ideal for straightforward problems (e.g., simple rash, asymptomatic cough, medication refills) that require a minimum of five minutes of medical discussion, says Toni Elhoms, CCS, CPC, chief executive officer of Alpha Coding Experts, LLC, in Orlando, Florida. Consider the following codes that Medicare accepts during the current public health emergency (PHE). Commercial payers may accept these codes, as well. Note that once the PHE has concluded, Medicare may only accept G2012 (virtual check-in) for telephone services.

Elhoms provides these tips to ensure compliance:

- Document verbal consent, including patient acknowledgment and acceptance of any copayments or coinsurance amounts due.

- Only count time spent on the phone engaging in medical discussion with the patient or caregiver. Do not report these codes for conversations lasting less than five minutes.

- Clearly document what was discussed, as well as the outcome of the conversation (e.g., medications prescribed, referrals to specialists, additional steps for the patient to take).

- Don’t report these codes when the telephone service ends with a decision to see the patient in 24 hours or the next available appointment.

- Don’t report these codes when the telephone service relates to a related E/M service performed within the previous seven days or within the postoperative period of a previously completed procedure.

- Only provide 99441-99443 and 98966-98968 for established patients. During the PHE, Medicare permits providers to bill G2012 for new and established patients.

‘The best way to operationalize these codes is to set up an edit in the practice management system that pends claims for a manual review to determine whether and which services are ultimately billable, Elhoms says.

Telehealth services

In the last few months, providers have adopted Telehealth to improve patient access and generate revenue during COVID-19. Among the services physicians can render via Telehealth to patients with Medicare during the current PHE are Medicare annual wellness visits, new and established patient office visits, prolonged services, smoking, and tobacco cessation counseling, annual depression and alcohol screenings, advanced care planning, and more. Medicare covers more than 200 services via Telehealth, many of which were added for temporary coverage during the current PHE. Commercial payer coverage of these services may vary, and it’s best to check with individual payers, Elhoms says.

Elhoms provides these tips for billing Telehealth services:

- Pay attention to audio-only vs. audio-visual requirements. Medicare requires the use of audio-visual technology for certain Telehealth services and permits audio-only for others. Commercial payers also may have specific requirements. For example, physicians can render a Telehealth visit for advanced care planning using audio-only, but they must use audio-visual technology for a new patient telehealth office visit.

- Don’t render Medicare’s Initial Preventive Physical Exam via Telehealth. Medicare does not permit it.

- Document verbal consent for Telehealth, including patient acceptance of any copayments or coinsurance amounts due.

- Use place of service (POS) code 11 and modifier -95 when billing Medicare. Note that commercial payers may require a different POS code (e.g., POS 2 or POS “other”) and modifier.

- Document, document, document. Physicians need to prove they met all of the code requirements even when rendering the service via Telehealth, Elhoms says. “Don’t pull in a problem list if you didn’t treat or manage all of those problems,” she adds. “Physicians need to link the diagnosis with the assessment and treatment plan. That’s imperative.” One caveat is that during the current PHE, physicians can bill 99201-99215 rendered via Telehealth based on time or medical decision-making. “The total time in direct medical discussion with the patient is going to be critical,” Elhoms says.

“The best advice I can give anyone doing Telehealth right now is to watch the CMS [Centers for Medicare & Medicaid Services] and commercial payer websites pretty much on a daily basis,” says Rhonda Buckholtz, CPC, CPMA, owner of Coding and Reimbursement Experts in Pittsburgh, Pennsylvania. “The coding of services changes constantly, and practices really need to be careful.”

Online digital E/M services

Though online digital E/M services are relatively new, they also can help practices increase patient access during COVID-19. Here’s how it works: An established patient initiates a conversation through a HIPAA-compliant secure platform (e.g., electronic health record portals, secure email, secure texting). A physician or other qualified health care professional reviews the query, as well as any pertinent data and records. Then they develop a management plan and subsequently communicate that plan to the patient or their caregiver through online, telephone, email or other digitally supported communication.

Elhoms provides these tips to maintain compliance:

- Use these codes when physicians or other qualified health care professionals make a clinical decision that would otherwise occur during an office visit. Do not use them for scheduling appointments or nonevaluative communication of test results.

- Use these codes only for established patients.

- Do not use these codes for fewer than five minutes of E/M services.

- Document verbal consent, including patient acknowledgment and acceptance of any copayments or coinsurance amounts due.

- Do not report these codes when the online digital E/M service ends with a decision to see the patient in 24 hours or the next available urgent visit appointment.

- Do not report these codes when the online digital E/M service relates to a related E/M service performed within the previous seven days or within the postoperative period of a previously completed procedure.

Promoting these services is often the biggest barrier, says Elhoms, who suggests putting up signs letting patients know they can access their provider electronically for non-urgent medical issues.

Remote patient monitoring

Remote patient monitoring (RPM) is a relatively easy way for physicians to keep tabs on patients without requiring them to come into the office. Medicare covers RPM for patients with one or more acute or chronic conditions, and commercial payer coverage may vary. During the PHE, physicians can initiate RPM on new and established patients. Normally, Medicare permits it only for established patients.

RPM consists of two forms: monitoring data through either a non-manual or manual data transfer, says Jim Collins, CPC, CCC, a consultant at CardiologyCoder.com, Inc. in Saratoga Springs, New York.

For example, physicians can remotely monitor a patient’s pulse oximetry, weight, blood pressure or respiratory flow rate using a device that transmits daily recordings or programmed alerts. Physicians can purchase them directly from manufacturers or patients can purchase the devices themselves. Collins says patients should look for Bluetooth-enabled devices or ones that include a built-in Global System for Mobile Communications (GSM) transmitter. The former requires an Internet connection, and the latter automatically transmits data to an internet cloud service through an encrypted bandwidth. Physicians can bill for the initial setup, cost of the device itself (when applicable), and data monitoring.

Another example is the self-measured blood pressure monitoring. When patients supply their own blood pressure device that a physician calibrates, physicians may be able to bill for patient education, device calibration, reviewing the data that the patient provides and communicating a treatment plan to the patient or caregiver.

“Monitoring physiologic data on a regular basis substantially reduces hospitalizations, trips to the emergency room and exacerbations of chronic conditions,” says Collins. “It can also be a huge chunk of revenue.”

Collins provides these tips for compliant RPM billing:

- Document patient consent. Patients must opt-in for these services.

- Document total time spent rendering these services to support time-based requirements.

- Know when these codes are appropriate. It’s unclear whether Medicare will pay physicians for monitoring physiologic data derived from internal devices (devices placed within the patient’s body) or data derived from wearable fitness devices.

- Only bill 99457 when the provider renders at least 20 minutes of live, interactive communication with the patient or caregiver. “It’s not going to be medically necessary to spend 20 minutes every month on every patient,” Collins says. “Patients could go for several months without physicians needing to do anything for them.”

Source: https://www.medicaleconomics.com/view/telehealth-coding-guide

“What’s Current in Coding?” is brought to you by EZClaim, a medical billing solution. To find out if it may work for you, either schedule a one-on-one consultation with their sales team, or download a FREE TRIAL to check it out the software yourself. For additional information right now, view their web site, send an e-mail to sales@ezclaim.com, or contact the sales team at 877.650.0904.