May 18, 2021 | Denied Claims, RCM Insight

Last month we looked at tools for getting clean claims out the door on the first try. Many billers or practices stop monitoring claims once the leave the practice management program, but this is where you are likely losing money. The unfortunate truth is you need to use the tools available to you to catch rejected and denied claims to ensure proper and timely payment. Today we will look at rejections and denials, and the resources you have (or need) to work efficiently.

The terms rejection and denial are used interchangeably in the billing world but they have distinct differences, including how you are notified. Let’s start with defining the differences.

Rejected Claims

- Claims can be rejected by the clearinghouse OR the payer

- Rejections are based on submission guidelines

- Rejected claims have not been entered into your payers system for adjudication

- Notified through a claim status report (ANSI 277) that comes back into most practice management programs from the clearinghouse

- Corrections do not require a resubmission code

Denied Claims

- Claims are denied by your payer

- Denials are based on policy coverage

- Denials have been accepted for adjudication and deemed unpayable

- Notified on remittance advice (ANSI 835/ERA)

- Payers may require a resubmission code and original reference number when submitting a corrected claim

If you are using a clearinghouse and receiving your claim status reports electronically, you will be notified quickly about rejected claims. There are two ‘checkpoints’ that will look for errors. The first is your clearinghouse, the second is the payer.

At each checkpoint claims will be Rejected or Accepted, these status updates come to you through a claim status report. If your practice management system is able to process these reports (ANSI 277) your claims will be updated with the accepted or rejected information you will be able to correct any rejected claims within your practice management system. When you see an error, start with checking who has rejected your claim. This will be the point of contact if you have questions about the rejection or how to correct it. If you are not already, make it a daily task to get your reports, correct any rejected claims, and resubmit those claims.

When a claim has been accepted by your clearinghouse and the payer it enters the adjudication system. This is where the payer will make a determination on payment based on the members coverage and your contract. The denials will appear on your remittance advice with a payment or as a zero dollar payment, indicating that they have reviewed your claim and they have determined no payment is applicable. If you are enrolled with you payer for electronic remittance advice (ERA) this file will come electronically and your practice management system will be able to list or identify denied claims. These claims will either need to be researched further for clarification on the denial or written off. It is vital that your practice management system can handle these scenarios appropriately so you do not lose money for payable services.

This is another scenario where technology can seem scary. However, efficiently monitoring and working is well worth the learning curve. If you are already sending electronically and not using the claim status report or electronic remittance advice – coordinate with your clearinghouse and practice management system to find out how these reports can save you time and money.

If you would like more information on creating workflows for rejections, denials, or enrolling with a clearinghouse, let RCM Insight help! Visit us at www.rcminsight.com to request a consultation.

[Contribution by Stephanie Cremeans with RCM Insight]

Apr 5, 2021 | Claim Status Inquiry, Claims, Denied Claims, RCM Insight

If a medical billing program has “scrubbing,” why did my medical billing claim still get denied? It is a common question that we are going to answer today.

First, let’s get a better understanding of the words we are talking about. In the medical billing world, validation and scrubbing tend to be used interchangeably. While they are similar – they are not actually the same. Understanding what you have and what you need will help you submit ‘clean’ claims.

According to Technopedia, data validation checks for the integrity and validity of data and ensures the data complies with the requirements. So, what requirements? Often people assume that this means payer requirements, but that is typically not standard. Validation rules are built into your practice management software and can be used for several points. Following are some common rules you may find in your program:

- Ensure NPI‘s and Tax IDs are the appropriate lengths

- Ensure patients date of birth is entered

- Ensure that a procedure code and place of service are present on each claim

While these scenarios are standard across the industry, there may be other situations that a validation rule can help. Some programs will allow you to create custom rules for your practice. A customized validation rule will allow you to create a rule for a payer requirement. For instance, you could create a rule to prevent the following:

- Do you have a code that always requires a modifier, but only for a specific payer?

- Work with pediatrics and always need the ‘relationship to insured’ to read something other than self

- How about insurance ID numbers that are a specific alpha-numeric combo, like 3 letters followed by 9 digits?

Keep in mind, if you are creating validation rules the program will make sure that the criteria are met based on the rule entered into your software. When creating custom rules, it is important to note that this will not verify payer billing guidelines. You will need to obtain information directly from your payer to create a rule that coincides with their policies.

Once any validation errors have been addressed your claims will go to the clearinghouse you are working with. Most clearinghouses offer claim scrubbing for an additional fee. Technopedia defines data scrubbing as the procedure of identifying and then modifying or removing incomplete, incorrect, inaccurately formatted, or repeated data.

Claim scrubbing is available in several ways. It may be used within your practice management system, your clearinghouse, or even a third-party vendor. Claim scrubbing services can vary greatly in what they are looking for.

Once the claim has left your practice management system it will likely go through at least 2 scrubbing programs—one with the clearinghouse and one with your payer, prior to accepting the claim for processing. When claims are found to have an error, these results are sent back through a Claim Status Report (ANSI 277 file or a human-readable text file). This report will include information about why the claim cannot be processed. This report will also indicate whether it is the clearinghouse or the payer that is rejecting the claim. If you have further questions about the rejection, you will need to contact the entity that has rejected it.

Checking the Claim Status Reports on a regular basis will help you correct the errors and resubmit in a timely manner. In addition, the information you have gathered from the rejections can be used to update internal processes or create customized validation rules to prevent future rejections for the same error–saving you time and money!

RCM Insight is a medical billing company that uses EZClaim’s medical billing software. For any details that have to do with claims validation and “scrubbing,” contact RCM Insight directly.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution by Stephanie Cremean’s with RCM Insights ]

Apr 5, 2021 | BillFlash, collections, Credit Card Processing, Denied Claims

With patient payment responsibility increasing each year, medical practices need to be extra diligent in collecting patient payments. This includes sending accounts to collections when necessary. Fortunately, there are steps you can take to make collections easier and more effective—both of which contribute to more revenue for your practice.

Here are three ways to improve your medical billing collections.

1. Be clear about your payment expectations

Make sure patients know when they will be expected to pay, and what payment methods you accept. Collecting copays before each visit is one of the best ways to avoid having accounts sent to collections, so making payment a part of the check-in process is a good idea. Post signs throughout the office to keep bills top of mind for patients. The more reminders you give patients about their payment responsibility, the less you will have to deal with collections.

2. Reach out to patients who have stopped paying

Keep an eye on delinquent accounts. If an account is approaching 30-60 days past due, it’s time to reach out to the patient. Try to have an empathetic conversation to see what you can do to help them pay off their bill. If they are experiencing financial difficulties, offer to adjust the payment terms to something more suitable to their situation. Even if it means you are only collecting part of their payment now, both the practice and the patient will be better off in the long run.

3. Automate what you can

The collections process is slow and cumbersome—if you’re doing everything manually. Software like BillFlash Integrated Collection Services saves your staff a lot of time by handling the manual processing for you. After that, all you need to do is approve which accounts to send to collections, based on the aging and amounts you prefer, and a collections expert will get to work collecting your revenue.

So, visit one of EZClaim’s partners, BillFlash, to learn more about how BillFlash Integrated Collection services can improve your medical billing collections.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

[ Contribution from the marketing team at BillFlash ]

Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

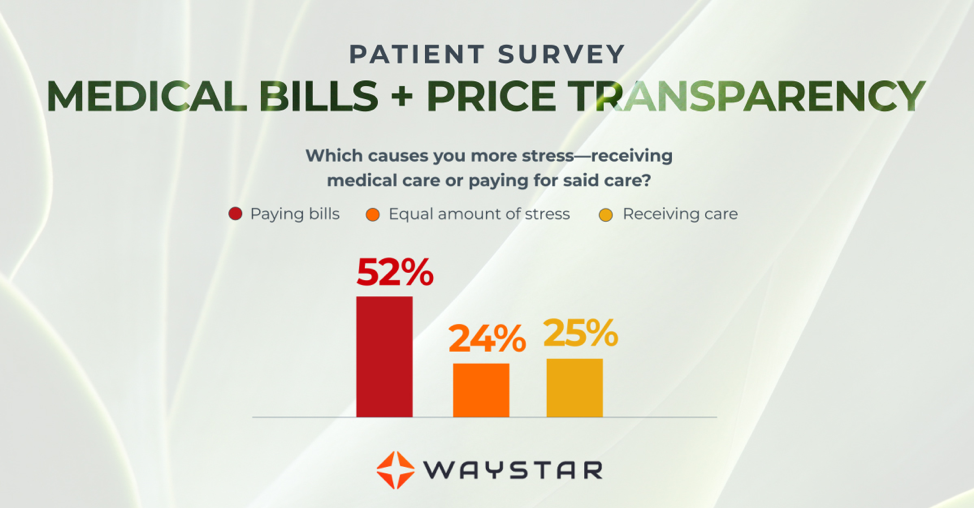

New Patient Survey About Price Transparency Rule

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

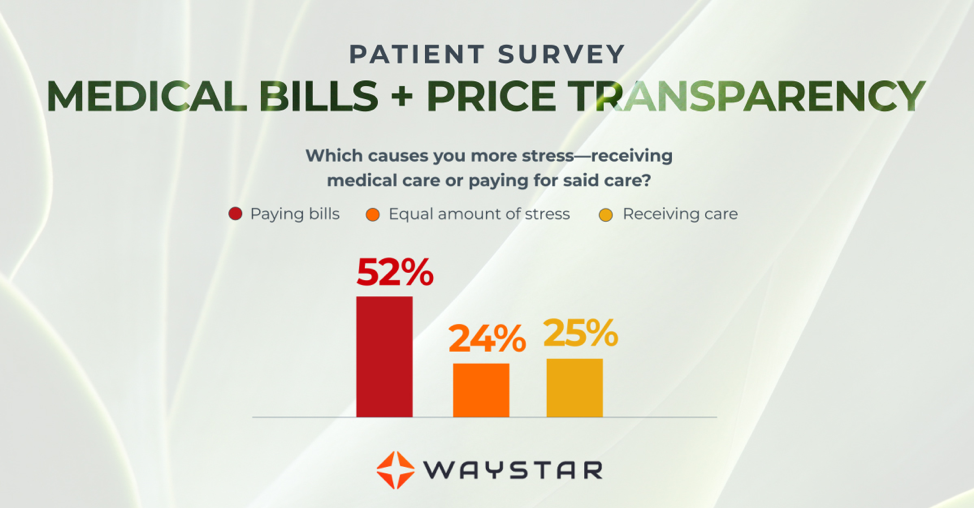

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]

Mar 10, 2021 | BillFlash, Claims, collections, Credit Card Processing, Fullsteam, Medical Billing Software Blog, Revenue

How to Modernize Your Medical Billing Payments Now

It is now very important to modernize medical billing payments capabilities since upwards of 80% of medical services that don’t get paid by insurance, never get paid!

Are you tired of providing medical services and not getting paid? Have you billed patients for their medical visit or co-pay just to find out that the bill showed up in collections? Are you looking for a better way to use modern technology to increase the number of medical claims being paid on time? If you own a medical practice or work in the medical billing industry, then chances are you have answered each question with a hearty “Yes!”

Last month, medical billing industry leaders came together to discuss how medical practices can streamline their payment systems and integrate credit card processing into their billing system. [ Participants: Dan Loch (VP of Sales & Marketing, EZClaim), Tony Peterson (VP of Business Development, BillFlash), and Michael Jones (Payment Services Analyst, FullSteam) all joined host Susan Martinez (Sales Consultant, EZClaim) ].

[ Click Here to LISTEN to the Exclusive Podcast ]

[ Click Here to VIEW the Exclusive Video ]

KEYS That Came Out of the Discussion:

• CHANGING SYSTEMS AND PROCESSES: The practices that are winning in the payment collections game, and seeing the highest percentage of claims paid, are the offices that have updated their systems from the old school and traditional forms of payment collection to the modern, state-of-the-art systems with payment integration. Plain and simple, this means first educating the patient from the moment they walk in the door and streamlining your payments into one medical billing system to prevent human error. [ Click here to LEARN MORE ].

• STREAMLINING CREDIT CARD PROCESSING: Practices often have jumped headlong into credit card processing by using simple systems with variable fees like Square or Stripe. The problem with that is two-fold: First, understanding processing fees, and secondly, avoiding the errors that occur in the steps of processing those purchases over to the billing record. However, now EZClaim’s medical billing software has an integrated payment feature—which streamlines the billing and simplifies the fees. [ Click here to LEARN MORE ].

These are only a few of the very informational topics that were discussed during this podcast. If you are interested in learning how your practice can put these systems in place, increase patient payments, and simplify your billing process in your office, then click here to listen to the podcast and prepare to learn some new, up-to-the-minute ‘insights’ on modern medical billing systems.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.