Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

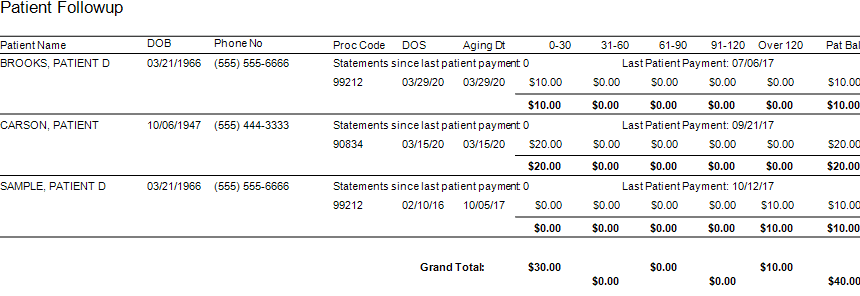

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]