Mar 23, 2020 | Uncategorized

During these unprecedented times, EZclaim is monitoring Coronavirus (COVID-19) developments, and are working to maintain the safety of our customers and employees. We are doing this by following the guidelines set forth by our state and local governments, and the recommendations from the CDC.

To enhance the safety of our employees, families, and communities, EZClaim is transitioning to a remote workforce to continue to serve our clients during this difficult period. We will remain available and anticipate no disruption to our service or support.

Feel free to e-mail us or visit the contact page on our website to issue any questions or concerns.

Thank you for your patience, and please be safe!

Sincerely,

EZclaim

Mar 10, 2020 | Live Compliance, Medical Billing Customer Service

Whether you are a person new to medical billing or someone who’s been in the business for years, launching a new medical billing practice can be hard. Understanding the market, connecting with new clients, and knowing how to master your processes are challenges that you often learn as you go. Despite these challenges, it is rewarding to be out on your own growing a new company. Before you jump, let us help you understand some essential keys that you can research upfront and prepare yourself to get one step closer to being successful.

1. ONE BILLING PLATFORM VERSUS MULTIPLE PLATFORMS: First and foremost you must make a conscious decision to either focus on being an expert on an individual medical billing platform, like EZClaim or tackling multiple platforms. There are pros and cons of both: being an expert can make you extremely efficient in your use of the software’s billing and, scheduling features, however, it can also limit your client base to only one set of software users. Whereas having a basic understanding of multiple platforms can allow you a larger base of medical offices while limiting your ability to truly understand how best to serve each individual client’s needs.

Pro tip: Start and master one trusted billing program, and grow your options as your billing business grows.

2. GET CLEAR ON THE CLEARINGHOUSE: A new billing company owner does not want to be held to just one clearinghouse as options are key here. Having the ability to work with any or many would be an essential piece to your billing services, however, you still want to know the best clearinghouses in the business. Understanding which clearinghouses provide the best products and services and being able to recommend those services to your client upfront will make your life easier and their business run smoother. For this very reason, EZClaim has built its software around partnerships and integrations with the best clearinghouses to make working with the one you need easy.

3. COMPLY OR DIE (HIPAA Compliance): The third key to any start-up is first understanding the importance of HIPAA Compliance. Medical billing firms literally can come crashing down with any missteps, mistakes, or misunderstandings of this essential piece of the puzzle. It goes without saying that if you are going to choose a billing software be sure that they have partnerships built around making sure you are protected. You are also responsible to make sure the data is protected so your customer and their patient’s data is safe.

HIPAA Hint: Check out Live Compliance for further details on the topic.

There are many options available out there for your new medical billing practice, and we recommend doing your research. Within that research, you will find that EZClaim ranks very high in performance and comes in at a great price.

To learn about EZClaim go to our about page, sign up for a demo, and/or download a trial for free today!

Mar 10, 2020 | Live Compliance, Partner

An independent physician gastroenterology practice in Utah had to report a breach related to a dispute with a Business Associate to the Office for Civil Rights Department of HHS.

After the investigation into the breach, it was determined that the practice of Steven A. Porter, MD “had failed to complete an accurate and thorough risk analysis, and failed to implement security measures sufficient to reduce risks and vulnerabilities to a reasonable and appropriate level” and therefore, has agreed to pay a $100,000 fine.

In addition to the monetary penalty, the practice is required to implement a Corrective Action Plan (CAP). According to the investigation resolution agreement, the practice agreed to conduct a thorough Risk Analysis, the Practice must develop a complete inventory of all its categories of electronic equipment, data systems, and applications that contain or store ePHI, which will then be incorporated into its Risk Analysis and must complete a Risk Management plan. They must also revise and implement actionable policies and procedures, all of which should have been in place prior to the breach incident.

Have you ever read such headlines and doubted whether a small Billing Company or independent physician practice actually ever face penalties?

According to the Resolution Agreement, the practice must also completely reinvent its Business Associate process, and implement a strict protocol to ensure it’s Business Associates are HIPAA Compliant. In addition to ensuring their Business Associate relationships are accurate, the entire staff must undergo security and privacy training that stresses the use of Business Associate services and applications, disclosures to Business Associates that require a Business Associates agreement, or other reasonable assurances in place to ensure that the Business Associate will and can safeguard the PHI and/or the ePHI. This puts immense pressure on the Business Associates, such as Billing Companies, to ensure that they are HIPAA Compliant, but also independent physician practices to ensure their Business Associates, “down the chain” are also compliant. This is also known as gaining Satisfactory Assurance of vendor HIPAA compliance.

What can you do?

As we have stressed before, it is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or another vendor, suspect a breach you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action. Keep in mind, a business associate is a ‘person’ or ‘entity’. This means there is no Billing Company too small or too large to comply with the Federal HIPAA regulations. Again, if you haven’t completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

What we do is keep this from ever being a worry for you! In fact, we have a 100% audit pass rate! For example, Live Compliance has easy to understand HIPAA breach notification training. We perform your security risk assessment and manage all your requirements, including business associates, in a clean, organized cloud-based portal. Don’t risk your company’s future, especially when we are offering a FREE Organization Assessment to help determine your company’s status. It’s easy, call us at (980) 999-1585, email me jim@LiveCompliance.com or visit LiveCompliance.com

[ Contributed by Jim Johnson, President of Live Compliance ].

Mar 10, 2020 | Health eFilings, Partner

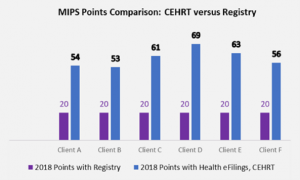

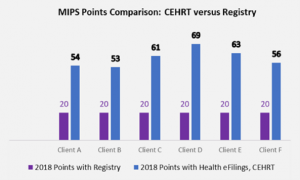

There are many commonly misunderstood aspects and nuances with the MIPS program, particularly in how points are earned. For a healthcare practice, it can be challenging to know exactly what to do to earn points, optimize the score, and protect their Medicare reimbursements. But, at the same time, the stakes have been raised every year and the final ruling of the program is even more complex than it has been in the past, further increasing the stress, burden, and financial risk for a healthcare practice.

The approach a practice takes to report for MIPS will greatly impact the results. Many do not understand or have awareness of, the different reporting methods available to them. Many Providers erroneously still think that a registry is the only reporting option available to them or that they are required to use a registry. Or, they think that their EHR covers their reporting obligation or that an EHR’s reports satisfy the MIPS requirements. These misperceptions and erroneous assumptions are detrimental to the financial interests of any practice.

There is a third reporting methodology that has been established and authorized by CMS, called CEHRT, or Certified EHR Technology (software). The CEHRT methodology assists CMS with their need for more valid data submitted through technology and to refocus Providers from merely using technology towards Providers leveraging technology to improve outcomes. Reporting via a CEHRT using software that has been certified by the ONC is a superior approach because it optimizes the points that could be earned and therefore, maximizes Medicare reimbursements for the practice.

Recently an RCM company CEO approached us at Health eFilings with the decision to use six of her clients to conduct a side-by-side comparison of the registry and Health eFilings (CEHRT) methodologies for reporting. In this manner, she intended to validate for herself whether a CEHRT or registry would generate the greatest ROI for her clients. The results of using Health eFilings’ MIPS Accelerator service, on average earned almost triple the points versus a registry for the same year for the same clients.

“Due to limited understanding and guidance, we weren’t aware of the differences of the reporting methodologies available for my clients. We believed there was greater opportunity, but the current registry methodology we had chosen didn’t demonstrate that for our clients.”

Katy, RCM Company CEO

This side-by-side comparison highlights not only that a CEHRT is a superior method of reporting as Health eFilings was able to leverage technology to facilitate the ease, accuracy, and completeness of tracking and reporting, but it also maximizes a Provider’s MIPS score. Additionally, given the levels of Medicare reimbursements for these practices, the higher score resulted in their earning a positive payment adjustment, which significantly improved their bottom line. And, take note that if the Registry were to perform the reporting for the 2019 reporting period, these practices would not earn enough points to avoid the penalty of negative 7%.

Health eFilings with its proprietary ONC certified software has many advantages over any type of registry:

- Automatically extracts data from any EHR or billing system

- No staff or IT time required to comply

- Benchmarks performance versus peers based on CMS standards

- The proprietary algorithm evaluates 9 million combinations to select the best quality measures to optimize the score

- Earn 10% in bonus points for the Quality category

- eCQM deciles earn more points than registry deciles

- Almost all eCQM’s have a CMS benchmark versus less than 25% of registry measures

- Electronically submits the data to CMS

And, important to note that it’s NOT too late to comply for the 2019 reporting period as Health eFilings is able to support new clients, but time is of the essence. Reach out NOW if you or your client hasn’t reported for 2019—there is NO REASON to accept the 7% revenue hit.

Now EZClaim and Health eFilings want to ensure you can partner with the only complete, end-to-end MIPS compliance solution that saves you significant time and money. To learn more, click the following link: https://healthefilings.com/ezclaim

[ Article was written by Sarah Reiter, Vice President of Strategic Partnerships with Health eFilings ].

Mar 10, 2020 | BillFlash, Partner

This article about new patient billing methods was written by Angie Carter with NexTrust.

Communication is easier than it’s ever been, but a lot of practices aren’t taking full advantage of two of today’s most effective mediums of communication: email and texting. Patients, like all other consumers, spend a lot of time on their phones; it’s where they keep in touch with friends and family, as well as businesses they work with regularly.

Most practices rely heavily on phone calls to contact their patients about appointment reminders, insurance issues, etc. But many adults now prefer to communicate via email or text. Often a quick phone call will do the trick, but email and texting get your foot in the door a lot more often. Furthermore, people are far more likely to respond to a text or email than a voicemail.

Here are a few ways to build your contact list at your practice to improve communication with patients, ensuring greater patient satisfaction and better cash flow.

- Collect cellphone numbers & email addresses during new patient registration.

Consider making these required fields. Allow the option to fill out more than one email address or mobile number as well, since most households have several. It would also be helpful to quickly explain why you need this information. BillFlash allows you to send out regular statements and eBills through email and text, and you can also quickly update your patients on any last-minute changes happening at your practice.

If you have a newsletter or regularly send out practice updates, make sure patients know about these as well. This is another opportunity to ensure you have the information you need to better communicate with your patients.

- Ask for an email address & cellphone number any time you confirm an appointment.

Even if your current patients have already given you this information, use appointment confirmations as an opportunity to verify the information you have on file is current. Email addresses change all the time, so it’s crucial to ensure they’re up to date so you know your messages are being received. And for patients who haven’t yet provided this information, this is a good time to tout the benefits of being digitally connected.

- Encourage mail-only patients to go paperless.

A huge barrier to patients paying their bills on time—or at all—is that it’s often not as simple to pay a medical bill as it is to pay, say, a utility bill. BillFlash simplifies this process tremendously, both for the patients and your practice. By providing an email address and cellphone number, patients can more easily stay current on their medical bills and procedures.

- Ask patients to provide feedback on your website.

Give your patients a space to express their thoughts at their convenience. Include a form on your website for patients to fill out—which would include their email address and phone number—and add the info they provide to your database. You could also post signs throughout your office encouraging patients to visit your website to provide feedback about the care they received that day.

- Add cellphone number/email to check-in sheet.

Most practices require patients to sign in whenever they come in for an appointment. Consider adding a column or two that asks for their email and cellphone number. At the top of the column, you could include a note that says something like “Want to receive appointment reminders via text or email?” to reiterate the benefits patients will receive by providing this information.

- Offer patients an incentive to provide their email address & cellphone number.

People love free stuff—that’s a given. Try running a fishbowl incentive every few months. All patients would need to do is drop their email address and/or cellphone number into a bowl and they’ll be entered into a drawing to win a prize. And why reward just the patients? Incentivize your office staff to collect this information as well.

Everyone has a cellphone number and email address, but it does take some effort to collect them. But it’s an effort that rewards you many times over, as this makes it easier to keep patients in the loop and ensure you get paid. BillFlash makes it easy to automate patient billing and payments—including sending reminders via email or text—to improve the financial health of your practice.

BillFlash is integrated into the EZclaim billing application. Click here to view a video that discusses the details.

For more information about new patient billing methods and sending electronic bill notifications through text and email, contact EZclaim or their statement and payment services partner, BillFlash, at 435-940-9123 or sales@billflash.com