Mar 10, 2021 | Medical Billing Software Blog, RCM

Medical billing technology is always changing, and usually much quicker than one expects. While your current processes may be working for you, there just may be something better available to reduce staff time and increase your revenues. The thing is, technology has made huge strides in the medical billing industry in recent years, offering a number of ways to send and receive data faster, while still protecting sensitive patient information.

So, over the next several posts, we will explore different features technology can offer to increase your efficiency as well as your ‘bottom line‘. We will consider how your Electronic Medical Record (EMR) can communicate with your Practice Management (billing) software, the key features to look for in your Practice Management software, and how it can communicate with other programs, such as Clearinghouses and statement vendors.

This Medical Billing Technology Series will include:

-

- Validation vs. Scrubbing

- Rejection vs. Denial

- Integrating With an EMR

- Integrating With a Clearinghouse

- Basics of ANSI/EDI Reports

- Patient Collection Policy/Credit Card Processing

- Using Templates

- Is Integrated Eligibility Worth It?

- Statement Options

- Selecting a Practice Management System (Ease of Use/Access; Training; and Support)

Now, not every office will benefit from the same “bells and whistles,” and there are so many options out there. It can be overwhelming. Chances are though, your office could benefit from considering some updates, and some may not even cost you at all!

EZClaim suggests that you take a fresh look at the workflows and processes that you have in place today, and start thinking about the tasks that are wasting time or that are causing delays in collecting payments (from both patients and insurance). These insights just may help you create a positive change to your workflow and your revenues!

So, if you need some help getting started, consider working with a consultant. One of EZClaim’s partners, RCM Insight, offers an annual fee schedule review, and during the month of February 2021, they will be offering four practices a FREE fee schedule review. So, visit their CONTACT US page for your chance to win! [ Note: RCM Insight uses EZClaim’s medical billing software for their billing services, so it could be a ‘win-win’ if you are—or will be—using EZClaim’s medical billing solution ].

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution: Stephanie Cremeans with RCM Insight ]

Mar 10, 2021 | Credit Card Processing, Medical Billing Customer Service, Medical Billing Software Blog, Trizetto Partner Solutions

What is Price Transparency?

It’s a story we hear too often. A person visits a hospital for a medical issue—whether it be a trip to the emergency room for a broken arm or a pre-scheduled appointment for a headache that just won’t go away—and receives a myriad of services and tests. Then comes the dreaded bill in the mail a few weeks later. Although they may inquire about an estimate at the time of service or have an idea of their coverage, the exact financial responsibility is often a mystery until that bill arrives. While the changes vary greatly, one thing that is certain: many people have trouble with their out-of-pocket costs. So much so that a recent survey from The Commonwealth Fund found that 72 million Americans have some sort of trouble with medical debt.

So, on January 1, 2021, the price transparency rule was put into effect—from the Centers for Medicare and Medicaid Services (CMS)—requiring all hospitals within the United States hospitals to publish the prices of various medical procedures. In particular, standard charges for services and items must be published online, available for patients to access. Until now, these prices were hard to find. The timing of this change—the beginning of the calendar year—comes at a time when healthcare pricing is top of mind since many customers most likely renewed or changed insurance carriers and coverage on January 1, 2021. With this comes a focus on out-of-pocket costs, deductibles, and more.

What Brought About This Radical Change?

Part of this change can be attributed to the consumers themselves. With the increase in high deductible health plans and increased out-of-pocket costs, finances are top of mind. In addition to these factors, today’s consumers demand a better overall patient experience. With the prevalence of online shopping, patients expect the same seamless transaction at the hospital that they receive with companies like Amazon, Walmart, and Home Depot. Just as consumers read product reviews before placing an item in their online shopping cart, patients research services and access peer reviews of physicians before they go to the office. In short, they want to be knowledgeable about their healthcare and crave tailored services with exceptional customer service.

Many believe this change will be well received, with Forbes calling the ruling a “gift to all Americans.” From the consumer’s standpoint, it will now be easier to make educated decisions based on cost. This will then cut down on the “unknown”—hopefully eliminating those hefty surprise bills—and opens the door to comparison shopping. Advocates are hoping this newfound transparency will eventually lower costs, with the competition eventually driving down the prices.

How Can Healthcare Organizations Navigate This Change?

This will not only promote transparency but will also increase convenience. By enabling patients to access and pay their bills on their own schedule with easy-to-implement solutions, organizations are meeting them halfway, so to speak. With easy-to-understand statements, integrated credit card processing, and 24/7 payment portals, it is no longer a hassle to manage medical financials. For healthcare organizations, facilitating proactive management of a person’s cost of care accelerates revenue collections and patient satisfaction improves.

In the larger sense, executives recognize that patients are taking more stock in their personal care. In order to thrive, hospitals and health systems must work toward creating the optimal patient experience, beyond just price transparency. With this, providers should aim to be more engaged and C-suite executives should try to provide additional benefits to their patients.

What Will This Mean for the Future of the Industry?

Only time will tell what the price transparency will mean for the industry. However, it is safe to say that this concept has the possibility to shape healthcare policies and processes for years to come.

So, for more information on solutions that equip you to have informed conversations about eligibility and financial responsibility, contact one of EZClaim’s partners, TriZetto Provider Solutions, to talk with one of their representatives today.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by TriZetto Provider Solutions Editorial Team ]

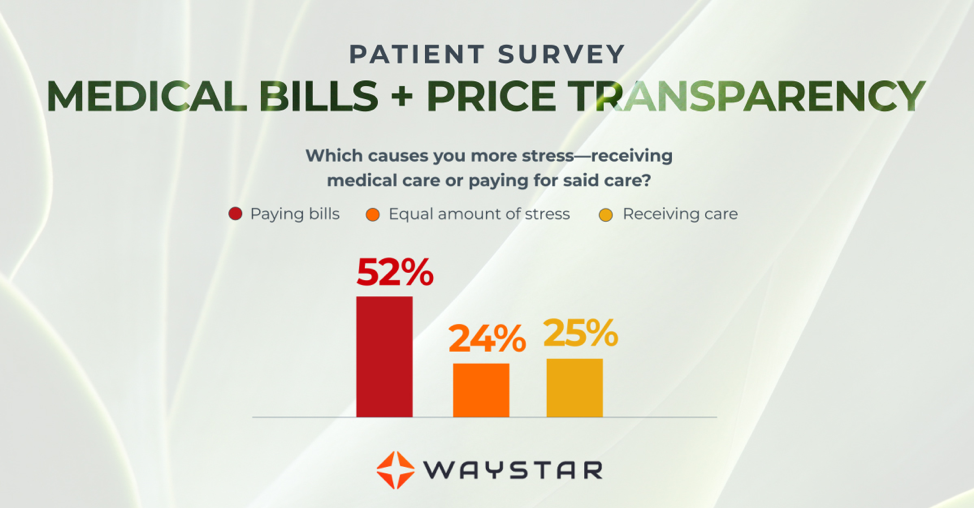

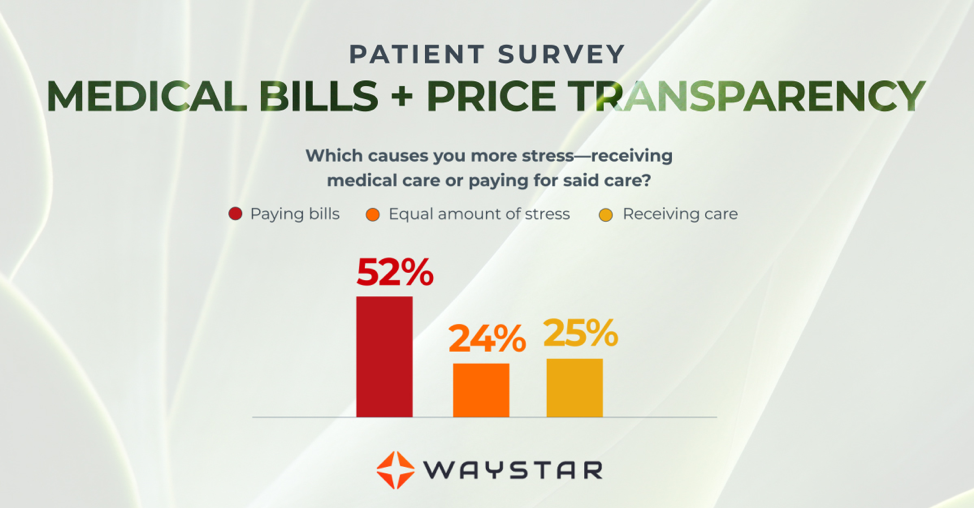

Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

New Patient Survey About Price Transparency Rule

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]

Mar 10, 2021 | Cloud Security, HIPAA, Live Compliance, Medical Billing Software Blog

How Can You Avoid Phishing Scams?

Phishing is the fraudulent practice of sending e-mails or text messages claiming to be from reputable companies in order to persuade individuals to reveal personal information, such as passwords and credit card numbers. Scammers use e-mail or text messages to trick you into giving them your personal information, trying to steal your passwords, credit card account numbers, or Social Security numbers. If they get that information, they could gain access to your accounts. Scammers launch thousands of phishing attacks like these every day—and they are OFTEN successful!

The FBI Internet Crime Complaint Center reported that $57 million was lost to phishing schemes in one year. Scammers often update their tactics, but there are some signs that will help you recognize a phishing e-mail or text message.

How to Recognize Phishing Scams

First, phishing e-mails and text messages may look like they are from a company you know or trust. They may look like they are from a bank, a credit card company, a social networking site, an online payment website, or an app or online store. Phishing e-mails and text messages often tell a story to trick you into clicking on a link or opening an attachment.

They may:

- Say they have noticed some “suspicious activity or log-in attempts”

- Claim there is a problem with your account or your payment information

- Say you “must confirm some personal information”

- Include a fake invoice

- Want you to click on a link to make a payment

- Say you are “eligible to register for a government refund”

- Offer a coupon for free stuff

What are the Signs of a Scam?

- The e-mail says your account is “on hold because of a billing problem.“

- The e-mail has a generic greeting, “Hi Dear.” (If you have an account with the business, it probably would not use a generic greeting like this).

- The e-mail invites you to click on a link to “update your payment details.”

Your e-mail spam filters may keep many phishing e-mails out of your inbox, BUT scammers are always trying to outsmart the spam filters. So, it is a good idea to add extra layers of protection.

Four Steps You Can Take Today

- Protect your computer by using security software.

Set the software to update automatically so it can deal with any new security threats.

- Protect your mobile phone by setting software to update automatically. These updates could give you critical protection against security threats.

- Protect your accounts by using multi-factor authentication. Some accounts offer extra security by requiring two or more credentials to log in to your account.

- Protect your data by backing it up. You can copy your computer files to an external hard drive or cloud storage. Be sure to check with

your IT department and designated Security Officer before copying data to other locations.

What to Do If You Suspect a Phishing Attack?

If you get an e-mail or a text message that asks you to click on a link or open an attachment, first answer this question: Do I have an account with the company or know the person that contacted me?

- If the answer is “No,” it could be a phishing scam

- If the answer is “Yes,” contact the company directly using a phone number or website you know is real, NOT the information in the e-mail. Attachments and links can install harmful malware.

- If you think a scammer has your information, like your Social Security, credit card, or bank account number, go to IdentityTheft.gov. There you will see the specific steps to take based on the information that you lost.

- If you think you clicked on a link or opened an attachment that downloaded harmful software, update your computer’s security software. Then run a scan.

- Finally, contact your Security Officer and IT Staff Immediately.

What Can I Do to Ensure This Doesn’t Happen?

One of EZClaim’s partners, Live Compliance, will make checking off your compliance requirements extremely simple. They have a service that is:

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities.

- Built directly into your portal, easily monitor where your workforce may be vulnerable with our Dark Web Breach Searches. Easily expose breach sources with ongoing searching of active employee email or domain ensuring continued awareness of potential breach exposure. Weekly automatic e-mail notifications if new breaches are discovered.

- Informational, and has short, informative, privacy awareness videos covering technical, administrative, and physical safeguards with topics such as Ransomware, Phishing, the Dark Web, Password Protection, etc. Delivered monthly with no logins required, empower your workforce to make conscious decisions when it comes to your organization’s privacy and security.

So, don’t risk your company’s future and avoid phishing scams especially when Life Compliance is offering a FREE Organization Assessment to help determine your company’s status. Call them at 980.999.1585, e-mail them at Jim@LiveCompliance.com, or visit LiveCompliance.com. For more specific information, e-mail support@livecompliance.com

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance | Photo Credit: Shutterstock ]

Mar 10, 2021 | BillFlash, Claims, collections, Credit Card Processing, Fullsteam, Medical Billing Software Blog, Revenue

How to Modernize Your Medical Billing Payments Now

It is now very important to modernize medical billing payments capabilities since upwards of 80% of medical services that don’t get paid by insurance, never get paid!

Are you tired of providing medical services and not getting paid? Have you billed patients for their medical visit or co-pay just to find out that the bill showed up in collections? Are you looking for a better way to use modern technology to increase the number of medical claims being paid on time? If you own a medical practice or work in the medical billing industry, then chances are you have answered each question with a hearty “Yes!”

Last month, medical billing industry leaders came together to discuss how medical practices can streamline their payment systems and integrate credit card processing into their billing system. [ Participants: Dan Loch (VP of Sales & Marketing, EZClaim), Tony Peterson (VP of Business Development, BillFlash), and Michael Jones (Payment Services Analyst, FullSteam) all joined host Susan Martinez (Sales Consultant, EZClaim) ].

[ Click Here to LISTEN to the Exclusive Podcast ]

[ Click Here to VIEW the Exclusive Video ]

KEYS That Came Out of the Discussion:

• CHANGING SYSTEMS AND PROCESSES: The practices that are winning in the payment collections game, and seeing the highest percentage of claims paid, are the offices that have updated their systems from the old school and traditional forms of payment collection to the modern, state-of-the-art systems with payment integration. Plain and simple, this means first educating the patient from the moment they walk in the door and streamlining your payments into one medical billing system to prevent human error. [ Click here to LEARN MORE ].

• STREAMLINING CREDIT CARD PROCESSING: Practices often have jumped headlong into credit card processing by using simple systems with variable fees like Square or Stripe. The problem with that is two-fold: First, understanding processing fees, and secondly, avoiding the errors that occur in the steps of processing those purchases over to the billing record. However, now EZClaim’s medical billing software has an integrated payment feature—which streamlines the billing and simplifies the fees. [ Click here to LEARN MORE ].

These are only a few of the very informational topics that were discussed during this podcast. If you are interested in learning how your practice can put these systems in place, increase patient payments, and simplify your billing process in your office, then click here to listen to the podcast and prepare to learn some new, up-to-the-minute ‘insights’ on modern medical billing systems.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.