Apr 5, 2021 | Medical Billing Software Blog, Waystar

For many providers, medical claim denials are one of the single biggest drains on revenue. When you consider that working just one denial costs about $25, knowing why claims are being denied and how to prevent them in the future isn’t a luxury—it’s a necessity.

Automation and advanced analytics can take much of the burden off your billing team by helping you identify potential denial triggers, adapt to constantly changing payer guidelines, and uncover actionable trends in your claim data.

Waystar’s Denials by the Numbers:

- 5-10% average denial rate amount physician practices

- 90% of denials are preventable

- 76% of providers say denials are their biggest RCM challenge

[ Note: View or download Waystar’s “Defeat Denials with Data” white paper here ]

Waystar, a partner of EZClaim, integrates easily with its medical billing software, creating a seamless exchange of claim, remit, and eligibility information. To learn more about defeating medical claim denials, or to add Waystar as your clearinghouse, visit this page.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article and white paper contributed by Waystar ]

Apr 5, 2021 | Medical Billing Software Blog, Revenue, Support and Training, Trizetto Partner Solutions

In the world of healthcare revenue cycle management, there are numerous scenarios that can put a stranglehold on your revenue if you’re not prepared. With the COVID-19 pandemic causing varying degrees of change in inpatient volumes and visits, and telemedicine coming further into play, physicians and their practices are having to quickly navigate the nuances of their financial well-being. A practice may be buttoned up from the time the patient walks in the door, but what happens after the visit will determine when the practice will get paid. This element of the revenue cycle starts with coding. Here are five medical coding challenges that will ruin your bottom line.

1. Coding to the Highest Specificity

Missing data on a claim relative to the patient’s diagnosis and procedure can easily cause a rise in denials once received by the payers, resulting in potentially thousands of dollars in write-offs. Medical coders are responsible for coding patients’ claims to the highest level of specificity, ensuring the appropriate CPT, ICD-10-CM, and HCPCS codes are applied based on the patient’s chart from the day’s services.

COVID-19 and telemedicine are frequently bringing on new codes and code sets, all with different variations and modifiers to make the matter even more complex. Medical coders spend a lot of time researching and learning new codes, but every year – and throughout the year – changes and updates are made. Payers don’t only want to know the diagnosis and the treatment; they want to know the cause as well. The Coronavirus Aid, Relief, and Economic Security Act passed in March of 2020 allows for an additional payment from Medicare of 20 percent for claim billed for inpatient COVID-19 patients, however, it was later indicated that a positive COVID-19 test must be stored in the patient’s medical records in order to be eligible for this payment. Being able to stay on top of codes specific to the patient’s diagnosis at treatment is more difficult than ever before.

2. Upcoding

While code specificity is important, so too is ensuring the claims do not contain codes for exaggerated procedures, or even procedures that were never performed, resulting in reimbursement for these false procedures. This seems logical enough, but upcoding can easily occur as a result of human error, misinterpretation of a physician’s notes, or lack of understanding of how to appropriately assign the thousands of ICD-10-CM codes in existence. To add to the pressure, the Office of the Inspector General issued a plan with objectives to prevent fraud and scams, and remedy misspending of COVID-19 response and recovery funds.

Much like under-coding or not providing enough data on the patient’s visit can create issues, upcoding can be a major contributor to financial loss for a practice. Questionable claims can be denied and sent back for corrections and appeals, but upcoding can have more serious ramifications outside of paper-pushing between coders and payers.

Whether it’s making sure the codes are in accordance with the care provided, understanding the code sets that apply for each procedure, or comprehension of the medical record, refraining from upcoding will help ensure a sturdy and compliant revenue stream.

3. Missing or Incorrect Information

There’s a common theme to coding challenges, and that’s having the sufficient information necessary. This information typically is pulled from a patient’s chart or record of a visit, which is often completed by the attending physician. However, even when a claim is submitted, providing required information relative to the procedure to the payer is critical as well. Situations such as failure to report time-based treatments (such as anesthesia, pain management, or hydration treatments) or reporting a code without proper documentation can result in denials.

Furthermore, information in a patient’s electronic health record may also contain inaccurate information. Keystrokes and other human errors can cause these situations to flare up, and it takes a diligent, thoughtful coder to read between the lines and ensure claims have the appropriate information.

4. Timeliness of Coding

The Medical Group Management Association (MGMA) suggested in their 2018 Setting Practice Standards report that a Primary Care Physician should maintain a claim submission rate of 3.11 days after the date of service, but it is becoming increasingly difficult for practices to sustain anything close to this rate. Constant changes to code sets, an increased focus on submitting claims with sufficient and compliant information, and the requirement to code claims to the highest level of specificity, can easily delay the submission by days or weeks.

Nevertheless, delays in coding and submitting claims can cause major lags in payment and substantial loss in revenue. Insurance payers have statutes of limitations that require claims to be submitted anywhere from 120 to just 60 days after the date of service. Simply put – the more time spent coding the claim, the later it will be submitted, thus increasing the odds that the claim will be denied. Expert coders are aware of this and do everything in their power to get coded claims out the door.

5. Staffing Shortages

However, finding experts well versed in coding claims quickly, accurately and in compliance with the False Claims Act is not always an easy task. As you can imagine, the increasing need for care within the senior population is causing a rise in claim volumes, and trying to find a team of coders who know the ins and outs of complex ICD-10-CM coding can easily cause a bottleneck in the revenue cycle. Health executives expressed their struggles to find talent back in 2015, and some forecasts expect a decline in commercial payments by 2024 to further hamper a C-suite’s ability to manage labor costs. The ramifications of incorrect coding are still a key topic of discussion to this day.

The time has come for practices to begin looking outside of their organization for coding support. How is your practice planning to tackle the coding conundrum? When choosing a partner for your medical coding needs, you need to pick an expert to help your practice stay on target. TriZetto Provider Solutions, a Cognizant Company, has available highly-trained, AAPC & AHIMA certified coders with the experience of getting the details right the first time and understand the importance of coding to the medical practice.

For more information about TriZetto Provider Solutions, a partner of EZClaim, visit their website, contact them, or give them a call at 800.969.3666.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution of the TriZetto Provider Solutions Editorial Team ]

Apr 5, 2021 | AMBA National Conference, Medical Billing Software Blog, MMBA Chapter Meetings, Support and Training

In this interview with a medical billing expert and co-owner of Elite Billing Resolutions, Vicky Greenwood, we talk about dealing with the challenges in owning a billing company, some important skills that every medical biller needs, and the value of choosing the right medical billing software. In our time speaking with Vicky, we focused on topics that will aid, contribute, and help grow the skills of the medical billing community. We at EZClaim believe in highlighting the best practices in the industry and sharing those with the larger community. We encourage you to consider these insights, and then let us know what topics you would like to learn more about.

EZCLAIM: When did you get into medical billing?

VICKY: “I started in 1994, and at the time we were working on a dinosaur of a system called, “Signature.” We would have to wait overnight to process the entire day’s work. Then we would return in the morning to see if there were any errors in the batch or denials in the claims, which meant being accurate in entering information was essential. Outside of that, we kept all our paperwork in filing cabinets, and they needed to be sorted and organized by date. If a date was off in the filing system it could take the better part of a day to find a patient’s claim. The difference between then and now is night and day. I am definitely thankful for technology.”

EZCLAIM: Why did you start Elite Medical Billing?

VICKY: “We started Elite Medical Billing because we wanted to be able to directly impact our medical practices with the services we provided, and we wanted the freedom to enjoy doing it for our clients. I also knew that I was experienced in the field, was competent at my job, and enjoyed doing what needed to be done to get practices paid. Once I honed those skills and knew we could do it. We hired a lawyer and an accountant, then formed our company.”

EZCLAIM: What are challenges in starting a company?

VICKY: “First, you have to understand the value of time management and delegation. You don’t want to bite off more than you can chew. It is good to know when you need to ask for help. Next, you want to find good staff. I look for people who have the right attitude about the job first and have the characteristics to be proactive and work hard. Then, I look for experience in the field, learning if they had hands-on experience with claims, denials, and coordination of benefits is part of that. At the end of the day, my staff are my [company], and fortunately, most of my staff have been with me from the beginning.”

EZCLAIM: Why did you choose EZClaim?

VICKY: “We had a client who needed software and, being a smaller company, we needed cost-effective software with strong tech support. When we searched on Google for “easy to use medical billing software,” we found EZClaim. We were won over by the first phone call. Since then, we have been reminded of how great a decision that we made. The simplicity by which you can enter the information, process new patients, and ‘claim them’ within minutes is invaluable. That combined with the great customer service—that answers our questions most often on the first call with detailed answers—and video tutorial support is why we will continue to use and promote the software.”

EZCLAIM: Are you a member of AMBA and MMBA?

VICKY: “We joined the MMBA and AMBA in 2016 to help us certify our billing company. That process and the training, testing, and materials were amazing pieces of helping us get established and grow. In addition, the expos, webinars, and online support offer an abundance of information. Of course, the annual expos are both informative and a great work trip for team building and fun. We make it annually to the MMBA, but our next big goal is to go to the AMBA in Las Vegas!”

EZCLAIM: Have some final thoughts to offer fellow medical billers and business owners?

VICKY: “As a medical biller and owner, you have to be willing to talk with physicians. You need to show them the vouchers and documentation of your work. And it is important to communicate how they bill and how they can be sure to properly classify to get paid. You need to review what they have done in the past and how they can improve in the future by training staff.”

“You can also add value by making them the good guy and yourself the bad guy when dealing with patients and getting paid. We allow patients to call us directly, we answer the questions, and tell them how much they have to pay—then we forward the call to the office. Remember, at the end of the day, you have to show them the money. They work hard and they deserve to get paid.”

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Mar 10, 2021 | Medical Billing Software Blog, RCM

Medical billing technology is always changing, and usually much quicker than one expects. While your current processes may be working for you, there just may be something better available to reduce staff time and increase your revenues. The thing is, technology has made huge strides in the medical billing industry in recent years, offering a number of ways to send and receive data faster, while still protecting sensitive patient information.

So, over the next several posts, we will explore different features technology can offer to increase your efficiency as well as your ‘bottom line‘. We will consider how your Electronic Medical Record (EMR) can communicate with your Practice Management (billing) software, the key features to look for in your Practice Management software, and how it can communicate with other programs, such as Clearinghouses and statement vendors.

This Medical Billing Technology Series will include:

-

- Validation vs. Scrubbing

- Rejection vs. Denial

- Integrating With an EMR

- Integrating With a Clearinghouse

- Basics of ANSI/EDI Reports

- Patient Collection Policy/Credit Card Processing

- Using Templates

- Is Integrated Eligibility Worth It?

- Statement Options

- Selecting a Practice Management System (Ease of Use/Access; Training; and Support)

Now, not every office will benefit from the same “bells and whistles,” and there are so many options out there. It can be overwhelming. Chances are though, your office could benefit from considering some updates, and some may not even cost you at all!

EZClaim suggests that you take a fresh look at the workflows and processes that you have in place today, and start thinking about the tasks that are wasting time or that are causing delays in collecting payments (from both patients and insurance). These insights just may help you create a positive change to your workflow and your revenues!

So, if you need some help getting started, consider working with a consultant. One of EZClaim’s partners, RCM Insight, offers an annual fee schedule review, and during the month of February 2021, they will be offering four practices a FREE fee schedule review. So, visit their CONTACT US page for your chance to win! [ Note: RCM Insight uses EZClaim’s medical billing software for their billing services, so it could be a ‘win-win’ if you are—or will be—using EZClaim’s medical billing solution ].

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution: Stephanie Cremeans with RCM Insight ]

Mar 10, 2021 | Credit Card Processing, Medical Billing Customer Service, Medical Billing Software Blog, Trizetto Partner Solutions

What is Price Transparency?

It’s a story we hear too often. A person visits a hospital for a medical issue—whether it be a trip to the emergency room for a broken arm or a pre-scheduled appointment for a headache that just won’t go away—and receives a myriad of services and tests. Then comes the dreaded bill in the mail a few weeks later. Although they may inquire about an estimate at the time of service or have an idea of their coverage, the exact financial responsibility is often a mystery until that bill arrives. While the changes vary greatly, one thing that is certain: many people have trouble with their out-of-pocket costs. So much so that a recent survey from The Commonwealth Fund found that 72 million Americans have some sort of trouble with medical debt.

So, on January 1, 2021, the price transparency rule was put into effect—from the Centers for Medicare and Medicaid Services (CMS)—requiring all hospitals within the United States hospitals to publish the prices of various medical procedures. In particular, standard charges for services and items must be published online, available for patients to access. Until now, these prices were hard to find. The timing of this change—the beginning of the calendar year—comes at a time when healthcare pricing is top of mind since many customers most likely renewed or changed insurance carriers and coverage on January 1, 2021. With this comes a focus on out-of-pocket costs, deductibles, and more.

What Brought About This Radical Change?

Part of this change can be attributed to the consumers themselves. With the increase in high deductible health plans and increased out-of-pocket costs, finances are top of mind. In addition to these factors, today’s consumers demand a better overall patient experience. With the prevalence of online shopping, patients expect the same seamless transaction at the hospital that they receive with companies like Amazon, Walmart, and Home Depot. Just as consumers read product reviews before placing an item in their online shopping cart, patients research services and access peer reviews of physicians before they go to the office. In short, they want to be knowledgeable about their healthcare and crave tailored services with exceptional customer service.

Many believe this change will be well received, with Forbes calling the ruling a “gift to all Americans.” From the consumer’s standpoint, it will now be easier to make educated decisions based on cost. This will then cut down on the “unknown”—hopefully eliminating those hefty surprise bills—and opens the door to comparison shopping. Advocates are hoping this newfound transparency will eventually lower costs, with the competition eventually driving down the prices.

How Can Healthcare Organizations Navigate This Change?

This will not only promote transparency but will also increase convenience. By enabling patients to access and pay their bills on their own schedule with easy-to-implement solutions, organizations are meeting them halfway, so to speak. With easy-to-understand statements, integrated credit card processing, and 24/7 payment portals, it is no longer a hassle to manage medical financials. For healthcare organizations, facilitating proactive management of a person’s cost of care accelerates revenue collections and patient satisfaction improves.

In the larger sense, executives recognize that patients are taking more stock in their personal care. In order to thrive, hospitals and health systems must work toward creating the optimal patient experience, beyond just price transparency. With this, providers should aim to be more engaged and C-suite executives should try to provide additional benefits to their patients.

What Will This Mean for the Future of the Industry?

Only time will tell what the price transparency will mean for the industry. However, it is safe to say that this concept has the possibility to shape healthcare policies and processes for years to come.

So, for more information on solutions that equip you to have informed conversations about eligibility and financial responsibility, contact one of EZClaim’s partners, TriZetto Provider Solutions, to talk with one of their representatives today.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by TriZetto Provider Solutions Editorial Team ]

Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

New Patient Survey About Price Transparency Rule

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

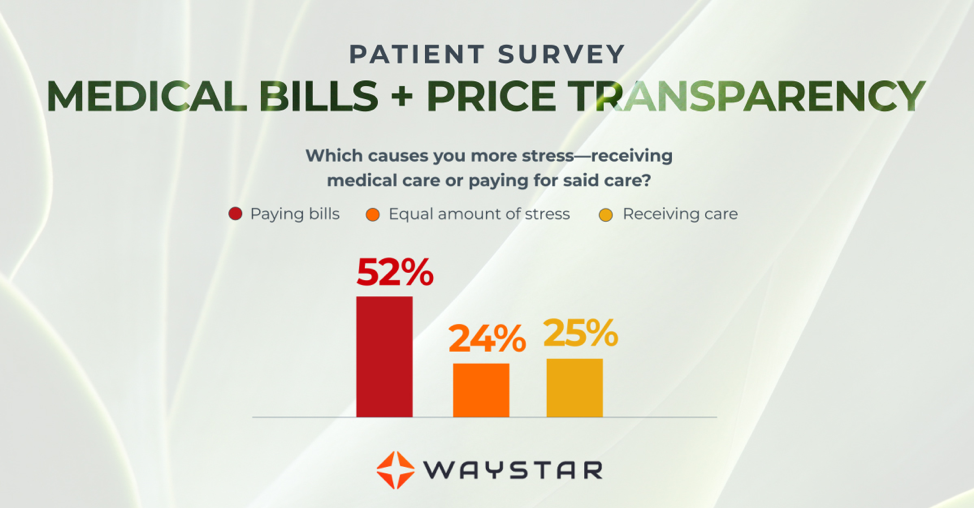

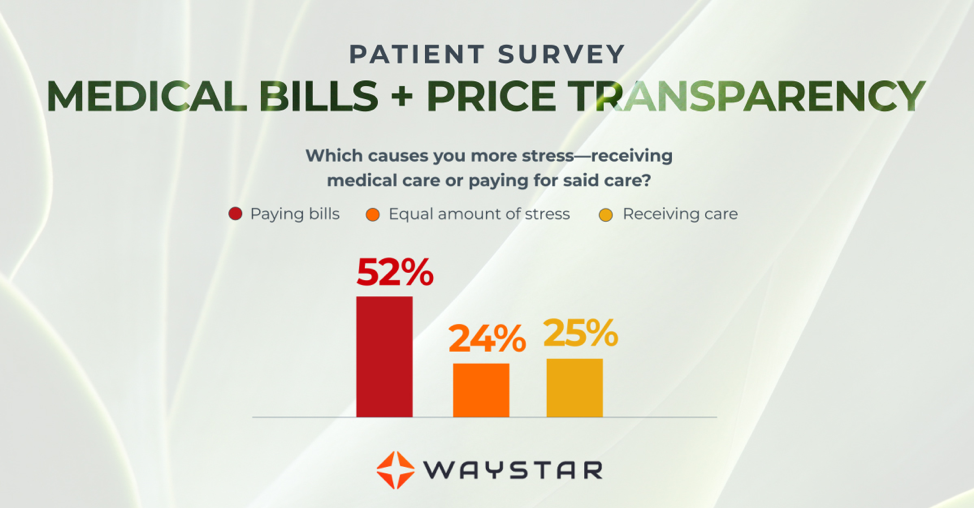

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]