Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner, Trizetto Partner Solutions

A group of senators introduced the “Health Care PRICE Transparency Act” in a move to empower patients to lower their healthcare costs.

On a basic level, the Act will require all medical facilities to post payer-negotiated rates for all shoppable services, so the patient can find the most inexpensive way to take care of their medical needs. This legislation will give Americans the chance to see the actual costs of their healthcare visits, which in theory, will increase competition and lower healthcare costs for everyone.

The added transparency of the Act will bring more accountability and competition to the healthcare industry, and gives American’s more control over their healthcare costs. However, if you are a medical practice, a hospital, or a member of the medical billing community, you need to know how you can best respond.

• “What is this procedure going to cost?”: There is going to be mounting pressure on practitioners, medical billers, and hospitals to have answers for the cost of procedures. Jeff Leibach, a director of Guidehouse’s healthcare strategic solutions team, says that “regardless of the legal fate of the final rule, hospitals need to be prepared for more price transparency in the future.” So, to get in front of this—and help you compete against your competitors—you should be prepared with both what it will cost for individual services and procedures, as well as, a ‘value statement’ on why it will cost what you are charging.

• Prepare to Comply or Cover the Costs: As it stands now, the legislation is moving towards technology assisting with the billing transparency. This will aid the patients to better understand the cost of services. This is a ‘clarion call’ for you to begin preparing for this reality or you will struggle with being fined and potentially publicly shamed in publications for being offenders. We recommend starting to comply NOW before the deadline ‘sneaks up’ on you.

• Use It To Improve: Currently, healthcare practices are, in many cases, already working at capacity. The added effort of defining cost and selling procedures are enough to make some healthcare facilities put this off until it is too late. Yet, while many may be considering accepting the fines and fees associated with non-compliance, we advise using this as an opportunity to improve—to better establish your medical practice’s services and promote your ability to be proactive to change. Getting ahead of the coming ‘wave’ of consumer expectations of healthcare will be a benefit.

• Seek Out Vendors That Can Assist: The changes that are coming for individual practices and healthcare providers can be overwhelming, and potentially it might just be more than what an IT team or private practice can handle. Forward-thinking billing departments should be investing in software vendors that can help fill that gap. EZClaim is a medical billing software company that partners with Trizetto to provide a tool called, Patient Responsibility Estimation (PRE). This tool assists in clarifying costs to consumers by providing a cheap and fast way for them to pay for out-of-pocket costs. [ Click here to learn more about how EZClaim can help you ].

It is clear that the expectations of consumers are changing, and the wave of medical transparency is on its way. Accepting it, preparing for it, and using vendor software to help overcome it, can be the difference of your practice avoiding fines and fees. For those forward-thinking and proactive practices who want to learn about how EZClaim can help, e-mail one of their sales representatives, go to their website for more details, or download a FREE 30-day trial today!

May 12, 2020 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

If you are a member of the MEDICAL BILLING COMMUNITY, the norms of the day-to-day have changed. With the recent COVID-19 pandemic and the ‘stay-at-home’ order, you may find yourself with either more time on your hands and/or an increase of claims with new patients. During this time, we want to offer you a couple of suggestions so that you can make the best use of the additional time you have, and also help you improve your billing processes.

The first thing to consider is to review your Accounts Receivable (AR)—to collect payments due you to INCREASE YOUR INCOME. According to the American Medical Association (AMA), claim denial rates range between 0.5% and up to 3% or more, and that 90% of claim denials are preventable. Some of the most common claim denial reasons can be rectified by correcting claim management workflows, including claim submission and patient registration procedures. The following are a few of the most common oversights for claim denial.

- Use EZClaim software to check automatically for missing information, including absent or incorrect patient demographic information and technical errors

- Make sure you do not have duplicate claim submissions

- Check that claims do not have services previously adjudicated

- Review for claims with services not covered by the payer

- Make sure the time limit for claim submission has not expired

Secondly, revisit and resubmit open claims. Surprisingly, 31% of providers still use a manual process to resubmit. Our partner, TriZetto Provider Solutions (TPS), has an Advanced Reimbursement Manager Pro (ARM) that has two great tools that can improve your ability to tackle collecting and repaying underpaid and overpaid accounts. Below are some key features that can be automated by their software, and will help to improve your billing processes:

- Identify common errors and payer trends

- Analyze contract performance

- Customize and assign work into queues

- Quickly access information from interactive dashboards

- Automate the appeal process

Thirdly, know that EZClaim and our partner TPS have worked together to bring you the most powerful medical billing software tools to solve claim denials. Our partnership not only simplifies the billing process but also helps resolve denied claims in an efficient way. In addition to that, our customer support team is available to help you learn best practices with these tools, and support you however you need it.

Finally, if you are frustrated with your current medical billing solution, investigate how EZclaim’s medical billing solution may work for you. You can either schedule a one-on-one consultation with our sales team or download a FREE TRIAL to check it out the software yourself. For additional information right now, contact EZclaim’s sales team at 877.650.0904 or send an e-mail to sales@ezclaim.com.

Apr 13, 2020 | Medical Billing Software Blog, Trizetto Partner Solutions

On January 13th we posted part one on this topic of Eligibility in healthcare, in that, we touched on deductibles, co-pay, and max out-of-pocket pay. Now in part two, we review the impact of price transparency in healthcare and its importance to the healthcare team decisions.

Consumers are the most important member of the healthcare team and are better collaborators in their care when they know all the variables and their required responsibilities in the process.

The individual consumer’s healthcare team includes, along with themselves, the physician and their staff, the pharmacist, an insurance adviser, and possibly some gatekeepers as well. The communication of clear symptoms when a patient is diagnosed is the responsibility of that team along with building an understanding of the financial responsibility that goes with any medical solution. While providing answers, options and solutions is a provider’s responsibility, so is providing a cost for the provided care. Therefore, price transparency can be achieved when the cost for that care is presented in a clear and concise fashion so the patient can understand what they owe, why they owe it, and when it is due.

Ensuring your staff is educated on discussing the financial responsibility with the patient from the first appointment and forward will strengthen the healthcare partnership and assist in the collection process. Understanding the steps that occur post the upfront estimate can be beneficial to the team. This discussion can be bolstered by ensuring bills are clearly marked with the statement, “this is a bill”, also clearly listing what the patient is being charged for when the bill is due and offering details on the methods of payment that are accepted. This clarifies what insurance will cover for the patient and their own out-of-pocket cost, prompting them to share any concerns and constraints with payments upfront.

Estimating patient responsibility is one part of the reimbursement process that is used for transparency for patient billing. The estimates can be provided using a spreadsheet of prior reimbursement and your most commonly billed CPT codes. If you would like an automated and more accurate option then look into a software tool like the Patient Responsibility Estimator by our solutions partner, TriZetto Provider Solutions (TPS). Giving this to the patient at the time of checking in will assure they have a rough idea of the costs and allow the office to collect upfront if needed.

For more information on how EZClaim can help you with this journey, schedule time with our sales team. Ready to get started? Download your FREE 30-day Trial today!

[ Contribution by Brenda Smelser with the DMC ]

Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

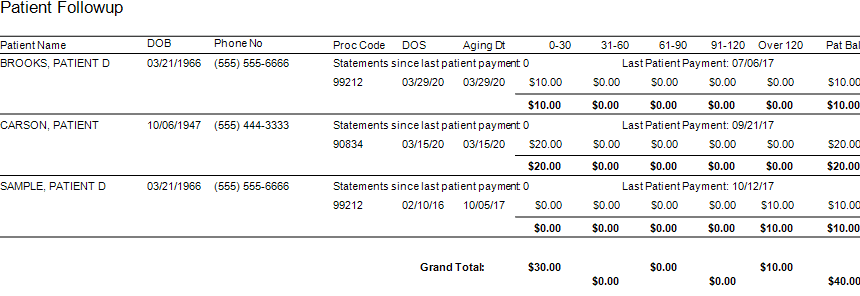

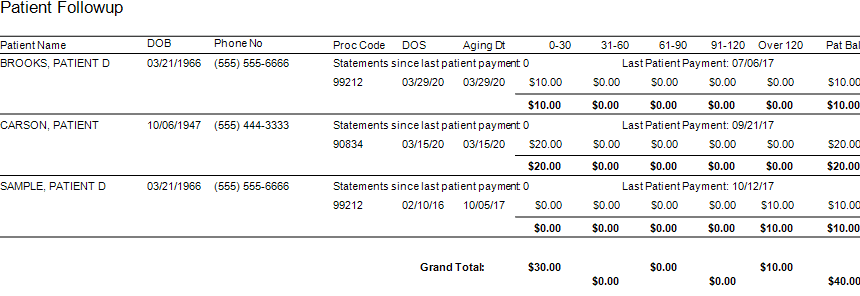

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]

Mar 10, 2020 | Live Compliance, Medical Billing Customer Service

Whether you are a person new to medical billing or someone who’s been in the business for years, launching a new medical billing practice can be hard. Understanding the market, connecting with new clients, and knowing how to master your processes are challenges that you often learn as you go. Despite these challenges, it is rewarding to be out on your own growing a new company. Before you jump, let us help you understand some essential keys that you can research upfront and prepare yourself to get one step closer to being successful.

1. ONE BILLING PLATFORM VERSUS MULTIPLE PLATFORMS: First and foremost you must make a conscious decision to either focus on being an expert on an individual medical billing platform, like EZClaim or tackling multiple platforms. There are pros and cons of both: being an expert can make you extremely efficient in your use of the software’s billing and, scheduling features, however, it can also limit your client base to only one set of software users. Whereas having a basic understanding of multiple platforms can allow you a larger base of medical offices while limiting your ability to truly understand how best to serve each individual client’s needs.

Pro tip: Start and master one trusted billing program, and grow your options as your billing business grows.

2. GET CLEAR ON THE CLEARINGHOUSE: A new billing company owner does not want to be held to just one clearinghouse as options are key here. Having the ability to work with any or many would be an essential piece to your billing services, however, you still want to know the best clearinghouses in the business. Understanding which clearinghouses provide the best products and services and being able to recommend those services to your client upfront will make your life easier and their business run smoother. For this very reason, EZClaim has built its software around partnerships and integrations with the best clearinghouses to make working with the one you need easy.

3. COMPLY OR DIE (HIPAA Compliance): The third key to any start-up is first understanding the importance of HIPAA Compliance. Medical billing firms literally can come crashing down with any missteps, mistakes, or misunderstandings of this essential piece of the puzzle. It goes without saying that if you are going to choose a billing software be sure that they have partnerships built around making sure you are protected. You are also responsible to make sure the data is protected so your customer and their patient’s data is safe.

HIPAA Hint: Check out Live Compliance for further details on the topic.

There are many options available out there for your new medical billing practice, and we recommend doing your research. Within that research, you will find that EZClaim ranks very high in performance and comes in at a great price.

To learn about EZClaim go to our about page, sign up for a demo, and/or download a trial for free today!