Sep 4, 2022 | MedCycle Solutions, Partner

Collections aren’t the most glamorous part of running a practice. Perhaps the only thing worse than making collections calls is receiving them! Unfortunately, collections are necessary and if done correctly, it will allow you to collect on accounts that have sat stagnant for months, sometimes years.

In our years of experience managing collections for small and medium physician practices, we’ve identified seven best practices for optimizing your collections.

- Speak their language. There are so many ways to communicate these days. Routinely ask and record how your patients prefer to be contacted. Phone? Email? Text? Mail? Patient Portal? For best collections results, communicate with your patients using their preferred communication method.

- Allow multiple payment options. Similar to communication methods, there are several payment methods that different people prefer. For some, a payment plan might be their best option. For others, credit card payments. For yet others, cash or checks. Sometimes, patients want the ability to finance their medical procedures through a healthcare financing company like Care Credit. And with today’s ever-changing technology, look into text message billing reminders with links to pay from their phone – and even QR code-driven options! Make sure your practice can accept multiple forms of payment to optimize your collections.

- Coach your staff. We encourage you to train your patient-facing staff to implement some basic key principles: Be a good listener; Talk in terms of the other person’s interest; Make the other person feel important and do it sincerely. By implementing these simple practices, your patients will feel less attacked and more heard – which in turn will hopefully lead to increased payments.

- Optimize technology. Most practice management systems, patient portals, and/or EHR platforms have advanced notification settings where you’re able to reach out to the patient (via their preferred communication method, of course) with reminders, balances, past-due alerts, etc. Using technology to automate parts of the process can reduce the heavy lifting for your staff.

- Discuss costs upfront. Being upfront about the costs of your patient’s care is one of the most effective ways to minimize collections. If you offer a limited number of services, consider listing the prices on your website or marketing collateral. If you’re a general practice, ensure your staff is communicating with patients before treatment regarding costs and how they plan on paying for their care. A shift we’ve seen over the past several years in healthcare is having a Patient Financial Counselor on the front end. This roles’ primary responsibility is to know what the patient is coming in for, verifying their benefits & coverage – and then reaching out to the patient before the appointment to provide them with an out-of-pocket estimate and payment options. That way, when the patient presents for the appointment, they are already aware of their financial obligations, and not surprised a few months later with a bill they were not expecting.

- Incentivize your collections staff. Collections can be tedious and tiresome. Consider offering incentives to help the task feel a little more exciting – small prizes can go a long way in motivating! Some incentives we’ve seen include PTO, cash, practice logo wear , and gift cards – based on the amount they’ve collected.

- Enlist expert help. Consider partnering with a healthcare-focused organization that specializes in collections. The tricks they’ve learned by working with other practices may decrease your outstanding balances in a shorter amount of time than doing so internally.

Implementing these tips can help reduce your collections timeline and increase the amount you’re collecting.

There are many great organizations that can help you in these areas – and MedCycle Solutions is one of them. If you’re wondering how partnering in these areas could work for your practice, let’s connect. Ranadene (Randi) Tapio, MBA, CMRS, CPCS is the Founder & CEO MedCycle Solutions, which provides Revenue Cycle Management, Credentialing, Outsourced Coding, and Consulting Services to a number of healthcare providers in a variety of specialties. To find out more about MedCycle Solutions services please visit www.MedCycleSolutions.com. You can reach Randi via email at Randi@MedCycleSolutions.com or call 320-290-6448.

EZClaim is a leading medical billing, scheduling, and payment software provider that combines a best-in-class product with exceptional service and support. For more information, schedule a consultation today, email our experts, or call at 877.650.0904.

May 12, 2022 | Health eFilings, Partner

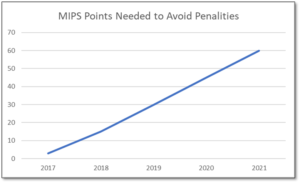

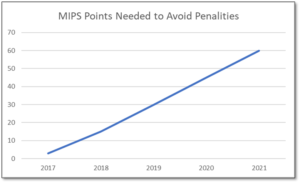

MIPS is a point-based program and understanding how to earn MIPS points is critical to avoid a 9% penalty. The MIPS program continues to change and evolve each year as it meets the goals laid out in the MACRA law and carried out by CMS. Since the program was implemented in 2017 the points threshold to avoid a penalty has grown from 3 to 60 out of a possible 100 MIPS points; the penalty has increased from 3% to 9% of annual Medicare reimbursements; and, the number of patients required to be reported on has increased from 20 patients to all patients for all payors. With the rules changing every year, the strategy you previously used to score MIPS points and report may no longer be optimal. If you want to avoid the 9% penalty in 2021 and beyond, you must think differently and evolve your strategy for MIPS.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your MIPS score. Here are three critical considerations that provide guidance on ensuring you have the right MIPS strategy to optimize your ability to earn MIPS points for the 2021 reporting period.

The Quality Category, worth the most points, is the category to focus most of your effort. Because the Quality category is worth anywhere from 40 to 85 MIPS points, focusing on this category throughout the year is critical. You need to submit a full year’s worth of data so now is the time to ensure that you are capturing all relevant data in your EHR and or billing system so that it can be properly extracted and reported on for your submission.

40% of the MIPS points require you meet stringent timeframe requirements. Two of the MIPS categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform and document activities for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long you will find it impossible to put the right actions in place to complete the activities necessary to earn any of the MIPS points in these categories.

The reporting methodology you choose impacts the points you can earn. Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the MIPS points you could earn. Unless you select a reporting partner that will help you earn the most points available by leveraging technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score, you risk leaving MIPS points on the table and significantly sub-optimizing your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the MIPS points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings’, a CEHRT, is the national leader in automated MIPS reporting and our cloud-based ONC certified software fully automates the MIPS reporting process. And because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes, you will save significant time while maximizing your financial upside.

Contact Sarah Reiter, sreiter@healthefilings.com, or 608.841.1866 to find out how to maximize your reimbursements and protect your bottom line.

About Health eFilings:

Health eFilings, a CEHRT, is the national leader in automated MIPS compliance and quality data analytics. Its services drive improved patient outcomes, optimized quality measures, and stronger financial results for healthcare practices. Their proprietary cloud-based ONC certified software is significantly more efficient and effective than any registry as it does all the work to extract, calculate, benchmark, format, and electronically submit MIPS data to CMS so clients avoid significant penalties and earn maximum reimbursements. And, you can have peace of mind knowing you are working with the best partner because CMS has accepted 100% of Health eFilings’ submissions. Learn more here: https://healthefilings.com/ezclaim

ABOUT EZCLAIM:

EZClaim is a leading medical billing and scheduling software provider that combines a best-in-class product, with correspondingly exceptional service and support. For more inforatmion, schedule a consultation today, email our experts, or call at 877.650.0904.

Jan 15, 2022 | EZClaim

As we move into the new year, we wanted to take a moment to share the most popular articles of 2021. We’ve ranked them below so that you can be sure that you haven’t missed out on any resources that EZClaim clients have found useful in the past year.

Here are the most popular blog posts of 2021:

This interview was by far and away the most popular blog post over the past year. Jennifer and Maura provide some great insight and best practices, including their “investigative” approach to medical billing and the problem-solving skills that are necessary. Here is a summary of that article:

Are you working in the medical billing industry as a biller or an owner of a billing company? If so, the key medical billing insights and best practices that came out of our interview with Maura Jansen (VP of Operations) and Jennifer Withington (Director of Revenue) at Missing Piece Billing & Consulting Solutions will be very valuable for you to consider.

Jennifer, an expert in understanding the problem-solving techniques and the investigative nature of medical billing, offers insights that both educate and inspire. Maura, an executive member of the billing community, also added an important perspective about EZClaim’s medical billing software. The following are some highlights from our interview.

Getting patient billing information quickly can be a big pain point, so it makes sense that this article was among the most read of the year. We walked through some tips and ticks for saving time including the EZClaim eligibility feature:

Can you add up the number of hours your billing team spent during any given week or month waiting on-hold with insurance companies to get patient billing information? Does your staff invest hours of their valuable time seeking out the smallest of details to get paid? Are you aware that integrated eligibility, through EZClaim’s medical billing software, can reduce that time on-hold to a fraction of the total?

It is estimated that the average biller can spend up to 2-hours on-hold just to get an insurance company on the phone. Add to that an average of 10 – 15 minutes to talk through a patient and most companies will only address one or two patients at a time.

In this interview with a medical billing expert and co-owner of Elite Billing Resolutions, Vicky Greenwood, we talk about dealing with the challenges in owning a billing company, some important skills that every medical biller needs, and the value of choosing the right medical billing software. In our time speaking with Vicky, we focused on topics that will aid, contribute, and help grow the skills of the medical billing community. We at EZClaim believe in highlighting the best practices in the industry and sharing those with the larger community. We encourage you to consider these insights, and then let us know what topics you would like to learn more about.

Double data entry is frustrating. Luckily there is a better way—integrating your EHR with EZClaim.

Are you or your staff having to enter every patient into your EHR program and then again into EZClaim? There is an easier way! Integrating your programs will put an end to duplicate data entry, saving your practice time and money!

So, what exactly is an interface and how does it work? An interface is a way for two programs to share information. For EZClaim clients, the interface can be set up to share data from your EHR program to EZClaim. Your EHR can give you specifics on how to send the data to EZClaim.

Minimizing and preventing claim denials is a challenge that providers are increasingly running up against. We put together four strategies to address this growing problem:

Reducing claim denials has long been a challenge for providers. In the worst case, denied claims end up as unexpected—and sometimes unaffordable—bills for patients. The challenge only seems to be growing. A recent survey conducted by the American Hospital Association (AHA) found that 89% of respondents had seen a noticeable increase in denials over the past three years, with 51% describing the increase as “significant.”

Minimizing loss will be top of mind for providers as the COVID-19 pandemic continues to put a strain on their resources, and minimizing or preventing denials will need to be a core part of that strategy. With that in mind, we’re offering four tips to help guide revenue cycle strategies for better denial reduction in 2021.

There you have it, the most popular posts on the EZClaim blog in 2021. We look forward to keeping you up to date on everything medical billing in the new year!

Nov 11, 2021 | Health eFilings, Partner

MIPS Strategic Guide – How to Choose the Right Reporting Partner

Given the way the MIPS program has evolved, all healthcare practices regardless of size or specialty must evolve their approach to MIPS reporting to assure their success with the program. However, most clinicians do not understand or don’t have awareness of, the different reporting methods available to them and the impact the reporting method can have on their success with MIPS. With what is at stake financially, it is critical that you understand and select the right methodology and partner to maximize your MIPS points and protect your bottom line.

Many clinicians erroneously think that a registry is the only reporting option available to them or that they are required to use a registry. Or, they think that their EHR handles reporting for them. These misperceptions and general lack of awareness of the other reporting methodology will be detrimental to your ability to be successful with MIPS. And, given that 50% of all clinicians will be penalized annually by next year, the legacy reporting methods (registry or EHR) will not be able to fulfill enough of the reporting criteria to earn the minimum MIPS points needed to avoid the 9% reduction in Medicare reimbursements.

To help you determine if you are choosing the right reporting method and partner, we’ve identified the five most important factors to consider in order to increase your probability of avoiding the 9% penalty.

- Reporting Classification – is the reporting partner a CEHRT?

- Service Approach — Does the reporting partner use ONC certified software to do all the work with no IT resources, administrative support, or workflow changes?

- Quality Measures — Is the reporting partner certified by CMS to calculate all eCQMs, which earn significantly more points than registry measures?

- Benchmarking — Are proprietary algorithms used to assess the 9 million possible combinations of Quality measures to maximize earning MIPS points?

- Submission Method — Does the reporting partner submit a comprehensive electronic file directly to CMS to comply with reporting for all MIPS categories?

If you answer “no” to any of these questions, then the reporting partner you are working with will not be able to maximize the MIPS points you can earn. Given every MIPS point matters, because MIPS points determine your reimbursements and impact your bottom line, it’s time to consider a new strategy with a new reporting partner.

Health eFilings, a CEHRT, is the national leader in automated MIPS reporting. They utilize ONC-certified software to handle 100% of the tracking and reporting of the required data to CMS. And because their service is classified as an end-to-end electronic solution, you’ll also earn additional bonus points toward your MIPS score even though they are doing all the work. Health eFilings as your partner is the more effective and efficient reporting method so you will earn more points and, ultimately, receive higher reimbursements.

Learn more about how Health eFilings can help your practice here: https://healthefilings.com/ezclaim. Contact Sarah Reiter, sreiter@healthefilings.com, or 608.841.1866 to find out how to maximize your Medicare reimbursements and protect your bottom line.

About Health eFilings:

Health eFilings, a CEHRT, is the national leader in automated MIPS compliance and quality data analytics. Its services drive improved patient outcomes, optimized quality measures, and stronger financial results for healthcare practices. Their proprietary cloud-based ONC certified software is significantly more efficient and effective than any registry as it does all the work to extract, calculate, benchmark, format, and electronically submit MIPS data to CMS so clients avoid significant penalties and earn maximum reimbursements. And, you can have peace of mind knowing you are working with the best partner because CMS has accepted 100% of Health eFilings’ submissions. Learn more here: https://healthefilings.com/ezclaim

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Aug 19, 2021 | Partner

Designing a Superior Patient Experience

We live in a world of increasingly lofty consumer expectations—one where 44% of U.S. consumers will switch to a competitor following a poor customer service experience.

The medical industry is no exception to this trend.

In a study by PatientPop, 58 percent of Gen Z, Millennials, and Gen Xers, as well as 63 percent of individuals 55 and older, said that responsiveness to follow-up questions via email or phone outside of the appointment is critical or very important to overall satisfaction.

Patients want more than just excellent care from their healthcare providers. They expect easy access to medical records, convenient online scheduling and appointment reminders, prompt responsiveness, and painless ways to contact your office—24/7/365. And they’re also seeking compassionate and knowledgeable representatives who are willing to provide caring and accurate resolutions to their issues.

As a medical provider, you should not only focus on bringing in new patients but also continually strive to improve patient retention. Growth in customer retention rates by 5 percent can increase profitability anywhere from 25 to 95 percent, after all.

So how do you design an experience that increases patient satisfaction and retention? Let’s dive in.

1: Make Prompt Call Answering & Convenient Appointment Scheduling A Priority

As we mention above, patients want—and nowadays expect—your office to answer quickly as well as provide effective and swift resolutions to their health matters. But in a busy office, the staff is often focused on dealing with patients. Even front desk and administrative teams can become inundated with in-office tasks at a busy practice, leaving calls, messages, and emails unanswered.

A superior patient experience starts with prompt call answering and convenient appointment scheduling—a service that’s available to your patients whenever they need you, including weekends and holidays, and answers every call addresses delicate patient concerns with empathy, and schedules appointments quickly. If your staff is struggling to keep up with demand, consider outsourcing your phone answering and appointment scheduling. Not only will this improve patient satisfaction, but it also brings a sense of work-life balance to internal staff and allows you and your team to focus on what you do best; caring for patients.

2: Streamline and Perfect Your Patient Intake Process

The patient intake process is tedious, but it’s incredibly important to your operations, and speed and accuracy are vital. Streamlining and perfecting patient intake starts with leveraging the right software—one that makes it easy for patients to fill in their information and access their records, and provides all of the valuable data your practice needs to operate in an easy-to-navigate platform. For starters, your intake software should:

- Be encrypted for data transfer through the internet and HIPAA compliant

- Be intuitive and user-friendly

- Not require special software or hardware downloads or installation for the user

- Be portable into back-end systems

Your intake process should also be integrated with your electronic health records (EHR) software, and information should be updated and available in real-time for a smooth experience—for patients, admin staff, and providers—so that everyone is up-to-speed. Both technology and your process should remove redundancies from your workflow and streamline the intake experience.

3: Provide HIPAA-Compliant Live Chat & Text For Swift and Convenient Communication

Another great way to improve patient experience is via live chat and text, through which you and your staff can communicate with patients wherever they are, send appointment reminders, have two-way private and secure conversations, multitask as needed and be available when emergencies happen.

HIPAA-compliant chat and text messaging lets you communicate efficiently and accurately with patients and simultaneously safeguards electronically protected health information (PHI) while taking full advantage of the speed and flexibility of today’s communication technology.

Some of the many benefits of secure live chat and text in the healthcare realm include:

- Reduced response times, including in the off-hours and on weekends or holidays

- Ability to provide immediate recommendations for care and preliminary diagnoses

- Ability to send follow-ups, like reminding patients to take medications, which creates better relationships between you and your patients

- Secure PHI storage that acts as a record of past conversations, symptoms, or complaints to improve future care, diagnosis, and treatment plans

4: Leverage Technology and Software Integrations For Smarter Decision-Making

Technology and software integrations have transformed healthcare and are vital in any medical practice. Why? Because when you streamline your office functions and workflows, you improve all aspects of patient care and experience.

First, your office should be using an EHR (electronic health record) system. This system automates access to client information, helping to improve workflows and reduce incidences of errors by improving the accuracy and clarity of medical records. It should include all the key clinical data relevant to each patient’s care, including:

- Demographics

- Progress notes

- Problems

- Medications

- Vital signs

- Past medical history

- Immunizations

- Laboratory data

- Radiology reports

Communication data collected throughout your patients’ experience with your office—such as phone conversations, appointment scheduling, and reminders, and live chat and text transcripts—should also be sent to and recorded in your EHR system.

Finally, the right software can help you make better patient and business decisions. For instance, maybe you want to know the percentage of patient calls versus the percentage of calls from hospitals that come into your office. Or, maybe you want to know which hospitals call you the most or you want to know the main reasons patients call so you can use that information to improve patient care and education.

How The Highest-Performing Medical Practices Prioritize Patient Experience

Medical practices that provide a superior service experience are available to their patients 24/7, have a streamlined and accurate intake process, are tech-forward, and have omnichannel communication options that empower patients to reach out any time and from anywhere. But most medical practices don’t do it all on their own. The highest-performing medical providers leverage an outside service provider like Nexa to improve client satisfaction, increase retention and grow their revenue. Learn more about how Nexa can help your medical practice level up by visiting nexa.com/medical.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

[ Contribution from the marketing team at Nexa ]