Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

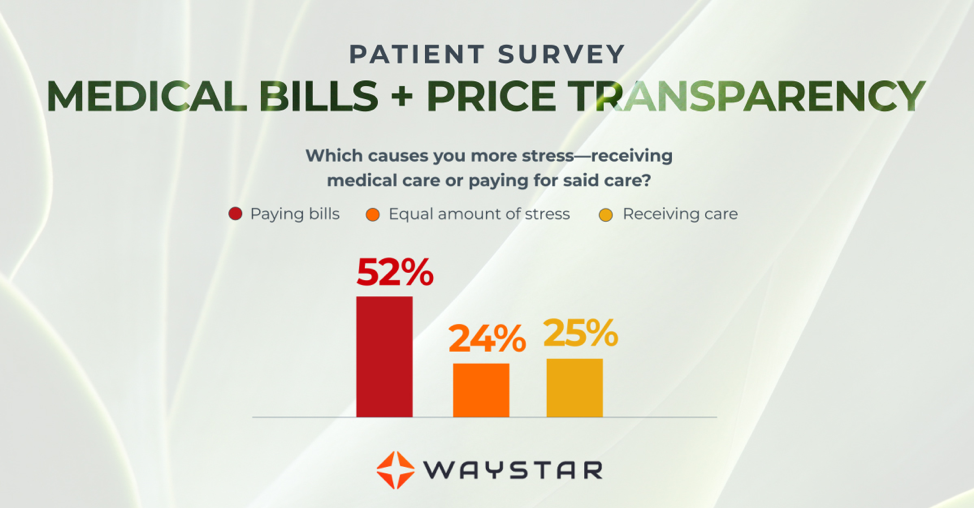

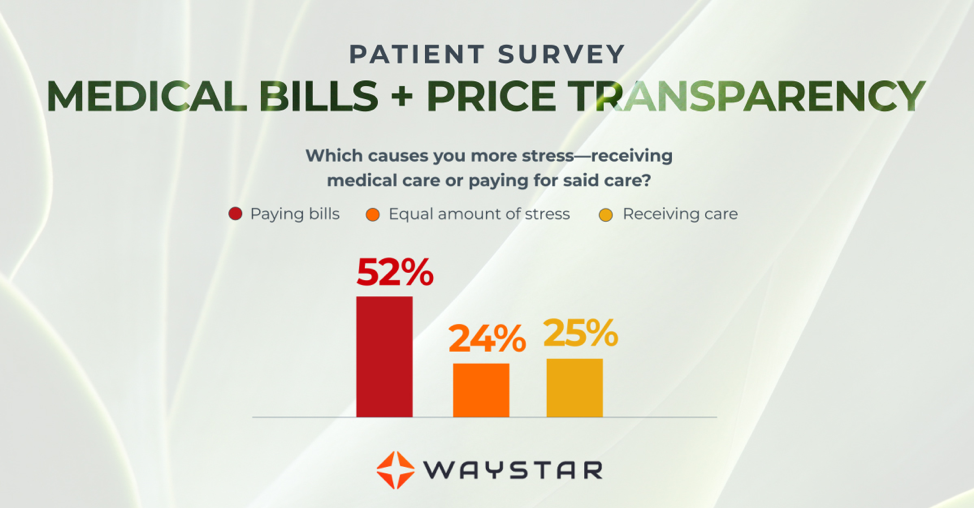

New Patient Survey About Price Transparency Rule

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]

Mar 10, 2021 | Cloud Security, HIPAA, Live Compliance, Medical Billing Software Blog

How Can You Avoid Phishing Scams?

Phishing is the fraudulent practice of sending e-mails or text messages claiming to be from reputable companies in order to persuade individuals to reveal personal information, such as passwords and credit card numbers. Scammers use e-mail or text messages to trick you into giving them your personal information, trying to steal your passwords, credit card account numbers, or Social Security numbers. If they get that information, they could gain access to your accounts. Scammers launch thousands of phishing attacks like these every day—and they are OFTEN successful!

The FBI Internet Crime Complaint Center reported that $57 million was lost to phishing schemes in one year. Scammers often update their tactics, but there are some signs that will help you recognize a phishing e-mail or text message.

How to Recognize Phishing Scams

First, phishing e-mails and text messages may look like they are from a company you know or trust. They may look like they are from a bank, a credit card company, a social networking site, an online payment website, or an app or online store. Phishing e-mails and text messages often tell a story to trick you into clicking on a link or opening an attachment.

They may:

- Say they have noticed some “suspicious activity or log-in attempts”

- Claim there is a problem with your account or your payment information

- Say you “must confirm some personal information”

- Include a fake invoice

- Want you to click on a link to make a payment

- Say you are “eligible to register for a government refund”

- Offer a coupon for free stuff

What are the Signs of a Scam?

- The e-mail says your account is “on hold because of a billing problem.“

- The e-mail has a generic greeting, “Hi Dear.” (If you have an account with the business, it probably would not use a generic greeting like this).

- The e-mail invites you to click on a link to “update your payment details.”

Your e-mail spam filters may keep many phishing e-mails out of your inbox, BUT scammers are always trying to outsmart the spam filters. So, it is a good idea to add extra layers of protection.

Four Steps You Can Take Today

- Protect your computer by using security software.

Set the software to update automatically so it can deal with any new security threats.

- Protect your mobile phone by setting software to update automatically. These updates could give you critical protection against security threats.

- Protect your accounts by using multi-factor authentication. Some accounts offer extra security by requiring two or more credentials to log in to your account.

- Protect your data by backing it up. You can copy your computer files to an external hard drive or cloud storage. Be sure to check with

your IT department and designated Security Officer before copying data to other locations.

What to Do If You Suspect a Phishing Attack?

If you get an e-mail or a text message that asks you to click on a link or open an attachment, first answer this question: Do I have an account with the company or know the person that contacted me?

- If the answer is “No,” it could be a phishing scam

- If the answer is “Yes,” contact the company directly using a phone number or website you know is real, NOT the information in the e-mail. Attachments and links can install harmful malware.

- If you think a scammer has your information, like your Social Security, credit card, or bank account number, go to IdentityTheft.gov. There you will see the specific steps to take based on the information that you lost.

- If you think you clicked on a link or opened an attachment that downloaded harmful software, update your computer’s security software. Then run a scan.

- Finally, contact your Security Officer and IT Staff Immediately.

What Can I Do to Ensure This Doesn’t Happen?

One of EZClaim’s partners, Live Compliance, will make checking off your compliance requirements extremely simple. They have a service that is:

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities.

- Built directly into your portal, easily monitor where your workforce may be vulnerable with our Dark Web Breach Searches. Easily expose breach sources with ongoing searching of active employee email or domain ensuring continued awareness of potential breach exposure. Weekly automatic e-mail notifications if new breaches are discovered.

- Informational, and has short, informative, privacy awareness videos covering technical, administrative, and physical safeguards with topics such as Ransomware, Phishing, the Dark Web, Password Protection, etc. Delivered monthly with no logins required, empower your workforce to make conscious decisions when it comes to your organization’s privacy and security.

So, don’t risk your company’s future and avoid phishing scams especially when Life Compliance is offering a FREE Organization Assessment to help determine your company’s status. Call them at 980.999.1585, e-mail them at Jim@LiveCompliance.com, or visit LiveCompliance.com. For more specific information, e-mail support@livecompliance.com

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance | Photo Credit: Shutterstock ]

Feb 9, 2021 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

The COVID-19 pandemic has put a spotlight on the need for mental health resources as illness, job losses, and isolation continues to create unprecedented stress levels. According to recent surveys conducted by the Larry A. Green Center, more than half of clinicians reported declining health among patients due to closed facilities and delayed care, and more than one-third noted that patients with chronic conditions were in noticeably worse health as a result. Even more striking, over 85 percent reported a decline in inpatient mental health with 31 percent seeing a rise in addiction.

With mental health access at the forefront of our minds, there is no doubt a demand for qualified professionals that can handle these complex patient needs. While the sense of urgency for these services exists, especially as more and more healthcare consumers are resuming in-person appointments, unfortunately, there are processes in place that can create unnecessary roadblocks for practitioners.

Complying with the Council for Affordable Quality Healthcare’s (CAQH) behavioral health credentialing requirements are especially challenging. Unlike traditional medicine, treatments and therapies for conditions such as addiction are not as well understood by payers. This makes it more difficult to gain or maintain the credentials necessary to submit claims for therapy services.

Ninety percent of the time counselors and therapists apply for network status are denied! That’s a striking statistic, even for seasoned professionals, and everyone can agree that appealing denials and requesting payers review credentials in greater depth are a time consuming and expensive burden. On average, the time required for behavioral health credentialing of professionals is up to five times greater than for medical professionals because of nuances specific to the industry. The turnaround for completed enrollments is slower too, on average 180 days versus 120 days. In addition, some payers will only allow certain therapies for providers without advanced degrees. Because denials for behavioral health are common, therapists must understand which therapies a network will accept and focus on therapy-specific credentialing. In the current environment, practitioners should also ensure that Telehealth or virtual appointments will be covered for the safety of all.

So how can mental health providers stay ahead of enrollments and avoid credentialing-related denials? Outside assistance from experts like those at TriZetto Provider Solutions offers an end-to-end credentialing service that ensures continuous payer follow up and insight into enrollment status. Our credentialing professionals are devoted to helping providers gain and maintain their credentials. We understand the nuances associated with behavioral health credentialing and have direct relationships with all major payers. TPS allows you to do what you do best – manage patient care – by alleviating the burden of credentialing and making sure you never miss quarterly re-attestation deadlines.

If your mental health services are being denied, we are here to help. Learn how solutions from TriZetto Provider Solutions can help your practice simplify credentialing.

TriZetto Provider Solutions is a partner of EZClaim and can assist you with all your coding needs. For more details about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: The TriZetto Provider Solutions editorial team ]

Feb 9, 2021 | Claims, Electronic Billing, Features, Medical Billing Customer Service, Medical Billing Software Blog

Are you working in the medical billing industry as a biller or an owner of a billing company? If so, the KEY medical billing insights and best practices that came out of our interview with Maura Jansen (VP of Operations) and Jennifer Withington (Director of Revenue) at Missing Piece Billing & Consulting Solutions will be VERY VALUABLE for you to consider.

Jennifer, an expert in understanding the problem-solving techniques and the investigative nature of medical billing, offers insights that both educate and inspire. Maura, an executive member of the billing community, also added an important perspective about EZClaim’s medical billing software. The following are some highlights from our interview.

EZCLAIM: When did you get into the industry?

JENNIFER: “I worked in group homes for the waiver side of group aid and then I went to Missing Piece. Missing Piece primarily deals with ABA providers and provides early intervention rendered to children. For me, the move from waivers with adults to professional billing, indirectly assisting children, was attractive and I took to the billing side of things.”

EZCLAIM: What does that mean when you say you took to the billing side of things?

JENNIFER: “Insurance doesn’t make a lot of sense when you first start. So, I took to the investigative side of making sense of medical billing claims. Figuring out what the payer’s rules are, reading their manuals, and figuring out the technical jargon with the purpose of preventing claim denials was attractive. I liked the puzzle of it.”

EZCLAIM: Are there things that you value in your work that offer meaning to what you do?

JENNIFER: “It’s really when I know that if I do not intercede with the insurance company and get this paid the patient is going to be responsible for the balance. So, to help, I have taken things to the department of insurance, or I have gone ahead and filed that third letter of appeal and really taken the time to research it. Because I don’t want a parent who is already struggling with having a child with more needs than maybe the other children would have, I don’t want them struggling with a $25,000 bill. ABA is extremely expensive because it works. And so, if insurance doesn’t pay it then the only other funder is the parent. And my goal is that parents should not have to pay any more than they absolutely have to.”

EZCLAIM: What are some of the strengths that make you good at what you do?

JENNIFER: “I am a good problem solver. I am good at taking a large problem and breaking it into smaller problems and knocking each one down until I solve the bigger issue. At the end of the day, that’s really what accounts receivable is.”

EZCLAIM: What would be an example of your problem solving on a day-to-day basis?

JENNIFER: “So you always start with the denial and then you have to work back to the billing. For example, if I have a claim denied for services rendered from an out-of-network service provider, but we know we are in-network then my first problem is, are we actually in-network? Then, you go onto the next link which is did the payer recognize you as in-network? It becomes like a decision tree, if you get a ‘yes’ then you are probably done, and you get the claim processed. If it is ‘no’, then you have to start digging with the payers contacting reps, make calls, and supply them with documents to get down to why they don’t have your provider listed within the network. Once you solve that problem, then the claim should be able to be processed. It is either going to pay or deny. Then depending on which one it is, you apply the same technique.”

EZCLAIM: What would you offer someone who is considering entering the field?

JENNIFER: “You should be good at processing and reading information because to get a claim paid you to have to know the rules of engagement. You need to be familiar with how to read a contract, how to read technical information about billing, and have to have a glossary of information about what you are billing. Those are the building blocks to get to know what you are doing.”

EZCLAIM: You work with EZClaim’s medical billing software platform, what role does their software providers and how does that impact your work?

JENNIFER: “EZClaim really serves to eliminate these denials before they happen, which is the ultimate goal of any accounts receivable or billing. EZClaim has edits that we use. It alerts us if the system thinks the claim is a duplicate, for example. It also helps in the set-up of the claim. We load all the fee schedules in EZClaim’s procedure code library and that lets us monitor the charge rate, make sure all the points of billing are on the claim (i.e. correct code, modifier, and charge). They also make sure that the authorization is appended to the claim. And then after we have actually done the work of getting a claim in the system, we use EZClaim reports to audit our own billing. So, we use the EZClaim service report. It makes it easier for us and our providers to see what has been billed and make sure that the billing is correct.”

EZCLAIM: If you were going to share something with your colleagues in the field, what would you share about the software that makes your life easier?

JENNIFER: “Number one, it is not the software itself, it’s the EZClaim staff. Their customer service is far beyond what a normal billing software company provides. If I have a problem, or if I have a report, or if I have a data point that isn’t in any report, they are available and they are there for me. And if they don’t have a solution for the problem, they will provide me with a workaround. So, that is very valuable. That is why Missing Piece works so well with EZClaim because customer service is number one for us, too. They don’t just want to answer your question, they want to help you understand your question.”

“The other thing that I find valuable is that their reporting modules are just a lot more robust than the other billing software companies that I have dealt with.”

EZCLAIM: Maura, do you have any thoughts from an administrative level that you can offer on EZClaim?

MAURA: “Well, when we hire a new person we know that, even if this person has very little experience in the healthcare field, it’s going to be a quick and easy process for them to learn EZClaim… EZClaim has also made it kind of a joy to work with. We really value them as a partner. We love the service they provide, and we value them as a platform.”

ABOUT EZCLAIM:

EZClaim can also help you with medical billing insights since it is a medical billing and scheduling software company. It provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Jan 11, 2021 | Electronic Billing, Partner, Waystar

With Medicare Advantage enrollment continuing to rise and more plans offering more benefits than ever, big changes are coming in 2021. This post will discuss the key changes to Medicare Advantage plans in the next year, program updates due to the COVID-19 public health emergency, and advice on how to navigate billing and reimbursement concerns.

For the first time in history, Medicare Advantage (MA) penetration has reached 40% of the total Medicare-eligible population. Currently, 25.4 million people are enrolled in Medicare Advantage (MA) plans, with a total Medicare-eligible population of 62.4 million, according to the Centers for Medicare and Medicaid Services (CMS). [ Link to report ]

With an aging population, enrollment in Medicare Advantage plans will only continue to grow (The Congressional Budget Office projects enrollment in these plans to rise to about 51% by 2030).

Medicare Advantage is an alternative to traditional Medicare that acts as an all-in-one health plan and is sold by private insurers. All Medicare Advantage plans must provide at least the same level of coverage as original Medicare, but they may impose different rules, restrictions, and costs. Most Advantage plans offer the same A and B coverage for the same monthly premium as regular Medicare plans, but also often include Part D prescription drug coverage, limited vision, and dental care, broader coverage, lower premiums, maximum out-of-pocket limits, and extra benefits—all of which expanded in 2020.

While this represents a distinct opportunity for many providers to be more profitable, growing enrollment also poses challenges. Medicare beneficiaries have more choice than ever before when it comes to selecting an MA plan.

According to the Kaiser Family Foundation (KFF), there are 3,148 Medicare Advantage plans available for individual enrollment for the 2020 plan year—an increase of 414 plans since 2019. The average beneficiary could choose among 28 plans in 2020. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycles, who need to navigate hurdles that vary by the plan in order to get reimbursed.

MA plans also tend to be more transient, meaning patients may switch often, even yearly if they choose through the open enrollment period. Providers must better manage every patient accordingly so they can maximize plan benefits. Doing so takes more effort, but the payoff can lead to profit.

CMS has clearly stated a goal to move from the current fee-for-service models toward value-based care. While the Medicare Advantage population grew by 60% from 2013 to 2019, the fee-for-service Medicare population only grew by 5%. The progress Medicare Advantage plans have achieved essentially creates an idea marketplace for beneficiaries. Enrollment costs are down and more plans than ever are offering new, innovative benefits. But what does this mean for providers?

So, how has COVID-19 affected Medicare Advantage plans? Well, the COVID-19 stimulus package, the Coronavirus Aid, Relief and Economic Security (CARES) Act, includes $100 billion in new funds for hospitals and other healthcare entities. The Centers for Medicare and Medicaid Services (CMS) made $30 billion of these funds available to healthcare providers based on their share of total Medicare fee-for-service (FFS) reimbursements in 2019, resulting in higher payments to hospitals in some states than others, according to KFF. Hospitals in states with higher shares of Medicare Advantage enrollees may have lower FFS reimbursement overall. As a result, some hospitals and other healthcare entities may be reimbursed less than they would if the allocation of funds considered payments received on behalf of Medicare Advantage enrollees.

In response to the COVID-19 emergency, many Medicare Advantage insurers waived cost-sharing requirements for COVID-19 treatment, meaning that Medicare Advantage beneficiaries will not have to pay cost-sharing if they require hospitalization due to COVID-19 (though they would if they are hospitalized for other reasons).

If a vaccine for COVID-19 becomes available to the public, Medicare is required to cover it under Part B with no cost-sharing for traditional Medicare or Medicare Advantage plan beneficiaries, based on a provision in the Coronavirus Aid Relief, and Economic Security (CARES) Act.

A Spotlight on Prior Authorization

Medicare Advantage plans can require enrollees to receive prior authorization before service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2020, according to KFF. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, and is infrequently required for preventive services. Prior authorization can create barriers for providers and beneficiaries, but it’s meant to prevent patients from getting services that are not medically necessary, thus reducing costs for beneficiaries and insurers.

In a 2018 analysis, KFF found that four out of five MA enrollees—or 80%—are in plans that require prior authorization for at least one Medicare-covered service. More than 60% of MA plan enrollees require prior authorization before receiving home health services, and that percentage increases to more than 70% for skilled nursing facility and inpatient hospital stays.

The Families First Coronavirus Response Act (FFCRA) prohibits the use of prior authorization or other utilization management requirements for these services. A significant number of Medicare Advantage plans have waived prior authorization requirements for individuals needing treatment for COVID-19.

How Providers Can Prepare for a Medicare Advantage Boom

Medicare beneficiaries have more choice than ever before when it comes to selecting a MA plan. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycle. Healthcare providers will need to navigate new hurdles that vary by the MA plan in order to get reimbursed.

When beneficiaries change plans, it creates another challenge for providers. Historically, about 10% of MA enrollees change plans during open enrollment. Although this number seems low, even a small change in coverage can cause big problems for a healthcare provider’s revenue and cash flow. Billing the wrong insurance company leads to costly denials and appeals. Becker’s Hospital Review estimates that healthcare providers spend about $118 per claim on appeals. A study by the Medical Group Management Association found that the cost to rework a denied claim is approximately $25, and more than 50% of denied claims are never reworked.

Despite the challenges, providers don’t want to be left out of the MA boom. But how can they best prepare? Well, first off, healthcare providers need to ensure they are capturing accurate patient information. Next, they need to reevaluate workflows, so they are prepared to handle time-consuming prior authorizations. Additionally, healthcare organizations must consider how frequently they are re-running eligibility on patient rosters to make certain they do not miss a change in insurance coverage for patients under their care. Providers should re-run patient rosters monthly, so they have the most accurate benefit information. This will help them avoid unnecessary claim denials.

As MA continues to ramp up, the most successful providers will be those who work with a revenue cycle management partner that understands the nuances of Medicare reimbursement as well as the added complexities of MA.

With the acquisition of eSolutions, a leader in revenue cycle technology with Medicare-specific solutions, EZClaim’s ‘partner’, Waystar, so happens to be the first technology to unite commercial, government, and patient payments into a single platform, solving a major challenge and creating meaningful efficiencies. Billing Medicare, Medicare Advantage, and commercial claims from a single platform eliminates the hassle of managing multiple revenue cycle platforms and allows providers to get deeper AI-generated insights for faster reimbursement and increased value—for their organizations and their patients.

For more information about Waystar‘s platform, visit their website, or give them a call at 844.492.9782. To find out more about EZClaim‘s medical billing software, visit their website, e-mail their support team, or call them at 877.650-0904.

[ Article contributed by Waystar ]