May 5, 2022 | HIPAA, Live Compliance, Medical Billing Software Blog, Support and Training

Your organization’s annual HIPAA Security Risk Assessment and Analysis are only one element of the compliance process, and whether you’re a Business Associate or Covered Entity, your organization must also “implement security updates as necessary and correct identified security deficiencies”. In other words, you must act via a Corrective Action Plan (CAP) following the required risk assessment process.

Here are a few common Corrective Action Plan steps:

- Implement technical policies and procedures to allow access only to those persons or software programs that have been granted access rights to information systems maintained.

- Implement procedures to regularly review records of information system activity, such as audit logs, access reports, and security incident tracking reports.

- Conduct accurate and thorough assessments of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of ePHI.

- Develop a complete inventory of all its categories of electronic equipment, data systems, and applications that contain or store ePHI, which will then be incorporated into its Risk Analysis, and must complete a Risk Management plan.

What happens if I fail to complete my Security Risk Assessment?

Failing to complete your annual Risk Assessment oftentimes means the organization will be required to complete a “robust” Corrective Action Plan (CAP) and often with at least two years of monitoring activity.

Have you ever doubted whether a small billing company or independent physician practice actually ever face penalties?

Well, keep in mind, a Business Associate is a ‘person’ or ‘entity’. This means that there is no billing company too small to have to comply with the Federal HIPAA regulations. Again, if you have not completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

It is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or another vendor suspects a breach, you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action.

An EZClaim partner, Live Compliance, will help you to make checking off your compliance requirements extremely simple. They provide:

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities.

- Complete set of HIPAA Policies and procedures built directly into your portal. Includes actionability, change management documentation, and Incident Response Policy to assist with your Corrective Action Planning. Easily share policies with staff with one click.

- Built directly into your portal, easily monitor where your workforce may be vulnerable with our Dark Web Breach Searches. Easily expose breach sources with ongoing searching of active employee email or domain ensuring continued awareness of potential breach exposure. Weekly automatic email notifications if new breaches are discovered.

- Short, informative, privacy awareness videos covering technical, administrative, and physical safeguards with topics such as ransomware, phishing, the Dark Web, password protection, and more. All delivered monthly with no logins required, they empower your workforce to make conscious decisions when it comes to your organization’s privacy and security.

So, don’t risk your company’s future, especially when Live Compliance is offering a FREE Organization Assessment to help determine your company’s status. For more information, visit their website, e-mail them, or give them a call at 980.999.1585.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution by Jim Johnson with Live Compliance ]

Dec 14, 2020 | Live Compliance, Medical Billing Software Blog, Partner, Support and Training

There are a few HIPAA items to focus on RIGHT NOW—before the end of 2020!

The U.S. Department of Health and Human Services (HHS) has designated the “Health Insurance Portability and Accountability Act” (HIPAA) as the national standard for protecting the privacy and security of health information (in 1996). This led to the Health Information Technology for Economic and Clinical Health Act (HITECH), which has a provision in it for audits, and the HHS Office for Civil Rights is responsible for carrying out HIPAA audits, and responding to complaints and breaches. Ignoring them is not an option!

A Risk Assessment IS NOT Enough

A risk assessment is only one element of the compliance process. You must also “implement security updates as necessary and correct identified security deficiencies.” In other words, you must act via a Corrective Action Plan (CAP) and follow the required risk assessment process.

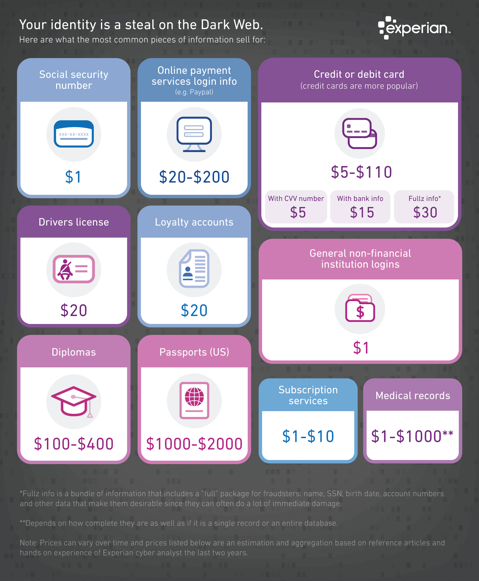

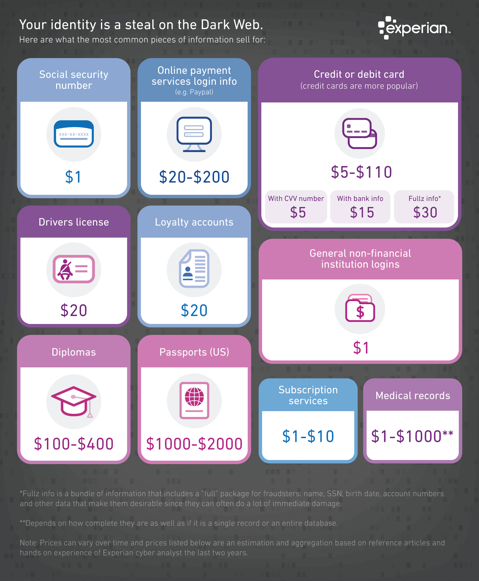

Dark Web

It is no secret that the “Dark Web” is a scary place to lose your information. So, what if it did happen and affected your entire company? Identity thieves get anywhere from $1-$1,000 for medical records, for each instance! So, how can you protect yourself and/or your organization?

Well, data breaches are becoming more common—sometimes which are out of your control—so carefully monitoring where you store and enter your passwords can be extremely beneficial to help minimize the risk of a hack and keeping personal or patient information protected.

One solution for this is the automatic Dark Web monitoring built into the portal of one of EZClaim’s partners, Live Compliance. Their solution helps keep an ‘eye’ on employees whose information was involved in a breach, and suggests next steps to take where the breach was found. Then, it allows your to conduct an accurate and thorough Security Risk Assessment. This is not only required, but is a useful tool to expose potential vulnerabilities, including those that involve password protection.

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

● Reliable and effective compliance

● Completely online, our role-based courses make training easy for remote or in-office employees

● Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location.

● Policies and procedures are curated to fit your organization, ensuring employees are updated on all workstation use and security safeguards in the office, or out. It is updated in real time.

● An electronic document is sent to employees and business associates

So, don’t risk your company’s future, especially when Live Compliance offers a FREE Organization Assessment to help determine your company’s status.

For additional details, call them at 980.999.1585, e-mail them, or visit their website at LiveCompliance.com

[ Article provided by Jim Johnson of Live Compliance ].

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call a representative today at 877.650.0904.

Nov 10, 2020 | Administrative Safeguards, HIPAA, Live Compliance, Medical Billing Software Blog

The noncompliance of HIPAA security rules has had huge consequences for an IT and health information management company.

CHSPSC LLC, (“CHSPSC”) has agreed to pay over $2 million to the Office for Civil Rights (OCR) at the U.S. Department of Health and Human Services (HHS), for the breach of Protected Health Information (PHI). The Business Associate was notified by the Federal Bureau of Investigation (FBI) that it had traced a cyber-hacking group’s advanced persistent threat into CHSPSC’s information system.

After OCR ‘s investigation, it was found that CHSPSC had “longstanding, systemic noncompliance with the HIPAA Security Rule including failure to conduct a risk analysis, and failures to implement information system activity review, security incident procedures, and access controls.” The large health system provided various Business Associate services, including IT and health information management, to hospitals and physician clinics. These violations could have easily been avoided! OCR Director Roger Severino said, “The healthcare industry is a known target for hackers and cyber-thieves. The failure to implement the security protections required by the HIPAA Rules, especially after being notified by the FBI of a potential breach, is inexcusable.”

In addition to the monetary penalty, the Business Associate will be required to complete a “robust” Corrective Action Plan (CAP) with monitoring activity for at least the next two years. CHSPSC will also be required to do the following:

• Implement technical policies and procedures to allow access only to those persons or software programs that have been granted access rights to information systems maintained

• Implement procedures to regularly review records of information system activity, such as audit logs, access reports, and security incident tracking reports

• Conduct accurate and thorough assessments of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of ePHI

All this shows that ANYONE can face HUGE penalties, and they would most likely bankrupt a small billing company or an independent physician practice.

So, based on this specific example, it is VERY important to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or other vendor, suspect a breach, you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action.

Keep in mind, a Business Associate is a ‘person’ or ‘entity’. This means that ALL billing companies—large or small—need to comply with the Federal HIPAA security rules and regulations. So, if your company has not completed an accurate and thorough security risk assessment, there is a possibility that you could be penalized under ‘willful neglect’. (This category alone gas a fine of $50,000 per violation!)

So then, what can be done to ensure this doesn’t happen to my billing company or my organization? Well, one of EZClaim’s partners, Live Compliance, can make determining your compliance requirements extremely simple:

• Completely online, Life Compliance’s role-based courses make training easy for remote or in-office employees

• Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location.

• Policies and procedures are curated to fit your organization, ensuring employees are updated on all workstation use and security safeguards in or out of the office. Update is in real time.

• Electronic, prepared document sending and signing to employees and business associates

So, don’t risk your company’s future, especially when Life Compliance is offering a FREE Organization Assessment to help determine your company’s status. Either call Life Compliance at 980.999.1585, visit LiveCompliance.com to schedule an assessment, or e-mail Jim Johnson.

[ Article contributed by Jim Johnson of Live Compliance ]

———————————-

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support, and can help improve medical billing revenues. To learn more, visit their website, e-mail them at sales@ezclaim.com, or call a representative today at 877.650.0904.

Jul 14, 2020 | Administrative Safeguards, Uncategorized

Credit card collections are a BIG part of any successful medical practice, and there has been a shift, in the last decade, that more insurance policies are adding co-pays with higher deductibles—which makes getting paid even more challenging.1 One industry report said that “73% of physicians shared that it typically takes at least one month to collect a payment, and 12% of their patients wait more than three months to pay.”2 With the current trend, more medical practices and their billing departments (or outsourced billing firms) are going the route of processing payment via credit cards, which has its PROS and CONS.

In light of this new information, the following are a few pros and cons for credit card processing that we anticipate in the near future and some insights for choosing the best billing software that supports the credit card processing needs of medical practices:

- PRO: To protect against the dangers of stolen data, fraud, or other compromises in security, practices should seek out medical billing software that has credit card processing built-in, which can help safeguard against these dangers.

- CON: Security is a big risk, and a leak in data leading to stolen funds can end up in a physician paying out-of-pocket for the breach. It is also important to note that breach of credit card data is also considered a violation under the federal Health Insurance Portability and Accountability Act (HIPAA).

- PRO: Implementing credit card processing will reduce long waiting periods for payments from the majority of your patients, and will also reduce the additional effort your billing staff has to extend to collect on overdue notices.

- CON: Practices cannot require patients to share their credit card information to receive medical care, and even if patients do share their credit card information, physicians cannot continue to charge the credit card without a patient’s consent.

- PRO: Physicians can end the process of being a “line of credit” to unpaid or underpaid claims, and collect on funds immediately.

- CON: You will need to implement internal processes that include, but are not limited to proper personal information storage and security, establishing guidelines on maximum percentages charged per bill, and personal consent forms.

Overall, there are definitely MORE ‘PROS’ than cons for implementing credit card processing for your medical practice, and all the trends are pointing to this being the PREFERRED METHOD of payment in the near future. EZClaim is proud to announce that it will release an integrated credit card processing solution, EZClaimPay, that is backed by a national merchant services vendor. [ EZClaim will be sharing more details about EZClaimPay in the weeks to come, via their social media platforms, their monthly newsletter, direct communications, and more ].

In addition to the credit card collections PROS and CONS above, we reached out to one of our partners, Live Compliance, to gather some regulatory and security advice. They suggested the following:

- When accessing, transmitting, storing, or receiving any Protected Health Information (PHI), the Health and Human Services (HHS) Office of Civil Rights (OCR) mandates that you are to maintain HIPAA compliance.

- When accepting, processing, or maintaining credit card information and debit card information, you must ensure that your organization is PCI DSS compliant (Payment Card Industry Data Security Standard).

- In addition to the above Federal regulatory requirements, most states require privacy and security compliance requirements to be implemented, along with strict adherence to the privacy of Personally Identifiable Information (PII) and Breach Notification requirements.

For more information on your compliance requirements, visit Live Compliance for a Free Organization Assessment to identify and uncover your organization’s vulnerabilities.

If you are not a current customer of EZClaim, we would very much like to connect with you. You can either schedule a one-on-one consultation with our sales team, view a recorded demo, or download a FREE 30-day trial right now. For detailed product features or general information about EZClaim, visit our website at ezclaim.com.

[ NOTE: If you would like a quote on the upcoming merchant services, please e-mail sales@ezclaim.com your last three merchant statements. For more on our ongoing updates and industry news, you can follow EZClaim on Facebook and LinkedIn ].

Source Material:

1 – America’s Health Insurance Plans” report that there were 20.2 million co-pays in 2017, which was up tremendously from just over 1 million in 2005.

2 – Source: From InstaMed’s annual “Trends in Healthcare Payments” report.

> For more on this topic, read a previous article, “Why Do I Have A Balance? – Patient Payments”

Apr 13, 2020 | Live Compliance, Medical Billing Software Blog, Partner

Since CMS HHS just updated their Telehealth regulations to adjust to the COVID-19 environment—including having a remote workforce—we wanted to provide a clear update to independent physicians and billers to advise them of the fast-moving changes of many regulations, and what to expect in the near future.

It is important to note that CMS has recently announced that new and established patients have availability to Telehealth, and HHS OIG is providing flexibility for healthcare providers to reduce or waive cost-sharing for Telehealth visits paid by federal healthcare programs. CMS is also expanding Telehealth services to people with medicare.

As a result, please see the below video from CMS which highlights the Medicare Coverage and Payment of Virtual Services and Telehealth.

In addition, we’ve included a few key questions and answers below. If you have further questions about Telehealth and your compliance, contact Jim Johnson with Live Compliance at Jim@LiveCompliance.com or (980) 999-1585.

1. Who can provide Telehealth services?

-

- Physicians

- Nurse Practitioners

- Physician assistants

- Nurse-midwives

- Certified nurse anesthetists

- Clinical psychologists

- Registered dietitians

- Nutrition professionals

2. What services can a medicare beneficiary receive through Telehealth?

-

- Evaluation and management visits (common office visits)

- Mental health counseling

- Preventive health screenings

- More than 80 additional services

3. What are the types of virtual services?

-

- Medicare Telehealth visits

- Virtual check-ins

- E-visits

- Telephone services

Live Compliance is an EZclaim premier partner for HIPAA compliance and is integrated into EZclaim’s billing solution.

If you have any further questions about Telehealth regulations and your compliance, e-mail Jim Johnson at Live Compliance at Jim@LiveCompliance.com, or phone him at (980) 999-1585.

[ Contribution by Jim Johnson with the Live Compliance ]