Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

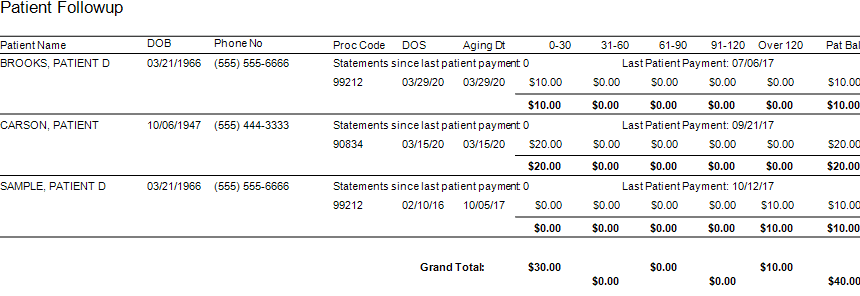

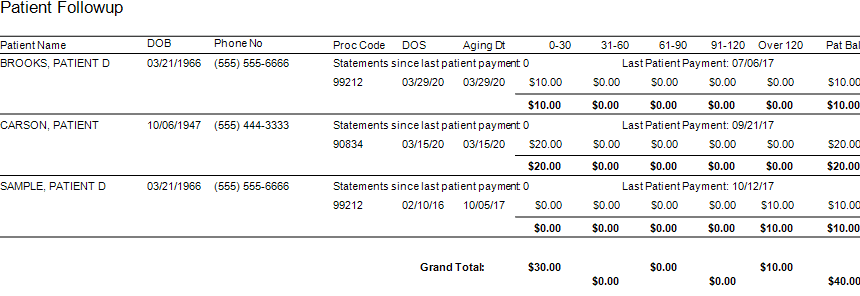

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]

Apr 13, 2020 | Alpha II, Medical Billing Software Blog, Partner

One of our partners, Alpha II, is presenting a special webinar on COVID-19 billing changes on April 16, 2020, “COVID-19: Critical Coding and Regulatory Updates,” to provide the most up-to-date information on the coming changes to new procedures, diagnosis codes, telehealth updates, and changes to regulatory policies.

As guidelines for coding and billing of COVID-19 services are revised almost daily, rest assured Alpha II is working to implement these critical changes to regulations and coding guidance as quickly as possible by conducting near-daily promotions.

Here is a very brief summary of some of the updates we’ve implemented:

-

- Clarification of correct telehealth rendering POS and use of modifier -95

- Modification of diagnosis code edits for billing of COVID-19 symptoms from February 20 – March 31, 2020, and use of new diagnosis U07.1 for dates of service on or after April 1, 2020

- Addition of the new AMA CPT code 87635 effective March 13, 2020

- Addition of the new CMS CPT codes U0001 and U0002 retroactively effective February 4, 2020

- Modification for waiver of DME replacement requirements prior to March 1, 2020

- Modification for waiver of occurrence code 70 on SNF three-consecutive day stay validation prior to March 1, 2020

- Modification to LCD/NCD edits to relax rules related to respiratory-related devices and services

- Modification to Medicaid for the temporary suspension to prior authorization rules in PHE areas effective March 1, 2020

You can get all the latest COVID-19 specific updates here: https://www.alphaii.com/landing/covid19

Alpha II is an EZclaim partner that provides “Claim Scrubbing” for our medical billing software system. View our website for more details on this: https://ezclaim.com/partners/

Apr 13, 2020 | Health eFilings, Partner

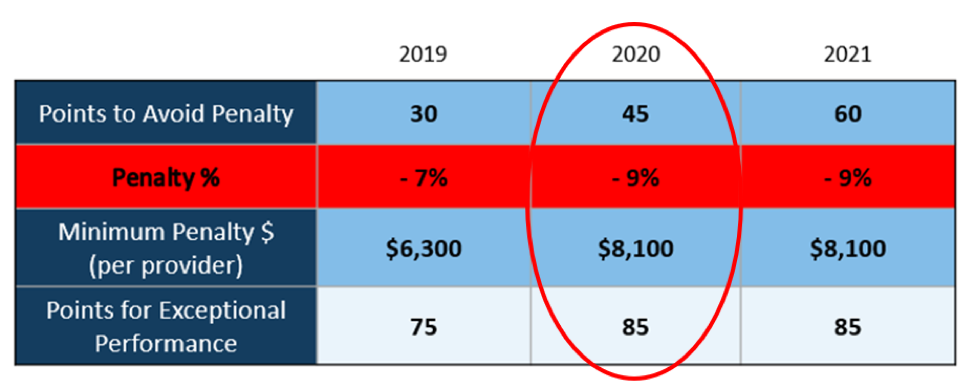

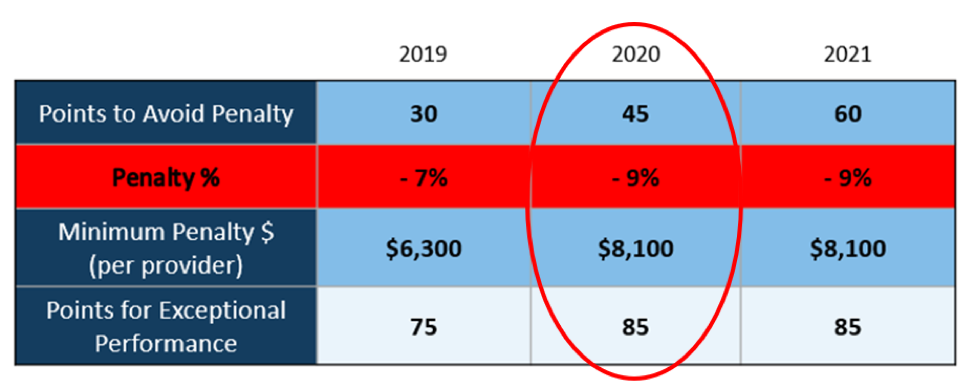

There WILL NOT be any changes to the MIPS Program in 2020, so all payers must be submitted and a minimum of 45 points must be earned to avoid the 9% penalty.

On March 23, 2020, CMS made it perfectly clear that MIPS Program is not going away in 2020. It also reiterated that the data requirements and thresholds in place for the 2020 program have not changed. Additionally, Promoting Interoperability and Improvement Activities must be done for the required durations, or no points will be earned for those categories.

To put this in context, while the stakes have been raised every year, the final ruling for the 2020 reporting period is the most complex to-date, further increasing the stress, burden, and financial risk for over 900,000 clinicians who bill Medicare Part B. Failure to comply or earn enough points for the 2020 reporting period will result in an automatic 9% penalty on every Medicare Part B claim paid for an entire year. This equates to a minimum of a $8,100 per provider hit to the bottom line.

Given the unprecedented time when everyone’s bottom line is at risk, now is the time to get a handle on what’s at risk with the MIPS program and proactively engage to ensure your bottom line is not further jeopardized by being assessed a 9% penalty. It can be challenging to know exactly what you need to do to earn points, optimize your score, and protect your Medicare reimbursements, as there are many commonly misunderstood aspects and nuances with the MIPS program.

So, with what is at stake and the inherent complexity in earning points, it is critical that you select the right methodology and partner who can help you maximize reimbursements and protect your bottom line. Not all reporting methodologies are the same.

Health eFilings‘ CEHRT is the best choice for a reporting partner. Their cloud-based ONC-certified software fully automates the process and does all the work without any IT resources, administrative support, and workflow changes from the practice. Health eFilings service is an end-to-end electronic solution that will save significant time, be a turn-key submission process, and maximize the financial upside for providers.

As more than 25% of the 2020 reporting period is behind us, now is the time to act while there is still plenty of time to positively impact your results and points earned.

Health eFiling provides the nation’s only fully automated solution for MIPS compliance and is integrated with EZclaim’s billing solution. Click on the following link for more details: https://healthefilings.com/ezclaim

[Contribution by Sarah Reiter with the Senior VP of Strategic Partnerships]

Mar 10, 2020 | Live Compliance, Partner

An independent physician gastroenterology practice in Utah had to report a breach related to a dispute with a Business Associate to the Office for Civil Rights Department of HHS.

After the investigation into the breach, it was determined that the practice of Steven A. Porter, MD “had failed to complete an accurate and thorough risk analysis, and failed to implement security measures sufficient to reduce risks and vulnerabilities to a reasonable and appropriate level” and therefore, has agreed to pay a $100,000 fine.

In addition to the monetary penalty, the practice is required to implement a Corrective Action Plan (CAP). According to the investigation resolution agreement, the practice agreed to conduct a thorough Risk Analysis, the Practice must develop a complete inventory of all its categories of electronic equipment, data systems, and applications that contain or store ePHI, which will then be incorporated into its Risk Analysis and must complete a Risk Management plan. They must also revise and implement actionable policies and procedures, all of which should have been in place prior to the breach incident.

Have you ever read such headlines and doubted whether a small Billing Company or independent physician practice actually ever face penalties?

According to the Resolution Agreement, the practice must also completely reinvent its Business Associate process, and implement a strict protocol to ensure it’s Business Associates are HIPAA Compliant. In addition to ensuring their Business Associate relationships are accurate, the entire staff must undergo security and privacy training that stresses the use of Business Associate services and applications, disclosures to Business Associates that require a Business Associates agreement, or other reasonable assurances in place to ensure that the Business Associate will and can safeguard the PHI and/or the ePHI. This puts immense pressure on the Business Associates, such as Billing Companies, to ensure that they are HIPAA Compliant, but also independent physician practices to ensure their Business Associates, “down the chain” are also compliant. This is also known as gaining Satisfactory Assurance of vendor HIPAA compliance.

What can you do?

As we have stressed before, it is important for you to understand that every complaint or potential breach must be investigated by HHS/OCR. If you, a billing company, or another vendor, suspect a breach you must inform the covered entity (your client) and have a breach risk assessment completed to determine key factors and take action. Keep in mind, a business associate is a ‘person’ or ‘entity’. This means there is no Billing Company too small or too large to comply with the Federal HIPAA regulations. Again, if you haven’t completed an accurate and thorough security risk assessment prior to that, you could also be penalized under ‘willful neglect’. This category alone is $50,000 per violation!

What we do is keep this from ever being a worry for you! In fact, we have a 100% audit pass rate! For example, Live Compliance has easy to understand HIPAA breach notification training. We perform your security risk assessment and manage all your requirements, including business associates, in a clean, organized cloud-based portal. Don’t risk your company’s future, especially when we are offering a FREE Organization Assessment to help determine your company’s status. It’s easy, call us at (980) 999-1585, email me jim@LiveCompliance.com or visit LiveCompliance.com

[ Contributed by Jim Johnson, President of Live Compliance ].

Mar 10, 2020 | BillFlash, Partner

This article about new patient billing methods was written by Angie Carter with NexTrust.

Communication is easier than it’s ever been, but a lot of practices aren’t taking full advantage of two of today’s most effective mediums of communication: email and texting. Patients, like all other consumers, spend a lot of time on their phones; it’s where they keep in touch with friends and family, as well as businesses they work with regularly.

Most practices rely heavily on phone calls to contact their patients about appointment reminders, insurance issues, etc. But many adults now prefer to communicate via email or text. Often a quick phone call will do the trick, but email and texting get your foot in the door a lot more often. Furthermore, people are far more likely to respond to a text or email than a voicemail.

Here are a few ways to build your contact list at your practice to improve communication with patients, ensuring greater patient satisfaction and better cash flow.

- Collect cellphone numbers & email addresses during new patient registration.

Consider making these required fields. Allow the option to fill out more than one email address or mobile number as well, since most households have several. It would also be helpful to quickly explain why you need this information. BillFlash allows you to send out regular statements and eBills through email and text, and you can also quickly update your patients on any last-minute changes happening at your practice.

If you have a newsletter or regularly send out practice updates, make sure patients know about these as well. This is another opportunity to ensure you have the information you need to better communicate with your patients.

- Ask for an email address & cellphone number any time you confirm an appointment.

Even if your current patients have already given you this information, use appointment confirmations as an opportunity to verify the information you have on file is current. Email addresses change all the time, so it’s crucial to ensure they’re up to date so you know your messages are being received. And for patients who haven’t yet provided this information, this is a good time to tout the benefits of being digitally connected.

- Encourage mail-only patients to go paperless.

A huge barrier to patients paying their bills on time—or at all—is that it’s often not as simple to pay a medical bill as it is to pay, say, a utility bill. BillFlash simplifies this process tremendously, both for the patients and your practice. By providing an email address and cellphone number, patients can more easily stay current on their medical bills and procedures.

- Ask patients to provide feedback on your website.

Give your patients a space to express their thoughts at their convenience. Include a form on your website for patients to fill out—which would include their email address and phone number—and add the info they provide to your database. You could also post signs throughout your office encouraging patients to visit your website to provide feedback about the care they received that day.

- Add cellphone number/email to check-in sheet.

Most practices require patients to sign in whenever they come in for an appointment. Consider adding a column or two that asks for their email and cellphone number. At the top of the column, you could include a note that says something like “Want to receive appointment reminders via text or email?” to reiterate the benefits patients will receive by providing this information.

- Offer patients an incentive to provide their email address & cellphone number.

People love free stuff—that’s a given. Try running a fishbowl incentive every few months. All patients would need to do is drop their email address and/or cellphone number into a bowl and they’ll be entered into a drawing to win a prize. And why reward just the patients? Incentivize your office staff to collect this information as well.

Everyone has a cellphone number and email address, but it does take some effort to collect them. But it’s an effort that rewards you many times over, as this makes it easier to keep patients in the loop and ensure you get paid. BillFlash makes it easy to automate patient billing and payments—including sending reminders via email or text—to improve the financial health of your practice.

BillFlash is integrated into the EZclaim billing application. Click here to view a video that discusses the details.

For more information about new patient billing methods and sending electronic bill notifications through text and email, contact EZclaim or their statement and payment services partner, BillFlash, at 435-940-9123 or sales@billflash.com