Aug 11, 2020 | Medical Billing Software Blog

The most important thing a medical practice can do for their financial health is collecting payments from patients. So, because patients are not usually savvy when it comes to the nuts and bolts of their contract, they become frustrated when you send them a bill and, beginning on January 1st, your office staff get inundated with the question, “Why do I have a balance?”

“Approximately 68% of patients with bills of $500 or less did not pay off the full balance during 2016—up from 53% in 2015 and 49% in 2014.” Source: Patients May be the New Payers, But Two in Three Do Not Pay Their Hospital Bills in Full, TransUnion Healthcare, June 26, 2017

So, let’s make sure your office is equipped and able for collecting payments from patients for the services you rendered, rather than them becoming a part of this scary statistic.

Let’s begin with the basics: Make sure that your staff understands these key terms, and is comfortable explaining them to your patients.

Deductible: The deductible is the amount the patient has to pay for covered services before the insurance plan pays. Some insurance plans will apply an office visit to the deductible, others will not. Family plans typically have an individual and family deductible.

Copay & Coinsurance: These are both the portion the patient will be responsible for after their deductible has been met. Copays are a set, flat fee. Coinsurance is a set percentage that the patient will pay.

Maximum Out-of-Pocket: This is the limit of what a patient will pay for covered services within a plan year. Again, on family plans, there may be an individual max and family max.

Now, keep in mind that your staff will not know the details of your patients’ plans, nor should they be expected to! In the ever-changing world of health insurance, patients need to become better consumers. So, just being able to explain these key terms and why they create a patient balance will help them become better insurance plan shoppers!

Use your tools. Look into using Integrated Eligibility (available through your billing software and your clearinghouse). This will allow your staff to check remaining deductible balances, copay, and coinsurance amounts with the click of a button. These results allow practices to confidently collect at the time of service rather than spending time and money on sending statements and working to collect after the visit.

In addition to that, create a plan and stick to it. Use this time to review the efficiency of your patient collections plan. Are you using an outdated plan or policy? Have you considered offering payment plans to patients with an HSA card kept on file? Make sure that your employees understand how important patient collections are to the practice, educate them on the plan, and support them when they hold patients accountable to the patient collections policy.

For more information on how EZClaim can help you with this journey, schedule time with our sales team. Or, if you ready to get started right now, then download your FREE 30-day demo today!

[ Written by Stephanie Cremeans of EZClaim ]

Aug 11, 2020 | ChartSwap, Partner

An online “Health Information Exchange” (HEI) can be the answer to managing the release-of-information (ROI) process completely digitally.

Many healthcare providers are spending a significant amount of time and money on fulfilling requests for medical and/or billing records. Outdated and inefficient modes of technology like printers, postal mail and fax machines make up much of that cost. Time spent on having employees complete record fulfillment operation—or money spent on working with third-party release-of-information (ROI) companies—add significantly to strains on manpower and/or budgets. Then add in the money spent on postage and in-office time spent responding to status calls, and you have a significant cost center that is not benefitting your business.

In today’s digital world, both businesses and consumers expect efficient, safe, online transactions. While the healthcare industry had a longer grace period for digital transformation initiatives, a new survey reveals that 75% of people now expect the same service from healthcare organizations that they receive from other businesses. This is driving many organizations to re-think the current, highly ROI process and seek a simple, secure, and more cost-effective digital ROI solution.

Utilizing an online Health Information Exchange may be the answer to your problems. By utilizing the FREE proprietary software that the country’s fastest growing HIE, ChartSwap, healthcare entities can manage the ROI process completely digitally in a HIPPA- and HITECH-compliant, SOC 2, Type II-certified and conveniently cloud-based environment. In addition to eliminating the need for paper, printers, postage, and other unnecessary and inconvenient expenses, ChartSwap allows records providers to conduct all communication with requestors 100% online without the security concerns associated with e-mail.

ChartSwap users set their own fees and can quickly and conveniently collect payments electronically via either credit card or PayPal (which includes the option for ACH transfer). Over 90% of ChartSwap requestors use online payment methods, and for the few who still prefer to send a paper check, ChartSwap handles the receipt and processing of those payments on your behalf. That means that 100% of your payments for medical and billing records will be handled by the ChartSwap platform—at absolutely no cost to you!

Using ChartSwap has been shown to improve employee productivity by 50% or more, thanks to ChartSwap’s advanced digital workflows, automatic status alerts, and fully online communication model. Additionally, the turnaround time for fulfilling records requests via ChartSwap can be as quick as two days and rarely exceeds 14 days—that’s more than 50% faster than the turnaround time on requests fulfilled by traditional methods.

To learn more about taking back control of your office’s record fulfillment operations, and turn this cost center into a profit center, visit ChartSwap today.

ChartSwap is a partner of EZClaim, a medical billing software solution. For more details about EZClaim, visit their website at EZClaim.com

Aug 11, 2020 | Features, Medical Billing Customer Service, Partner

Which is the BEST kind of Medical Billing Software? “All-in-One” or “Specialized”?

When considering WHICH medical billing solution they should use, practices wonder which is best, an “all-in-one” solution or specialized software. Well, the following are a few important pros and cons to consider when making a choice between these solutions.

ALL-IN-ONE:

An “all-in-one” system tries to provide a single, comprehensive solution that offers functionality for the major areas of the practice—Practice Management (PM), Electronic Medical/Health Records (EMR/EHR), and Revenue Cycle Management (RCM)—accessed from one central point. It has features like clinical notes, patient information, and history, diagnosis and treatments, scheduling, appointment reminders, reports, patient educational resources, as well as a medical billing section.

PROS:

• Most of what a practice need is included in the system

• There is no need to be concerned with multiple integrations or vendors

CONS:

• Tends to have a higher ‘entry’ cost

• Usually designed for the “middle-of-the-road,” therefore sometimes doesn’t properly address specific needs of a practice

• Sometimes, the practice is left paying for additional customizations to fit their particular needs

SPECIALIZED SOFTWARE:

Specialized medical billing software, on the other hand, is particularly programmed to maintain billing details of tests, procedures, examinations, diagnoses, and treatments conducted on patients. However, many specialized software providers extend their scope to include features like practice management, scheduling, and other administrative and clinical functions (that are generally a part of EHR software systems) by partnering with other specialty software companies—creating a “best-in-class” solution.

PROS:

• Integrating multiple “best-in-class” software packages—each taking a much more focused approach—creates an offering with much more in-depth capabilities

• Usually are more ‘nimble’ in responding to industry and regulatory changes

• More ’scalable’ in supporting the growth of a practice

CONS:

• Most of the time the practice has to deal with multiple vendors

CONCLUSION:

Where “all-in-one” solutions offer a wide breadth of capabilities across the business, they usually also lack focus, depth, and sophistication. “All-in-one” solutions are usually only efficient in one area, with the other areas tend to be ‘compromised’ and not fully developed. Then, when it comes to flexibility, they tend to be slow to adapt to changing practice needs.

Specialized software, however, typically offer a more efficient experience, with each ‘component’ streamlined and designed with a specific purpose in mind. Their focus on limiting the software scope makes them flexible and easy to use.

EZClaim—a leading software package in medical billing and practice management—has made it easier for the medical practice to have the benefit of a “all-inclusive” solution. They have created the best of both worlds by taking on the responsibility of integrating the “best-of-breed” into a harmonized “best-of-class” offering that allows the practice to pick and choose for their specific needs. The seamless integration of partner products and services ensures the practice does not have to give up robustness and flexibility for a simplified “all-in-one” solution, and it further enhances the practice’s workflow.

As a specific example, one of EZClaim’s partners is TriZetto Provider Solutions (TPS), a provider that seamlessly blends claims processing with revenue management and analytics software, so the practice can get paid faster, and more accurately.

Today, the practice can get the benefit of all the power and ease of use of EZClaim’s medical billing software and all the access and security that is needed when dealing with personal records by using TPS—which includes patient access, claims and denials management, patient financials, and advisory services.

The powerful integration between EZClaim and TPS efficiently adds functionality to the practice. Now the practice can gain deeper insight into the claim lifecycle, and take the proper steps to improve the overall health of the practice. The right ‘integrated’ solution makes all the difference!

So, if your practice needs more confident billing, after payments, and more informed decisions, but the power of EZClaim and TPS to work for your practice with the integrated suite of revenue cycle solutions.

In addition to TPS, EZClaim has tightly integrated a variety of of ‘components’ to be able to offer an “all-inclusive” best-in-class solution for a medical practice’s needs: Electronic Health Records (EHR), Clearinghouse, statement and payment services, HIPPA compliance, claims scrubbing, appointment reminders, and inventory management. It has partnered with a variety of providers like QuickEMR, BestNotes, and PracticeFusion [ Click here for an entire list of EZClaim’s partners ].

It is important to note that an “all-in-one” solution does not usually include the Clearinghouse portion that TPS offers. The powerful integration between EZClaim, TPS, and EZClaim’s EMR partners, efficiently adds functionality to ANY practice!

If you are considering the best course of action to meet your practice’s needs, consider using EZClaim by downloading a FREE TRIAL or contact one of their product specialists today to explore all the options for how to best solve your practice’s operational challenges, and grow your business.

For details and features about EZClaim’s medical billing software, visit their website.

Jul 14, 2020 | Health eFilings, MIPS Reporting, Partner, Revenue

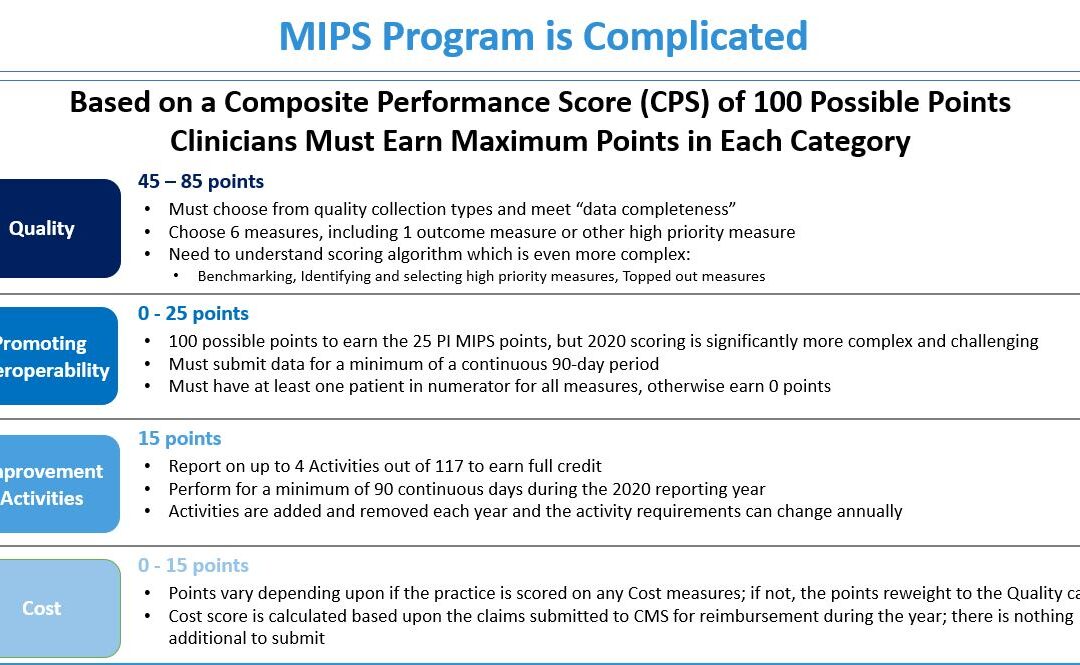

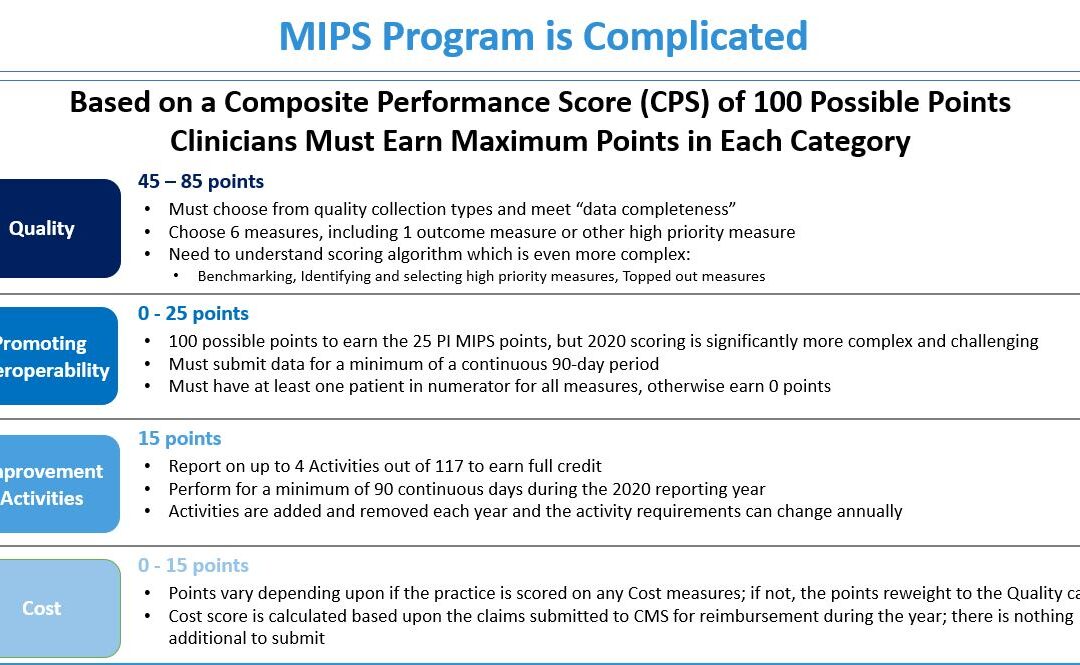

The 2020 MIPS reporting is already half done, and given that MIPS (Merit-based Incentive Payment System) is a points-based program, the goal is to earn as many points as possible to avoid this year’s 9% penalty and potentially even earn a positive payment adjustment. However, earning the 45 points necessary to avoid the penalty for the 2020 reporting period will be no easy feat. With over half of the reporting period already behind us, it is imperative you ACT NOW so you don’t find yourself in a position later in the year that you can’t recover from in terms of earning points.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your score. Here are three critical actions to take right now so that you will still optimize your ability to earn points for the 2020 reporting period:

1. Focus on the Quality Category

There are various points available within each of the categories and the Quality Category has the most points associated with it. Based on a number of factors, the category is worth anywhere from 45 to 85 points. This is a critical category to be focused on throughout the year, so now is the time to ensure that you are tracking all relevant data so that it can be properly reported on within your submission.

2. Understand the Timeframe Requirements

Two of these categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long in the year you will find it impossible to put the right actions in place in order to complete the activities necessary to earn any of the points in these categories.

3. Choose the Right Reporting Methodology

Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the points you could earn. Additionally, there is strategic maneuvering that can be done throughout the reporting period with exemptions and reweighting of points that can set you up to optimize your performance and your score. Therefore, you must select a reporting partner that will help you earn the most points available and leverages technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings is a certified EHR technology (CEHRT) and the national leader in automated MIPS reporting. Their cloud-based ONC-certified software fully automates the reporting process. Because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes from you, the practice will save significant time while maximizing its financial upside.

To learn more about how to properly perform your 2020 MIPS reporting, contact EZClaim’s partner, Health eFilings, so they can help before it’s too late!

For details and features about EZClaim’s medical billing software, or general information about the company, visit their website.

[ Written by Sarah Reiter, SVP Strategic Partnerships, Health eFilings ]

Jun 10, 2020 | Administrative Safeguards, Live Compliance, Partner

On March 26, 2020, Washington D.C significantly amended its Data Breach Notification Law (D.C. Act 23-268), to expand the definition of personal information and require businesses obtaining such information to implement “reasonable security safeguards”. The new law took effect on May 19, 2020, in the midst of dramatic societal change. Indeed, COVID-19 has accelerated the digital transition and hastened the need for security and privacy issues to be at the forefront of the state legislature. So, what are the major changes and updates under the D.C Act 23-268?

The definition of personal information has been significantly expanded and includes several new elements. Previously, the law only considered personal information to be a person’s first name (or initial) and surname and sensitive identifying numbers i.e. social security number, driver’s license number, D.C identification card number, or credit card number.

Personal information also included a combination of a person’s name and any codes that would enable access to a person’s individual financial or credit account. The current update expands the definition of what is classified as personal information to the following:

- Unique Identification Numbers: passport number, taxpayer identification number, or any other identification number issued on a government document.

- Medical Information: DNA profile or genetic, biometric, or health insurance information.

- Financial information: Account number or any numbers or codes allowing access to an individual’s financial or credit account.

- Other Data: Any listed data that would allow an individual to carry out identity theft. The new legal definition also includes any username or email address combined with any information allowing access to another’s personal account.

Mandatory Breach Notification

- C Attorney General Notification Notices:

The law previously only required the D.C Attorney General to be notified if over 1,000 residents were affected by a data security breach. It now requires the D.C Attorney General to be notified when a qualifying data breach affects 50 D.C residents or more. The notice must include the nature and cause of the data breach, the number of affected residents, types of personal information compromised, and corrective steps that have been taken.

- Individual Breach Notification Notices:

Affected residents must also be notified ‘’in the most expedient manner possible, without unreasonable delay’’. New content requirements for individual breach notification notices include the types of data compromised and toll-free numbers for credit reporting agencies and the D.C Attorney General.

Business and Service Provider Security Requirements

Businesses and service providers are now subject to more stringent security protection requirements. Any organization handling D.C residents’ personal information must “implement and maintain reasonable security safeguards”. The amended law also stipulates that any entity using a third-party service provider must have a written agreement in place requiring the latter to “implement and maintain reasonable security safeguards”.

Failure to comply with the new legal requirements of the new Data Breach Notification Law and to implement and ensure “reasonable security safeguards’, there could be a significant economic and reputational loss.

To assist you in identifying the extent to which your organization is at risk of a data breach, Life Compliance is offering a FREE Organization Assessment to determine your company’s specific vulnerabilities and risk exposure to cybercrime. This will ensure you have the best possible insight and protection as you guide your company into the digital future.

Live Compliance provides all of your HIPAA privacy, security requirements, and measures. HIPAA compliance is a requirement for Covered Entities and Business Associates to safeguard personal, private, and protected health information. Organizations can excel in health care without the struggle of compliance requirements.

Live Compliance is a preferred partner of EZClaim, and their software is integrated into our medical billing software. For detailed product features or general information about EZClaim medical billing solutions, visit our website, contact us via e-mail, or call our support team directly at 877.650.0904.

[ Written by Jim Johnson, President of Live Compliance ]