Jul 12, 2022 | Live Compliance, Partner

Whether you’re a one-person billing company or a multi-location organization, it’s possible that you’ve seen or heard of Malware and the potential risks associated with it and how it can cause major downtime and potential HIPAA violations due to breached information.

Criminals use malware to steal personal information, send spam, and commit fraud. Malware includes viruses, spyware, and other unwanted software that gets installed on your computer or mobile device without your consent. These programs can cause your device to crash and can be used to monitor and control your online activity. They also can make your computer vulnerable to viruses and deliver unwanted or inappropriate ads.

Here are a few, high-level quick steps you can take to spot and avoid Malware.

First, let’s talk security software.

Install and update security software, and use a firewall. Set your security software, internet browser, and operating system (like Windows or Mac OS X) to update automatically, and don’t forget to Back up your data regularly. Strong security software can prevent a hack or scam before it happens. You should install well-known software directly from the source. Sites that offer lots of different browsers, PDF readers, and other popular software for free are more likely to include malware. Read each screen when installing new software. If you don’t recognize a program or are prompted to install additional “bundled” software, decline the additional program or exit the installation process.

Don’t change your browser’s security settings and pay attention to your browser’s security warnings. Many browsers come with built-in security scanners that warn you before you visit an infected webpage or download a malicious file.

Next, watch what you’re clicking on.

Instead of clicking on a link in an email, type the URL of a trusted site directly into your browser. Scammers send emails that appear to be from companies you know and trust. The links may look legitimate, but clicking on them could download malware or send you to a scam site. Don’t open attachments in emails unless you know who sent it and what it is. Opening the wrong attachment — even if it seems to be from friends or family — can install malware on your computer.

Avoid clicking on pop-ups or banner ads about your computer’s performance! Scammers insert unwanted software into banner ads that look legitimate, especially ads about your computer’s health. Avoid clicking on these ads if you don’t know the source.

Your computer may be infected with malware if it:

-

- slows down, crashes or displays repeated error messages

- won’t shut down or restart

- serves a multitude of pop-ups

- serves inappropriate ads or ads that interfere with page content

- won’t let you remove unwanted software

- injects ads in places you typically wouldn’t see them, such as government websites

- displays web pages you didn’t intend to visit, or sends emails you didn’t write

Other warning signs of malware include:

-

- new and unexpected toolbars or icons in your browser or on your desktop

- unexpected changes in your browser, like using a new default search engine or displaying new tabs you didn’t open

- a sudden or repeated change in your computer’s internet home page

- a laptop battery that drains quicker than it should

At Live Compliance, we make checking off your compliance requirements extremely simple.

- Reliable and Effective Compliance

- Completely online, our role-based courses make training easy for remote or in-office employees.

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities, including those such as Password Protection.

- Policies and Procedures curated to fit your organization ensuring employees are updated on all Workstation Use and Security Safeguards in the office, or out. Update in real-time.

- Electronic, prepared document sending and signing to employees and business associates.

Don’t risk your company’s future, especially when we are offering a free Organization Assessment to help determine your company’s status. Call us at (980) 999-1585, or email me, Jim Johnson at Jim@LiveCompliance.com or visit www.LiveCompliance.com

For more information about DarkWeb breaches please contact us at (980) 999-1585 or email us at support@livecompliance.com

Jun 15, 2021 | Claims, Credit Card Processing, Medical Billing Customer Service, Medical Billing Software Blog

Are you or your staff having to enter every patient into your EHR program and then again into EZClaim? There is an easier way! Integrating your programs will put an end to duplicate data entry, saving your practice time and money!

So, what exactly is an interface and how does it work? An interface is a way for two programs to share information. For EZClaim clients, the interface can be set up to share data from your EHR program to EZClaim. Your EHR can give you specifics on how to send the data to EZClaim.

In EZClaim you will have an opportunity to review the file prior to saving the data. When you complete the import process, your claims will be created, and libraries will be updated. In addition to creating your claims for each visit, an interface can also create Physician/Facility library entries, as well as Payer library entries, and create new or update existing patient accounts.

If you are working with one of our partner EHRs (Visit our Partner List) the integration between programs can be set up quickly and easily. Since the process varies slightly depending on the EHR you are using, time to complete the integration request will vary.

If you are not using a partner EHR, you may still be able to integrate with EZClaim.

Following are some options:

- In our Online Help File the format types and specifications are available for you to share with your EHR vendor. If they can provide a file in one of the required formats you will be able to import your data.

- You may consider using a third party to write a custom interface for you. If you would like more information on this, contact EZClaim and we will be happy to provide information on consultants who are familiar with the EZClaim platform.

If you have questions, please submit them via email to support@ezclaim.com so a technician can review them and get back with you.

May 18, 2021 | Denied Claims, RCM Insight

Last month we looked at tools for getting clean claims out the door on the first try. Many billers or practices stop monitoring claims once the leave the practice management program, but this is where you are likely losing money. The unfortunate truth is you need to use the tools available to you to catch rejected and denied claims to ensure proper and timely payment. Today we will look at rejections and denials, and the resources you have (or need) to work efficiently.

The terms rejection and denial are used interchangeably in the billing world but they have distinct differences, including how you are notified. Let’s start with defining the differences.

Rejected Claims

- Claims can be rejected by the clearinghouse OR the payer

- Rejections are based on submission guidelines

- Rejected claims have not been entered into your payers system for adjudication

- Notified through a claim status report (ANSI 277) that comes back into most practice management programs from the clearinghouse

- Corrections do not require a resubmission code

Denied Claims

- Claims are denied by your payer

- Denials are based on policy coverage

- Denials have been accepted for adjudication and deemed unpayable

- Notified on remittance advice (ANSI 835/ERA)

- Payers may require a resubmission code and original reference number when submitting a corrected claim

If you are using a clearinghouse and receiving your claim status reports electronically, you will be notified quickly about rejected claims. There are two ‘checkpoints’ that will look for errors. The first is your clearinghouse, the second is the payer.

At each checkpoint claims will be Rejected or Accepted, these status updates come to you through a claim status report. If your practice management system is able to process these reports (ANSI 277) your claims will be updated with the accepted or rejected information you will be able to correct any rejected claims within your practice management system. When you see an error, start with checking who has rejected your claim. This will be the point of contact if you have questions about the rejection or how to correct it. If you are not already, make it a daily task to get your reports, correct any rejected claims, and resubmit those claims.

When a claim has been accepted by your clearinghouse and the payer it enters the adjudication system. This is where the payer will make a determination on payment based on the members coverage and your contract. The denials will appear on your remittance advice with a payment or as a zero dollar payment, indicating that they have reviewed your claim and they have determined no payment is applicable. If you are enrolled with you payer for electronic remittance advice (ERA) this file will come electronically and your practice management system will be able to list or identify denied claims. These claims will either need to be researched further for clarification on the denial or written off. It is vital that your practice management system can handle these scenarios appropriately so you do not lose money for payable services.

This is another scenario where technology can seem scary. However, efficiently monitoring and working is well worth the learning curve. If you are already sending electronically and not using the claim status report or electronic remittance advice – coordinate with your clearinghouse and practice management system to find out how these reports can save you time and money.

If you would like more information on creating workflows for rejections, denials, or enrolling with a clearinghouse, let RCM Insight help! Visit us at www.rcminsight.com to request a consultation.

[Contribution by Stephanie Cremeans with RCM Insight]

Apr 5, 2021 | EZClaim Premier, Features, Medical Billing Software Blog

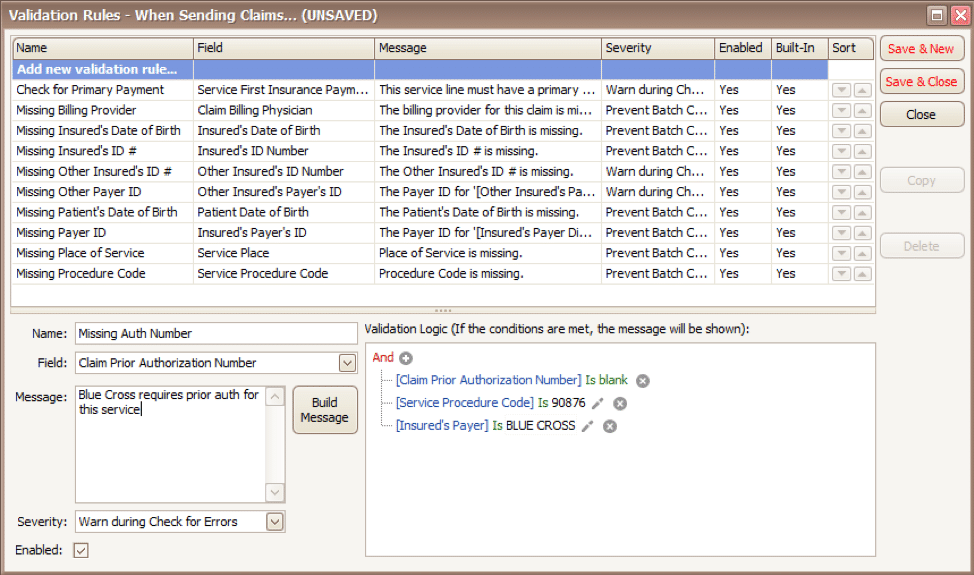

EZClaim medical billing software has many features built into the program to help you submit clean claims for quick payment and some that can be customized to fit your specific needs. This post will look at the ability to create customized validation rules.

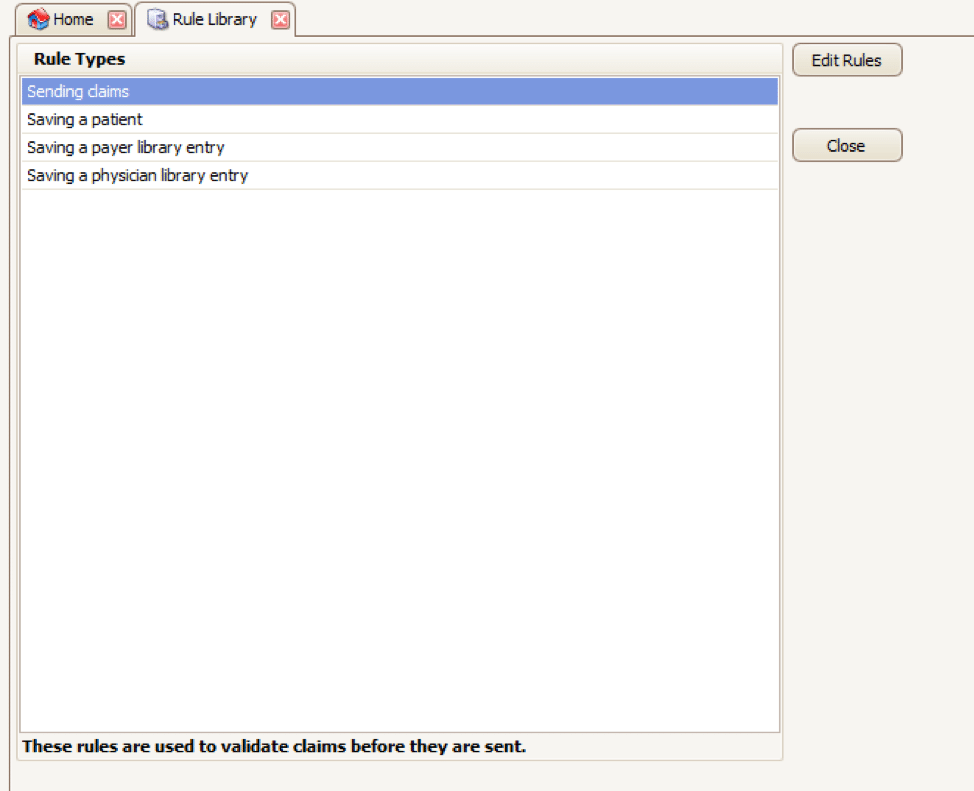

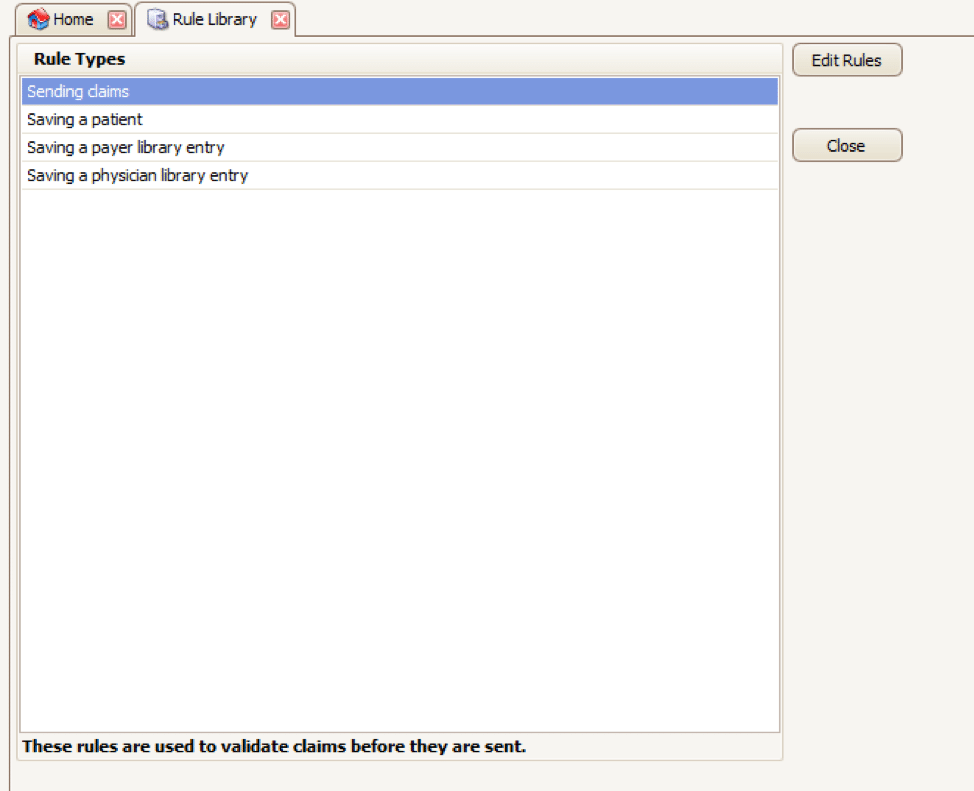

Your EZClaim program already includes standard validation rules. To access these rules and create your own, press CTRL-ALT-V. This will open the Rule Library.

Here you will find four different types of rules to work with, rules related to:

- Sending claims

- Saving a patient

- Saving a payer library entry

- Saving a physician library entry

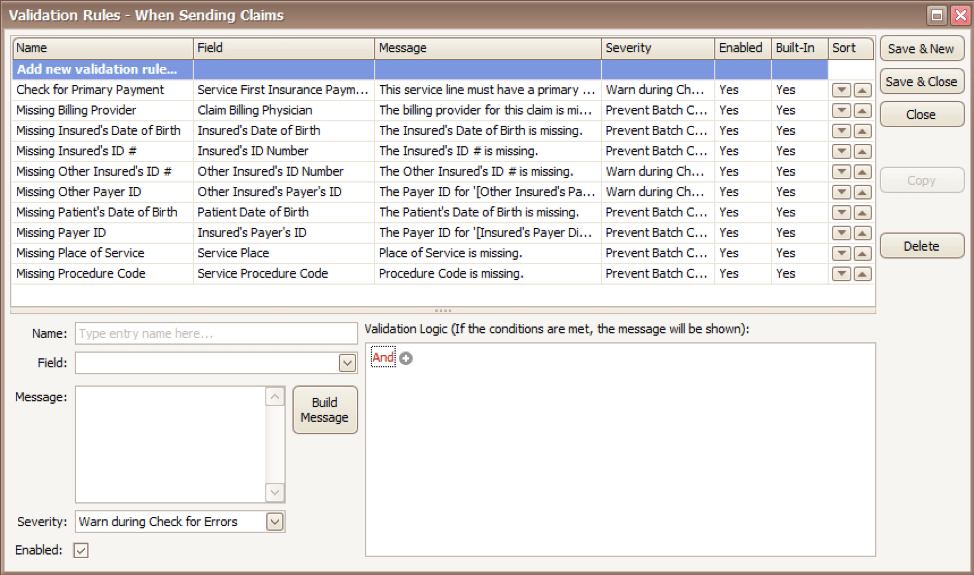

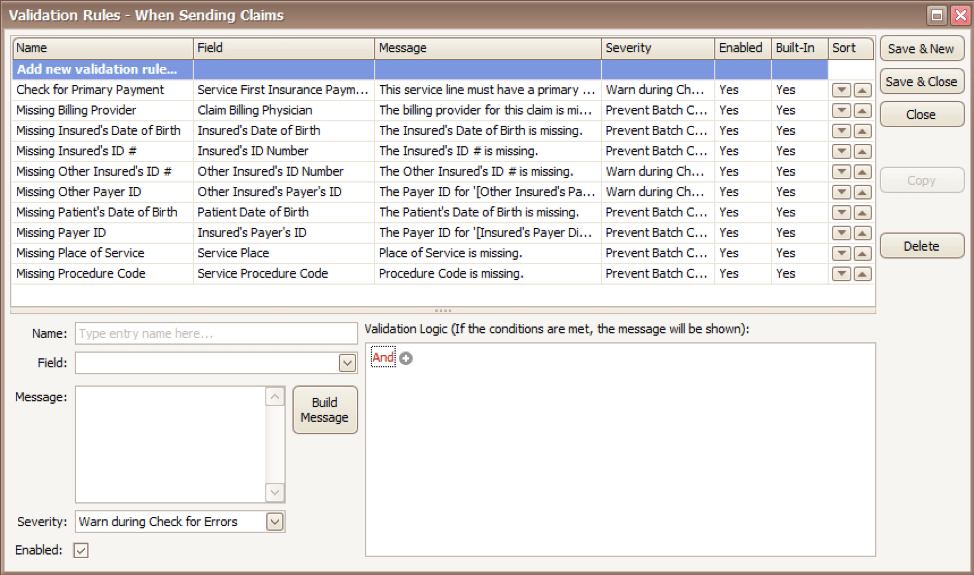

Now, click on the rule type you would like to work with and click Edit Rules. A list of rules that are already in the program will appear, along with the option at the top to “Add new validation rule“.

To get started, you will fill in the fields on the bottom left side of the screen:

Name: Name the rule anything you would like

Field: This is the field in Premier that you want to validate

Message: This is the message that will show when the error is encountered (consider using casual wording or extra punctuation so it is easily identified as a custom rule rather than a default rule)

Severity: Do you want the program to simply warn you that there may be an error or stop you from completing the task?

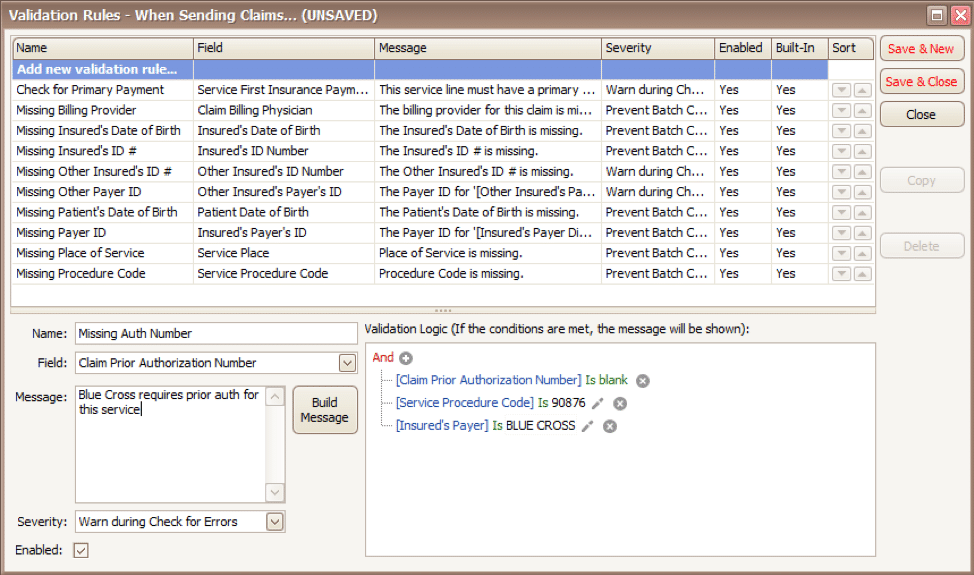

Next, you will build the logic for the validation of the field you have named above. In the example below, the rule has been created to warn users if ALL the following statements are true:

- Authorization Number is blank

- Procedure Code is 90876

- Payer is Blue Cross

Before you begin working with your validation rules it is extremely important to keep the following in mind:

- Rules are created to check for bad or missing data, not to confirm good data.

- Rules in the Sending Claims area may prevent batches from being created.

- If you wish to bypass a built-in validation rule you may disable it, if you want to customize it you can Copy the rule, update, and disable the original rule.

- Rules are the sole responsibility of the practice, EZClaim cannot troubleshoot custom validation rules.

As you can see, custom rules allow you to be very specific and can include multiple data points. Learning to use validation rules can be tricky and may take a few tries to get the rule built correctly. However, once you have the rule in place you can avoid payment delays and needing to resubmit claims.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Apr 5, 2021 | Medical Billing Software Blog, Waystar

For many providers, medical claim denials are one of the single biggest drains on revenue. When you consider that working just one denial costs about $25, knowing why claims are being denied and how to prevent them in the future isn’t a luxury—it’s a necessity.

Automation and advanced analytics can take much of the burden off your billing team by helping you identify potential denial triggers, adapt to constantly changing payer guidelines, and uncover actionable trends in your claim data.

Waystar’s Denials by the Numbers:

- 5-10% average denial rate amount physician practices

- 90% of denials are preventable

- 76% of providers say denials are their biggest RCM challenge

[ Note: View or download Waystar’s “Defeat Denials with Data” white paper here ]

Waystar, a partner of EZClaim, integrates easily with its medical billing software, creating a seamless exchange of claim, remit, and eligibility information. To learn more about defeating medical claim denials, or to add Waystar as your clearinghouse, visit this page.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article and white paper contributed by Waystar ]