Feb 10, 2022 | Partner, TriZetto Provider Solutions

While the No Surprises Act aims to address many issues involved in the patient price transparency process, a lot of attention will be put on out-of-networks charges. Many of the provisions will address how patients will be relieved of surprise medical bills from services that were rendered by providers outside of their insurance networks, and providers are wanting to know how to prepare for potential changes in their revenue. We detail how CMS has planned to address out-of-network payment disputes for emergency situations, as well as situations when services were non-emergent.

Emergency Out-of-Network Services

Providers will begin to see differences in reimbursements for emergency out-of-network claims. These will be paid using a ‘Qualified Payment Amount’. Payers are instructed to use different methods to determine the payment amounts, which will vary by the location of the service.

Dispute Resolution

Providers will need to be prepared to review these claims to see that they were paid appropriately or if there is a need to dispute the claim. If a dispute is in order, CMS provides a portal to initiate a dispute. Dispute resolution follows a strict timeline that goes as follows:

- Submit Claim

- After claim submission the health plan has up to 30 days to pay or deny

- Negotiate Payment

- Next, payers and providers have 30 days of claim payment or denial to negotiate

- Initiate Dispute

- Providers then have within 4 days of end of negotiations to initiate a dispute using the CMS Portal

- Select Arbitrator

- If no agreement come from the negotiations, one will be selected by CMS within 3 days

- Submit Dispute

- Within 10 days of arbitrator selection, provider and payers submit documentation and offer for reimbursement

- Arbitrator Decision

- The arbitrator then decides which offer to be paid within 30 days of the dispute

- Final Payment

- And final payment will be made within 30 days of the arbitrator decision

Non-Emergency Out-of-Network Services

The No Surprises Act prescribes that out-of-network patients will receive good faith estimates prior to receiving services at medical facilities. The act covers self-pay and uninsured patients, but may also include patients whose health plan does not cover the services to be provided, as well as patients who have benefits but are opting not to use them. Patients who receive a bill for services that differs from the estimate by more than $400 will have up to 120 days from receiving the bill to dispute the charges. Additional rulemaking will be forthcoming to define how provider and payer systems should interact to provide cost information for the estimate.

Keep abreast with updated regulations and the key points of the No Surprises Act (NSA) that could impact your revenue cycle by visiting TriZetto Provider Solutions’ designated landing page. Subscribe to NSA news updates and explore solutions that equip you to have informed conversations about financial responsibility and eligibility.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Feb 9, 2022 | DocVocate, Partner

Denial management has been a thorn in the side of provider RCM teams forever. And unfortunately, despite expanded EHR use and claim coding improvements, denial rates have continued to rise into the pandemic; from 9% in 2016 to 10.8% mid-pandemic in 2020.

Cost To Rework Claims

To make matters worse, the average cost of reworking denials ranges from $25-$118 per claim. As a result, over 60% of denials are never resubmitted! Here’s why:

- Lack of A/R Specific Software: Payer and EHR variability has forced A/R into manual workflows

- Staff Cost: Cost to retain skilled A/R follow up staff

Keys To Optimizing Denial Management

The good news is, modern software tools are easier to build and here to help provider billing teams. Historically, only large hospitals and payers had access to the most advanced technology, but that’s changing rapidly. Here are a few A/R follow up areas where modern software can help.

Auto-Triage of Claims

The current standard for all billing teams is to assess each claim one-by-one. Typically, it’s an “ERA by ERA” assessment that often requires further digging to really determine the correct action. However, payer claim decisions are pattern-based. With modern tools that combine these patterns with your preferred triaging, the software can triage claims in batches. This both removes the repetitive process of claim triage and optimizes the proper action decision.

100% Digital Appeals

Even after choosing to appeal a claim or send a medical record, the process of building an appeal letter, filling out a payer form, and then submitting it back to the various payers is extremely time consuming. Some teams report that it takes 35 minutes per claim!

Finding the right language to best appeal the denial is challenging on its own. What worked and what didn’t work — and why? Billing agents are often left to themselves to figure this out. From there, actually submitting the appeal via postal mail, fax, or payer portal is both time consuming, costly, and often requires a different team to touch the appeal.

Having a solution that turns this entire build and submission into a single, digital process for all denial types and payers is the only way to solve this major pain.

Team Performance Tracking

Without a digital A/R follow tool, described above, billing team managers are left to track their team’s performance through the use of onerous spreadsheets and difficult to assess reports. Managers rely on their team members to train each other and report back any difficulties they might be experiencing. This leads to real gaps in performance assessment and, ultimately, the ability to help their teams succeed.

Having a digital A/R solution fixes that. The need for a real-time dashboard that provides these KPIs, along with real-time alerts related to individual agent performance, is the way forward.

Real-Time Denial Trends AND Alerts

Finally, as mentioned earlier, denials happen in patterns. The challenge is, those patterns vary by payer, provider, region, and specialty. And they change over time too! So, these patterns are difficult to track manually. Each pattern change has immediate downstream effects that can lead all the way back to the providers themselves, with annoying code corrections and medical records requests.

A modern A/R solution that is dedicated to sharing these patterns via a real-time dashboard is the key. Not just a static dashboard with denial statistics, but in-app and email alerts that indicate an important change in a pattern. That aspect is especially important, because all billing agents are extremely busy and are bogged down by task after task. A smart platform that informs you of the most important information without any effort from you is required.

This is an exciting time for provider billing teams. At DocVocate, our team is passionate about helping provider billing teams. We’ve spent considerable time thoughtfully building our platform, Appealio, just for you. New tools are on the way to help!

If you found this helpful and would like to discuss further, please feel free to reach out to us at info@docvocate.com.

Dec 30, 2021 | Partner, TriZetto Provider Solutions

Are You Getting the Most Out of Your Credentialing?

Enrollment status can greatly affect the dollar amount payers reimburse, and some specialists are opting to go out of network. We weigh the pros and cons of this trend to explain why it may make sense for select providers.

Did you know that reimbursement is directly tied to credentialing? It’s all in the details, and enrollment status can greatly affect the amount payers reimburse. When enrolling as an in-network provider, payers and providers decide on an agreed-upon rate. However, a physician can decide to forgo a traditional contract with a payer and instead choose to be labeled as “out of network”. Of course, they will still be listed as a provider, albeit without the stated reimbursement rates and payment security that comes with having a contract in place.

If you are wondering why this option is appealing to some physicians, just look at common treatments the average healthcare consumer may be familiar with. Every year, most adults and children visit their local eye specialist for an annual exam. An optometrist performing a routine eye exam will most likely receive optimal reimbursement. This service is covered by insurance in the majority of cases and the reimbursement will be within a standard range. However, if this same patient is then referred to an ophthalmologist for advanced cataract surgery, for example, the odds of insurance covering this procedure are less likely. From the standpoint of the ophthalmologist, his credentialing specifics may not matter too much, since he will be paid regardless and the patient is most likely assuming that they will have a large out-of-pocket cost. When all is said and done, the ophthalmologist is set up to take home more than if he was listed as an in-network option. Looking at it through the eyes of the surgeon, it would not make sense financially to be credentialing with payers the traditional way.

The benefit of being in-network boils down to the contracts that determine what providers will be paid. When a provider works with a payer, an agreed-upon rate is determined. If paperwork is filled out correctly and claims are submitted on time, there will not be too many surprises when the time comes to be reimbursed. A provider will know what to expect from a particular service. This process works best for providers that like the security of having a contract in place. However, these contacts with insurance companies often result in providers being paid less than fair market value. The truth of the matter is that fair market value may often be more than payers are willing to pay.

It’s not uncommon for family doctors, or eye care professionals that deliver routine exams like the example mentioned above, to work in-network because the margins are small. For highly specialized services, often considered elective and not covered by insurance, the potential for large reimbursement grows significantly. For instance, let’s say a plastic surgeon performs surgery in their own surgical suite. The procedure may cost $14,000. Through payer reimbursement as an in-network provider, the surgeon receives $4,000. However, if the surgeon is considered out-of-network, they have the ability to negotiate rates, meaning much more could potentially be earned. From the patient’s standpoint, it’s not uncommon for a patient to shop around and expect to use an out-of-network provider anyway for these types of highly specialized services.

When it comes to gaining credentials, an out-of-network provider will not have to go the traditional credentialing route. This question arises: Is it smarter for medical professionals to perform their services as in-network or out-of-network providers? The truth is, a lot of doctors do not actually realize they have the ability to negotiate. It all comes down to how they want to pay, and the power lies with the provider.

Credentialing is complicated, and it helps to have the right partner in place to navigate the path to credentials. TriZetto Provider Solutions (TPS) has experienced credentialing experts in place that can help with every aspect of the process. Visit our TPS partner page to learn more and request a demo.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Jan 11, 2021 | Electronic Billing, Health eFilings, Medical Billing Software Blog, Partner

If you are not a MIPS expert (Merit-based Incentive System), your Medicare reimbursements may be decreased by 9% in the next year. However, it’s not too late to avoid the penalty for the 2020 reporting period, but you need to act now!

One of EZClaim’s partners, Health eFilings’ has ONC-certified software that completely automates the MIPS compliance process for you. The software will automatically extract the required data directly from EZClaim (and/or your EHR), and then proprietary algorithms will process the 9,000,000 possible combinations of quality measures for each clinician to identify which measures should be submitted to CMS (Centers for Medicare and Medicaid Services) to earn you the most points.

Need a MIPS expert? Well, Health eFilings is one of the best, and CMS has accepted 100% of their submissions on behalf of their clients. If you have completed your 2020 reporting, reach out to them, and learn how you can earn even more points in 2021.

For more information about EZClaim’s medical billing software, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Sarah Reiter, SVP Strategic Partnerships, Health eFilings]

Jul 14, 2020 | Health eFilings, MIPS Reporting, Partner, Revenue

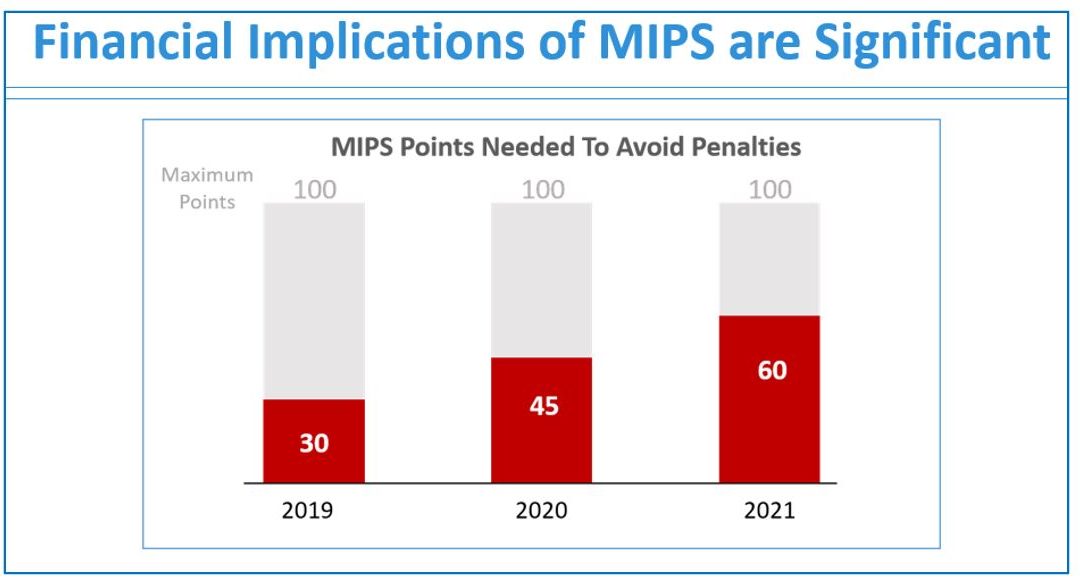

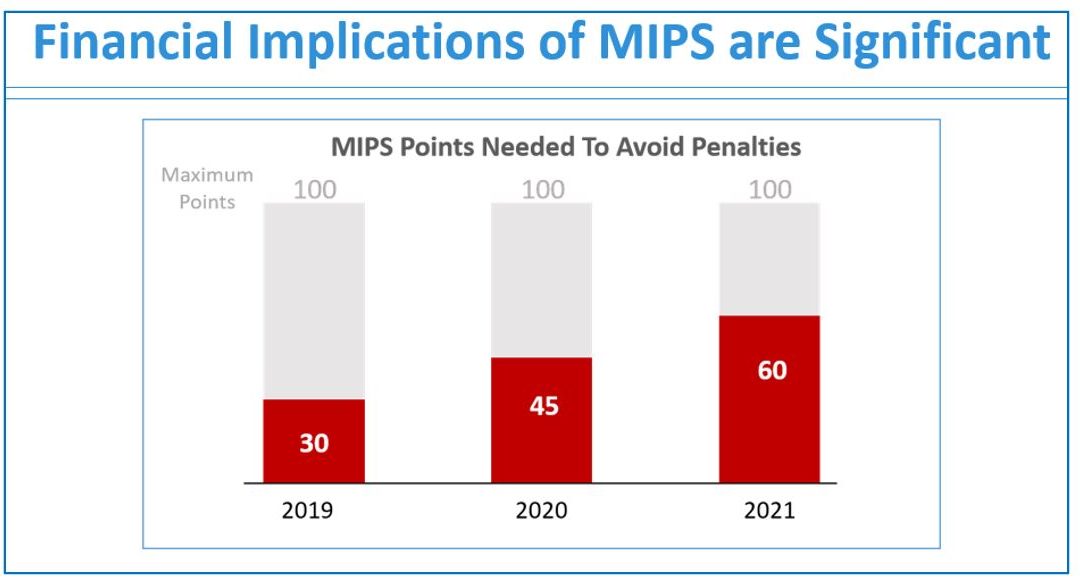

The 2020 MIPS reporting is already half done, and given that MIPS (Merit-based Incentive Payment System) is a points-based program, the goal is to earn as many points as possible to avoid this year’s 9% penalty and potentially even earn a positive payment adjustment. However, earning the 45 points necessary to avoid the penalty for the 2020 reporting period will be no easy feat. With over half of the reporting period already behind us, it is imperative you ACT NOW so you don’t find yourself in a position later in the year that you can’t recover from in terms of earning points.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your score. Here are three critical actions to take right now so that you will still optimize your ability to earn points for the 2020 reporting period:

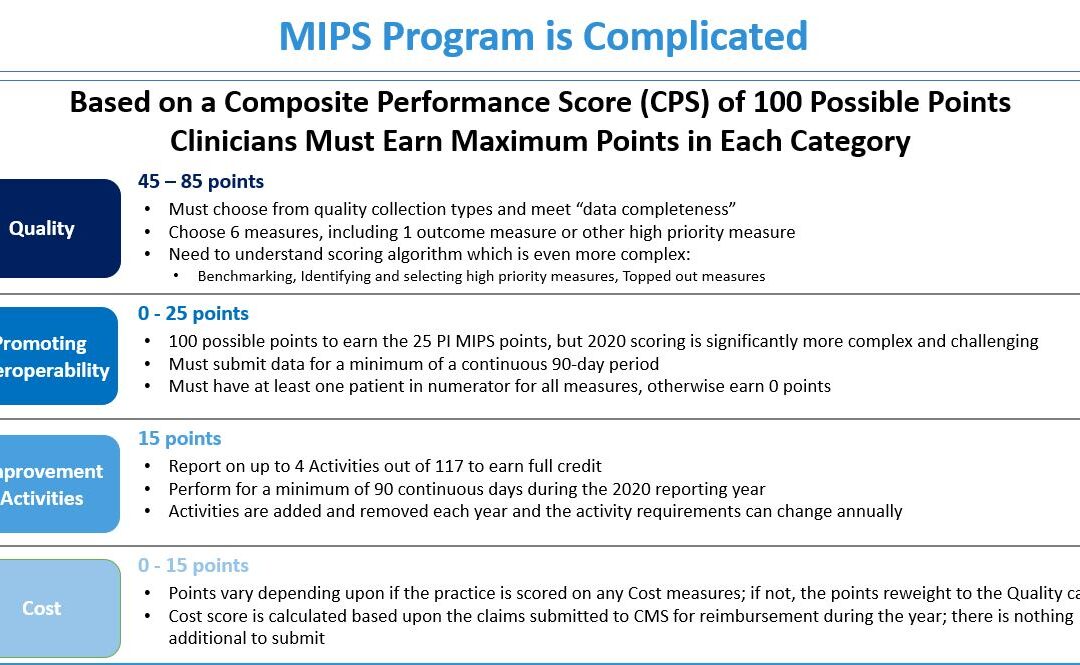

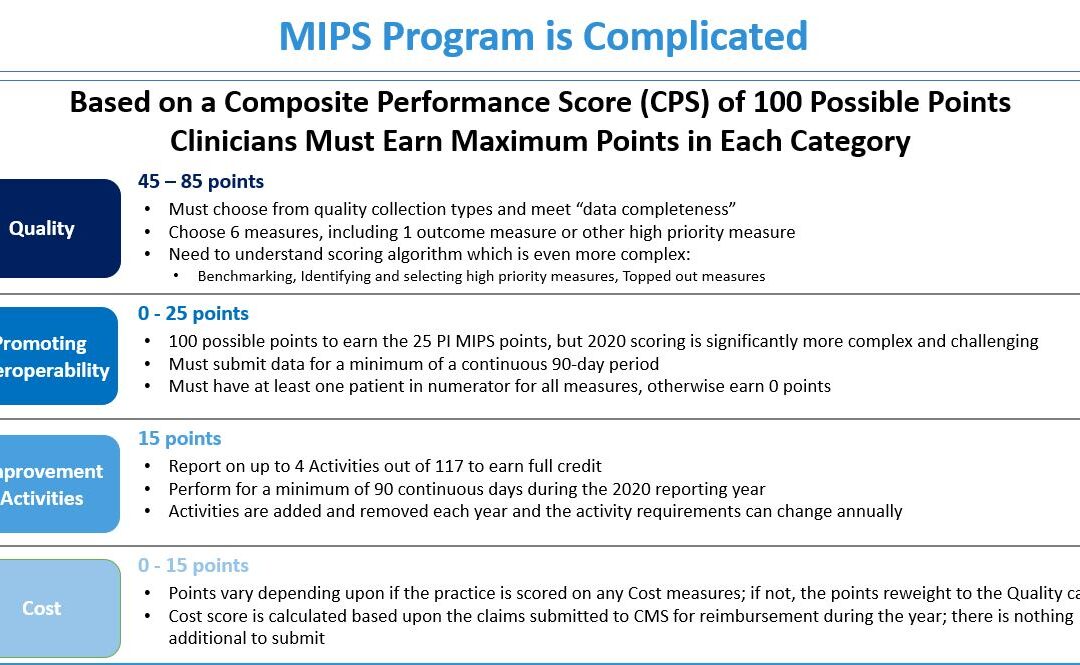

1. Focus on the Quality Category

There are various points available within each of the categories and the Quality Category has the most points associated with it. Based on a number of factors, the category is worth anywhere from 45 to 85 points. This is a critical category to be focused on throughout the year, so now is the time to ensure that you are tracking all relevant data so that it can be properly reported on within your submission.

2. Understand the Timeframe Requirements

Two of these categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long in the year you will find it impossible to put the right actions in place in order to complete the activities necessary to earn any of the points in these categories.

3. Choose the Right Reporting Methodology

Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the points you could earn. Additionally, there is strategic maneuvering that can be done throughout the reporting period with exemptions and reweighting of points that can set you up to optimize your performance and your score. Therefore, you must select a reporting partner that will help you earn the most points available and leverages technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings is a certified EHR technology (CEHRT) and the national leader in automated MIPS reporting. Their cloud-based ONC-certified software fully automates the reporting process. Because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes from you, the practice will save significant time while maximizing its financial upside.

To learn more about how to properly perform your 2020 MIPS reporting, contact EZClaim’s partner, Health eFilings, so they can help before it’s too late!

For details and features about EZClaim’s medical billing software, or general information about the company, visit their website.

[ Written by Sarah Reiter, SVP Strategic Partnerships, Health eFilings ]