Sep 14, 2022 | EZClaim

As competition in the healthcare industry continues to heat up, providers and billers must look to new options to provide seamless and flexible payment options to retain customers and attract new ones.

Providing a variety of convenient payment options is more important than ever

Patients are frustrated by their healthcare payment options. While they understand the importance of paying their bills, they also want to be able to pay them in a way that is convenient. Many patients would rather pay their bills by credit card rather than cash or check, but they do not always have this option.

Patients have adopted a consumer mindset. From their perspective healthcare transactions should be no different from other transactions. They are more reluctant than ever to put a check in the mail and cross their fingers. In a world of easy online payments and tap-to-pay convenience, healthcare providers need to recognize that the patient financial experience is just as important as the patient care experience.

Most importantly, providing these payment options are not just about giving patients more convenience, but about the bottom line. Embracing new functionality like card-on-file recurring billing and SMS text message payment reminders saves your staff time and increases payment rates.

“We sent out the first SMS payment requests last week, and within several hours had generated 9 payments for a total of over $2,400 back from the patients! The provider is thrilled.”

As the healthcare industry continues to become more competitive, it becomes more critical than ever to create efficiencies wherever possible.

Patient payment data security must be a top priority

In 2016, healthcare organizations suffered a record-breaking number of data breaches. These breaches are not just affecting the health of patients and the financial bottom line of providers – they are also affecting their reputation.

A survey conducted by Ponemon Institute in 2017 revealed that healthcare organizations lost an average of $2.1 million per breach and nearly a third reported losing between $1 million and $10 million per breach. In addition to these costs, there are also significant reputational consequences for healthcare organizations that suffer a data breach. More than half (52%) said they would avoid using a provider following a data breach.

Consumers are concerned about safeguarding their medical information when paying bills; 47% have significant concerns regarding the security of making payments for both medical bills and health plan premiums. They want to take advantage of the consumer protection guarantees that their credit card company offers and a PCI compliant payment processing like EZClaimPay.

Finding the right payment processing partner

Healthcare is more complex than many other industries — a tangle of relationships between patients, healthcare providers, insurers, and unique regulatory requirements such as HIPAA. In this context, there are many providers find that their payment and billing systems do not work well together. Because of these challenges, medical billers and healthcare providers stand to benefit by working closely with their payment processors.

EZClaim set out to build a payment processor from the ground up that addresses these concerns. EZClaimPay helps billers and providers save time and money with functionality like card-on-file recurring billing, ability to offset processing costs with the platform fee functionality, and automatic reconciliation. Plus, increase payment rates with text message reminders and convenient payment portal. Most importantly, because we serve healthcare providers exclusively, we have ensured compliant, industry standard security including PCI compliance.

Streamlining and optimizing payment processing expedites the patient payment process while increasing back-office efficiencies. Healthcare providers that offer seamless, secure, and flexible billing and payment options will retain more customers and continue to attract new ones.

EZClaim is a leading medical billing, scheduling, and payment software provider that combines a best-in-class product with exceptional service and support. For more information, schedule a consultation today, email our experts, or call at 877.650.0904.

Aug 15, 2022 | MedCycle Solutions, Partner

By Ann Knutson, CPC-A

The healthcare revenue cycle includes all administrative and clinical functions that involve capturing, managing, and collecting the provider’s/facilities revenue. The cycle includes three distinct parts of the practice/facility that’s referred to as the front-end, middle, and back end. Unfortunately, most of the time there is little coordination between the three areas which can lead to more claim denials and lost revenue for the practice/facility. Therefore, adding a revenue integrity team to your practice/facility dramatically improves operational efficiency, compliance measures, and reimbursement rates. Members of the team must have extensive knowledge of and be familiar with the complete healthcare revenue cycle.

In order to foster collaboration between all three areas of a practice/facility that affect the revenue cycle, specific training needs to be implemented for staff, along with coding and documentation education for providers.

Specific staff training includes:

- Keeping up to date on billing requirements, such as coding guidelines, billing regulations, and insurance payer policies.

- Reimbursement updates, such as data showing rate of reimbursement vs. denials/rejections.

- Key performance indicators, such as data regarding common billing or coding errors leading to claim denials and rejections.

- Job expectations, such as all billing employees must know every aspect and function of their job in detail.

Provider education involves:

- Chart reviews to verify proper documentation.

- Quarterly meetings regarding coding guidelines, payer rules, and the importance of medical necessity.

Furthermore, creating templates and tip sheets for billers, coders, and providers improves operational efficiencies, clean claim submission, and proper provider documentation. It also decreases claim denials and puts everyone in the practice/facility on the same page.

In addition, the collaboration between coders and the accounts receivable team is crucial to improving reimbursement rates, the outcome of claim appeals, and compliance with regulations. It can also help to reduce the number of claim denials and rejections. Plus, medical coders are able to share their expertise regarding regulations and proper coding with the Accounts Receivable (AR) team members. This helps the AR team with reconciling claim rejections and denials along with properly submitting appeals. On the other hand, the AR team can inform coders of the current codes or coding combinations that are being rejected or denied by payers. With this vital information, coders can make the required coding and billing changes as they enter the charges and submit the claims. This can greatly improve the rate of clean claims submission. (AAPC, 2021)

Therefore, it’s in the best interest of a practice/facility to implement a revenue cycle management team that is familiar with the entire revenue cycle, fosters collaboration between all areas of the practice/facility and providers, and maintains open communication between all departments in order to maximize revenue cycle efficiency and reimbursement. For assistance with maximizing your revenue cycle efficiency, please contact us at MedCycle Solutions.

For more information about maximizing revenue cycle efficiency, please visit www.aapc.com.

Ann Knutson, CPC-A is an Accounts Receivable Specialist at MedCycle Solutions, which provides Revenue Cycle Management, Credentialing, Outsourced Coding, and Consulting Services to a number of healthcare providers in a variety of specialties. To find out more about MedCycle Solutions services please visit www.MedCycleSolutions.com.

Aug 11, 2022 | EZClaim

The revenue cycle is a crucial component of a medical practice. Revenue Cycle Management (RCM) is the process of managing patient accounts, interacting with payers, processing claims, and collecting payments related to health care services. As the industry becomes more competitive and physicians are expected to perform more administrative tasks on their own, RCM has become even more important for healthcare providers today than ever before. Unfortunately, many practices still struggle with managing their RCM processes in an efficient manner that allows them to focus on what matters most: patient care. Below is a list of common mistakes made by healthcare providers when it comes to RCM.

Below is an overview of the seven key components of RCM and ways to avoid some of the most common mistakes.

Insurance Verification and Authorization

Insurance verification and authorization is a critical step in the revenue cycle process. If this step fails, all other steps must be repeated. This can result in delays, rework, denials of claims and even patient non-compliance.

- Verify that the patient is covered by their insurance plan and will not be responsible for additional costs related to their treatment or procedure (co-pay and deductibles).

- Verify that your provider is in network for each specific procedure with their chosen health plan/policy before completing any work on behalf of the patient.

- Ensure that all documentation supports your claim(s), including diagnosis codes and clinical notes from EMRs or doctors’ offices detailing what was performed during each visit. These details should align with those found on physical charts signed by both patients and providers alike.

- Verify eligibility rules as defined by health plans: has a deductible been met? Is there a copay amount due before benefits kick in? In some cases it may be necessary to contact members directly via phone or email asking them these questions so they know exactly how much they owe out-of-pocket. Our partner TriZetto Provider Solutions offers integrated eligibility verification. Automating this due diligence on the front end ensures that you are not left with the cost of having a biller redo this work, or worse, writing of claims.

Patient Registration and Copay Collection

Patient registration and copay collection are important first steps to ensure that your revenue cycle is functioning properly. Patient service, claims submission, remittance processing, and back-end patient collections are all vital components of the revenue cycle management process.

Without these steps in place, you will not be able to complete the full revenue cycle management process.

Service Coding and Charges

The service coding process identifies the type of service or procedure that was performed by your staff. Accurately documenting and coding charges allow you to:

- Assign appropriate codes for reimbursements from government programs, insurance companies and self-pay patients.

- Determine the level of reimbursement for each code

- Avoid fraud and abuse

Billing and Collections

It is critical to collect payments on time, in full and accurately. If you do so consistently, it will be easier to predict future cash flow needs and improve your ability to manage the revenue cycle.

Timely billing is critical because it allows the practice to collect their fees before they become delinquent. Delinquent accounts must be reported to credit agencies which can negatively impact a patient’s ability and willingness to pay for other services at your facility in the future. Late fees should also be considered for patients who are more than 60 days late paying their bill – this can help generate additional revenue by encouraging prompt payment from patients who may otherwise have ignored their bills altogether.

Accuracy is key when collecting payments because inaccurate claims may result in denied reimbursement by Medicare or third-party payers’ due out-of-pocket expenses for patients who were mistakenly overcharged by providers.

Consistency means that providers need regular updates on where each account stands within its cycle; this helps ensure that both patient satisfaction levels remain high and that everyone receives timely access. Efficiency refers not only to how quickly accounts move through management but also how quickly they get paid so providers know exactly how much money they’ll have coming in each month before making subsequent budgeting decisions.

EZClaim provides great tools to help ensure your collections are timely, accurate, and consistent. EZClaim allows you to keep a credit card on file. With approval to charge up to a specified amount, you can make it convenient for your patients and ensure payments are timelier than ever. EZClaimPay also offers email and SMS text message-based reminders, which have proven effective in increasing payment rates.

Denial Management

Denial management is the process of managing patient denials. Denials can be caused by a variety of reasons, including incorrect CPT codes, missing information, or provider errors. Therefore, it’s important to have ready-to-go processes for handling them and getting paid as soon as possible.

When you receive a denial from an insurance company, there are several things you should do immediately:

- Double-check that all your claims are accurate and complete before submitting them for payment. If there is any ambiguity on the part of the patient or their healthcare provider, this will increase the likelihood that your claim will be denied due to lack of clarity.

- Request that more specific details regarding the denial be provided. This allows better preparation when submitting future claims related to this patient’s care and ensures there aren’t additional denials for similar reasons.

The revenue cycle is a crucial component of any medical practice. It’s also one of the most challenging aspects of running a practice, especially in today’s increasingly complex environment. This article has highlighted some common mistakes that can be made when managing your revenue cycle and how to avoid them.

Jul 19, 2022 | EZClaim

Demand for different care models and emerging technologies are changing how healthcare is delivered in 2022. These are the trends to watch this year.

More Medical Technology Integration

Integrating medical technologies to broaden available data and improve patient outcomes will continue to impact the way hospitals, healthcare centers, and care providers operate. These new tools and integrations will allow healthcare professionals to use more efficient workflows thanks to better APIs and less data silos.

Integration means collecting more data with new remote monitoring and Medical “Internet of Things” devices. This data can then be centralized for patients and doctors with with cloud-based electronic health record platforms. It also means better patient education with consumer mobile apps, automated care-team emails and text messages, and digital therapeutics. These integrated tools will continue making it easier for doctors to collect and access more precise and detailed patient data than ever before.

As more technology works together, providers can identify and solve medical issues faster and more accurately. Further, patients are given opportunities to become more involved in achieving their healthcare goals and taking part in preventative measures.

Telehealth Continues to Grow

Today, many providers offer telehealth options to patients who prefer to meet with their doctor via phone or video. This option is one of the fastest growing in healthcare and will be an increasingly popular way to access healthcare in the coming years.

Telehealth can be beneficial for both providers and patients by lowering costs and increasing availability. Telemedicine allows healthcare providers to reduce their overhead and pass on those savings to patients by removing the need to visit a physical office. In addition, telehealth capabilities have made rural access easier by giving Americans a broader range of providers in different specialties. Traveling for healthcare can be expensive in terms of money and time. Virtual care offers lower costs, greater access to primary care for those in rural areas, and better public health.

The option to meet with a provider by phone or video is also a great tool to bring in and retain new patients. Lowering barriers to entry and establishing relationships via video or phone can be a great way to provide quality care initially and preserve that patient over the long term.

Healthcare consumerism was slowly growing before COVID, and patients see technology as a way to improve their mental and physical well-being. Telehealth will play a major role in those consumer expectations.

Home Health will Become More Popular

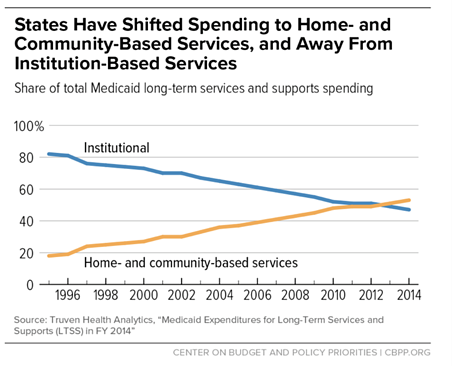

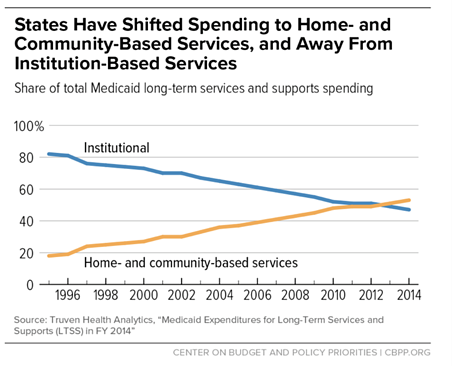

As more baby-boomers hit retirement age, demand for home health nurses and services—which were already seeing a surge in demand with COVID-19—will only continue to increase. As home health monitoring technology becomes increasingly available, states and private equity increases funding for these programs, and many seniors opt to return home instead of a skilled nursing facility, the trend towards home health is clear.

Medicare data reflects this trend as well with the Medicaid Innovation Accelerate Program reporting continued growth in home and community services.

Emerging technologies and care models are driving the way forward in 2022. These innovations will provide new ways for providers to deliver better care and more value to their patients.

EZClaim is a leading medical billing, scheduling, and payment software provider that combines a best-in-class product with exceptional service and support. For more information, schedule a consultation today, email our experts, or call at 877.650.0904.

Jul 12, 2022 | MedCycle Solutions, Partner

Have you increased the amount of Telehealth visits with your patients?

If not, you and your patients may be missing out.

Over the past two years, the COVID-19 pandemic has changed the landscape of patient care and increased the need for providers to utilize virtual healthcare services. Due to the Public Health Emergency (PHE) policy update, many healthcare practices had to shut down, pause or augment their services with telemedicine to provide flexibility in patient support.

Here are four ways Telehealthcare has been implemented to provide safe, necessary care for patients while augmenting revenue.

- Stop the Spread of Contagions

With the need to quarantine, social distance, and reduce the risk for clinic staff and patients, many health practices adapted ways of providing non-emergency services. For patients with (possible) highly contagious diseases, such as COVID-19, many clinics ask patients to schedule virtual appointments to avoid possible infections and further outbreaks. This allows for keeping both the staff and patients as safe as possible while still receiving necessary treatment.

- Provide Essential Health Services

For those patients that suffer from White Coat Syndrome going to the doctor’s office causes a great deal of stress and anxiety. By allowing patients to access care in the comfort of their own home for managing chronic health conditions, routine services, prescriptions, and referrals for testing and labs, this allows for greater patient access. Plus, it has the added benefit of reduced overhead costs associated with cleaning and turning exam rooms.

- Provide Physical and Occupational Therapy Healthcare

Accidents happen. Whether motor vehicle accidents, workplace injuries, or trips and falls – PT and OT is imperative to keep patients mobile and progressing. Many providers offer hybrid services with virtual appointments for patients to keep them mobile while supervising and adapting exercises in their home environments.

- Provide Mental and Behavioral Healthcare

Mental and behavioral healthcare is one of many patient-care needs. This is especially true for long-term residential care. Many nursing home facilities transitioned to telemedicine during the COVID-19 pandemic.

The U.S. Department of Health and Human Services, via the Centers for Medicare & Medicaid Services (CMS) heavily promoted the switch to Telehealth as infection prevention and control measures. They’ve made digital resources available that offer behavioral health and best practice guides for long-term nursing homes, a telemedicine tool kit, as well as other guidance.

If you think your practice and patients can benefit from implementing telehealth visits stay tuned for our next article on 5 Resources for Implementing Telehealth & Telemedicine.

Mariellen Mezzacappa has a variety of experience in the medical field. She has worked for doctors, hospitals, pharmacies, and insurance companies. Her experience includes bill review and coding with a wide range from EAPG 3M, DRG, Workers Compensation to Appeals and coder Affidavits for Litigation. She provides verification of code selection for operation reports, documentation review, and credentialing. Additionally, she has worked on operation policies, compliance training, and project management.

MedCycle Solutions provides Revenue Cycle Management, Credentialing, Outsourced Coding, and Consulting Services to a number of healthcare providers in a variety of specialties. To find out more about MedCycle Solutions services please visit www.MedCycleSolutions.com.