Oct 13, 2020 | BillFlash, Revenue, Webinar

Feeling overwhelmed by the complexity of the revenue cycle management process? This webinar will help you identify the most important measures affecting practice revenue, will explain how to make improvements to improve cash flow, as well as how to save your staff time.

PRESENTED BY: Stephanie Cremeans, CPC, CPMA, CPPM, Founder of RCM Insight

Wednesday, November 4th at 11 am MT/1 pm ET

You Will Learn The Following:

- Creating scorecards to eliminate issues that are preventing payments

- Identifying and improving processes that improve revenue

- Organizing staff to monitor and improve the financial process

- Avoiding the pitfalls of uncompensated care

- Teaching & training to get results

______________________

About Stephanie Cremeans:

Stephanie has served in various roles in the medical billing and coding field including Revenue Cycle Manager, Consultant, Auditor, Biller and Coder. Stephanie has a passion for educating providers, coders, and billers on how to maximize revenue through proper documentation and effective workflows. She has worked with several specialties including family medicine, cardiology, physiatry, urgent care, GI, pediatrics, OB/GYN, and behavioral health.

Click here to register for the BillFlash Webinar, “Simple Tips to Improve Your Practice’s Cash Flow Process“

Oct 12, 2020 | Medical Billing Software Blog, Partner, Revenue, Waystar

Today’s healthcare landscape faces truly unprecedented challenges, which means it’s more important to get the most out of your analytics to develop more informed, strategic decisions. There’s a deep well of data that each revenue cycle feeds into, which if properly analyzed, can help organizations operate at their most efficient and effective. Here are the four stages of data analytics workflows that are key to developing those actionable insights: A “Trigger,” or the point in your revenue cycle that sets up the call for deeper analysis; “Interpretation” of data to determine root causes and identify appropriate next steps; “Intervention” to improve specific metrics; and “Tracking” of said metrics to chart success in achieving desired outcomes.

So, let’s examine what a successful version of each stage looks like:

Trigger:

The trigger occurs when you notice something that needs further investigation. With the right analytics tool you can easily access all of your key performance indicators, financial goals and more, providing the visibility you need into your rev cycle. When something looks amiss or needs improving, you can drill down to the level that shows what’s really going on.

Interpretation:

Even a wealth of data amounts to nothing without an efficient way to process and communicate key takeaways. You’ll need to equip your team with access to concise reports, smart visualizations and relevant historical data in order to get them to the insights that drive action.

Intervention:

Now is the time to take action. Intervention is ultimately tied directly to your ability to drill down into the data underlying problematic areas of your revenue cycle and clearly communicate takeaways with your team. Success at this stage depends on designing a plan based on your best understanding of underlying issues and the most effective way to address them.

Tracking:

Your intervention plan is built on KPIs that naturally intertwine with the way you measure success across your revenue cycle. With proper implementation and tracking, running with the analytics cycle can become a simple addition to your everyday workflow. More than delivering on your initial goals, the true power of analytics is the ability to deliver repeat value on your initial investment.

Wrap Up

A strong analytics solution does more than deliver a more fully developed picture of your revenue cycle performance. It provides actionable business intelligence, cuts down on time between analysis and action, and lessens the strain on your IT department.

Waystar is a ‘partner’ of EZClaim, and provides analytics for a practice using their medical billing software. For more details about EZClaim’s products and services, visit their website: https://ezclaim.com/

To learn more about how Waystar can help you harness the power of your data, call their main office at 844-4WAYSTAR, or call sales at 844-6WAYSTAR.

[ Contributed by Waystar ]

Aug 11, 2020 | BillFlash, Partner, Revenue

Educating patients about their payment options can improve your medical practice revenue.

Imagine for a moment that you are planning to buy a car. Before you even enter a car lot, you do some research on the type of car you need, the features you are looking for, and how much you are able to spend. You might even get an opinion from a friend or check out reviews online.

After you have gathered all the information you need, you feel you are ready to start shopping—and confident that you might even get some new keys by the end of the day.

This is very similar to how most business transactions work: They have a need, they research the best ways to meet their need, and they make a purchase.

However, the healthcare industry doesn’t follow this formula. Your medical practice is a business just like any other, but your customers—aka, patients—often seek out your services not knowing exactly what they will be “buying” from you, nor how much they will be paying. Add in health insurance and surprise bills and you have a confusing hodgepodge of information that calculates the patient’s final bill, which they likely will not see for several weeks.

The current system is inefficient, and it is part of the reason that up to 30% of patient bills go unpaid every year.

Changing the Patient’s Financial Experience

Many practices have improved their revenue flow by simply treating their patients more like customers. In other words, they educate them on the financial side of things, as well as how to manage their health.

In a recent NexTrust webinar, three-quarters of poll respondents (doctors and practice managers) said that they speak to patients about their payment options. Thirty-one percent said that they currently use electronic communications, and only 8% use printed materials (flyers, signs, etc.).

While speaking to patients is a good start, getting payment information in writing is crucial to driving this information home. Patients already have a lot to remember regarding their care. A simple handout on how and when to make their payments can make it much easier for patients to manage their payment responsibility.

Most providers—over 90%—educate patients about how to pay on their statements. It certainly doesn’t hurt to communicate this information this way, but don’t rely on it exclusively. Most people skim the statement to see how much they owe and most miss important instructions.

So, as you educate patients on their payment options, keep these four key areas in mind to improve your medical practice revenue:

1) Set Clear Expectations about Payments

The first step in financially engaging your patients is to remind them you are a business, and that you require regular, on-time payments to keep your doors open. Patients often don’t see their doctors as business owners. A simple statement upfront about your payment expectations encourages patients to be more proactive about paying their bills on time.

2) Educate Patients about Your Payments Process

When patients understand your payments process, they are empowered to be more proactive in participating in it. You know where billing and payments fit into your practice workflow, so make sure patients understand that, too. If you require copays to be paid before a visit, communicate that beforehand so they can be prepared. In addition to that, also communicate clearly about when any remaining balances are due.

3) Push Your Online Payment Options

The best thing you can do to increase payments is to educate patients about their online payment options. Don’t just say “We accept payments online” and leave it at that. Show them where to go to complete payments. Also tell them about the variety of payment options available to them.

For example, EZClaim customers have several online payment options:

• Guest Pay: Patients can quickly pay their balance without having to set up an account

• MyProviderLink.com: If the patient wants access to more features (such as the ability to check their balance without having to call the office or to set up automatic payments), they can register for an account through BillFlash’s payment portal

• LinkPay: The practice sends a payment link to the patient before their visit, so they can pay what they owe before the visit starts

• PlanPay: Split up larger bills into smaller monthly payments

Online payments are the future of healthcare. So, make sure your online payment options are front and center whenever you bill patients. This could include a note in their statement directing them to pay online, handing out instruction cards on how to pay online, and posting signs throughout your office directing patients to your payment portal.

4) Reach Out to Patients You Haven’t Seen Lately

Forty percent of patients defer or skip care because they don’t think they can afford it. Make sure you get the word out to your entire patient base that you can accommodate any patient’s financial circumstances, whether that means setting up a payment plan or delaying payment for a few months. If patients know they have affordable payment options, they will be more likely to seek you out when they need help, rather than going somewhere else or deferring care entirely.

Empowering Patients to Take Ownership Over Their Healthcare Bills

Most patients want to pay their medical bills promptly and in full, but being in the dark about what they are being charged for and what their payment options are makes that difficult. The patient financial experience matters, and when you educate your patients on their online payment options and are transparent about costs, they usually respond positively, and you will improve your medical practice revenue.

Learn more about the pay services available to EZClaim customers by visiting their partner’s website, BillFlash.com, or by e-mailing sales@billflash.com.

To learn more about EZClaim’s medical billing software solution, visit their website at EZClaim.com.

[ Written by Angela Carter with BillFlash ]

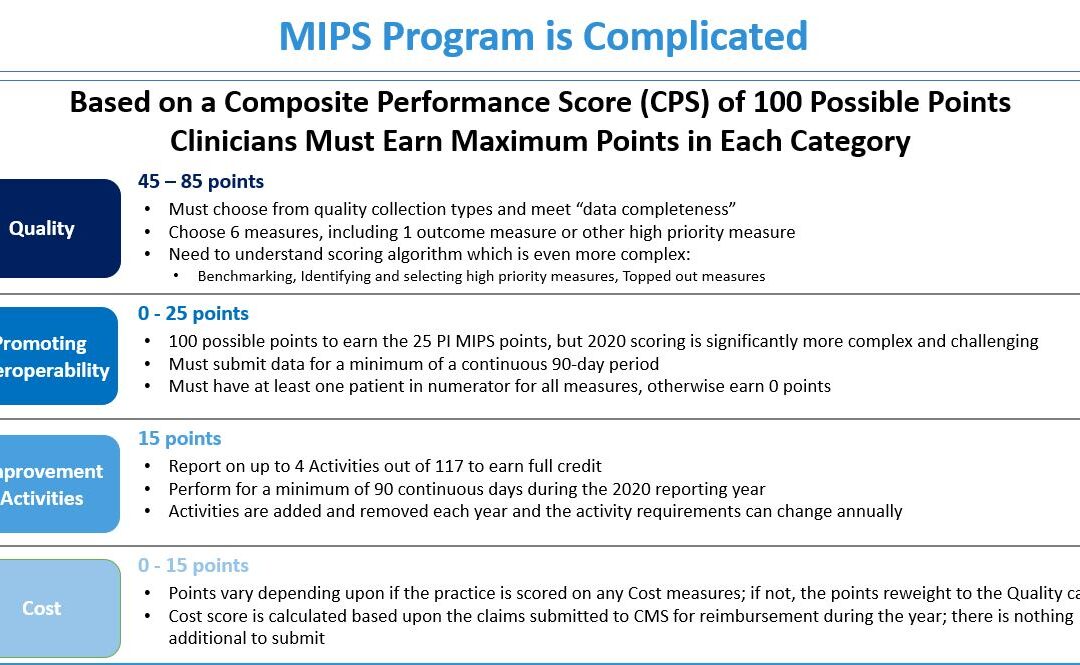

Jul 14, 2020 | Health eFilings, MIPS Reporting, Partner, Revenue

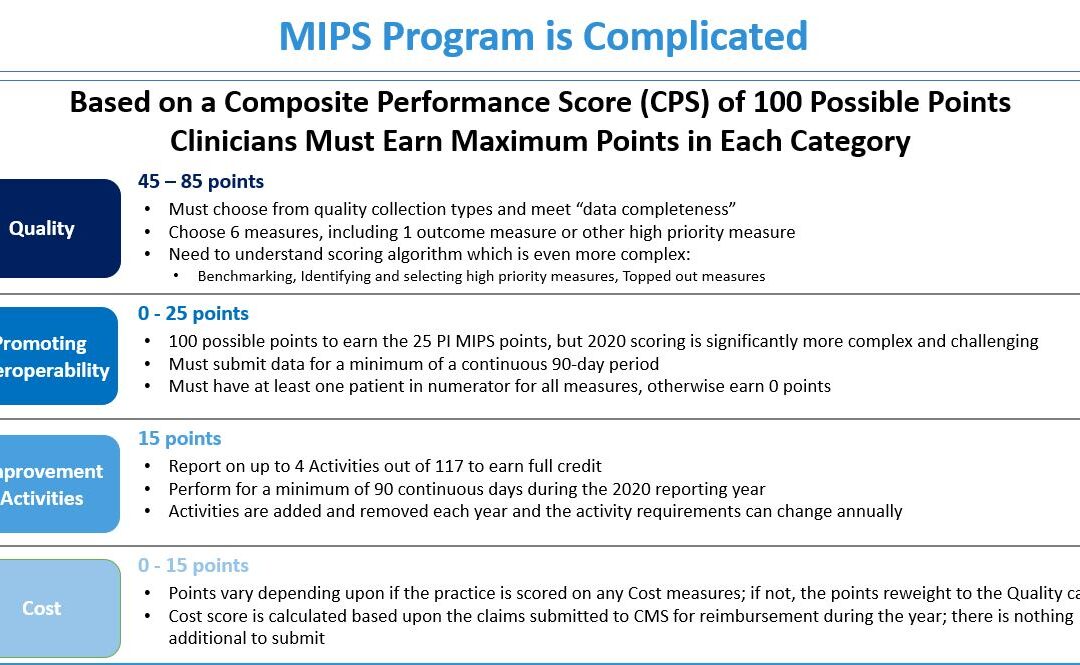

The 2020 MIPS reporting is already half done, and given that MIPS (Merit-based Incentive Payment System) is a points-based program, the goal is to earn as many points as possible to avoid this year’s 9% penalty and potentially even earn a positive payment adjustment. However, earning the 45 points necessary to avoid the penalty for the 2020 reporting period will be no easy feat. With over half of the reporting period already behind us, it is imperative you ACT NOW so you don’t find yourself in a position later in the year that you can’t recover from in terms of earning points.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your score. Here are three critical actions to take right now so that you will still optimize your ability to earn points for the 2020 reporting period:

1. Focus on the Quality Category

There are various points available within each of the categories and the Quality Category has the most points associated with it. Based on a number of factors, the category is worth anywhere from 45 to 85 points. This is a critical category to be focused on throughout the year, so now is the time to ensure that you are tracking all relevant data so that it can be properly reported on within your submission.

2. Understand the Timeframe Requirements

Two of these categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long in the year you will find it impossible to put the right actions in place in order to complete the activities necessary to earn any of the points in these categories.

3. Choose the Right Reporting Methodology

Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the points you could earn. Additionally, there is strategic maneuvering that can be done throughout the reporting period with exemptions and reweighting of points that can set you up to optimize your performance and your score. Therefore, you must select a reporting partner that will help you earn the most points available and leverages technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings is a certified EHR technology (CEHRT) and the national leader in automated MIPS reporting. Their cloud-based ONC-certified software fully automates the reporting process. Because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes from you, the practice will save significant time while maximizing its financial upside.

To learn more about how to properly perform your 2020 MIPS reporting, contact EZClaim’s partner, Health eFilings, so they can help before it’s too late!

For details and features about EZClaim’s medical billing software, or general information about the company, visit their website.

[ Written by Sarah Reiter, SVP Strategic Partnerships, Health eFilings ]

Jun 10, 2020 | Alpha II, Medical Billing Software Blog, Partner, Revenue, Webinar

Concerned about the claims process during COVID-19? Well, Alpha II remains on the forefront of the coding and billing changes during the COVID-19 public health emergency (PHE). They understand this is a confusing time for providers, practices, and hospitals.

Now more than ever, practitioners are relying on the revenue brought in by accurate claim submission. So, if you would like more up-to-date details, join us for our Bring Revenue Integrity to the Claims Process During COVID-19 webinar on June 16th at 1 p.m. ET, and learn how to recover revenue based on the waivers allowed under the PHE. Click here to register for the webinar.

We have also compiled a comprehensive COVID-19 billing and coding FAQ document of questions received during our highly-attended webinar series. Click here to download the resource.

As guidelines for coding and billing of COVID-19 services are revised regularly, Alpha II is implementing these critical changes to regulations and coding guidance—almost immediately.

Alpha II empowers precision across the revenue cycle process so you can experience reduced cost, improved cash flow, and increased revenue. Through its software-as-a-service (SaaS) solutions, Alpha II supports coding, compliance, claims editing, value-based quality reporting, and revenue analysis.

For more details about how Alpha II’s solutions can keep your coding, billing, and editing current, view our website or fill out our contact form to ask us a specific question.

Alpha II is a preferred partner of EZClaim, and their software is integrated into our medical billing software. For detailed product features or general information about EZClaim, visit our website at ezclaim.com/

Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

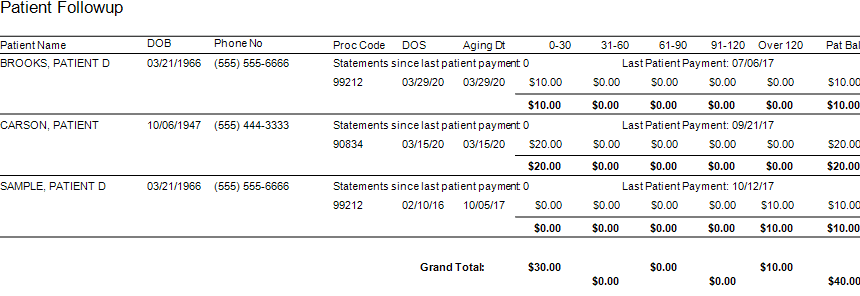

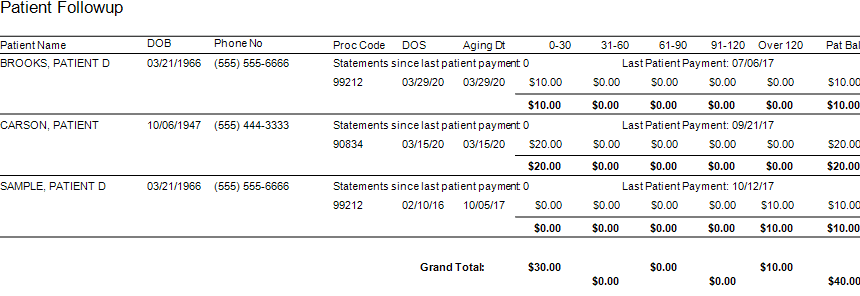

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]