Jul 3, 2022 | Partner, Trizetto Partner Solutions

It’s safe to say that healthcare practitioners are well aware of the importance of credentialing. Beyond the legalities required of practicing physicians, credentials are needed for a practice’s revenue cycle to function properly. If providers aren’t enrolled with payers, they can’t receive payment for submitted claims. It’s as simple as that.

New and existing providers are required to maintain credentials and it’s not an easy process, even for the most well-oiled office. In order to take on the most patients and collect optimal revenue, practices also need to accept a wide array of payers. In fact, there has been a 5 percent uptick in providers enrolled with 10-20 payers, according to VerityStream’s 2018 Provider Enrollment Survey. Gaining enrollment with these payers involves verifying qualifications in order to accept patients, submit claims and ensure a steady stream of cash. Administrators need to collect the educational history of providers, fill out forms and submit the applications. It sounds easy enough, right?

Think again. There are hours of administrative work needed and a high risk for human error, with any hiccup in the process likely causing delays. It’s been said that up to 85% of credentialing applications are incomplete, which could cause delayed billing, lost revenue or even audits.

When it comes to credentialing, time is money. A 2016 survey by Merritt Hawkins found that a non-credentialed doctor was losing approximately $6,600 a day. Multiply that by the total amount of physicians in a given practice, and the potential losses are staggering.

Credentialing is a necessary evil, so do you handle in house or outsource? That’s the million dollar question. Utilizing current staff resources sounds like the easy solution, but does your organization have a dedicated employee to focus on your credentialing needs? Probably not. Chances are, this employee is pulled in many directions and isn’t able to dedicate time solely to credentialing. And if you do plan to handle the process with current staff, are your employees well-versed in all payers and their processes? Factor in learning curves or potential staff turnover and the time associated with training new employees and the not-so obvious financial costs quickly add up.

So how does the average practice streamline the process and ensure that credentials are gained as painlessly as possible? The old adage “you get what you pay for” could easily apply to this scenario. Hiring an outside resource means you are essentially paying for expertise and efficiency, which will save time and money in the long run. Why wouldn’t you want to utilize expert resources with in-depth knowledge of payer and state nuances? However, before making a decision, you need to know how much your practice could save by using a third party. Knowledge is power and having an accurate picture of your potential revenue is the first step to determining the best option for your organization.

Access the credentialing ROI calculator from TriZetto Provider Solutions, a Cognizant Company, to receive an estimate of potential revenue savings. Discover the hidden costs associated with the credentialing process and see just how much revenue your practice could be leaving on the table. You’ll gain enrollments quickly and accurately, keep employee satisfaction levels high (since they won’t be burdened by the process) and ultimately, increase revenue.

Don’t allow the complicated payer credentialing and enrollment process to be a burden on your practice. The credentialing experts at TriZetto Provider Solutions have experience working with various payers and providers of all backgrounds. Our team will collect and submit information in a timely manner and perform all necessary follow-up tasks. Let us lighten your load so you can focus on patient care and growing your practice.

[Contribution by TriZetto Provider Solutions Editorial Team]

Jun 22, 2021 | BC Medical Billing, Partner

The impact of the COVID-19 pandemic will be felt in every industry for many months to come. For medical providers, they are facing some of the most challenging financial times they will ever know. Therefore, we understand that is it crucial for providers to re-assess their business and look for ways to cut costs with minimal impact on their practice of their patients.

To compound the issues providers are facing, there has been a wave of changes in recent years with new coding and telemedicine requirements that are making it difficult for provider offices to remain independent. Add on the constant rise in the cost of living while insurance reimbursements continue to decrease, and the issues get worse and worse.

Many have decided that outsourcing to a complete revenue cycle management company could:

-

- help alleviate some of the undue burdens

- cut costs

- keep providers compliant with their coding and billing

Ultimately, this allows providers to continue to focus on patient care which is their goal. As providers, you understand that revenue cycle management is a crucial part of your physician’s office. If not managed properly, it could result in an office leaving thousands of dollars on the table in unclaimed revenue. Over the years, our free audit services have allowed providers to have a free, transparent, and unbiased assessment of how their accounts receivable department functions. We are always amazed at how many providers do their billing in-house, and sometimes even when they outsource, are not aware of how much money they have sitting in their accounts receivables. Getting this knowledge is the first step to increasing revenue and efficiency.

In-house medical billers and third-party outsourced revenue cycle management companies should be giving provider offices monthly aging reports to assess their financial forecast. Each accounts receivable buckets over 60 days should hover at approximately 10% or less of the entire revenue balance. If account receivable buckets are higher than 10%, providers may be leaving money on the table, and the account may not be getting worked as providers think they are. In an effort to avoid unpaid claims and a spike in accounts receivable, outsourcing your revenue cycle management to a third-party medical billing company, such as BC Medical Billing, could help providers in countless ways. Many practices recognize that keeping their revenue cycle management optimized is key in delivering regular practice operations; however, they are not always sure how to achieve that. Outsourcing may be the solution!

Outsourcing alleviates the practice from managing a new medical billing employee, paying a salary and benefits, completing training, and onboarding protocols, and managing the lost time from a learning curve. Many providers feel that it is not a wise use of the back office executive personnel’s time to worry about finding coders in-house and then wondering if the charges are captures and billed correctly. Instead, the business office should be focusing on how to grow the providers and the physician practice.

Our free audits will help you determine if you have found the right solution for you. If not, we are always there to assist and increase the provider’s revenue.

May 18, 2021 | Denied Claims, RCM Insight

Last month we looked at tools for getting clean claims out the door on the first try. Many billers or practices stop monitoring claims once the leave the practice management program, but this is where you are likely losing money. The unfortunate truth is you need to use the tools available to you to catch rejected and denied claims to ensure proper and timely payment. Today we will look at rejections and denials, and the resources you have (or need) to work efficiently.

The terms rejection and denial are used interchangeably in the billing world but they have distinct differences, including how you are notified. Let’s start with defining the differences.

Rejected Claims

- Claims can be rejected by the clearinghouse OR the payer

- Rejections are based on submission guidelines

- Rejected claims have not been entered into your payers system for adjudication

- Notified through a claim status report (ANSI 277) that comes back into most practice management programs from the clearinghouse

- Corrections do not require a resubmission code

Denied Claims

- Claims are denied by your payer

- Denials are based on policy coverage

- Denials have been accepted for adjudication and deemed unpayable

- Notified on remittance advice (ANSI 835/ERA)

- Payers may require a resubmission code and original reference number when submitting a corrected claim

If you are using a clearinghouse and receiving your claim status reports electronically, you will be notified quickly about rejected claims. There are two ‘checkpoints’ that will look for errors. The first is your clearinghouse, the second is the payer.

At each checkpoint claims will be Rejected or Accepted, these status updates come to you through a claim status report. If your practice management system is able to process these reports (ANSI 277) your claims will be updated with the accepted or rejected information you will be able to correct any rejected claims within your practice management system. When you see an error, start with checking who has rejected your claim. This will be the point of contact if you have questions about the rejection or how to correct it. If you are not already, make it a daily task to get your reports, correct any rejected claims, and resubmit those claims.

When a claim has been accepted by your clearinghouse and the payer it enters the adjudication system. This is where the payer will make a determination on payment based on the members coverage and your contract. The denials will appear on your remittance advice with a payment or as a zero dollar payment, indicating that they have reviewed your claim and they have determined no payment is applicable. If you are enrolled with you payer for electronic remittance advice (ERA) this file will come electronically and your practice management system will be able to list or identify denied claims. These claims will either need to be researched further for clarification on the denial or written off. It is vital that your practice management system can handle these scenarios appropriately so you do not lose money for payable services.

This is another scenario where technology can seem scary. However, efficiently monitoring and working is well worth the learning curve. If you are already sending electronically and not using the claim status report or electronic remittance advice – coordinate with your clearinghouse and practice management system to find out how these reports can save you time and money.

If you would like more information on creating workflows for rejections, denials, or enrolling with a clearinghouse, let RCM Insight help! Visit us at www.rcminsight.com to request a consultation.

[Contribution by Stephanie Cremeans with RCM Insight]

Apr 5, 2021 | EZClaim Premier, Features, Medical Billing Software Blog

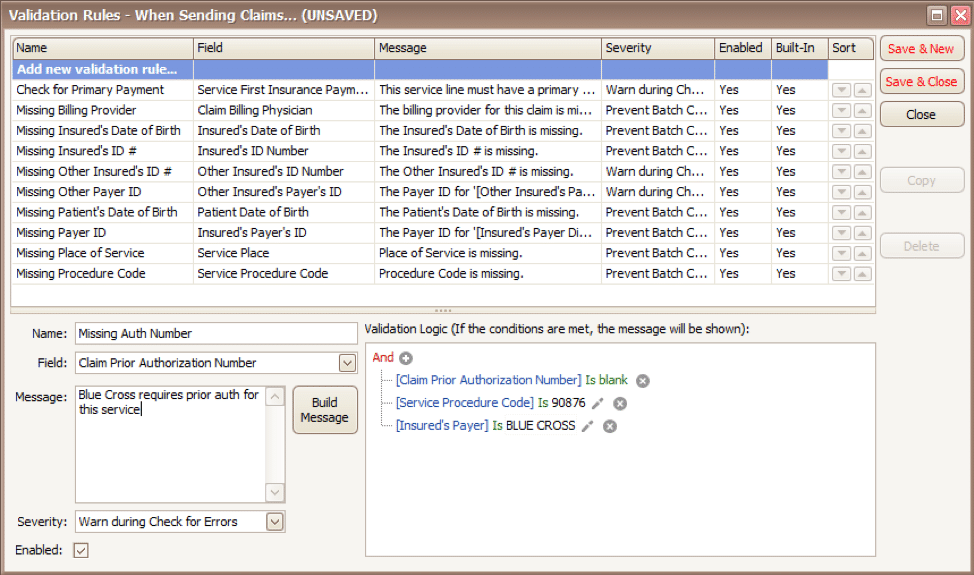

EZClaim medical billing software has many features built into the program to help you submit clean claims for quick payment and some that can be customized to fit your specific needs. This post will look at the ability to create customized validation rules.

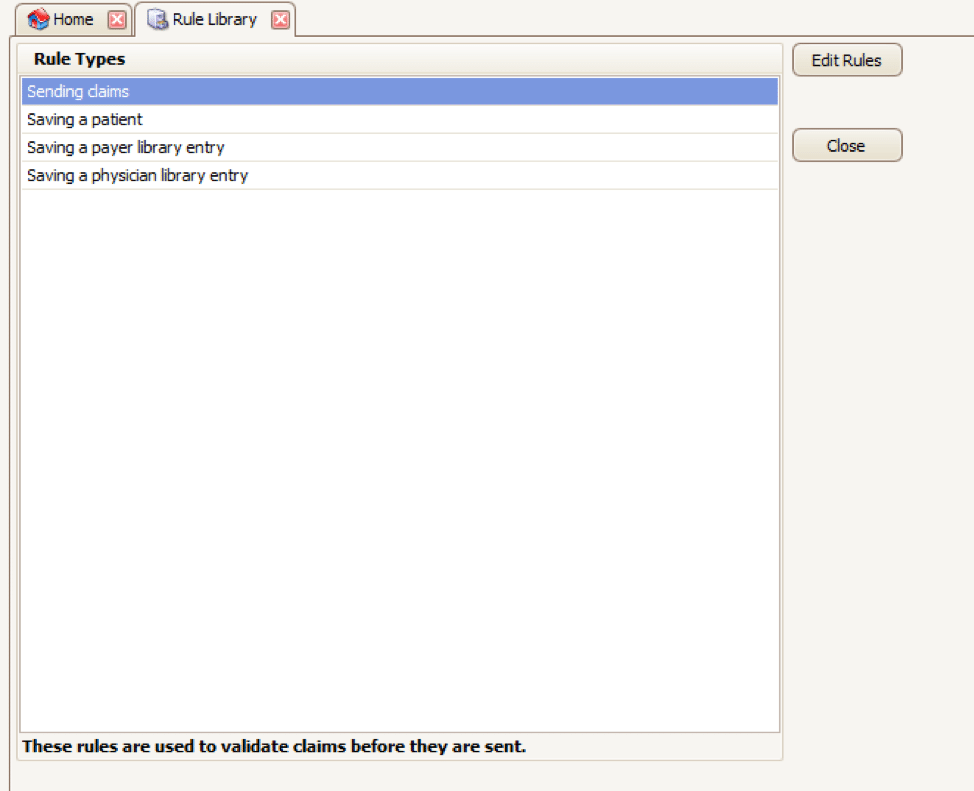

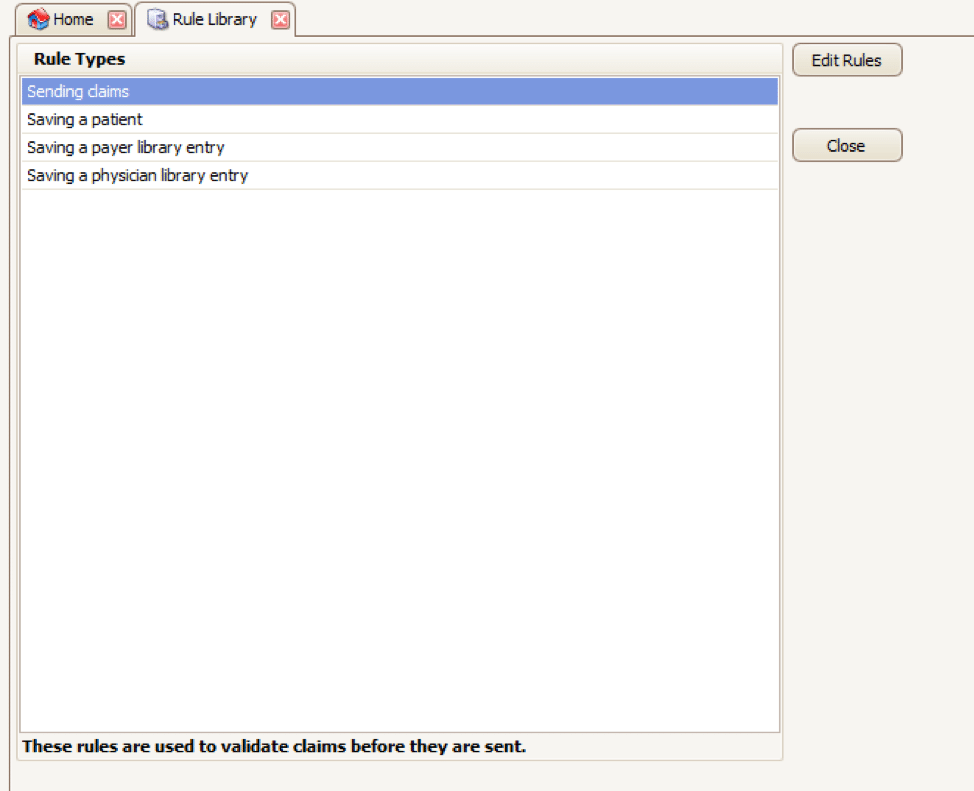

Your EZClaim program already includes standard validation rules. To access these rules and create your own, press CTRL-ALT-V. This will open the Rule Library.

Here you will find four different types of rules to work with, rules related to:

- Sending claims

- Saving a patient

- Saving a payer library entry

- Saving a physician library entry

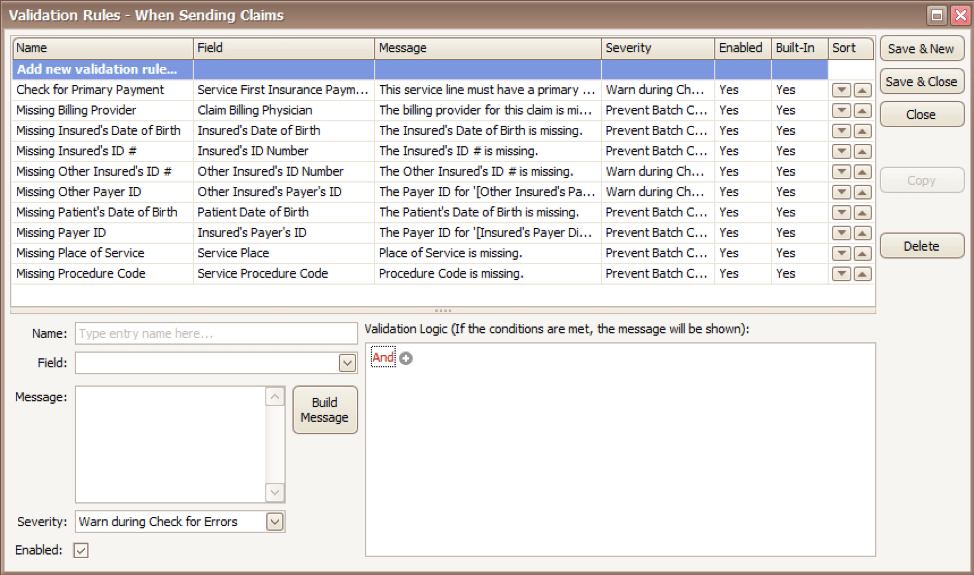

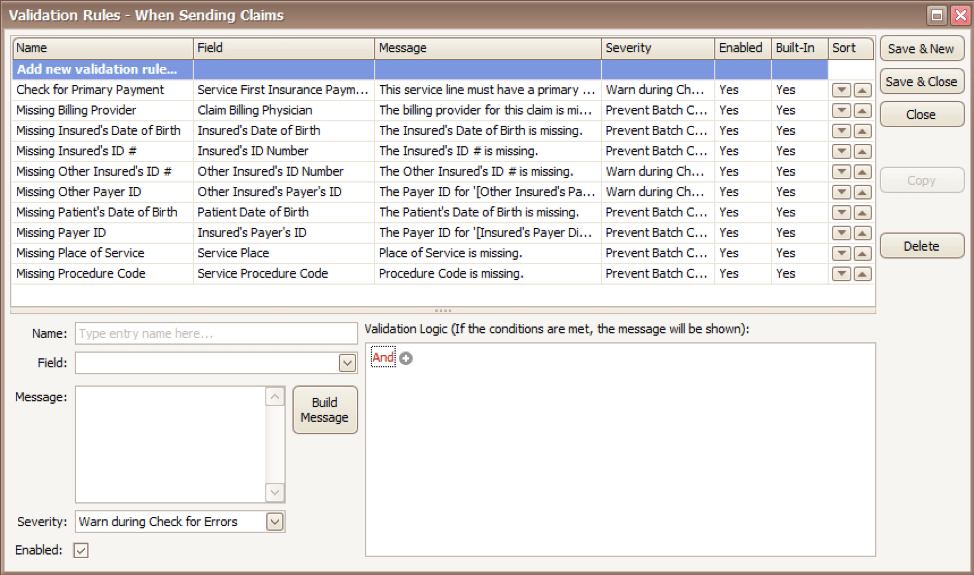

Now, click on the rule type you would like to work with and click Edit Rules. A list of rules that are already in the program will appear, along with the option at the top to “Add new validation rule“.

To get started, you will fill in the fields on the bottom left side of the screen:

Name: Name the rule anything you would like

Field: This is the field in Premier that you want to validate

Message: This is the message that will show when the error is encountered (consider using casual wording or extra punctuation so it is easily identified as a custom rule rather than a default rule)

Severity: Do you want the program to simply warn you that there may be an error or stop you from completing the task?

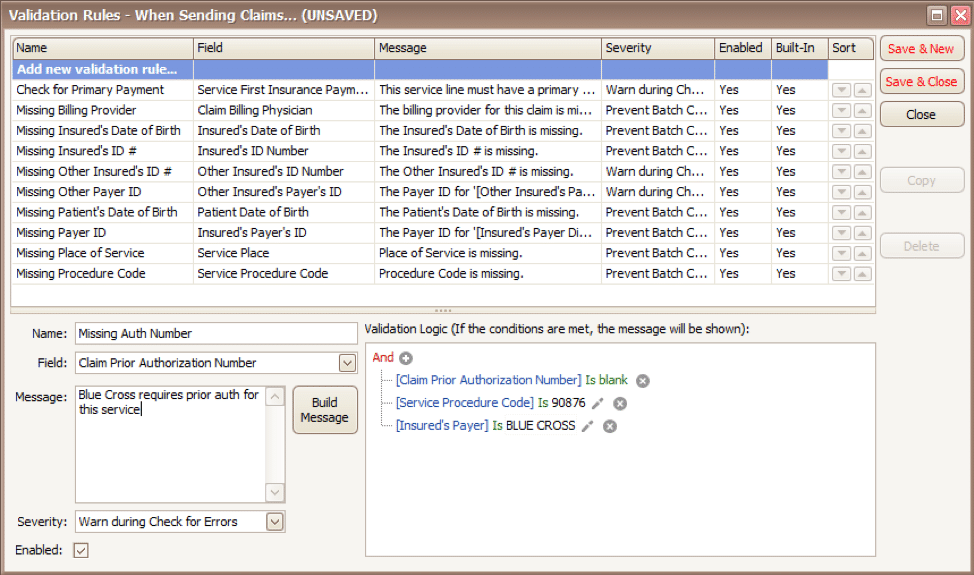

Next, you will build the logic for the validation of the field you have named above. In the example below, the rule has been created to warn users if ALL the following statements are true:

- Authorization Number is blank

- Procedure Code is 90876

- Payer is Blue Cross

Before you begin working with your validation rules it is extremely important to keep the following in mind:

- Rules are created to check for bad or missing data, not to confirm good data.

- Rules in the Sending Claims area may prevent batches from being created.

- If you wish to bypass a built-in validation rule you may disable it, if you want to customize it you can Copy the rule, update, and disable the original rule.

- Rules are the sole responsibility of the practice, EZClaim cannot troubleshoot custom validation rules.

As you can see, custom rules allow you to be very specific and can include multiple data points. Learning to use validation rules can be tricky and may take a few tries to get the rule built correctly. However, once you have the rule in place you can avoid payment delays and needing to resubmit claims.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Apr 5, 2021 | Medical Billing Software Blog, Waystar

For many providers, medical claim denials are one of the single biggest drains on revenue. When you consider that working just one denial costs about $25, knowing why claims are being denied and how to prevent them in the future isn’t a luxury—it’s a necessity.

Automation and advanced analytics can take much of the burden off your billing team by helping you identify potential denial triggers, adapt to constantly changing payer guidelines, and uncover actionable trends in your claim data.

Waystar’s Denials by the Numbers:

- 5-10% average denial rate amount physician practices

- 90% of denials are preventable

- 76% of providers say denials are their biggest RCM challenge

[ Note: View or download Waystar’s “Defeat Denials with Data” white paper here ]

Waystar, a partner of EZClaim, integrates easily with its medical billing software, creating a seamless exchange of claim, remit, and eligibility information. To learn more about defeating medical claim denials, or to add Waystar as your clearinghouse, visit this page.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article and white paper contributed by Waystar ]