Jul 3, 2022 | Partner, Trizetto Partner Solutions

It’s safe to say that healthcare practitioners are well aware of the importance of credentialing. Beyond the legalities required of practicing physicians, credentials are needed for a practice’s revenue cycle to function properly. If providers aren’t enrolled with payers, they can’t receive payment for submitted claims. It’s as simple as that.

New and existing providers are required to maintain credentials and it’s not an easy process, even for the most well-oiled office. In order to take on the most patients and collect optimal revenue, practices also need to accept a wide array of payers. In fact, there has been a 5 percent uptick in providers enrolled with 10-20 payers, according to VerityStream’s 2018 Provider Enrollment Survey. Gaining enrollment with these payers involves verifying qualifications in order to accept patients, submit claims and ensure a steady stream of cash. Administrators need to collect the educational history of providers, fill out forms and submit the applications. It sounds easy enough, right?

Think again. There are hours of administrative work needed and a high risk for human error, with any hiccup in the process likely causing delays. It’s been said that up to 85% of credentialing applications are incomplete, which could cause delayed billing, lost revenue or even audits.

When it comes to credentialing, time is money. A 2016 survey by Merritt Hawkins found that a non-credentialed doctor was losing approximately $6,600 a day. Multiply that by the total amount of physicians in a given practice, and the potential losses are staggering.

Credentialing is a necessary evil, so do you handle in house or outsource? That’s the million dollar question. Utilizing current staff resources sounds like the easy solution, but does your organization have a dedicated employee to focus on your credentialing needs? Probably not. Chances are, this employee is pulled in many directions and isn’t able to dedicate time solely to credentialing. And if you do plan to handle the process with current staff, are your employees well-versed in all payers and their processes? Factor in learning curves or potential staff turnover and the time associated with training new employees and the not-so obvious financial costs quickly add up.

So how does the average practice streamline the process and ensure that credentials are gained as painlessly as possible? The old adage “you get what you pay for” could easily apply to this scenario. Hiring an outside resource means you are essentially paying for expertise and efficiency, which will save time and money in the long run. Why wouldn’t you want to utilize expert resources with in-depth knowledge of payer and state nuances? However, before making a decision, you need to know how much your practice could save by using a third party. Knowledge is power and having an accurate picture of your potential revenue is the first step to determining the best option for your organization.

Access the credentialing ROI calculator from TriZetto Provider Solutions, a Cognizant Company, to receive an estimate of potential revenue savings. Discover the hidden costs associated with the credentialing process and see just how much revenue your practice could be leaving on the table. You’ll gain enrollments quickly and accurately, keep employee satisfaction levels high (since they won’t be burdened by the process) and ultimately, increase revenue.

Don’t allow the complicated payer credentialing and enrollment process to be a burden on your practice. The credentialing experts at TriZetto Provider Solutions have experience working with various payers and providers of all backgrounds. Our team will collect and submit information in a timely manner and perform all necessary follow-up tasks. Let us lighten your load so you can focus on patient care and growing your practice.

[Contribution by TriZetto Provider Solutions Editorial Team]

Apr 5, 2021 | EZClaim Premier, Features, Medical Billing Software Blog

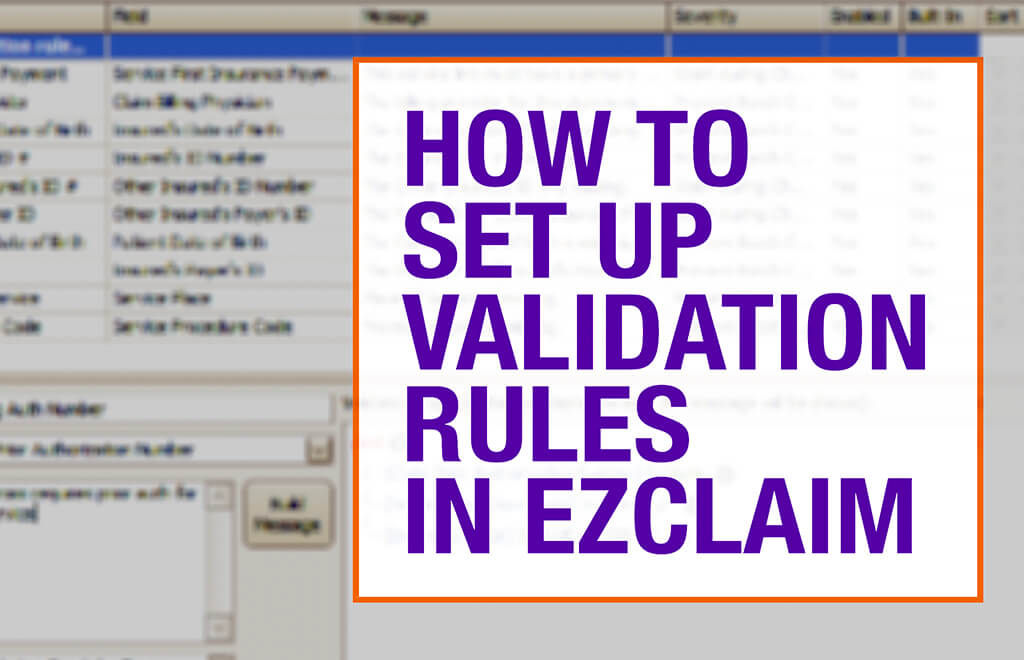

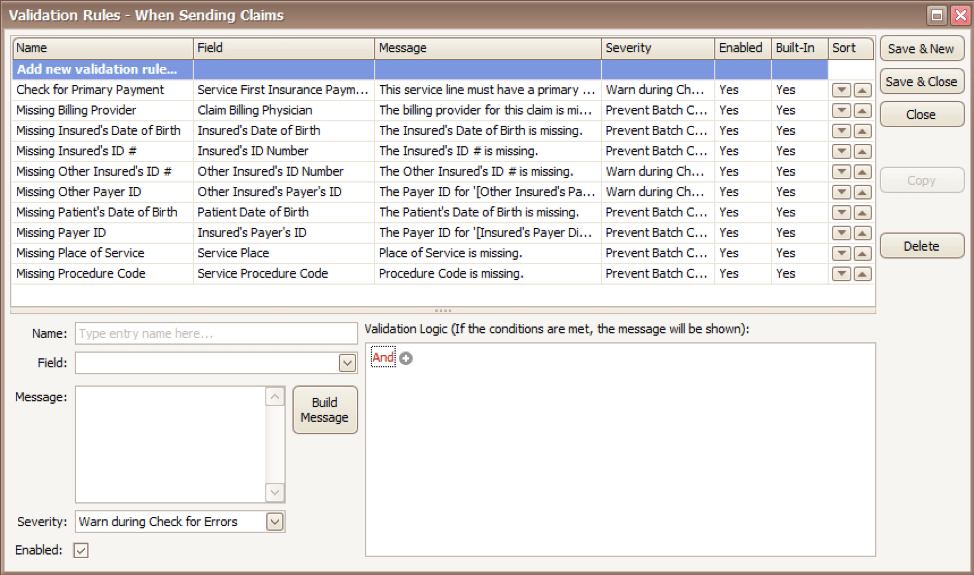

EZClaim medical billing software has many features built into the program to help you submit clean claims for quick payment and some that can be customized to fit your specific needs. This post will look at the ability to create customized validation rules.

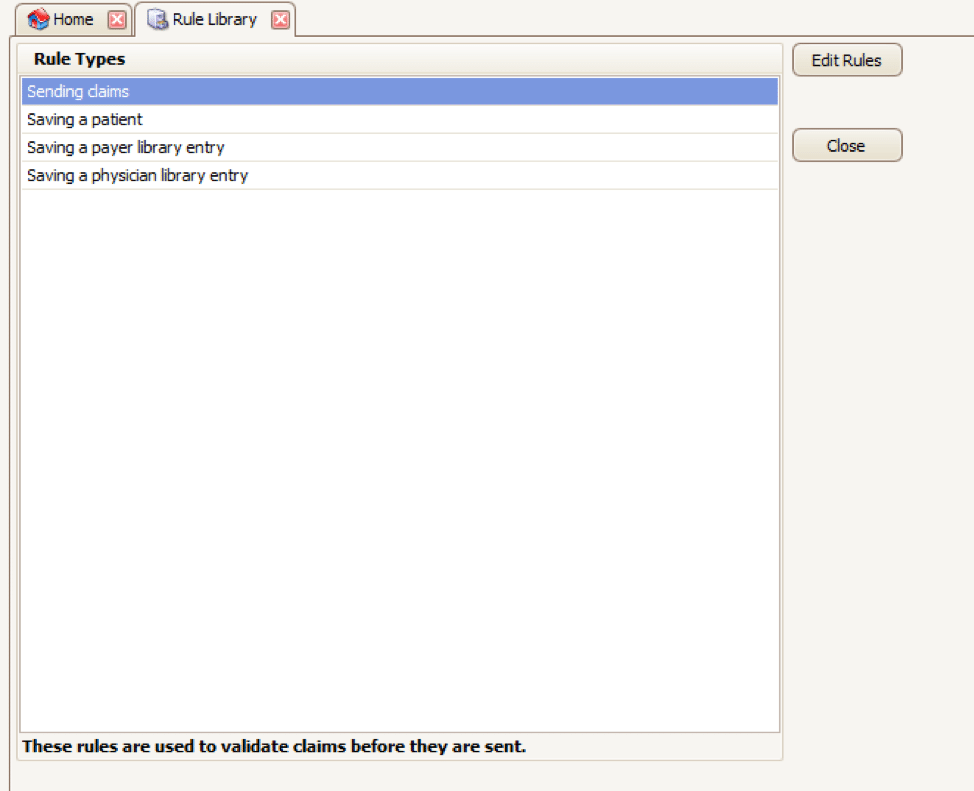

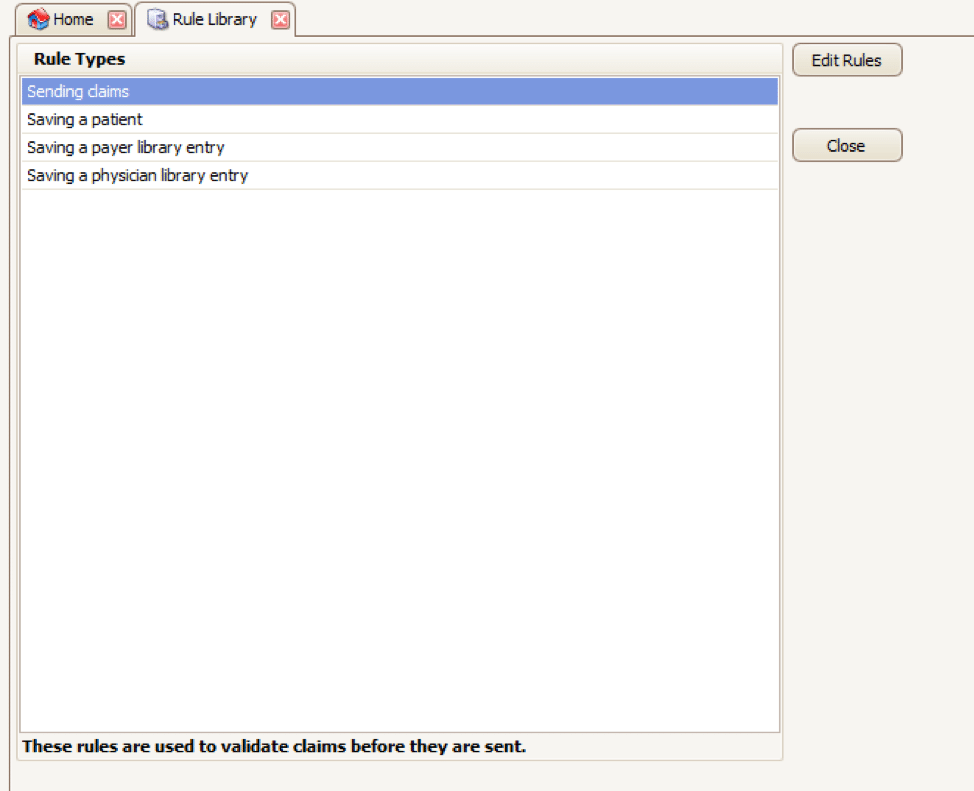

Your EZClaim program already includes standard validation rules. To access these rules and create your own, press CTRL-ALT-V. This will open the Rule Library.

Here you will find four different types of rules to work with, rules related to:

- Sending claims

- Saving a patient

- Saving a payer library entry

- Saving a physician library entry

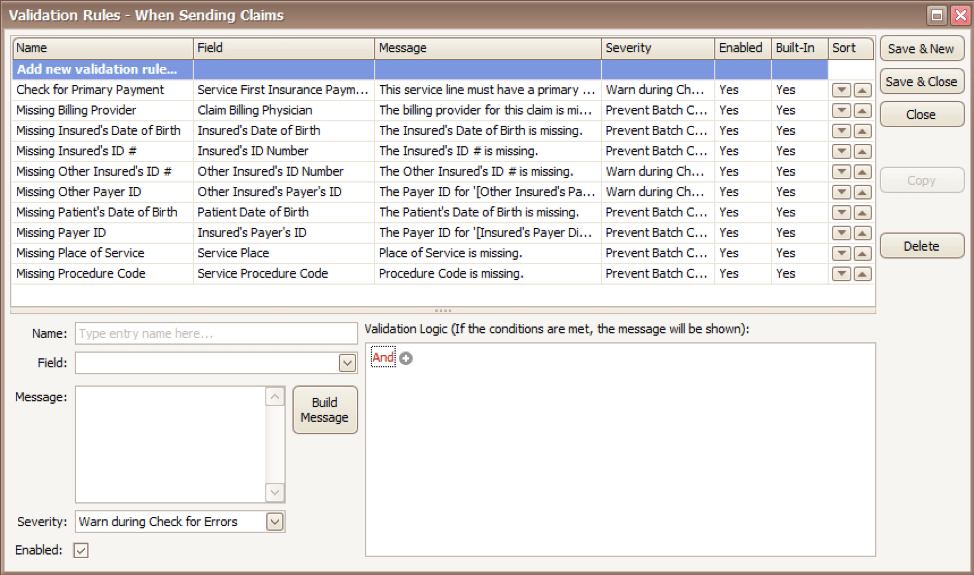

Now, click on the rule type you would like to work with and click Edit Rules. A list of rules that are already in the program will appear, along with the option at the top to “Add new validation rule“.

To get started, you will fill in the fields on the bottom left side of the screen:

Name: Name the rule anything you would like

Field: This is the field in Premier that you want to validate

Message: This is the message that will show when the error is encountered (consider using casual wording or extra punctuation so it is easily identified as a custom rule rather than a default rule)

Severity: Do you want the program to simply warn you that there may be an error or stop you from completing the task?

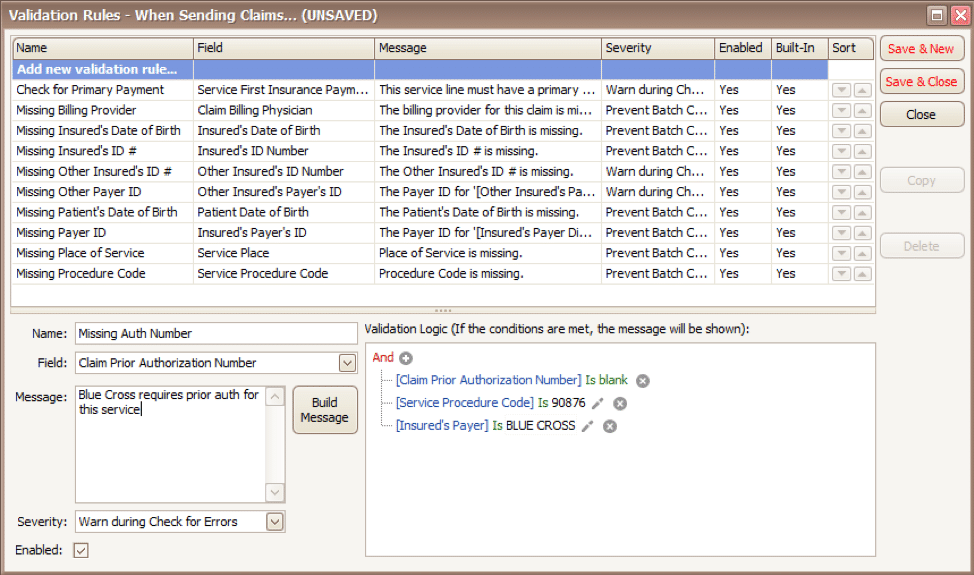

Next, you will build the logic for the validation of the field you have named above. In the example below, the rule has been created to warn users if ALL the following statements are true:

- Authorization Number is blank

- Procedure Code is 90876

- Payer is Blue Cross

Before you begin working with your validation rules it is extremely important to keep the following in mind:

- Rules are created to check for bad or missing data, not to confirm good data.

- Rules in the Sending Claims area may prevent batches from being created.

- If you wish to bypass a built-in validation rule you may disable it, if you want to customize it you can Copy the rule, update, and disable the original rule.

- Rules are the sole responsibility of the practice, EZClaim cannot troubleshoot custom validation rules.

As you can see, custom rules allow you to be very specific and can include multiple data points. Learning to use validation rules can be tricky and may take a few tries to get the rule built correctly. However, once you have the rule in place you can avoid payment delays and needing to resubmit claims.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Apr 5, 2021 | Medical Billing Software Blog, Waystar

For many providers, medical claim denials are one of the single biggest drains on revenue. When you consider that working just one denial costs about $25, knowing why claims are being denied and how to prevent them in the future isn’t a luxury—it’s a necessity.

Automation and advanced analytics can take much of the burden off your billing team by helping you identify potential denial triggers, adapt to constantly changing payer guidelines, and uncover actionable trends in your claim data.

Waystar’s Denials by the Numbers:

- 5-10% average denial rate amount physician practices

- 90% of denials are preventable

- 76% of providers say denials are their biggest RCM challenge

[ Note: View or download Waystar’s “Defeat Denials with Data” white paper here ]

Waystar, a partner of EZClaim, integrates easily with its medical billing software, creating a seamless exchange of claim, remit, and eligibility information. To learn more about defeating medical claim denials, or to add Waystar as your clearinghouse, visit this page.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article and white paper contributed by Waystar ]

Apr 5, 2021 | Medical Billing Software Blog, Revenue, Support and Training, Trizetto Partner Solutions

In the world of healthcare revenue cycle management, there are numerous scenarios that can put a stranglehold on your revenue if you’re not prepared. With the COVID-19 pandemic causing varying degrees of change in inpatient volumes and visits, and telemedicine coming further into play, physicians and their practices are having to quickly navigate the nuances of their financial well-being. A practice may be buttoned up from the time the patient walks in the door, but what happens after the visit will determine when the practice will get paid. This element of the revenue cycle starts with coding. Here are five medical coding challenges that will ruin your bottom line.

1. Coding to the Highest Specificity

Missing data on a claim relative to the patient’s diagnosis and procedure can easily cause a rise in denials once received by the payers, resulting in potentially thousands of dollars in write-offs. Medical coders are responsible for coding patients’ claims to the highest level of specificity, ensuring the appropriate CPT, ICD-10-CM, and HCPCS codes are applied based on the patient’s chart from the day’s services.

COVID-19 and telemedicine are frequently bringing on new codes and code sets, all with different variations and modifiers to make the matter even more complex. Medical coders spend a lot of time researching and learning new codes, but every year – and throughout the year – changes and updates are made. Payers don’t only want to know the diagnosis and the treatment; they want to know the cause as well. The Coronavirus Aid, Relief, and Economic Security Act passed in March of 2020 allows for an additional payment from Medicare of 20 percent for claim billed for inpatient COVID-19 patients, however, it was later indicated that a positive COVID-19 test must be stored in the patient’s medical records in order to be eligible for this payment. Being able to stay on top of codes specific to the patient’s diagnosis at treatment is more difficult than ever before.

2. Upcoding

While code specificity is important, so too is ensuring the claims do not contain codes for exaggerated procedures, or even procedures that were never performed, resulting in reimbursement for these false procedures. This seems logical enough, but upcoding can easily occur as a result of human error, misinterpretation of a physician’s notes, or lack of understanding of how to appropriately assign the thousands of ICD-10-CM codes in existence. To add to the pressure, the Office of the Inspector General issued a plan with objectives to prevent fraud and scams, and remedy misspending of COVID-19 response and recovery funds.

Much like under-coding or not providing enough data on the patient’s visit can create issues, upcoding can be a major contributor to financial loss for a practice. Questionable claims can be denied and sent back for corrections and appeals, but upcoding can have more serious ramifications outside of paper-pushing between coders and payers.

Whether it’s making sure the codes are in accordance with the care provided, understanding the code sets that apply for each procedure, or comprehension of the medical record, refraining from upcoding will help ensure a sturdy and compliant revenue stream.

3. Missing or Incorrect Information

There’s a common theme to coding challenges, and that’s having the sufficient information necessary. This information typically is pulled from a patient’s chart or record of a visit, which is often completed by the attending physician. However, even when a claim is submitted, providing required information relative to the procedure to the payer is critical as well. Situations such as failure to report time-based treatments (such as anesthesia, pain management, or hydration treatments) or reporting a code without proper documentation can result in denials.

Furthermore, information in a patient’s electronic health record may also contain inaccurate information. Keystrokes and other human errors can cause these situations to flare up, and it takes a diligent, thoughtful coder to read between the lines and ensure claims have the appropriate information.

4. Timeliness of Coding

The Medical Group Management Association (MGMA) suggested in their 2018 Setting Practice Standards report that a Primary Care Physician should maintain a claim submission rate of 3.11 days after the date of service, but it is becoming increasingly difficult for practices to sustain anything close to this rate. Constant changes to code sets, an increased focus on submitting claims with sufficient and compliant information, and the requirement to code claims to the highest level of specificity, can easily delay the submission by days or weeks.

Nevertheless, delays in coding and submitting claims can cause major lags in payment and substantial loss in revenue. Insurance payers have statutes of limitations that require claims to be submitted anywhere from 120 to just 60 days after the date of service. Simply put – the more time spent coding the claim, the later it will be submitted, thus increasing the odds that the claim will be denied. Expert coders are aware of this and do everything in their power to get coded claims out the door.

5. Staffing Shortages

However, finding experts well versed in coding claims quickly, accurately and in compliance with the False Claims Act is not always an easy task. As you can imagine, the increasing need for care within the senior population is causing a rise in claim volumes, and trying to find a team of coders who know the ins and outs of complex ICD-10-CM coding can easily cause a bottleneck in the revenue cycle. Health executives expressed their struggles to find talent back in 2015, and some forecasts expect a decline in commercial payments by 2024 to further hamper a C-suite’s ability to manage labor costs. The ramifications of incorrect coding are still a key topic of discussion to this day.

The time has come for practices to begin looking outside of their organization for coding support. How is your practice planning to tackle the coding conundrum? When choosing a partner for your medical coding needs, you need to pick an expert to help your practice stay on target. TriZetto Provider Solutions, a Cognizant Company, has available highly-trained, AAPC & AHIMA certified coders with the experience of getting the details right the first time and understand the importance of coding to the medical practice.

For more information about TriZetto Provider Solutions, a partner of EZClaim, visit their website, contact them, or give them a call at 800.969.3666.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution of the TriZetto Provider Solutions Editorial Team ]

Apr 5, 2021 | Claim Status Inquiry, Claims, Denied Claims, RCM Insight

If a medical billing program has “scrubbing,” why did my medical billing claim still get denied? It is a common question that we are going to answer today.

First, let’s get a better understanding of the words we are talking about. In the medical billing world, validation and scrubbing tend to be used interchangeably. While they are similar – they are not actually the same. Understanding what you have and what you need will help you submit ‘clean’ claims.

According to Technopedia, data validation checks for the integrity and validity of data and ensures the data complies with the requirements. So, what requirements? Often people assume that this means payer requirements, but that is typically not standard. Validation rules are built into your practice management software and can be used for several points. Following are some common rules you may find in your program:

- Ensure NPI‘s and Tax IDs are the appropriate lengths

- Ensure patients date of birth is entered

- Ensure that a procedure code and place of service are present on each claim

While these scenarios are standard across the industry, there may be other situations that a validation rule can help. Some programs will allow you to create custom rules for your practice. A customized validation rule will allow you to create a rule for a payer requirement. For instance, you could create a rule to prevent the following:

- Do you have a code that always requires a modifier, but only for a specific payer?

- Work with pediatrics and always need the ‘relationship to insured’ to read something other than self

- How about insurance ID numbers that are a specific alpha-numeric combo, like 3 letters followed by 9 digits?

Keep in mind, if you are creating validation rules the program will make sure that the criteria are met based on the rule entered into your software. When creating custom rules, it is important to note that this will not verify payer billing guidelines. You will need to obtain information directly from your payer to create a rule that coincides with their policies.

Once any validation errors have been addressed your claims will go to the clearinghouse you are working with. Most clearinghouses offer claim scrubbing for an additional fee. Technopedia defines data scrubbing as the procedure of identifying and then modifying or removing incomplete, incorrect, inaccurately formatted, or repeated data.

Claim scrubbing is available in several ways. It may be used within your practice management system, your clearinghouse, or even a third-party vendor. Claim scrubbing services can vary greatly in what they are looking for.

Once the claim has left your practice management system it will likely go through at least 2 scrubbing programs—one with the clearinghouse and one with your payer, prior to accepting the claim for processing. When claims are found to have an error, these results are sent back through a Claim Status Report (ANSI 277 file or a human-readable text file). This report will include information about why the claim cannot be processed. This report will also indicate whether it is the clearinghouse or the payer that is rejecting the claim. If you have further questions about the rejection, you will need to contact the entity that has rejected it.

Checking the Claim Status Reports on a regular basis will help you correct the errors and resubmit in a timely manner. In addition, the information you have gathered from the rejections can be used to update internal processes or create customized validation rules to prevent future rejections for the same error–saving you time and money!

RCM Insight is a medical billing company that uses EZClaim’s medical billing software. For any details that have to do with claims validation and “scrubbing,” contact RCM Insight directly.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution by Stephanie Cremean’s with RCM Insights ]