Jul 14, 2020 | Health eFilings, MIPS Reporting, Partner, Revenue

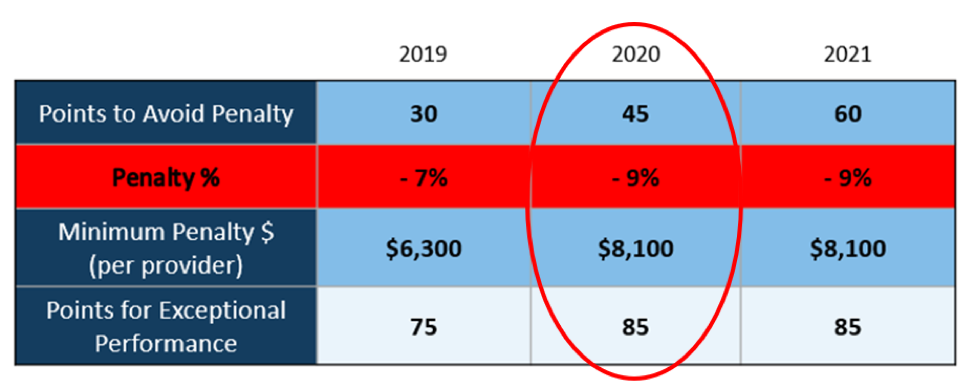

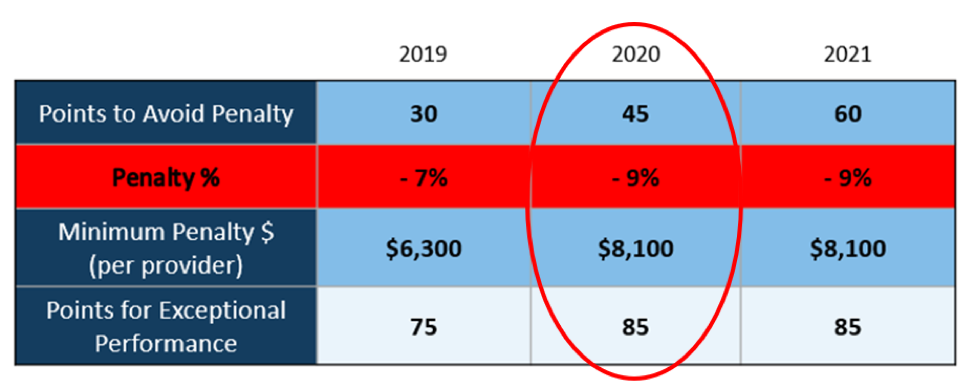

The 2020 MIPS reporting is already half done, and given that MIPS (Merit-based Incentive Payment System) is a points-based program, the goal is to earn as many points as possible to avoid this year’s 9% penalty and potentially even earn a positive payment adjustment. However, earning the 45 points necessary to avoid the penalty for the 2020 reporting period will be no easy feat. With over half of the reporting period already behind us, it is imperative you ACT NOW so you don’t find yourself in a position later in the year that you can’t recover from in terms of earning points.

With all the complexities and nuances of the program, it’s challenging to know what you can do to impact your score. Here are three critical actions to take right now so that you will still optimize your ability to earn points for the 2020 reporting period:

1. Focus on the Quality Category

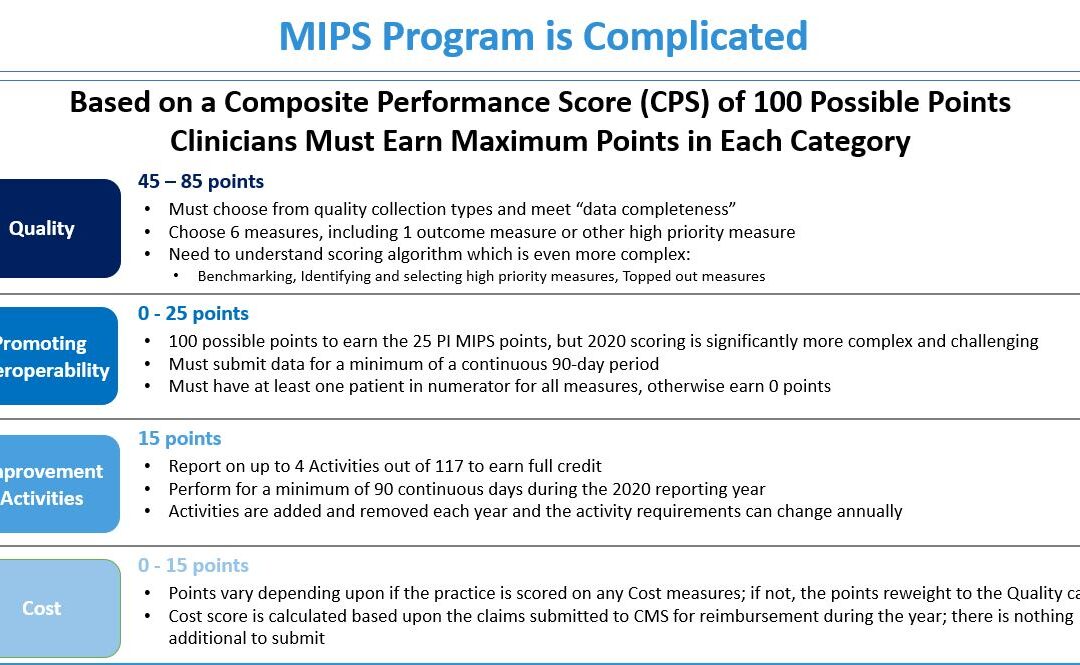

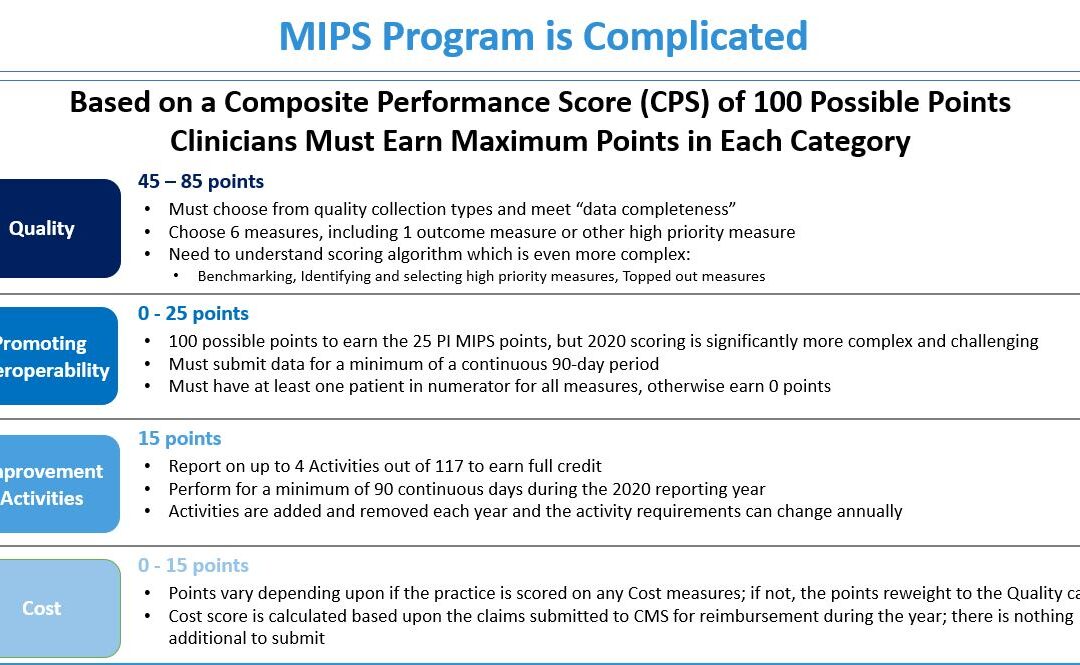

There are various points available within each of the categories and the Quality Category has the most points associated with it. Based on a number of factors, the category is worth anywhere from 45 to 85 points. This is a critical category to be focused on throughout the year, so now is the time to ensure that you are tracking all relevant data so that it can be properly reported on within your submission.

2. Understand the Timeframe Requirements

Two of these categories, Promoting Interoperability and Improvement Activities, have timeframe requirements where you must perform for a minimum of 90 continuous days. These are not easy categories in which to be successful and so if you wait too long in the year you will find it impossible to put the right actions in place in order to complete the activities necessary to earn any of the points in these categories.

3. Choose the Right Reporting Methodology

Not all reporting methodologies are the same and the reporting methodology you select has a significant impact on the points you could earn. Additionally, there is strategic maneuvering that can be done throughout the reporting period with exemptions and reweighting of points that can set you up to optimize your performance and your score. Therefore, you must select a reporting partner that will help you earn the most points available and leverages technology to facilitate the ease, accuracy, and completeness of tracking and reporting to maximize your score. Reporting via a CEHRT, like Health eFilings, is the best approach because it optimizes the points that could be earned and therefore, maximizes Medicare reimbursements.

Health eFilings is a certified EHR technology (CEHRT) and the national leader in automated MIPS reporting. Their cloud-based ONC-certified software fully automates the reporting process. Because Health eFilings’ service is an end-to-end electronic solution that doesn’t require any IT resources, administrative support, or workflow changes from you, the practice will save significant time while maximizing its financial upside.

To learn more about how to properly perform your 2020 MIPS reporting, contact EZClaim’s partner, Health eFilings, so they can help before it’s too late!

For details and features about EZClaim’s medical billing software, or general information about the company, visit their website.

[ Written by Sarah Reiter, SVP Strategic Partnerships, Health eFilings ]

May 12, 2020 | Electronic Billing, EZClaim Premier, Features

A recent medical billing webinar on Telehealth that EZclaim hosted is now available to review.

On April 30th, EZClaim hosted a Telehealth Updates Webinar for our clients with guest speaker Sandy Giangreco Brown – Director of Coding and Revenue Integrity Health Care at CliftonLarsonAllen, LLP

We had one of the largest viewing audiences 101 active attendees in the session. Sandy shared informative billing codes and direct links to update hands-on information for billers actively coding Telehealth sessions. For those of you who missed it, we have provided on our website the recorded session ezclaim.com/webinars and can provide the presentation slides too! Just send a request to sales@ezclaim.com

We continue to get views of this presentation and look forward to hosting more hot topics with the CLA Team.

With the onset of COVID-19 came a great opportunity for clinics and hospitals to offer Telehealth and Communication Technology Based (CTSB) services. The Centers of Medicare and Medicaid Services, or CMS, have provided many updates to the available services that can be provided and billed to the patients to help practices not only stay afloat financially but also and most importantly, to keep their staff safe and provide excellent care to their patients!

There were new guidelines released even after this webinar on 4/30/2020 (which can be found here – https://www.cms.gov/files/document/se20016.pdf, and now includes audio-only Telehealth for services such as psychotherapy, tobacco cessation and medical nutrition counseling as well as diabetes self-management training. CMS is also increasing the payments for the Audio Only services from $14-$41 nationally to $46-$110.

As of April 30, 2020, in order to bill Telehealth, RHCs are now required to bill the G2025–CG–95 from January 27, 2020, to June 30, 2020. Then from July 1, 2020, to the end of the PHE, they will be billing the G2025 with an optional 95 modifier, per CMS SE20016 Medicare Learning Network Transmittal.

FQHCs will need to report three (3) codes for their Telehealth Services:

- G0467 (or other appropriate FQHC specific payment code)

- 99214–95 (or other FQHC PPS Qualifying Payment Code)

- G2025–95

CLA is on the frontlines and closely monitoring and analyzing activities related to Telehealth and other virtual health regulations

CMS Telehealth fact sheet, Frequently Ask Questions:

As your practice adjusts to Telehealth going forward, EZclaim’s medical billing solution can help you simplify patient billing and help you get paid for Telehealth visits. (Our recent medical billing webinar on Telehealth may just help you better understand the current situation).

So, to help you investigate how EZclaim’s medical billing solution may work for you, either schedule a one-on-one consultation with our sales team or download a FREE TRIAL to check out the software yourself. For additional information right now, contact EZclaim’s sales team at 877.650.0904 or send an e-mail to sales@ezclaim.com.

[Contributed by Sandy Giangreco Brown – Director of Coding and Revenue Integrity Health Care, CliftonLarsenAllen LLP]

Apr 13, 2020 | Live Compliance, Medical Billing Software Blog, Partner

Since CMS HHS just updated their Telehealth regulations to adjust to the COVID-19 environment—including having a remote workforce—we wanted to provide a clear update to independent physicians and billers to advise them of the fast-moving changes of many regulations, and what to expect in the near future.

It is important to note that CMS has recently announced that new and established patients have availability to Telehealth, and HHS OIG is providing flexibility for healthcare providers to reduce or waive cost-sharing for Telehealth visits paid by federal healthcare programs. CMS is also expanding Telehealth services to people with medicare.

As a result, please see the below video from CMS which highlights the Medicare Coverage and Payment of Virtual Services and Telehealth.

In addition, we’ve included a few key questions and answers below. If you have further questions about Telehealth and your compliance, contact Jim Johnson with Live Compliance at Jim@LiveCompliance.com or (980) 999-1585.

1. Who can provide Telehealth services?

-

- Physicians

- Nurse Practitioners

- Physician assistants

- Nurse-midwives

- Certified nurse anesthetists

- Clinical psychologists

- Registered dietitians

- Nutrition professionals

2. What services can a medicare beneficiary receive through Telehealth?

-

- Evaluation and management visits (common office visits)

- Mental health counseling

- Preventive health screenings

- More than 80 additional services

3. What are the types of virtual services?

-

- Medicare Telehealth visits

- Virtual check-ins

- E-visits

- Telephone services

Live Compliance is an EZclaim premier partner for HIPAA compliance and is integrated into EZclaim’s billing solution.

If you have any further questions about Telehealth regulations and your compliance, e-mail Jim Johnson at Live Compliance at Jim@LiveCompliance.com, or phone him at (980) 999-1585.

[ Contribution by Jim Johnson with the Live Compliance ]

Apr 13, 2020 | Health eFilings, Partner

There WILL NOT be any changes to the MIPS Program in 2020, so all payers must be submitted and a minimum of 45 points must be earned to avoid the 9% penalty.

On March 23, 2020, CMS made it perfectly clear that MIPS Program is not going away in 2020. It also reiterated that the data requirements and thresholds in place for the 2020 program have not changed. Additionally, Promoting Interoperability and Improvement Activities must be done for the required durations, or no points will be earned for those categories.

To put this in context, while the stakes have been raised every year, the final ruling for the 2020 reporting period is the most complex to-date, further increasing the stress, burden, and financial risk for over 900,000 clinicians who bill Medicare Part B. Failure to comply or earn enough points for the 2020 reporting period will result in an automatic 9% penalty on every Medicare Part B claim paid for an entire year. This equates to a minimum of a $8,100 per provider hit to the bottom line.

Given the unprecedented time when everyone’s bottom line is at risk, now is the time to get a handle on what’s at risk with the MIPS program and proactively engage to ensure your bottom line is not further jeopardized by being assessed a 9% penalty. It can be challenging to know exactly what you need to do to earn points, optimize your score, and protect your Medicare reimbursements, as there are many commonly misunderstood aspects and nuances with the MIPS program.

So, with what is at stake and the inherent complexity in earning points, it is critical that you select the right methodology and partner who can help you maximize reimbursements and protect your bottom line. Not all reporting methodologies are the same.

Health eFilings‘ CEHRT is the best choice for a reporting partner. Their cloud-based ONC-certified software fully automates the process and does all the work without any IT resources, administrative support, and workflow changes from the practice. Health eFilings service is an end-to-end electronic solution that will save significant time, be a turn-key submission process, and maximize the financial upside for providers.

As more than 25% of the 2020 reporting period is behind us, now is the time to act while there is still plenty of time to positively impact your results and points earned.

Health eFiling provides the nation’s only fully automated solution for MIPS compliance and is integrated with EZclaim’s billing solution. Click on the following link for more details: https://healthefilings.com/ezclaim

[Contribution by Sarah Reiter with the Senior VP of Strategic Partnerships]