Jun 10, 2020 | Features, Medical Billing Software Blog

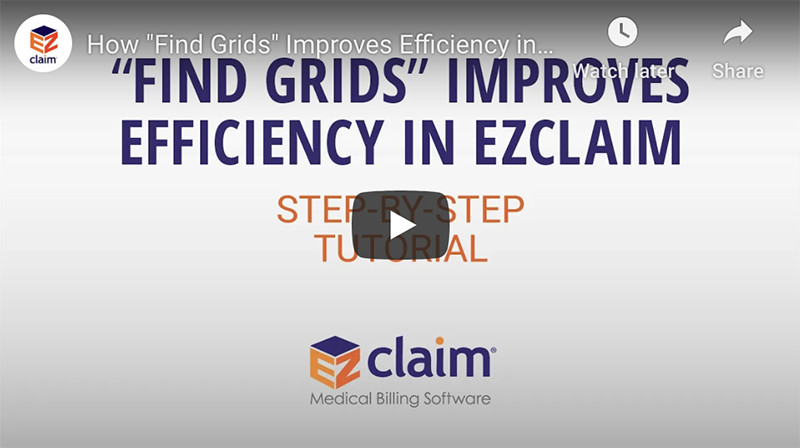

Whether you are an experienced EZClaim user looking to learn a new trick or just starting out with the software, “Find Grids” simplifies medical billing within the EZClaim software.

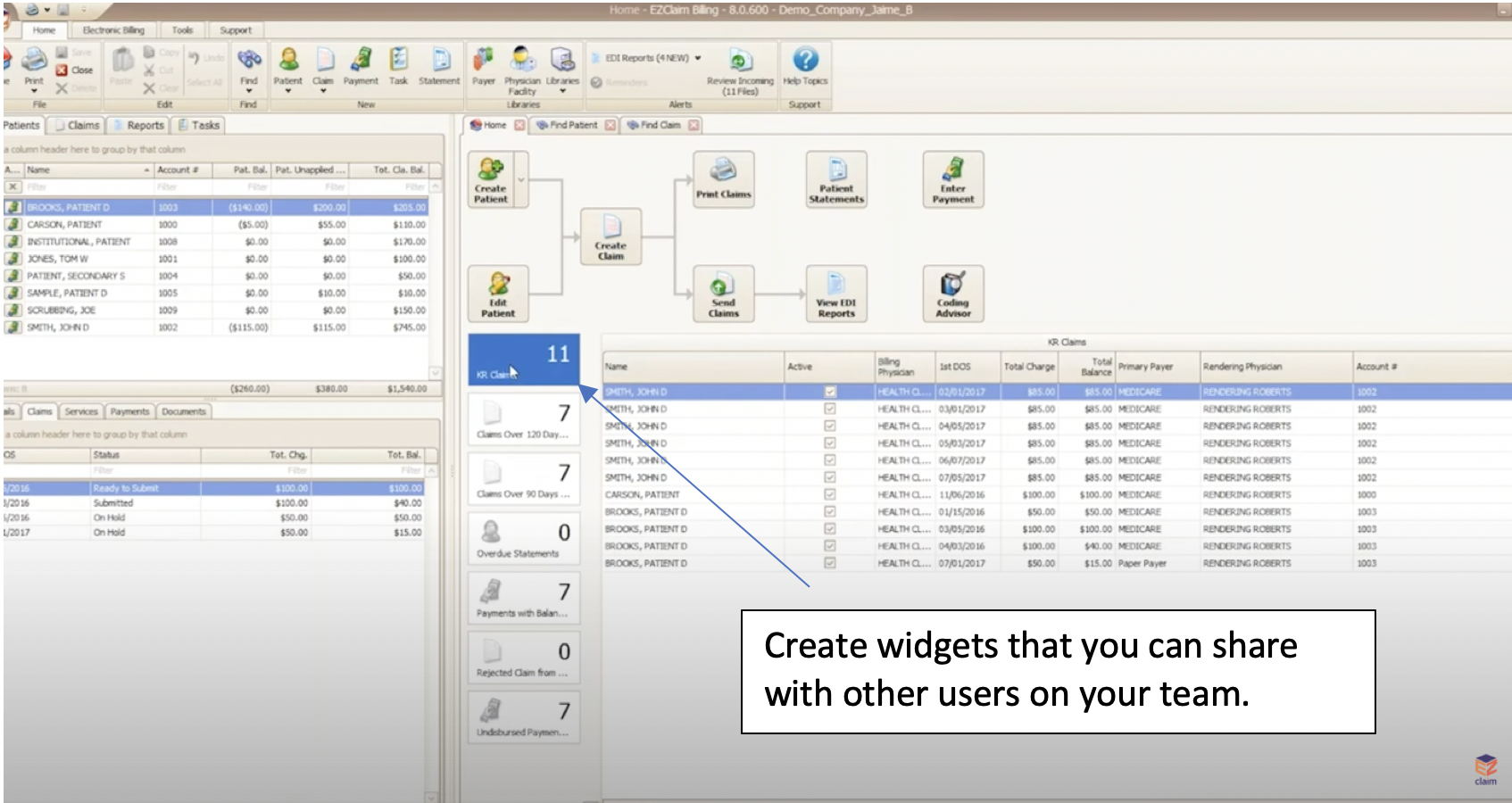

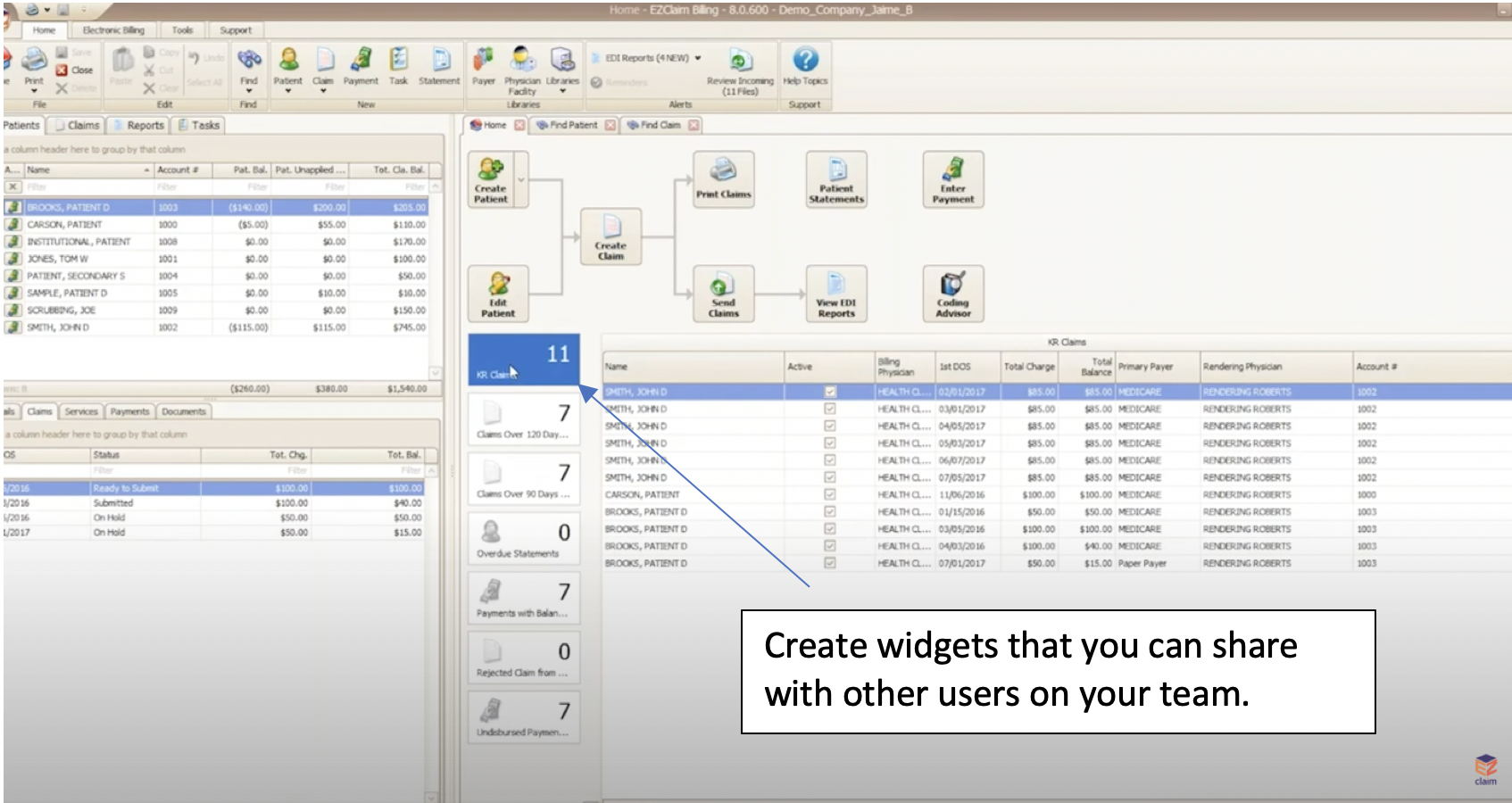

For the average biller, customizing grids is as important as adjusting your mirrors to face in the proper direction before driving your car. At a basic level, grids allow you to sort, filter, and customize your workflow and search needs. However, there is more flexibility available with grouping panels, flexible filtering rows, custom columns, and the ability to create and share widgets within the software—all of which will simplify your billing. (To learn more details, view the “Working with Grids” tutorial below).

CLICK FOR VIDEO: https://www.youtube.com/embed/ikUIM2AVURQ

The grids feature in EZClaim is a very powerful tool since the grids are highly customizable (they function like a spreadsheet). At the click of a button—or the stroke of a key—you can search for data and align your columns in your find claims field. If sorting to a specific set of claims is important to you, a simple click organizes your data to be queried for rendering. Sorting data has never been easier!

To simplify your workload even further, you can create an “established” find grid (i.e. find patient grids, find claim grids, find disbursement grids, etc.). You then can make bulk changes to the status of each claim without dealing with individual touches. Then, once you have created the filtered columns, you can go deeper and create reports that show you exactly what you want by using the filter editor. This is just one more way that EZClaim makes billing simpler and quicker. “Find grids” simplifies medical billing for all who use EZclaim’s software.

So, here’s a few questions to ask yourself. Is it important for you to customize your grids so that you can find what you need when you’re looking for it? Would you find it helpful to have auto-filters in place and be able to populate your search at the click of a button? Would it be helpful to be able to create a “widget” that you can share with your team?

So, here’s a few questions to ask yourself. Is it important for you to customize your grids so that you can find what you need when you’re looking for it? Would you find it helpful to have auto-filters in place and be able to populate your search at the click of a button? Would it be helpful to be able to create a “widget” that you can share with your team?

Well, if you answered “Yes” to any or all of the above questions, then our tutorial on “Find Grids” (click here to view) will guide you through, step-by-step, the most efficient use of the feature. In addition to that, you can also reach out to our customer service team for more details.

If you are new to medical billing, EZClaim can help with your evaluation. You can either schedule a one-on-one consultation with our sales team, view a recorded demo, or download a FREE 30-day trial right now.

For detailed product features or general information about EZClaim, visit our website at ezclaim.com/

May 12, 2020 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

If you are a member of the MEDICAL BILLING COMMUNITY, the norms of the day-to-day have changed. With the recent COVID-19 pandemic and the ‘stay-at-home’ order, you may find yourself with either more time on your hands and/or an increase of claims with new patients. During this time, we want to offer you a couple of suggestions so that you can make the best use of the additional time you have, and also help you improve your billing processes.

The first thing to consider is to review your Accounts Receivable (AR)—to collect payments due you to INCREASE YOUR INCOME. According to the American Medical Association (AMA), claim denial rates range between 0.5% and up to 3% or more, and that 90% of claim denials are preventable. Some of the most common claim denial reasons can be rectified by correcting claim management workflows, including claim submission and patient registration procedures. The following are a few of the most common oversights for claim denial.

- Use EZClaim software to check automatically for missing information, including absent or incorrect patient demographic information and technical errors

- Make sure you do not have duplicate claim submissions

- Check that claims do not have services previously adjudicated

- Review for claims with services not covered by the payer

- Make sure the time limit for claim submission has not expired

Secondly, revisit and resubmit open claims. Surprisingly, 31% of providers still use a manual process to resubmit. Our partner, TriZetto Provider Solutions (TPS), has an Advanced Reimbursement Manager Pro (ARM) that has two great tools that can improve your ability to tackle collecting and repaying underpaid and overpaid accounts. Below are some key features that can be automated by their software, and will help to improve your billing processes:

- Identify common errors and payer trends

- Analyze contract performance

- Customize and assign work into queues

- Quickly access information from interactive dashboards

- Automate the appeal process

Thirdly, know that EZClaim and our partner TPS have worked together to bring you the most powerful medical billing software tools to solve claim denials. Our partnership not only simplifies the billing process but also helps resolve denied claims in an efficient way. In addition to that, our customer support team is available to help you learn best practices with these tools, and support you however you need it.

Finally, if you are frustrated with your current medical billing solution, investigate how EZclaim’s medical billing solution may work for you. You can either schedule a one-on-one consultation with our sales team or download a FREE TRIAL to check it out the software yourself. For additional information right now, contact EZclaim’s sales team at 877.650.0904 or send an e-mail to sales@ezclaim.com.

May 12, 2020 | BillFlash, Features, Medical Billing Software Blog

Telemedicine was already growing in popularity prior to the onset of the Coronavirus pandemic. So, as the adoption rate increases, EZClaim clients may have questions about sending telemedicine charges and getting paid for Telehealth visits.

Telehealth challenges can range from issues with technology to getting paid. With Telehealth becoming the norm for many doctor-patient visits, it is important to have a thoughtful approach in place regarding collecting patient payments. To stay in business, you have to get paid for the work you are doing. So, establishing a process for Telehealth consultations is vital to your business, and it should be a top priority to build a successful program from beginning to end.

The answers to the following questions will help set the baseline for how to collect patient payments for

Telehealth visits:

- What is my process for charging for copays?

- How and when do I collect outstanding balances?

For example, if you collect payment before an in-person visit, you should collect payment before a Telehealth visit, too. There is no need to re-create your process completely. Just change what is needed to match your current in-office routine.

Sending Charges Before a Telehealth Visit

A simple way to send pre-visit charges to patients is to provide them with a link that takes them directly to the payment site. EZClaim’s medical billing solution is integrated with BillFlash LinkPay, which enables customers to provide payment for the upcoming visit. So, before the Telehealth session begins, the practice simply sends a link to their patient via an e-mail or text, making the appointment confirmation and the payment processing part of the check-in process. After the payment transaction is complete, it will immediately show up on the practice’s BillFlash report. LinkPay is designed to be easy to use and doesn’t require patients to remember a login or a chart number.

Here’s how EZClaim enables the process through BillFlash:

- Prior to Telehealth visit, the patient is sent a link to pay through LinkPay, and another link to join the Telehealth call

- The patient pays the required amount through LinkPay, which is immediately confirmed and processed

- The patient joins the Telehealth session

- Results and follow-up are completed electronically

- Insurance billing is completed

- The patient receives a paper statement or eBill notification for any remaining balance

- The patient is directed to pay the remaining balance online at MyProviderLink.com

Automate What Can Be Automated

With so many changes taking place in healthcare, a great way to help protect the financial stability of your practice is to automate what can be automated. This saves your staff time and decreases your cost of doing business.

One way to do this is to set up automatic payment plans for patients, particularly for those who have been hit hard by the economic impact of COVID-19. A payment plan is a good way of keeping the revenue flowing in, and it shows your patients that you are compassionate and willing to help them through these unprecedented times.

BillFlash also securely stores payment information, so patients will not need to re-enter their information every time they pay a new bill.

As you continue to adjust to Telehealth going forward, BillFlash can simplify patient billing and payments significantly and help getting paid for Telehealth visits.

So, for a LIMITED TIME (during May 2020), EZClaim customers can try BillFlash statement and eBill services for FREE for 30 days. Click on this link for more details about BillFlash or try it out for the next month.

For additional information, call BillFlash at 435-940-9123, or contact EZclaim’s support team at 877.650.0904 or support@ezclaim.com.

[Contributed by James Easley VP, Marketing NexTrust Inc.]

Apr 13, 2020 | Live Compliance, Medical Billing Software Blog, Partner

Since CMS HHS just updated their Telehealth regulations to adjust to the COVID-19 environment—including having a remote workforce—we wanted to provide a clear update to independent physicians and billers to advise them of the fast-moving changes of many regulations, and what to expect in the near future.

It is important to note that CMS has recently announced that new and established patients have availability to Telehealth, and HHS OIG is providing flexibility for healthcare providers to reduce or waive cost-sharing for Telehealth visits paid by federal healthcare programs. CMS is also expanding Telehealth services to people with medicare.

As a result, please see the below video from CMS which highlights the Medicare Coverage and Payment of Virtual Services and Telehealth.

In addition, we’ve included a few key questions and answers below. If you have further questions about Telehealth and your compliance, contact Jim Johnson with Live Compliance at Jim@LiveCompliance.com or (980) 999-1585.

1. Who can provide Telehealth services?

-

- Physicians

- Nurse Practitioners

- Physician assistants

- Nurse-midwives

- Certified nurse anesthetists

- Clinical psychologists

- Registered dietitians

- Nutrition professionals

2. What services can a medicare beneficiary receive through Telehealth?

-

- Evaluation and management visits (common office visits)

- Mental health counseling

- Preventive health screenings

- More than 80 additional services

3. What are the types of virtual services?

-

- Medicare Telehealth visits

- Virtual check-ins

- E-visits

- Telephone services

Live Compliance is an EZclaim premier partner for HIPAA compliance and is integrated into EZclaim’s billing solution.

If you have any further questions about Telehealth regulations and your compliance, e-mail Jim Johnson at Live Compliance at Jim@LiveCompliance.com, or phone him at (980) 999-1585.

[ Contribution by Jim Johnson with the Live Compliance ]

Apr 13, 2020 | Medical Billing Software Blog, Trizetto Partner Solutions

On January 13th we posted part one on this topic of Eligibility in healthcare, in that, we touched on deductibles, co-pay, and max out-of-pocket pay. Now in part two, we review the impact of price transparency in healthcare and its importance to the healthcare team decisions.

Consumers are the most important member of the healthcare team and are better collaborators in their care when they know all the variables and their required responsibilities in the process.

The individual consumer’s healthcare team includes, along with themselves, the physician and their staff, the pharmacist, an insurance adviser, and possibly some gatekeepers as well. The communication of clear symptoms when a patient is diagnosed is the responsibility of that team along with building an understanding of the financial responsibility that goes with any medical solution. While providing answers, options and solutions is a provider’s responsibility, so is providing a cost for the provided care. Therefore, price transparency can be achieved when the cost for that care is presented in a clear and concise fashion so the patient can understand what they owe, why they owe it, and when it is due.

Ensuring your staff is educated on discussing the financial responsibility with the patient from the first appointment and forward will strengthen the healthcare partnership and assist in the collection process. Understanding the steps that occur post the upfront estimate can be beneficial to the team. This discussion can be bolstered by ensuring bills are clearly marked with the statement, “this is a bill”, also clearly listing what the patient is being charged for when the bill is due and offering details on the methods of payment that are accepted. This clarifies what insurance will cover for the patient and their own out-of-pocket cost, prompting them to share any concerns and constraints with payments upfront.

Estimating patient responsibility is one part of the reimbursement process that is used for transparency for patient billing. The estimates can be provided using a spreadsheet of prior reimbursement and your most commonly billed CPT codes. If you would like an automated and more accurate option then look into a software tool like the Patient Responsibility Estimator by our solutions partner, TriZetto Provider Solutions (TPS). Giving this to the patient at the time of checking in will assure they have a rough idea of the costs and allow the office to collect upfront if needed.

For more information on how EZClaim can help you with this journey, schedule time with our sales team. Ready to get started? Download your FREE 30-day Trial today!

[ Contribution by Brenda Smelser with the DMC ]

Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

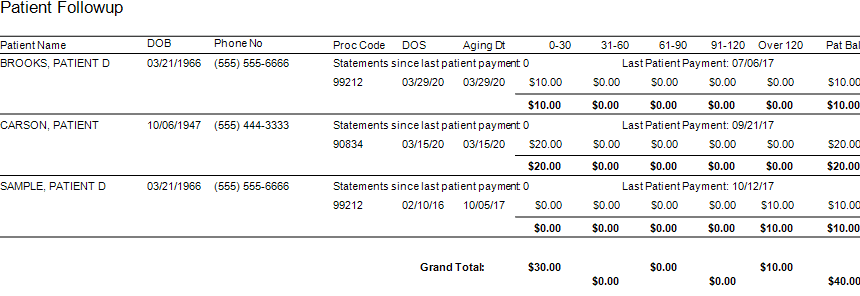

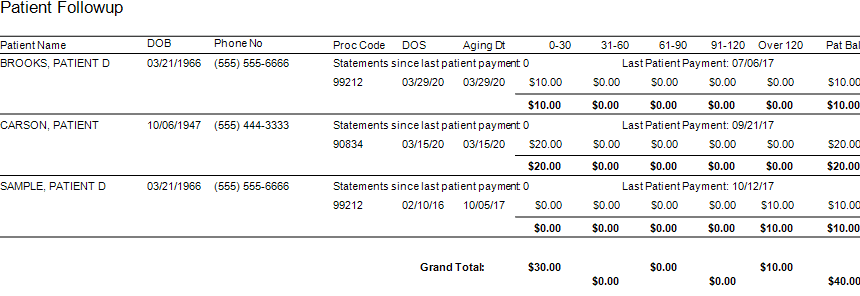

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]

So, here’s a few questions to ask yourself. Is it important for you to customize your grids so that you can find what you need when you’re looking for it? Would you find it helpful to have auto-filters in place and be able to populate your search at the click of a button? Would it be helpful to be able to create a “widget” that you can share with your team?

So, here’s a few questions to ask yourself. Is it important for you to customize your grids so that you can find what you need when you’re looking for it? Would you find it helpful to have auto-filters in place and be able to populate your search at the click of a button? Would it be helpful to be able to create a “widget” that you can share with your team?