Feb 9, 2021 | Electronic Billing, Medical Billing Software Blog, Partner

Do you have a fee schedule? If so, do you maintain it on a regular basis?

Well, this is an easy step to skip, but an annual review could put some extra cash in your pocket and help you keep a better handle on how much collectible money you have outstanding. Here are three things you should consider when creating or maintaining your fee schedule:

1. Mark Up the Charge Amount: Did you know that most payers will not pay you more than what you charge, even if you charge less than the allowed amount? They will accept whatever charge amount you have and adjust the difference, but they won’t pay you more than you charge. This can really cost your practice!

2. Allowed Amounts Change: In addition to payers updating the allowed amount for services, many insurances are offering incentive-based programs you may be eligible to collect a percentage over the allowed amount! If you are basing your charge amount on the payer’s allowed amount you may never see the incentive money that you have earned! Even a small percentage can add up quickly!

3. Decide on an Amount: If you aren’t sure where to start, consider setting your charge amounts based on the Medicare allowed amounts. Using 150% of the Medicare allowed amounts is a fairly standard starting point.

In addition to keeping the fee schedule current, make sure to monitor Allowed Amount and Paid Amount on a monthly basis. If you find that you are collecting the full allowed amount, it is time to increase the charge amount so you don’t leave money on the table!

If you need help getting started, consider working with a consultant. At RCM Insight, we offer annual fee schedule reviews. During the month of February 2021, we will be offering four practices a FREE fee schedule review, so visit our website at www.rcminsight.com and visit the CONTACT US page for your chance to win!

RCM Insight uses EZClaim’s medical billing software for their billing services. For more details about EZClaim’s medical billing solutions, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: Stephanie Cremeans with RCM Insight ]

Feb 9, 2021 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

The COVID-19 pandemic has put a spotlight on the need for mental health resources as illness, job losses, and isolation continues to create unprecedented stress levels. According to recent surveys conducted by the Larry A. Green Center, more than half of clinicians reported declining health among patients due to closed facilities and delayed care, and more than one-third noted that patients with chronic conditions were in noticeably worse health as a result. Even more striking, over 85 percent reported a decline in inpatient mental health with 31 percent seeing a rise in addiction.

With mental health access at the forefront of our minds, there is no doubt a demand for qualified professionals that can handle these complex patient needs. While the sense of urgency for these services exists, especially as more and more healthcare consumers are resuming in-person appointments, unfortunately, there are processes in place that can create unnecessary roadblocks for practitioners.

Complying with the Council for Affordable Quality Healthcare’s (CAQH) behavioral health credentialing requirements are especially challenging. Unlike traditional medicine, treatments and therapies for conditions such as addiction are not as well understood by payers. This makes it more difficult to gain or maintain the credentials necessary to submit claims for therapy services.

Ninety percent of the time counselors and therapists apply for network status are denied! That’s a striking statistic, even for seasoned professionals, and everyone can agree that appealing denials and requesting payers review credentials in greater depth are a time consuming and expensive burden. On average, the time required for behavioral health credentialing of professionals is up to five times greater than for medical professionals because of nuances specific to the industry. The turnaround for completed enrollments is slower too, on average 180 days versus 120 days. In addition, some payers will only allow certain therapies for providers without advanced degrees. Because denials for behavioral health are common, therapists must understand which therapies a network will accept and focus on therapy-specific credentialing. In the current environment, practitioners should also ensure that Telehealth or virtual appointments will be covered for the safety of all.

So how can mental health providers stay ahead of enrollments and avoid credentialing-related denials? Outside assistance from experts like those at TriZetto Provider Solutions offers an end-to-end credentialing service that ensures continuous payer follow up and insight into enrollment status. Our credentialing professionals are devoted to helping providers gain and maintain their credentials. We understand the nuances associated with behavioral health credentialing and have direct relationships with all major payers. TPS allows you to do what you do best – manage patient care – by alleviating the burden of credentialing and making sure you never miss quarterly re-attestation deadlines.

If your mental health services are being denied, we are here to help. Learn how solutions from TriZetto Provider Solutions can help your practice simplify credentialing.

TriZetto Provider Solutions is a partner of EZClaim and can assist you with all your coding needs. For more details about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: The TriZetto Provider Solutions editorial team ]

Feb 9, 2021 | Claims, Electronic Billing, Features, Medical Billing Customer Service, Medical Billing Software Blog

Are you working in the medical billing industry as a biller or an owner of a billing company? If so, the KEY medical billing insights and best practices that came out of our interview with Maura Jansen (VP of Operations) and Jennifer Withington (Director of Revenue) at Missing Piece Billing & Consulting Solutions will be VERY VALUABLE for you to consider.

Jennifer, an expert in understanding the problem-solving techniques and the investigative nature of medical billing, offers insights that both educate and inspire. Maura, an executive member of the billing community, also added an important perspective about EZClaim’s medical billing software. The following are some highlights from our interview.

EZCLAIM: When did you get into the industry?

JENNIFER: “I worked in group homes for the waiver side of group aid and then I went to Missing Piece. Missing Piece primarily deals with ABA providers and provides early intervention rendered to children. For me, the move from waivers with adults to professional billing, indirectly assisting children, was attractive and I took to the billing side of things.”

EZCLAIM: What does that mean when you say you took to the billing side of things?

JENNIFER: “Insurance doesn’t make a lot of sense when you first start. So, I took to the investigative side of making sense of medical billing claims. Figuring out what the payer’s rules are, reading their manuals, and figuring out the technical jargon with the purpose of preventing claim denials was attractive. I liked the puzzle of it.”

EZCLAIM: Are there things that you value in your work that offer meaning to what you do?

JENNIFER: “It’s really when I know that if I do not intercede with the insurance company and get this paid the patient is going to be responsible for the balance. So, to help, I have taken things to the department of insurance, or I have gone ahead and filed that third letter of appeal and really taken the time to research it. Because I don’t want a parent who is already struggling with having a child with more needs than maybe the other children would have, I don’t want them struggling with a $25,000 bill. ABA is extremely expensive because it works. And so, if insurance doesn’t pay it then the only other funder is the parent. And my goal is that parents should not have to pay any more than they absolutely have to.”

EZCLAIM: What are some of the strengths that make you good at what you do?

JENNIFER: “I am a good problem solver. I am good at taking a large problem and breaking it into smaller problems and knocking each one down until I solve the bigger issue. At the end of the day, that’s really what accounts receivable is.”

EZCLAIM: What would be an example of your problem solving on a day-to-day basis?

JENNIFER: “So you always start with the denial and then you have to work back to the billing. For example, if I have a claim denied for services rendered from an out-of-network service provider, but we know we are in-network then my first problem is, are we actually in-network? Then, you go onto the next link which is did the payer recognize you as in-network? It becomes like a decision tree, if you get a ‘yes’ then you are probably done, and you get the claim processed. If it is ‘no’, then you have to start digging with the payers contacting reps, make calls, and supply them with documents to get down to why they don’t have your provider listed within the network. Once you solve that problem, then the claim should be able to be processed. It is either going to pay or deny. Then depending on which one it is, you apply the same technique.”

EZCLAIM: What would you offer someone who is considering entering the field?

JENNIFER: “You should be good at processing and reading information because to get a claim paid you to have to know the rules of engagement. You need to be familiar with how to read a contract, how to read technical information about billing, and have to have a glossary of information about what you are billing. Those are the building blocks to get to know what you are doing.”

EZCLAIM: You work with EZClaim’s medical billing software platform, what role does their software providers and how does that impact your work?

JENNIFER: “EZClaim really serves to eliminate these denials before they happen, which is the ultimate goal of any accounts receivable or billing. EZClaim has edits that we use. It alerts us if the system thinks the claim is a duplicate, for example. It also helps in the set-up of the claim. We load all the fee schedules in EZClaim’s procedure code library and that lets us monitor the charge rate, make sure all the points of billing are on the claim (i.e. correct code, modifier, and charge). They also make sure that the authorization is appended to the claim. And then after we have actually done the work of getting a claim in the system, we use EZClaim reports to audit our own billing. So, we use the EZClaim service report. It makes it easier for us and our providers to see what has been billed and make sure that the billing is correct.”

EZCLAIM: If you were going to share something with your colleagues in the field, what would you share about the software that makes your life easier?

JENNIFER: “Number one, it is not the software itself, it’s the EZClaim staff. Their customer service is far beyond what a normal billing software company provides. If I have a problem, or if I have a report, or if I have a data point that isn’t in any report, they are available and they are there for me. And if they don’t have a solution for the problem, they will provide me with a workaround. So, that is very valuable. That is why Missing Piece works so well with EZClaim because customer service is number one for us, too. They don’t just want to answer your question, they want to help you understand your question.”

“The other thing that I find valuable is that their reporting modules are just a lot more robust than the other billing software companies that I have dealt with.”

EZCLAIM: Maura, do you have any thoughts from an administrative level that you can offer on EZClaim?

MAURA: “Well, when we hire a new person we know that, even if this person has very little experience in the healthcare field, it’s going to be a quick and easy process for them to learn EZClaim… EZClaim has also made it kind of a joy to work with. We really value them as a partner. We love the service they provide, and we value them as a platform.”

ABOUT EZCLAIM:

EZClaim can also help you with medical billing insights since it is a medical billing and scheduling software company. It provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

Jan 11, 2021 | Electronic Billing, Health eFilings, Medical Billing Software Blog, Partner

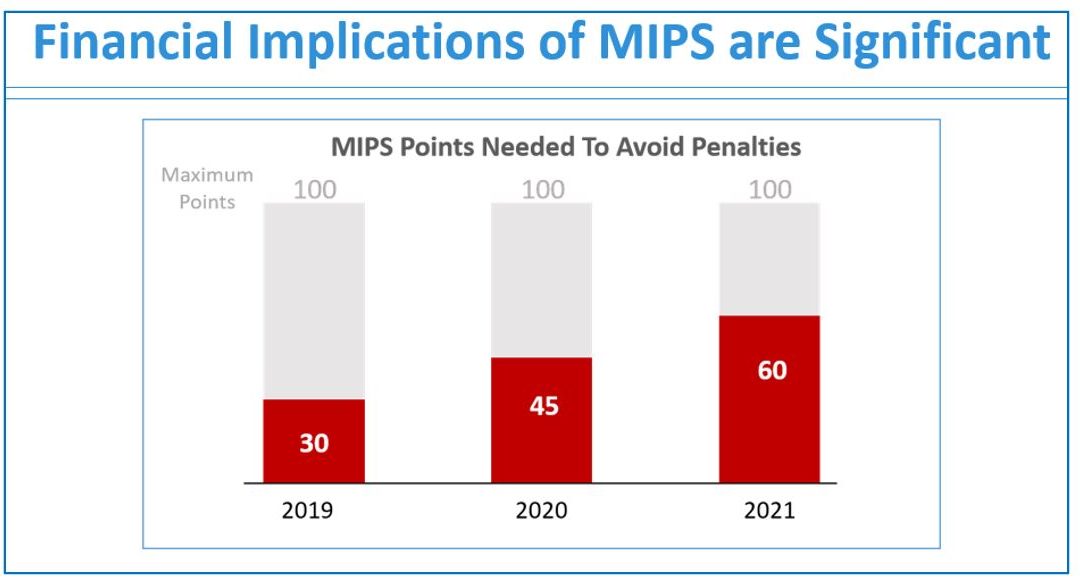

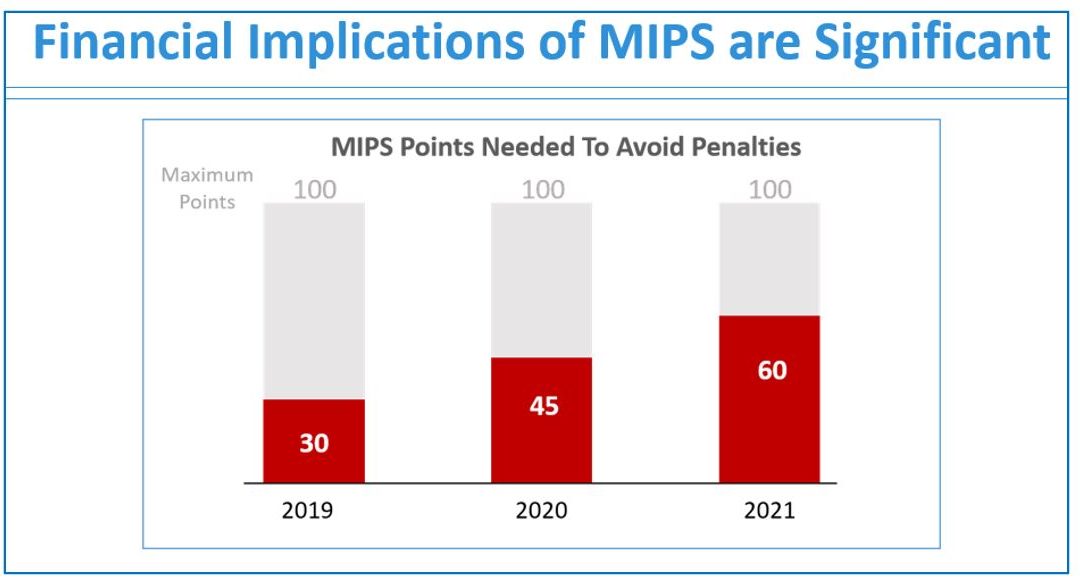

If you are not a MIPS expert (Merit-based Incentive System), your Medicare reimbursements may be decreased by 9% in the next year. However, it’s not too late to avoid the penalty for the 2020 reporting period, but you need to act now!

One of EZClaim’s partners, Health eFilings’ has ONC-certified software that completely automates the MIPS compliance process for you. The software will automatically extract the required data directly from EZClaim (and/or your EHR), and then proprietary algorithms will process the 9,000,000 possible combinations of quality measures for each clinician to identify which measures should be submitted to CMS (Centers for Medicare and Medicaid Services) to earn you the most points.

Need a MIPS expert? Well, Health eFilings is one of the best, and CMS has accepted 100% of their submissions on behalf of their clients. If you have completed your 2020 reporting, reach out to them, and learn how you can earn even more points in 2021.

For more information about EZClaim’s medical billing software, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Sarah Reiter, SVP Strategic Partnerships, Health eFilings]

Jan 11, 2021 | BillFlash, Medical Billing Software Blog, NexTrust, Partner

There are five primary medical practice fundamentals that, if focused on, will ensure your practice is working toward goals that will make the biggest difference. Practices are pulled in many directions each day, and it can be difficult to know what to prioritize, so the following are some recommendations.

1) Define Patient Engagement Goals

Perhaps one of the most overused terms in today’s medical field is “patient engagement.” Much like the drawer filled with important yet miscellaneous items, if you can’t actually define it, you probably aren’t going to do something with it.

In 2021, it is imperative to define your office’s patient engagement goals in order to determine whether they are being met, and more importantly, if the value you’ve placed on engagement is benefitting your bottom line. This could include engaging via a more personal checkout process that explains how billing and payment will be done and asking patients if there are certain times of the year they wish to be notified for annual wellness checks.

2) Ask For Online Reviews

Reviews remain one of the highest drivers of new customer acquisition. As a local business, you can create a Google Business account online that provides your address, phone number, and link to your website. Included is the ability to add reviews as well as phrases and keywords about your business within the Google Business dashboard, and it’s all free!

To encourage your patients to leave reviews, create cards with step-by-step instructions for posting online reviews via Google. Be picky. Make sure you ask your best patients to participate, who will be honored that you asked. Don’t forget to monitor to see how your business listing looks to potential new patients.

3) Offer Friendly Medical Bills

Of course, we’re not suggesting you add flowers or poignant sayings. Rather, explain a statement to your patients at checkout or within their financial package; this helps the process flow more naturally. BillFlash patient statements have five different messaging rows you can customize for communication. Plus, you can also send electronic patient statements through text and email.

In 2021, communication with patients—even on billing statements—should be natural, friendly, and simple. Getting paid is a segment of the medical practice workflow and should be as easy and frictionless as possible.

4) Ask About Payment Preferences

People are driven by routine and behavior. In today’s world, when paying for an item, the buyer is offered numerous options including cash, debit and credit, no-interest, pay-over-time plans, payment apps, or even Near Field Communication (NFC) like Apple and Google Pay. Granted, the last two have had very low adoption rates, but keeping an eye on payment trends costs little more than time and may add something unexpected to your bottom line.

In 2021, identifying the preferred patient payment options could be the difference between getting paid quickly and not getting paid at all. Don’t overlook the enormous value people place on how they give and take money.

5) Use RCM Services

An RCM vendor helps you get the most out of your practice revenue. They help you collect more from difficult balances, empower patients to pay in full, and improve your claims processing—without adding extra work for your office staff. Working with the right RCM services provider ensures you are paid more for the work you do. They also help identify reasons for claims denials, which have a positive impact on your practice revenue, as well.

For more information about automated patient statements and patient payment options, contact EZClaim, NexTrust BillFlash, GetPaid@BillFlash.com, or call BillFlash at 435.940.9123 (Option 3). For more details about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650.0904.