Oct 12, 2020 | Partner, Trizetto Partner Solutions, Webinar

Reserve your place for a webinar that will inform you on how to increase your revenue with a proper medical billing verification strategy.

With increased patient financial responsibility, it’s extremely important to proactively check your patients’ benefits coverage and provide payment estimates to avoid any unexpected costs. By enhancing your medical billing verification strategy and providing patient financial transparency upfront, it increases the likelihood that you’ll rake in more revenue this season.

Join EZClaim and TriZetto Provider Solutions, a Cognizant Company, for a webinar on Thursday, October 29, 2020 at 1 p.m. ET, to discover strategies your practice can catch falling revenue through seamless integration and automation.

During This Webinar We Will Discuss:

• Patient Responsibility Estimation: Quickly obtain patient financial estimates at the point of service to help increase patient revenue, decrease billing costs, and improve patient satisfaction through price transparency.

• Integrated Eligibility: Connect to payers through a single application to get the most up-to-date information on patient coverage, co-pays, deductibles, and more. Proactively verify patient eligibility, for up to 50 patients at a time directly from your EZClaim Premier program.

• Insurance Eligibility Discovery: Submit a real-time eligibility request using minimal data and identify a patient’s insurance carrier in a matter of seconds. Maintain groups of your common payers and easily locate active patients and full eligibility benefits on our website.

RESERVE YOUR PLACE NOW!

ABOUT THE PRESENTERS:

EZCLAIM: EZClaim is a medical billing and scheduling software company that provides best-in-class customer service and support. To learn more, e-mail them at sales@ezclaim.com or call a representative today at 877.650.0904.

TRIZETTO: TriZetto combines innovative, proven products with an exacting commitment to serving our customers, in order to provide you with the tools you need to effectively manage your reimbursement cycle.

Oct 12, 2020 | Medical Billing Software Blog, Partner, Revenue, Waystar

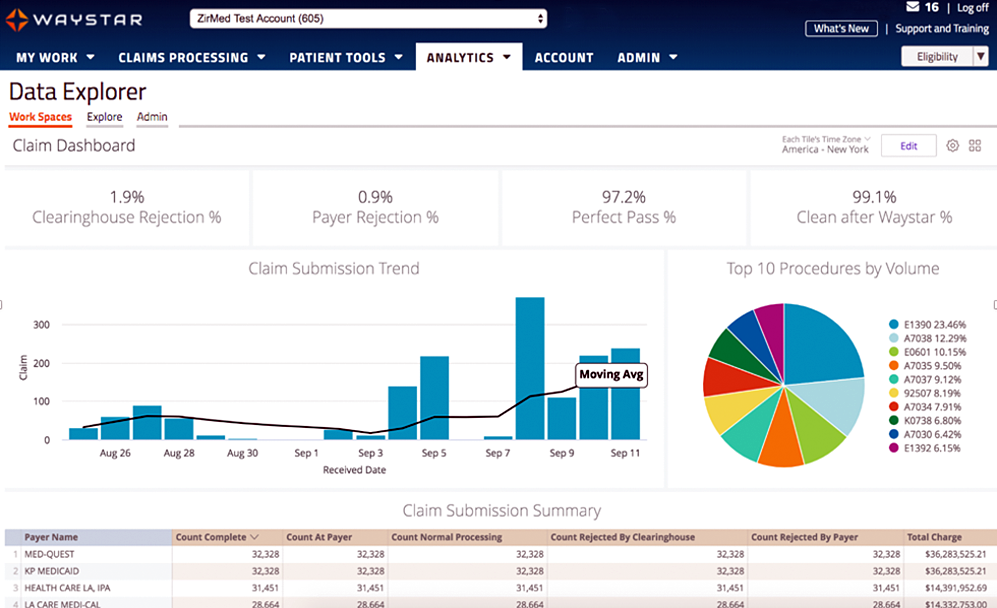

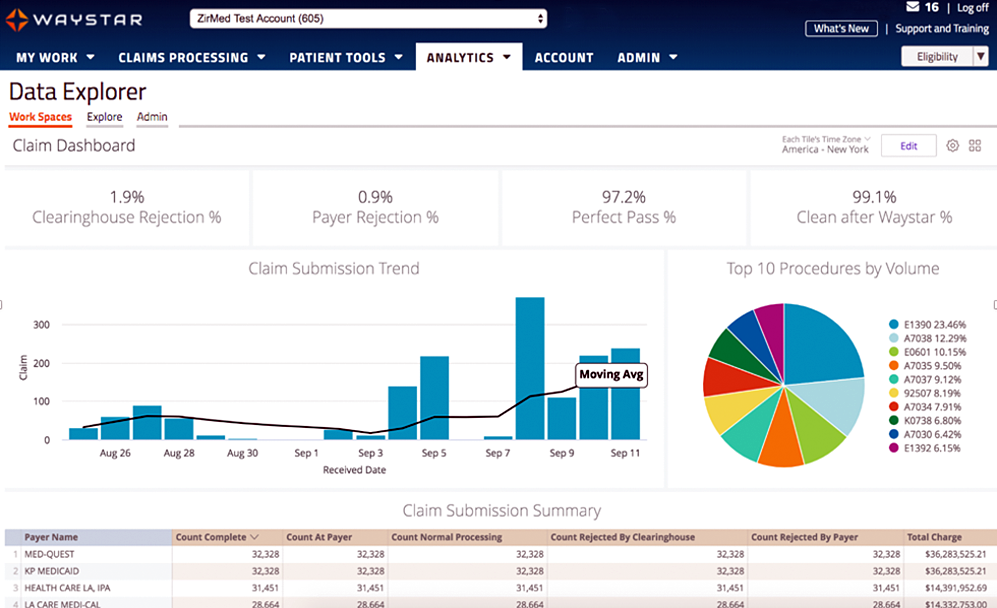

Today’s healthcare landscape faces truly unprecedented challenges, which means it’s more important to get the most out of your analytics to develop more informed, strategic decisions. There’s a deep well of data that each revenue cycle feeds into, which if properly analyzed, can help organizations operate at their most efficient and effective. Here are the four stages of data analytics workflows that are key to developing those actionable insights: A “Trigger,” or the point in your revenue cycle that sets up the call for deeper analysis; “Interpretation” of data to determine root causes and identify appropriate next steps; “Intervention” to improve specific metrics; and “Tracking” of said metrics to chart success in achieving desired outcomes.

So, let’s examine what a successful version of each stage looks like:

Trigger:

The trigger occurs when you notice something that needs further investigation. With the right analytics tool you can easily access all of your key performance indicators, financial goals and more, providing the visibility you need into your rev cycle. When something looks amiss or needs improving, you can drill down to the level that shows what’s really going on.

Interpretation:

Even a wealth of data amounts to nothing without an efficient way to process and communicate key takeaways. You’ll need to equip your team with access to concise reports, smart visualizations and relevant historical data in order to get them to the insights that drive action.

Intervention:

Now is the time to take action. Intervention is ultimately tied directly to your ability to drill down into the data underlying problematic areas of your revenue cycle and clearly communicate takeaways with your team. Success at this stage depends on designing a plan based on your best understanding of underlying issues and the most effective way to address them.

Tracking:

Your intervention plan is built on KPIs that naturally intertwine with the way you measure success across your revenue cycle. With proper implementation and tracking, running with the analytics cycle can become a simple addition to your everyday workflow. More than delivering on your initial goals, the true power of analytics is the ability to deliver repeat value on your initial investment.

Wrap Up

A strong analytics solution does more than deliver a more fully developed picture of your revenue cycle performance. It provides actionable business intelligence, cuts down on time between analysis and action, and lessens the strain on your IT department.

Waystar is a ‘partner’ of EZClaim, and provides analytics for a practice using their medical billing software. For more details about EZClaim’s products and services, visit their website: https://ezclaim.com/

To learn more about how Waystar can help you harness the power of your data, call their main office at 844-4WAYSTAR, or call sales at 844-6WAYSTAR.

[ Contributed by Waystar ]

Sep 10, 2020 | Live Compliance, Medical Billing Software Blog, Partner

So, what’s the best path for HIPAA Compliance? It’s risk analysis.

The HIPAA Security Rule requires covered entities and business associates to ensure the confidentiality, integrity, and availability of all electronic protected health information (ePHI) that it creates, receives, maintains, or transmits.

Conducting a risk analysis—which is an accurate and thorough assessment of the potential risks and vulnerabilities to the confidentiality, integrity, and availability of the ePHI held by an organization—is not only a Security Rule requirement, but is also fundamental to identifying and implementing safeguards that comply with and carry out the Security Rule standards and implementation specifications.

However, despite this long-standing HIPAA requirement, OCR investigations frequently find that organizations lack sufficient understanding of where all of the ePHI entrusted to their care is located.

Although the Security Rule does not require it, creating and maintaining an up-to-date, information technology (IT) asset inventory could be a useful tool in assisting in the development of a comprehensive, enterprise-wide risk analysis, to help organizations understand all of the places that ePHI may be stored within their environment, and improve their HIPAA Security Rule compliance.

How Can You Manage This at Your Organization?

You can try to manage this by yourself, but it would probably be more efficient and superior in implementation if you used an expert. A partner of EZClaim, Live Compliance, is one of those experts. They can help you easily manage, maintain, and assign your hardware and technical inventory to remote or in-office employees.

Do You Have Additional Questions?

If you have any questions about the best path for HIPPA compliance, contact Jim Johnson at Live Compliance (E-mail: jim@livecompliance.com; Phone: (980) 999-1585).

For more on EZClaim’s products, either schedule a one-on-one consultation with their sales team, or download a FREE TRIAL to check it out the software yourself. For additional information right now, view their web site, send an e-mail to sales@ezclaim.com, or contact the sales team at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance ]

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner

In the wake of the COVID-19 pandemic, Telehealth adoption has exploded, and there are six revenue cycle metrics to track.

Many patients are prohibited or reluctant to venture out for on-site care. The combination of relaxed regulations and expanded payment parity for appointments has made virtual meetings easier and more attractive for providers, who are turning to these technologies to stay engaged with patients—and maintain cashflow. Dr. Robert McLean, a former president of the American College of Physicians, recently said, “this crisis has forced us to change how we deliver health care more in 20 days than we had in 20 years.”

A new industry report predicts that the number of Telehealth visits in the US will surpass one billion by the end of the year, and speculates that nearly half of those visits will be related to COVID-19. At Waystar, we have been closely monitoring claim trends and are seeing this growth firsthand. In fact, the volume of Telehealth claims on the Waystar platform has grown by more than 100 times since mid-March. On two particular days in late April, they accounted for more than 15% of our total daily claim volume. Before COVID-19, they would have accounted for less than one percent!

For many providers, this shift will require new revenue cycle strategies to meet growing patient demand without overwhelming clinicians and administrative teams—or already strained operating budgets. It’s important to remember this is still very much an evolving care delivery model with the opportunity for errors on the part of both payers, providers, and administrative staff. For this reason, revenue cycle professionals should diligently monitor claims to ensure proper adjudication, identify learning opportunities, and uncover areas for operational improvement.

Below, we’ve listed six core Telehealth-related metrics you should regularly track to ensure billing accuracy, maximize payer reimbursement, and reduce claim rejections and denials. For more on how to best navigate the evolving telemedicine landscape, check out our resource hub here.

To report on Telehealth-related claims, you’ll first need to identify and isolate claims containing Telehealth procedure codes. See CMS’ Telehealth code list to identify the specific procedure codes and modifiers that apply to your organization.

Payer Analysis:

1. Payer Telehealth claim rejections by volume and/or billed amount

2. Payer Telehealth claim denials by volume and/or billed amount

If your Telehealth claims are being denied or rejected, do you know which specific payers are doing so at the highest rate? Drill down to discover the specific reason codes payers are attaching to rejections and denials so you can better understand payer-specific rules and avoid these oversights in the future. In some cases, you may identify trends that warrant a call to the payer to correct.

Provider Analysis:

3. Telehealth claim volume by the provider

Review this claim volume by individual provider. If you notice providers within your organization generating a much lower volume of Telehealth claims than peers, perhaps they could benefit from additional training on Telehealth technology and use cases.

Ensuring Billing Accuracy:

4. Telehealth claim rejections by biller/team

5. Telehealth claim denials by biller/team

Are certain billing personnel or teams producing higher denial or rejection rates than others? Keep a close eye on these trends and remember most of this is new for everyone. If some team members are seeing more rejections or denials than they should, it could be a great opportunity to hold training and collaborate on strategies for success.

Maximizing Reimbursement:

6. Telehealth claim volume by procedure code

Which Telehealth codes are you using? Each code reimburses at a different rate, so choosing the wrong ones could leave money on the table. Be sure to read up on CMS’ requirements (check out their fact sheet and code list) to ensure you’re choosing the appropriate code(s) on each Telehealth claim.

Waystar Analytics

You have all the data you need to drive informed decision making and improve financial performance—you just need the right analytics tool in your corner. Our new Waystar Analytics solution offers a pre-built Telehealth dashboard that can help you easily interpret, share all the metrics above, and track these revenue cycle metrics. Click here to learn more about Waystar Analytics and how it can deliver the insights you need during this time of transition.

[ By Waystar ]

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner, Trizetto Partner Solutions

A group of senators introduced the “Health Care PRICE Transparency Act” in a move to empower patients to lower their healthcare costs.

On a basic level, the Act will require all medical facilities to post payer-negotiated rates for all shoppable services, so the patient can find the most inexpensive way to take care of their medical needs. This legislation will give Americans the chance to see the actual costs of their healthcare visits, which in theory, will increase competition and lower healthcare costs for everyone.

The added transparency of the Act will bring more accountability and competition to the healthcare industry, and gives American’s more control over their healthcare costs. However, if you are a medical practice, a hospital, or a member of the medical billing community, you need to know how you can best respond.

• “What is this procedure going to cost?”: There is going to be mounting pressure on practitioners, medical billers, and hospitals to have answers for the cost of procedures. Jeff Leibach, a director of Guidehouse’s healthcare strategic solutions team, says that “regardless of the legal fate of the final rule, hospitals need to be prepared for more price transparency in the future.” So, to get in front of this—and help you compete against your competitors—you should be prepared with both what it will cost for individual services and procedures, as well as, a ‘value statement’ on why it will cost what you are charging.

• Prepare to Comply or Cover the Costs: As it stands now, the legislation is moving towards technology assisting with the billing transparency. This will aid the patients to better understand the cost of services. This is a ‘clarion call’ for you to begin preparing for this reality or you will struggle with being fined and potentially publicly shamed in publications for being offenders. We recommend starting to comply NOW before the deadline ‘sneaks up’ on you.

• Use It To Improve: Currently, healthcare practices are, in many cases, already working at capacity. The added effort of defining cost and selling procedures are enough to make some healthcare facilities put this off until it is too late. Yet, while many may be considering accepting the fines and fees associated with non-compliance, we advise using this as an opportunity to improve—to better establish your medical practice’s services and promote your ability to be proactive to change. Getting ahead of the coming ‘wave’ of consumer expectations of healthcare will be a benefit.

• Seek Out Vendors That Can Assist: The changes that are coming for individual practices and healthcare providers can be overwhelming, and potentially it might just be more than what an IT team or private practice can handle. Forward-thinking billing departments should be investing in software vendors that can help fill that gap. EZClaim is a medical billing software company that partners with Trizetto to provide a tool called, Patient Responsibility Estimation (PRE). This tool assists in clarifying costs to consumers by providing a cheap and fast way for them to pay for out-of-pocket costs. [ Click here to learn more about how EZClaim can help you ].

It is clear that the expectations of consumers are changing, and the wave of medical transparency is on its way. Accepting it, preparing for it, and using vendor software to help overcome it, can be the difference of your practice avoiding fines and fees. For those forward-thinking and proactive practices who want to learn about how EZClaim can help, e-mail one of their sales representatives, go to their website for more details, or download a FREE 30-day trial today!

Aug 11, 2020 | BillFlash, Partner, Revenue

Educating patients about their payment options can improve your medical practice revenue.

Imagine for a moment that you are planning to buy a car. Before you even enter a car lot, you do some research on the type of car you need, the features you are looking for, and how much you are able to spend. You might even get an opinion from a friend or check out reviews online.

After you have gathered all the information you need, you feel you are ready to start shopping—and confident that you might even get some new keys by the end of the day.

This is very similar to how most business transactions work: They have a need, they research the best ways to meet their need, and they make a purchase.

However, the healthcare industry doesn’t follow this formula. Your medical practice is a business just like any other, but your customers—aka, patients—often seek out your services not knowing exactly what they will be “buying” from you, nor how much they will be paying. Add in health insurance and surprise bills and you have a confusing hodgepodge of information that calculates the patient’s final bill, which they likely will not see for several weeks.

The current system is inefficient, and it is part of the reason that up to 30% of patient bills go unpaid every year.

Changing the Patient’s Financial Experience

Many practices have improved their revenue flow by simply treating their patients more like customers. In other words, they educate them on the financial side of things, as well as how to manage their health.

In a recent NexTrust webinar, three-quarters of poll respondents (doctors and practice managers) said that they speak to patients about their payment options. Thirty-one percent said that they currently use electronic communications, and only 8% use printed materials (flyers, signs, etc.).

While speaking to patients is a good start, getting payment information in writing is crucial to driving this information home. Patients already have a lot to remember regarding their care. A simple handout on how and when to make their payments can make it much easier for patients to manage their payment responsibility.

Most providers—over 90%—educate patients about how to pay on their statements. It certainly doesn’t hurt to communicate this information this way, but don’t rely on it exclusively. Most people skim the statement to see how much they owe and most miss important instructions.

So, as you educate patients on their payment options, keep these four key areas in mind to improve your medical practice revenue:

1) Set Clear Expectations about Payments

The first step in financially engaging your patients is to remind them you are a business, and that you require regular, on-time payments to keep your doors open. Patients often don’t see their doctors as business owners. A simple statement upfront about your payment expectations encourages patients to be more proactive about paying their bills on time.

2) Educate Patients about Your Payments Process

When patients understand your payments process, they are empowered to be more proactive in participating in it. You know where billing and payments fit into your practice workflow, so make sure patients understand that, too. If you require copays to be paid before a visit, communicate that beforehand so they can be prepared. In addition to that, also communicate clearly about when any remaining balances are due.

3) Push Your Online Payment Options

The best thing you can do to increase payments is to educate patients about their online payment options. Don’t just say “We accept payments online” and leave it at that. Show them where to go to complete payments. Also tell them about the variety of payment options available to them.

For example, EZClaim customers have several online payment options:

• Guest Pay: Patients can quickly pay their balance without having to set up an account

• MyProviderLink.com: If the patient wants access to more features (such as the ability to check their balance without having to call the office or to set up automatic payments), they can register for an account through BillFlash’s payment portal

• LinkPay: The practice sends a payment link to the patient before their visit, so they can pay what they owe before the visit starts

• PlanPay: Split up larger bills into smaller monthly payments

Online payments are the future of healthcare. So, make sure your online payment options are front and center whenever you bill patients. This could include a note in their statement directing them to pay online, handing out instruction cards on how to pay online, and posting signs throughout your office directing patients to your payment portal.

4) Reach Out to Patients You Haven’t Seen Lately

Forty percent of patients defer or skip care because they don’t think they can afford it. Make sure you get the word out to your entire patient base that you can accommodate any patient’s financial circumstances, whether that means setting up a payment plan or delaying payment for a few months. If patients know they have affordable payment options, they will be more likely to seek you out when they need help, rather than going somewhere else or deferring care entirely.

Empowering Patients to Take Ownership Over Their Healthcare Bills

Most patients want to pay their medical bills promptly and in full, but being in the dark about what they are being charged for and what their payment options are makes that difficult. The patient financial experience matters, and when you educate your patients on their online payment options and are transparent about costs, they usually respond positively, and you will improve your medical practice revenue.

Learn more about the pay services available to EZClaim customers by visiting their partner’s website, BillFlash.com, or by e-mailing sales@billflash.com.

To learn more about EZClaim’s medical billing software solution, visit their website at EZClaim.com.

[ Written by Angela Carter with BillFlash ]