Jun 24, 2021 | Partner, RCM Insight

Have you ever been a bit overwhelmed when shopping around for all your medical practice needs? Of course! There are so many pieces required to meet all the HIPAA and reporting requirements, but it’s also about efficiency and ease of sharing information between clinicians to administrators. This can make the all-in-one Electronic Health Record (EHR) and Practice Management (PM) systems very tempting. Keep in mind, you will pay a hefty price for an all-in-one, which makes this a very simple decision for some practices. The good news: You have alternatives that still provide the same ease of sharing data through integration. I recently interviewed Dan Loch, President of EZClaim Software, LLC. EZClaim offers a stand-alone billing platform that offers several options for integration with clearinghouses and EHR’s. I asked Dan what he felt the biggest advantages were to using stand-along programs.

-

- Your practice will get the best of both worlds! Often practices will find a great EHR, but the billing side is not the best, or vice-versa. Using stand-alone programs that can talk to each other allows a practice to choose an EHR solution that is best for their clinicians AND a PM solution that is best for the billers and administrators.

- Typically, stand-alone systems are more ‘nimble’ in responding to industry and regulatory changes.

- Integrating multiple ‘best-in-class’ software packages creates an offering with much more in-depth capability.

If you are currently using separate EHR and PM solutions but the programs are not integrated – consider looking into this feature. This will relieve the burden of entering data twice. Start by verifying if the programs have an existing integration.

-

- If so, the hard part is done! Just ask what the process is to get set up and if there are any fees associated.

- If not, consider contacting your PM software vendor to inquire what formats they accept for EHR integrations. Once they provide the specs, work with your EHR to determine if you can export in the required format.

There is no single solution that works for every practice. If you’d like to learn more, check out this article from EZClaim ‘All-in-One’ or ‘Specialized’ Medical Billing Software? Which is Best? I hope that this information will help you weigh your options and find the right fit for your specific situation. If you have questions or would like some help determining what would be best, RCM Insight is here to help! Visit us at www.rcminsight.com and submit a request to chat on the Contact Us page.

Jun 22, 2021 | BC Medical Billing, Partner

The impact of the COVID-19 pandemic will be felt in every industry for many months to come. For medical providers, they are facing some of the most challenging financial times they will ever know. Therefore, we understand that is it crucial for providers to re-assess their business and look for ways to cut costs with minimal impact on their practice of their patients.

To compound the issues providers are facing, there has been a wave of changes in recent years with new coding and telemedicine requirements that are making it difficult for provider offices to remain independent. Add on the constant rise in the cost of living while insurance reimbursements continue to decrease, and the issues get worse and worse.

Many have decided that outsourcing to a complete revenue cycle management company could:

-

- help alleviate some of the undue burdens

- cut costs

- keep providers compliant with their coding and billing

Ultimately, this allows providers to continue to focus on patient care which is their goal. As providers, you understand that revenue cycle management is a crucial part of your physician’s office. If not managed properly, it could result in an office leaving thousands of dollars on the table in unclaimed revenue. Over the years, our free audit services have allowed providers to have a free, transparent, and unbiased assessment of how their accounts receivable department functions. We are always amazed at how many providers do their billing in-house, and sometimes even when they outsource, are not aware of how much money they have sitting in their accounts receivables. Getting this knowledge is the first step to increasing revenue and efficiency.

In-house medical billers and third-party outsourced revenue cycle management companies should be giving provider offices monthly aging reports to assess their financial forecast. Each accounts receivable buckets over 60 days should hover at approximately 10% or less of the entire revenue balance. If account receivable buckets are higher than 10%, providers may be leaving money on the table, and the account may not be getting worked as providers think they are. In an effort to avoid unpaid claims and a spike in accounts receivable, outsourcing your revenue cycle management to a third-party medical billing company, such as BC Medical Billing, could help providers in countless ways. Many practices recognize that keeping their revenue cycle management optimized is key in delivering regular practice operations; however, they are not always sure how to achieve that. Outsourcing may be the solution!

Outsourcing alleviates the practice from managing a new medical billing employee, paying a salary and benefits, completing training, and onboarding protocols, and managing the lost time from a learning curve. Many providers feel that it is not a wise use of the back office executive personnel’s time to worry about finding coders in-house and then wondering if the charges are captures and billed correctly. Instead, the business office should be focusing on how to grow the providers and the physician practice.

Our free audits will help you determine if you have found the right solution for you. If not, we are always there to assist and increase the provider’s revenue.

Mar 10, 2021 | Medical Billing Software Blog, Partner, Waystar

New Patient Survey About Price Transparency Rule

With the cost of insurance premiums and deductibles both on the rise, patients have begun taking on greater responsibility for paying for healthcare than ever before. In return, they are becoming more discerning shoppers and expect more from the patient experience that their providers are delivering. One of the biggest steps that have been taken to create a more standardized, consumer-like experience is the introduction of the final price transparency rule from the Centers for Medicare and Medicaid Services.

More than half of consumers have received an unexpected medical bill

Despite the $3.81 trillion that was spent on healthcare in 2019, America’s healthcare payments system has long remained opaque and broken. Patients are frequently faced with unexpected or surprisingly high medical bills, discover too late that a provider they’d been told was in-network was actually out of network, and are forced to wait 60-90 days to receive their medical bills.

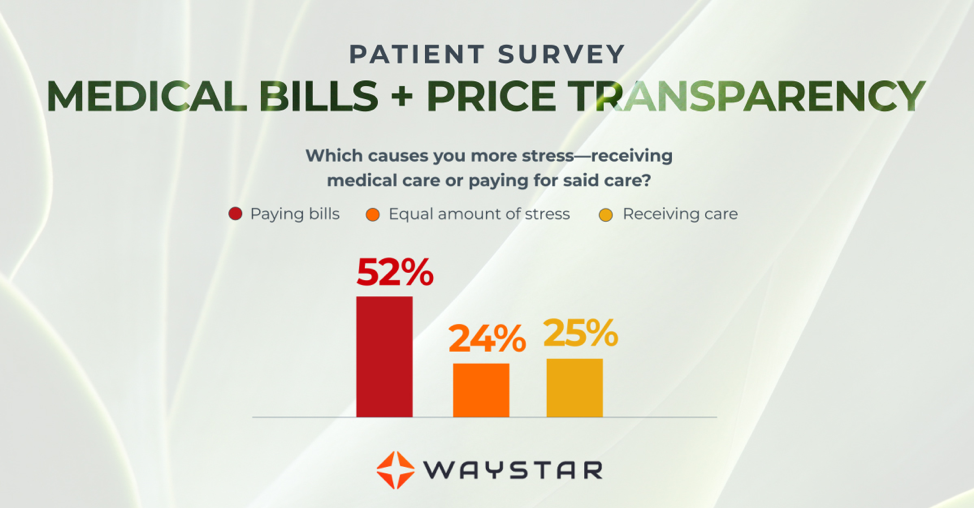

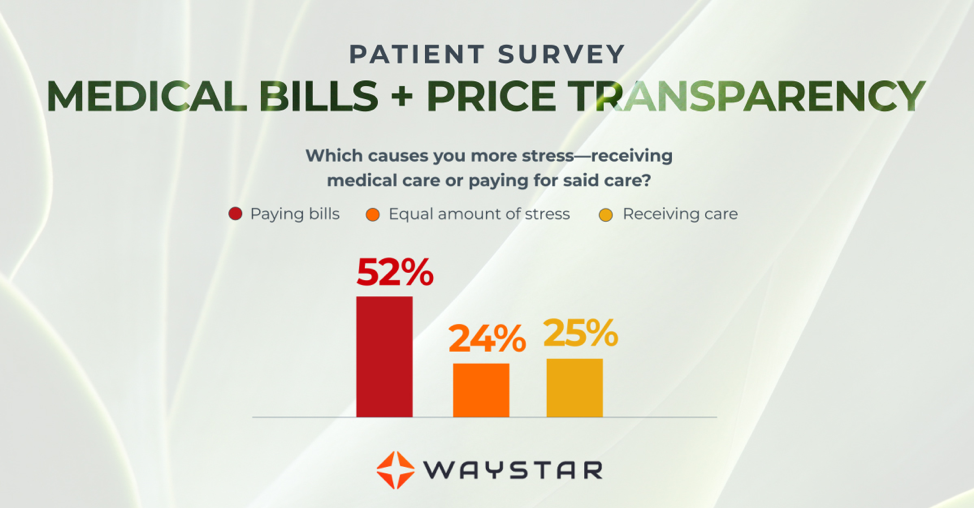

Patients are more concerned about billing than the quality of care

In October 2020, Waystar surveyed 1,000 consumers about their experiences with medical bills, and awareness and attitudes towards the upcoming price transparency rule. More than half of respondents have received an unexpected medical bill, meaning that they assumed a service was covered by insurance and it ultimately was not, or the amount they expected to pay out of pocket was different from the bill they received.

> > > CLICK HERE To Read the Results of the Waystar Survey < < <

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Article contributed by Waystar ]

Feb 9, 2021 | Claim Status Inquiry, Claims, Denied Claims, Electronic Billing, Medical Billing Software Blog, Partner, Waystar

Reducing claim denials has long been a challenge for providers. In the worst case, denied claims end up as unexpected—and sometimes unaffordable—bills for patients. The challenge only seems to be growing. A recent survey conducted by the American Hospital Association (AHA) found that 89% of respondents had seen a noticeable increase in denials over the past three years, with 51% describing the increase as “significant.”

Minimizing loss will be top of mind for providers as the COVID-19 pandemic continues to put a strain on their resources, and minimizing or preventing denials will need to be a core part of that strategy. With that in mind, we’re offering four tips to help guide revenue cycle strategies for better denial reduction in 2021.

1. Analyze and Assess

In order to achieve and maintain a healthier denial rate, it’s vital to have a good handle on the factors creating problems in the first place. Keep the following in mind as you start to structure your analysis:

- Review key performance indicators: Take a look at which metrics are being used to benchmark success or failure and see if it’s time for a refresh

- Evaluate workflows: It’s important to have a clear understanding of how your team operates, and that you can detail workflows as step-by-step processes

- Assess tools: Inventory the software you’re using and discuss with your team how it helps or hinders them

- Staff efficiency: Consider the number of team members and resources involved in each step of the denial management process

It’s also important to talk to staff. Your team can offer invaluable insight on what is and isn’t working to help you develop a more comprehensive understanding of the shape and scope of the systemic issues contributing to your denial rate.

2. Reduce Errors Upfront

Eligibility, registration, and authorization errors remain the greatest cause of denials and write-offs, so a good first step is to focus on being proactive instead of reactive. Often, it’s easy to get into a routine where errors are only addressed after they occur. But incorporating tech to verify coverage and benefit accuracy in advance can lead to higher efficiency and much less manual labor spent to correct those issues later on.

Similarly, a recent AHA report found a failure to obtain prior authorization to be one of the most common reasons for a claim to be denied by a commercial health plan. In another recent survey, the American Medical Association found that 86% of providers surveyed were struggling with a high administrative burden created by prior authorizations.

Recent innovations have made the process simpler than ever. The right prior authorization solution can automate the process and make it simpler, smarter, and much less labor-intensive, reducing manual input errors and preventing denials.

3. Cut Down on Manual Labor

Claim denials are often the result of staff trying to keep track of a seemingly overwhelming number of rules and regulations while juggling various systems and filing requirements. When your staff is overburdened, it’s that much easier for them to make simple errors or miss deadlines.

There are numerous tools available for teams who are either struggling with paper-based processes or databases without automation. With an AI-powered solution, you can streamline a number of time-consuming tasks while simultaneously automatically ensuring you’re identifying missing data or claim errors that can be corrected before they’re submitted.

It’s also a good idea to review any potential new tools with your team. Their insight will help you properly determine which solutions will actually improve their workflows, and which could prove an expensive time sink.

4. Use Stronger Reporting Tools

Accurate and in-depth reporting should be core to your strategy. Effective reporting tools let you quantify and assess the issues that influence your denial rate, allowing you to easily spot persistent workflow errors or other systemic problems that can create extra work or strain resources.

New tools powered by AI and machine learning offer more robust reporting options than ever, with advanced analytics and visualization capabilities that make it easy to explore complex data sets or identify trends. Mountains of information can now be easily managed and measured, giving you access to operational insights that will help you better understand problem areas and identify opportunities for improvement.

The Wrap-up

With the right tools, a solid strategy, and expert guidance, you can take a proactive approach to reducing claim denials. Our automated tools make it easy for your team to streamline their workflows while reducing errors and administrative costs. With Hubble, our AI and RPA platform, you can unlock the insights you need to reduce your denial rate and increase cash flow.

Waystar, a partner of EZClaim, also offers a number of front-end solutions to help you take a more proactive approach to your denial rate. Click here to learn more about how Waystar can help you with reducing claim denials and claim management. For more information about Waystar’s platform, visit their website, or give them a call at 844.492.9782.

To find out more about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650-0904.

[ Contribution: Waystar ]

Feb 9, 2021 | Electronic Billing, Medical Billing Software Blog, Partner

Do you have a fee schedule? If so, do you maintain it on a regular basis?

Well, this is an easy step to skip, but an annual review could put some extra cash in your pocket and help you keep a better handle on how much collectible money you have outstanding. Here are three things you should consider when creating or maintaining your fee schedule:

1. Mark Up the Charge Amount: Did you know that most payers will not pay you more than what you charge, even if you charge less than the allowed amount? They will accept whatever charge amount you have and adjust the difference, but they won’t pay you more than you charge. This can really cost your practice!

2. Allowed Amounts Change: In addition to payers updating the allowed amount for services, many insurances are offering incentive-based programs you may be eligible to collect a percentage over the allowed amount! If you are basing your charge amount on the payer’s allowed amount you may never see the incentive money that you have earned! Even a small percentage can add up quickly!

3. Decide on an Amount: If you aren’t sure where to start, consider setting your charge amounts based on the Medicare allowed amounts. Using 150% of the Medicare allowed amounts is a fairly standard starting point.

In addition to keeping the fee schedule current, make sure to monitor Allowed Amount and Paid Amount on a monthly basis. If you find that you are collecting the full allowed amount, it is time to increase the charge amount so you don’t leave money on the table!

If you need help getting started, consider working with a consultant. At RCM Insight, we offer annual fee schedule reviews. During the month of February 2021, we will be offering four practices a FREE fee schedule review, so visit our website at www.rcminsight.com and visit the CONTACT US page for your chance to win!

RCM Insight uses EZClaim’s medical billing software for their billing services. For more details about EZClaim’s medical billing solutions, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: Stephanie Cremeans with RCM Insight ]

Feb 9, 2021 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

The COVID-19 pandemic has put a spotlight on the need for mental health resources as illness, job losses, and isolation continues to create unprecedented stress levels. According to recent surveys conducted by the Larry A. Green Center, more than half of clinicians reported declining health among patients due to closed facilities and delayed care, and more than one-third noted that patients with chronic conditions were in noticeably worse health as a result. Even more striking, over 85 percent reported a decline in inpatient mental health with 31 percent seeing a rise in addiction.

With mental health access at the forefront of our minds, there is no doubt a demand for qualified professionals that can handle these complex patient needs. While the sense of urgency for these services exists, especially as more and more healthcare consumers are resuming in-person appointments, unfortunately, there are processes in place that can create unnecessary roadblocks for practitioners.

Complying with the Council for Affordable Quality Healthcare’s (CAQH) behavioral health credentialing requirements are especially challenging. Unlike traditional medicine, treatments and therapies for conditions such as addiction are not as well understood by payers. This makes it more difficult to gain or maintain the credentials necessary to submit claims for therapy services.

Ninety percent of the time counselors and therapists apply for network status are denied! That’s a striking statistic, even for seasoned professionals, and everyone can agree that appealing denials and requesting payers review credentials in greater depth are a time consuming and expensive burden. On average, the time required for behavioral health credentialing of professionals is up to five times greater than for medical professionals because of nuances specific to the industry. The turnaround for completed enrollments is slower too, on average 180 days versus 120 days. In addition, some payers will only allow certain therapies for providers without advanced degrees. Because denials for behavioral health are common, therapists must understand which therapies a network will accept and focus on therapy-specific credentialing. In the current environment, practitioners should also ensure that Telehealth or virtual appointments will be covered for the safety of all.

So how can mental health providers stay ahead of enrollments and avoid credentialing-related denials? Outside assistance from experts like those at TriZetto Provider Solutions offers an end-to-end credentialing service that ensures continuous payer follow up and insight into enrollment status. Our credentialing professionals are devoted to helping providers gain and maintain their credentials. We understand the nuances associated with behavioral health credentialing and have direct relationships with all major payers. TPS allows you to do what you do best – manage patient care – by alleviating the burden of credentialing and making sure you never miss quarterly re-attestation deadlines.

If your mental health services are being denied, we are here to help. Learn how solutions from TriZetto Provider Solutions can help your practice simplify credentialing.

TriZetto Provider Solutions is a partner of EZClaim and can assist you with all your coding needs. For more details about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650.0904.

[ Contribution: The TriZetto Provider Solutions editorial team ]