Feb 9, 2021 | Administrative Safeguards, Cloud Security, Live Compliance, Medical Billing Software Blog, Partner

Ransomware hackers target medical billing companies, and it CAN AFFECT your entire company! (Ransomware is a type of malicious software designed to block access to a computer system until a sum of money is paid.)

Often out of one’s control, ransomware hackers target medical billing companies because of the tremendous value of the data. BUT, there are steps that CAN BE TAKEN to protect you, your company, and your patients and/or clients.

NetWalker Ransomware, for example, gained notoriety for targeting hospitals and healthcare providers with e-mails claiming to provide information about COVID-19. (The e-mail usually has an attachment that downloads the ransomware from a remote server when clicked on.) The thing is, this is very lucrative for identity thieves since medical records information sells anywhere from $1-$1000!

As the number of healthcare providers taking advantage of Telehealth continues to increase—now outnumbering in-person visits—the number of ransomware attacks continues to increase as well. This means Billers and Providers must be aware of the programs that are used on their machines and ensure necessary steps are taken to safeguard against hackers and attacks.

How can you protect yourself and/or your organization?

- Carefully monitoring where you store and enter your passwords can be extremely beneficial to help minimize the risk of a hack and keeping personal or patient information protected.

- Routine password changes and monitoring where you store and enter your passwords can be extremely beneficial to help reduce the risk of becoming a victim to a hacker. Passwords should be long, unique in characters, capitalization, and alphanumerical.

- Have you had an accurate and thorough Security Risk Assessment and/or penetration testing? If you haven’t completed an accurate and thorough security risk assessment, you could also be penalized under ‘willful neglect’ (this category alone is $50,000 per violation!) in addition to the higher risk of ransomware attacks.

- If you believe you might have revealed sensitive information about your organization, report it to the appropriate people within the organization, including network administrators. They can be alert for any suspicious or unusual activity.

- The strength of your passwords directly impacts your online security.

Live Compliance can help. They aggregate breaches which enables you to assess where personal data has been exposed. Dark Web scanning is built right into their Portal, and it allows you to keep an eye on employees whose information was involved in a breach, where the breach took place, and then suggest the next steps to take.

At Live Compliance, they make checking off your compliance requirements extremely simple and to ensure this doesn’t happen to you or your organization:

- Reliable and effective compliance

- Completely online, our role-based courses make training easy for remote or in-office employees

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. (Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities, including those such as password protection.)

- Policies and procedures curated to fit your organization ensuring employees are updated on all workstation use and security safeguards in the office, or out of the office—all updated in real-time

- Electronic, prepared document sending and signing to employees and business associates

So, don’t risk your company’s future on ransomware hackers. Contact one of EZClaim’s partners, Live Compliance, especially since they are offering a FREE Organization Assessment to help determine your company’s status. E-mail them, visit their website at LiveCompliance.com, or call them at 980.999.1585.

For more information about EZClaim’s medical billing software, which provides a best-in-class product with correspondingly exceptional service and support, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance ]

Jan 11, 2021 | Electronic Billing, Partner, Waystar

With Medicare Advantage enrollment continuing to rise and more plans offering more benefits than ever, big changes are coming in 2021. This post will discuss the key changes to Medicare Advantage plans in the next year, program updates due to the COVID-19 public health emergency, and advice on how to navigate billing and reimbursement concerns.

For the first time in history, Medicare Advantage (MA) penetration has reached 40% of the total Medicare-eligible population. Currently, 25.4 million people are enrolled in Medicare Advantage (MA) plans, with a total Medicare-eligible population of 62.4 million, according to the Centers for Medicare and Medicaid Services (CMS). [ Link to report ]

With an aging population, enrollment in Medicare Advantage plans will only continue to grow (The Congressional Budget Office projects enrollment in these plans to rise to about 51% by 2030).

Medicare Advantage is an alternative to traditional Medicare that acts as an all-in-one health plan and is sold by private insurers. All Medicare Advantage plans must provide at least the same level of coverage as original Medicare, but they may impose different rules, restrictions, and costs. Most Advantage plans offer the same A and B coverage for the same monthly premium as regular Medicare plans, but also often include Part D prescription drug coverage, limited vision, and dental care, broader coverage, lower premiums, maximum out-of-pocket limits, and extra benefits—all of which expanded in 2020.

While this represents a distinct opportunity for many providers to be more profitable, growing enrollment also poses challenges. Medicare beneficiaries have more choice than ever before when it comes to selecting an MA plan.

According to the Kaiser Family Foundation (KFF), there are 3,148 Medicare Advantage plans available for individual enrollment for the 2020 plan year—an increase of 414 plans since 2019. The average beneficiary could choose among 28 plans in 2020. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycles, who need to navigate hurdles that vary by the plan in order to get reimbursed.

MA plans also tend to be more transient, meaning patients may switch often, even yearly if they choose through the open enrollment period. Providers must better manage every patient accordingly so they can maximize plan benefits. Doing so takes more effort, but the payoff can lead to profit.

CMS has clearly stated a goal to move from the current fee-for-service models toward value-based care. While the Medicare Advantage population grew by 60% from 2013 to 2019, the fee-for-service Medicare population only grew by 5%. The progress Medicare Advantage plans have achieved essentially creates an idea marketplace for beneficiaries. Enrollment costs are down and more plans than ever are offering new, innovative benefits. But what does this mean for providers?

So, how has COVID-19 affected Medicare Advantage plans? Well, the COVID-19 stimulus package, the Coronavirus Aid, Relief and Economic Security (CARES) Act, includes $100 billion in new funds for hospitals and other healthcare entities. The Centers for Medicare and Medicaid Services (CMS) made $30 billion of these funds available to healthcare providers based on their share of total Medicare fee-for-service (FFS) reimbursements in 2019, resulting in higher payments to hospitals in some states than others, according to KFF. Hospitals in states with higher shares of Medicare Advantage enrollees may have lower FFS reimbursement overall. As a result, some hospitals and other healthcare entities may be reimbursed less than they would if the allocation of funds considered payments received on behalf of Medicare Advantage enrollees.

In response to the COVID-19 emergency, many Medicare Advantage insurers waived cost-sharing requirements for COVID-19 treatment, meaning that Medicare Advantage beneficiaries will not have to pay cost-sharing if they require hospitalization due to COVID-19 (though they would if they are hospitalized for other reasons).

If a vaccine for COVID-19 becomes available to the public, Medicare is required to cover it under Part B with no cost-sharing for traditional Medicare or Medicare Advantage plan beneficiaries, based on a provision in the Coronavirus Aid Relief, and Economic Security (CARES) Act.

A Spotlight on Prior Authorization

Medicare Advantage plans can require enrollees to receive prior authorization before service will be covered, and nearly all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services in 2020, according to KFF. Prior authorization is most often required for relatively expensive services, such as inpatient hospital stays, skilled nursing facility stays, and Part B drugs, and is infrequently required for preventive services. Prior authorization can create barriers for providers and beneficiaries, but it’s meant to prevent patients from getting services that are not medically necessary, thus reducing costs for beneficiaries and insurers.

In a 2018 analysis, KFF found that four out of five MA enrollees—or 80%—are in plans that require prior authorization for at least one Medicare-covered service. More than 60% of MA plan enrollees require prior authorization before receiving home health services, and that percentage increases to more than 70% for skilled nursing facility and inpatient hospital stays.

The Families First Coronavirus Response Act (FFCRA) prohibits the use of prior authorization or other utilization management requirements for these services. A significant number of Medicare Advantage plans have waived prior authorization requirements for individuals needing treatment for COVID-19.

How Providers Can Prepare for a Medicare Advantage Boom

Medicare beneficiaries have more choice than ever before when it comes to selecting a MA plan. While the choice is great for the beneficiary, it adds complexity to healthcare providers’ revenue cycle. Healthcare providers will need to navigate new hurdles that vary by the MA plan in order to get reimbursed.

When beneficiaries change plans, it creates another challenge for providers. Historically, about 10% of MA enrollees change plans during open enrollment. Although this number seems low, even a small change in coverage can cause big problems for a healthcare provider’s revenue and cash flow. Billing the wrong insurance company leads to costly denials and appeals. Becker’s Hospital Review estimates that healthcare providers spend about $118 per claim on appeals. A study by the Medical Group Management Association found that the cost to rework a denied claim is approximately $25, and more than 50% of denied claims are never reworked.

Despite the challenges, providers don’t want to be left out of the MA boom. But how can they best prepare? Well, first off, healthcare providers need to ensure they are capturing accurate patient information. Next, they need to reevaluate workflows, so they are prepared to handle time-consuming prior authorizations. Additionally, healthcare organizations must consider how frequently they are re-running eligibility on patient rosters to make certain they do not miss a change in insurance coverage for patients under their care. Providers should re-run patient rosters monthly, so they have the most accurate benefit information. This will help them avoid unnecessary claim denials.

As MA continues to ramp up, the most successful providers will be those who work with a revenue cycle management partner that understands the nuances of Medicare reimbursement as well as the added complexities of MA.

With the acquisition of eSolutions, a leader in revenue cycle technology with Medicare-specific solutions, EZClaim’s ‘partner’, Waystar, so happens to be the first technology to unite commercial, government, and patient payments into a single platform, solving a major challenge and creating meaningful efficiencies. Billing Medicare, Medicare Advantage, and commercial claims from a single platform eliminates the hassle of managing multiple revenue cycle platforms and allows providers to get deeper AI-generated insights for faster reimbursement and increased value—for their organizations and their patients.

For more information about Waystar‘s platform, visit their website, or give them a call at 844.492.9782. To find out more about EZClaim‘s medical billing software, visit their website, e-mail their support team, or call them at 877.650-0904.

[ Article contributed by Waystar ]

Jan 11, 2021 | Electronic Billing, Health eFilings, Medical Billing Software Blog, Partner

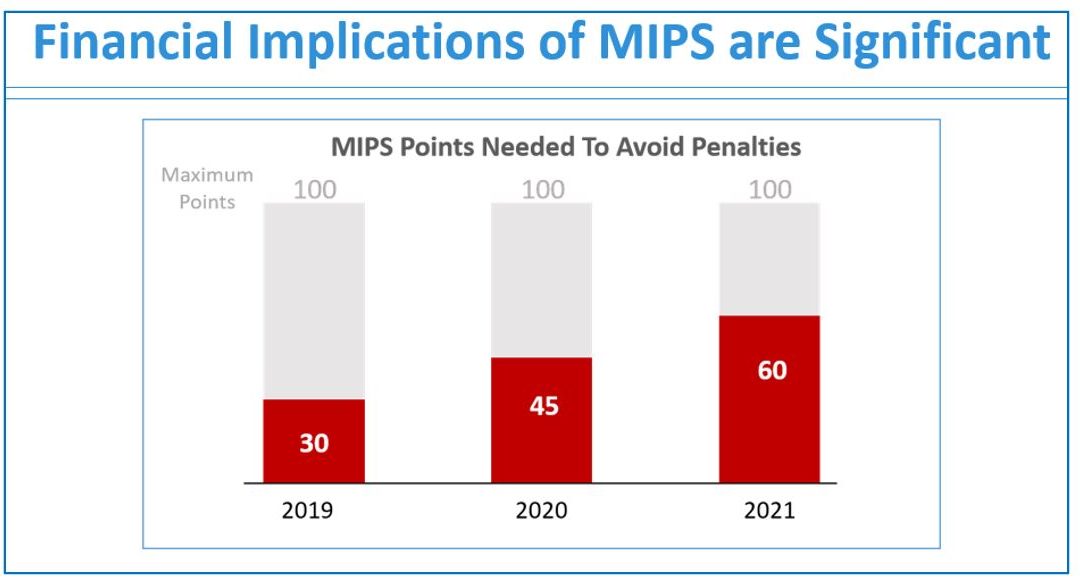

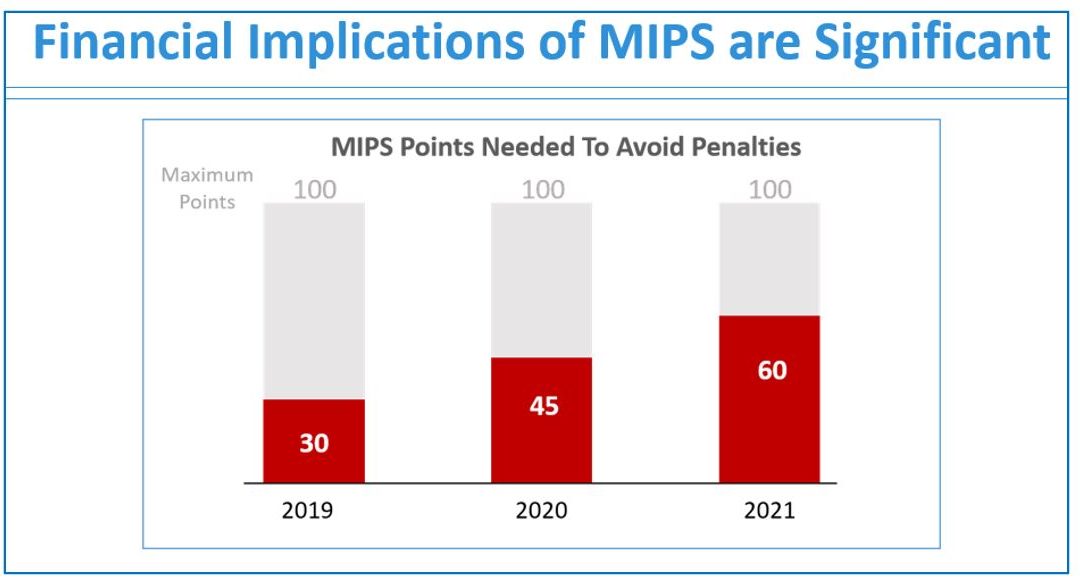

If you are not a MIPS expert (Merit-based Incentive System), your Medicare reimbursements may be decreased by 9% in the next year. However, it’s not too late to avoid the penalty for the 2020 reporting period, but you need to act now!

One of EZClaim’s partners, Health eFilings’ has ONC-certified software that completely automates the MIPS compliance process for you. The software will automatically extract the required data directly from EZClaim (and/or your EHR), and then proprietary algorithms will process the 9,000,000 possible combinations of quality measures for each clinician to identify which measures should be submitted to CMS (Centers for Medicare and Medicaid Services) to earn you the most points.

Need a MIPS expert? Well, Health eFilings is one of the best, and CMS has accepted 100% of their submissions on behalf of their clients. If you have completed your 2020 reporting, reach out to them, and learn how you can earn even more points in 2021.

For more information about EZClaim’s medical billing software, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Sarah Reiter, SVP Strategic Partnerships, Health eFilings]

Jan 11, 2021 | Administrative Safeguards, HIPAA, Live Compliance, Partner

The “Organizational Assessment“ is one simple step to avoid becoming a victim of dark web breaches.

There’s no secret that the Dark Web is a scary place to lose your information. Medical records information sell anywhere from $1-$1000 by identity thieves! So, what if it affected your entire company?

What is a “breach” and where has the data come from?

A “breach” is an incident where data is inadvertently exposed in a vulnerable system, usually due to insufficient access controls or security weaknesses in the software. Data breaches are becoming more common and sometimes out of your control.

You can protect yourself and/or your organization by:

- Carefully monitoring where you store and enter your passwords can be extremely beneficial to help minimize the risk of a hack and keeping personal or patient information protected

- Routine password changes and monitoring where you store and enter your passwords can be extremely beneficial to help reduce the risk of becoming a victim to a hacker. Passwords should be long, unique in characters, capitalization, and alphanumerical

If you believe sensitive information about your organization was compromised, report it to the appropriate people within the organization, including network administrators, so they can be alert for any suspicious or unusual activity.

The web browser, Firefox, has a “Monitor” that will warn you by saying, “Your password is your first line of defense against hackers and unauthorized access to your accounts. The strength of your passwords directly impacts your online security.”

EZClaim’s partner, Live Compliance, can help. They aggregate breaches and enable you to assess where your personal data has been exposed. Dark Web scanning is built right into the Live Compliance portal, which allows a company to keep an eye on employees whose information was involved in a breach (and where the breach took place), and the suggested next steps to take.

What can I do to ensure this doesn’t happen to me or my organization?

Live Compliance can make checking off your compliance requirements extremely simple. It provides:

- Reliable and effective compliance

- Completely online, our role-based courses make training easy for remote or in-office employees

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. Conducting an accurate and thorough Security Risk Assessment is not only required, but is a useful tool to expose potential vulnerabilities, including those such as password protection.

- Policies and Procedures curated to fit your organization ensuring employees are updated on all Workstation Use and Security Safeguards in the office, or out of the office, all updated in real-time

- Electronic, prepared document sending and signing to employees and business associates

So, don’t risk your company’s future on dark web breaches. Contact one of EZClaim’s partners, Live Compliance, especially since they are offering a FREE Organization Assessment to help determine your company’s status. E-mail them, visit their website at LiveCompliance.com , or call them at 980.999.1585.

For more information about EZClaim’s medical billing software, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance ]

Jan 11, 2021 | BillFlash, Medical Billing Software Blog, NexTrust, Partner

There are five primary medical practice fundamentals that, if focused on, will ensure your practice is working toward goals that will make the biggest difference. Practices are pulled in many directions each day, and it can be difficult to know what to prioritize, so the following are some recommendations.

1) Define Patient Engagement Goals

Perhaps one of the most overused terms in today’s medical field is “patient engagement.” Much like the drawer filled with important yet miscellaneous items, if you can’t actually define it, you probably aren’t going to do something with it.

In 2021, it is imperative to define your office’s patient engagement goals in order to determine whether they are being met, and more importantly, if the value you’ve placed on engagement is benefitting your bottom line. This could include engaging via a more personal checkout process that explains how billing and payment will be done and asking patients if there are certain times of the year they wish to be notified for annual wellness checks.

2) Ask For Online Reviews

Reviews remain one of the highest drivers of new customer acquisition. As a local business, you can create a Google Business account online that provides your address, phone number, and link to your website. Included is the ability to add reviews as well as phrases and keywords about your business within the Google Business dashboard, and it’s all free!

To encourage your patients to leave reviews, create cards with step-by-step instructions for posting online reviews via Google. Be picky. Make sure you ask your best patients to participate, who will be honored that you asked. Don’t forget to monitor to see how your business listing looks to potential new patients.

3) Offer Friendly Medical Bills

Of course, we’re not suggesting you add flowers or poignant sayings. Rather, explain a statement to your patients at checkout or within their financial package; this helps the process flow more naturally. BillFlash patient statements have five different messaging rows you can customize for communication. Plus, you can also send electronic patient statements through text and email.

In 2021, communication with patients—even on billing statements—should be natural, friendly, and simple. Getting paid is a segment of the medical practice workflow and should be as easy and frictionless as possible.

4) Ask About Payment Preferences

People are driven by routine and behavior. In today’s world, when paying for an item, the buyer is offered numerous options including cash, debit and credit, no-interest, pay-over-time plans, payment apps, or even Near Field Communication (NFC) like Apple and Google Pay. Granted, the last two have had very low adoption rates, but keeping an eye on payment trends costs little more than time and may add something unexpected to your bottom line.

In 2021, identifying the preferred patient payment options could be the difference between getting paid quickly and not getting paid at all. Don’t overlook the enormous value people place on how they give and take money.

5) Use RCM Services

An RCM vendor helps you get the most out of your practice revenue. They help you collect more from difficult balances, empower patients to pay in full, and improve your claims processing—without adding extra work for your office staff. Working with the right RCM services provider ensures you are paid more for the work you do. They also help identify reasons for claims denials, which have a positive impact on your practice revenue, as well.

For more information about automated patient statements and patient payment options, contact EZClaim, NexTrust BillFlash, GetPaid@BillFlash.com, or call BillFlash at 435.940.9123 (Option 3). For more details about EZClaim’s medical billing software, visit their website, e-mail their support team, or call them at 877.650.0904.

Jan 11, 2021 | Electronic Billing, Medical Billing Software Blog, Partner, Trizetto Partner Solutions

With a new year comes new medical coding changes.

After the examinations, x-rays, and surgeries, lives another major part of a physician’s day that happens behind the scenes. All the hard work needs to be processed through a successful claim submission, meaning that ultimately earning payment all boils down to one thing – coding. Evaluation and management codes, or E/M codes, are codes a physician uses to report a patient visit. This administrative task – a necessity for any physician – is often cumbersome and prone to errors. Most importantly, it uses up valuable time that could be better spent.

How many of us have experienced the “hurry up and wait” scenario? The type of appointment where you wait in a waiting room, then wait a little more in the exam room, then eventually get 10 minutes with your doctor…only to be rushed out so the next patient can be shuttled in. Unfortunately, it’s all too common. It’s safe to say that many patients could benefit from more face-to-face interaction with their providers.

Many people claim that payment for evaluation and management services is undervalued, specifically when it comes to ambulatory services. Additionally, it’s been argued that the fee schedule itself is not well-designed to support primary care, which requires ongoing care coordination for patients. Pressure existed to increase payment rates for ambulatory E/M services while reducing payment rates for other services. Thankfully, The Centers for Medicare and Medicaid Services (CMS) took notice. With the goal of increasing efficiencies to reduce unnecessary burdens, the “Patients over Paperwork” initiative was established. Per CMS, E/M codes make up 20% of total spending under the physician fee schedule. Part of this initiative aims to reduce the coding and documentation requirements for E/M codes, in turn giving physicians more time to spend with patients. In partnership with The American Medical Society (AMA), CMS worked to revise the rules for evaluation and management coding requirements. These changes were finalized in the 2020 Physician Fee Schedule (PFS) with an effective date of January 1, 2021.

So what exactly was revised? The E/M updates affect codes 99201 through 99215 and include the deletion of code 99201 along with revisions to the code selection for 99202 – 99215. Below is a summary of the revisions to E/M codes:

- Elimination of code 99201

- Decrease the burden of coding requirements

- Decreases the burden of documentation

- Decreases the need for audits

- Revises the definitions for Medical Decision Making (MDM)

- Revises the definition of time spent with the patient to total time including non-face-to-face for E/M services by a physician and other QHP

- Requires a history and/or examination when medically< necessary

- Offers a clear time ranges for each code for time spent with the patient

- Addition of a new 15-minute prolonged service code

- Clinicians will choose a code based on MDM or total time

These changes apply to office visits and other outpatient services. It’s noteworthy that these changes represent the first changes to the E/M codes in over 25 years! More importantly, the changes streamline the coding process, reduce clinician burden, and will allow physicians to put the focus back on patient care.

Billing and coding should always be top of mind, but it can be hard to keep up. This is why it’s critical for physicians, clinicians, coders, and billers to completely understand these changes. To help comprehension, the AMA released a checklist identifying ten steps to help the practices prepare for the upcoming changes that can be accessed here. To learn more about the medical coding changes and the summary of revisions, visit the AMA website.

TriZetto Provider Solutions is a partner of EZClaim, and can assist you with all your coding needs. For more details about the EZClaim medical billing solution, visit their website, e-mail their support team, or call them at 877.650.0904.

———————–

Note: This article is not a comprehensive overview and is NOT intended to provide coding advice, rather it is intended to highlight the new changes in effect and the need for physicians to ensure they have received the proper training for the upcoming changes.

[ Contributed by TriZetto Provider Solutions Editorial Team ]