Dec 14, 2020 | Live Compliance, Medical Billing Software Blog, Partner, Support and Training

There are a few HIPAA items to focus on RIGHT NOW—before the end of 2020!

The U.S. Department of Health and Human Services (HHS) has designated the “Health Insurance Portability and Accountability Act” (HIPAA) as the national standard for protecting the privacy and security of health information (in 1996). This led to the Health Information Technology for Economic and Clinical Health Act (HITECH), which has a provision in it for audits, and the HHS Office for Civil Rights is responsible for carrying out HIPAA audits, and responding to complaints and breaches. Ignoring them is not an option!

A Risk Assessment IS NOT Enough

A risk assessment is only one element of the compliance process. You must also “implement security updates as necessary and correct identified security deficiencies.” In other words, you must act via a Corrective Action Plan (CAP) and follow the required risk assessment process.

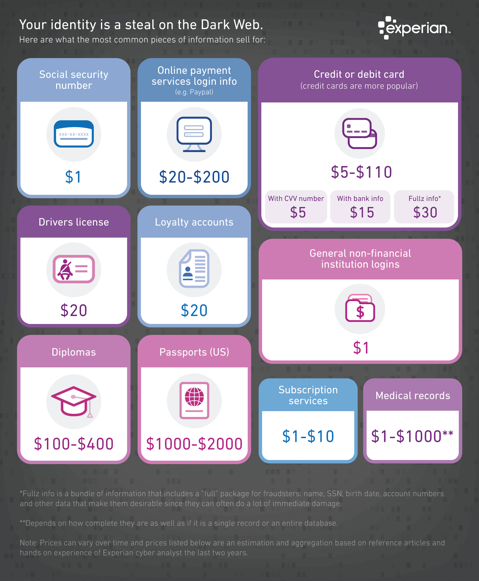

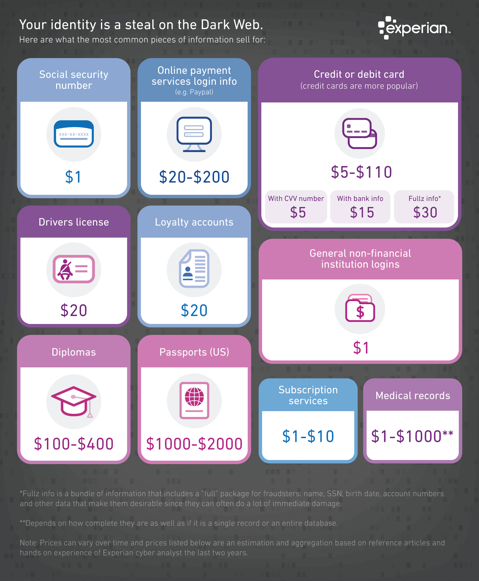

Dark Web

It is no secret that the “Dark Web” is a scary place to lose your information. So, what if it did happen and affected your entire company? Identity thieves get anywhere from $1-$1,000 for medical records, for each instance! So, how can you protect yourself and/or your organization?

Well, data breaches are becoming more common—sometimes which are out of your control—so carefully monitoring where you store and enter your passwords can be extremely beneficial to help minimize the risk of a hack and keeping personal or patient information protected.

One solution for this is the automatic Dark Web monitoring built into the portal of one of EZClaim’s partners, Live Compliance. Their solution helps keep an ‘eye’ on employees whose information was involved in a breach, and suggests next steps to take where the breach was found. Then, it allows your to conduct an accurate and thorough Security Risk Assessment. This is not only required, but is a useful tool to expose potential vulnerabilities, including those that involve password protection.

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

● Reliable and effective compliance

● Completely online, our role-based courses make training easy for remote or in-office employees

● Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location.

● Policies and procedures are curated to fit your organization, ensuring employees are updated on all workstation use and security safeguards in the office, or out. It is updated in real time.

● An electronic document is sent to employees and business associates

So, don’t risk your company’s future, especially when Live Compliance offers a FREE Organization Assessment to help determine your company’s status.

For additional details, call them at 980.999.1585, e-mail them, or visit their website at LiveCompliance.com

[ Article provided by Jim Johnson of Live Compliance ].

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call a representative today at 877.650.0904.

Dec 14, 2020 | BillFlash, Medical Billing Software Blog, Partner

If your New Year’s resolution is to get your practice back into tip-top shape, now is the time to determine your best ‘recipe’ for billing and payment success. In the spirit of the holidays, where award-winning recipes are part of the season, we have included our proven ‘recipe’ for billing and payment success:

INGREDIENTS:

– EZClaim billing software

– Patient statements

– Text & email eBills

– Online payments

– Payment plans

– Stored payments

– Automated payments

– Integrated Collection Services

PREPARATION:

Begin with EZClaim practice management software. Add integrated patient statements, and the ability to text and e-mail eBills. Then, mix in online payments, payment plans, automatic payments, and stored payments. Bake for 30-90 days, and watch your revenue rise! If needed, add a ‘dash’ of Integrated Collection Services to increase your serving amount.

Shape your billing and payment success by adding Pay Services, which will help your practice thrive financially in the new year (More details in this 60-second video). Also, view the Integrated Collection Services Video to learn how you can begin automating and simplifying the patient collections process.

OK, you might have found that a creative use of ‘recipe’, but you probably really want to see the Gingerbread cookie recipe in the photo. So, here it is:

Ingredients:

– 1/2 cups softened butter

– 1/4 cup packed brown sugar

– 1/4 cup granulated sugar

– 1 large egg

– 2 teaspoons ground cinnamon

– 1 tablespoon ground ginger

– 2-1/4 cups of flour

– 1/2 cup molasses

– 1 ‘dash’ of love

Preparation:

Cream butter and brown sugar together. Stir in molasses, then the egg. In a separate bowl, mix flour with all the spices. Stir in butter/sugar mix. If dough is too moist, add 2 tablespoons of flour.

Knead dough lightly, then chill for 40 minutes. Shape the dough into desired shapes. Bake at 350F until tops are ‘set’ (abut 8-12 minutes). Cool on a wire rack for at least 2 minutes before indulging! (If you don’t eat them all in one ‘sitting’, store them in an airtight container, at room temperature, for up to one month!).

[ Click here to download this delicious Gingerbread cookie recipe. (Also, we would love to see pics of your decorated cookies. Send them to sales@ezclaim.com) ].

As we approach the holiday season, EZClaim hopes that you are able to enjoy this time with your families!

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call a representative today at 877.650.0904.

Nov 10, 2020 | Administrative Safeguards, Cloud Security, EZClaim Cloud, HIPAA, Live Compliance, Medical Billing Software Blog, Partner

As 2020 comes to an end, the last thing on anyone’s mind is what operating system is installed on their computers. However, many are unaware that Windows 7 end of life happened over 10 months ago, and according to Microsoft, “If you are still using Windows 7, your PC may become more vulnerable to security risks.”

When an operating system reaches the end of its lifecycle, servicing and support is no longer available for the product. This means, Microsoft no longer releases important security updates or technical support for any issues! In addition to that, the antivirus software, “Microsoft Security Essentials,” is also unavailable, and they are warning that, “Windows 7 users will be at greater risk for viruses and malware.”

As a result, possibilities of exploitation of private and sensitive data and information is increased, which makes it even more easily accessible to lurking hackers. The Windows 10 update is a safer solution for the common user, but there are still some steps that both Covered Entities and Business Associates should take in order to remain in compliance with privacy settings and HIPAA Rules and Regulations after making the upgrade.

One of EZClaim’s partners, Live Compliance, is an expert in determining compliance, and have offered to help. In addition to upgrading your machine to the latest version, the Live Compliance team of HIPAA and HITECH experts will also ensure that your computer meets all other important compliance requirements, and is safe from other common vulnerabilities.

So, if you have questions regarding your organization’s compliance, Windows 7 end of life, or even assistance in setting up Windows 10, contact Live Compliance at 980.999.1585, or e-mail Jim Johnson.

[ Article contributed by Jim Johnson of Live Compliance ]

———————————-

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support, and can help improve medical billing revenues. To learn more, visit their website, e-mail them at sales@ezclaim.com, or call a representative today at 877.650.0904.

Nov 10, 2020 | Medical Billing Software Blog, Partner, Revenue, Support and Training, Waystar

There are five ‘phases’ in the life cycle of a medical bill: Pre-appointment; Point of care; Claim submission; Insurance payment or denial; and Patient payment. This post will overview each of these phases, and could even be considered to be a “101-level” course on Revenue Cycle Management.

There are five ‘phases’ in the life cycle of a medical bill: Pre-appointment; Point of care; Claim submission; Insurance payment or denial; and Patient payment. This post will overview each of these phases, and could even be considered to be a “101-level” course on Revenue Cycle Management.

With high deductible health plans on the rise, the recent explosion of telehealth appointments due to COVID-19, and many other factors in play, it’s more important than ever for everyone to understand the life cycle of a medical bill, and how the process works. The healthcare revenue cycle is relevant not only to those who work in healthcare, but to the patient, too.

The revenue cycle is the series of processes around healthcare payments—from the time a patient makes an appointment to the time a provider is paid—and everything in between. One way to think of it is in terms of the life cycle of a medical bill. Although there are many ways this process can play out, this post will lay out a common example below:

1. Pre-appointment

For most general care, the first stage of the revenue cycle begins when a patient contacts a provider to set up their appointment. Generally this is when relevant patient information will begin to be collected for the eventual bill, referred to on the financial side of healthcare as a claim.

At this point a provider will determine whether the appointment and procedure will need prior authorization from an insurance company (referred to as the payer). Also, the electronic health record (EHR) used to help generate the claim is created, and will begin to accumulate further detail as the provider sends an eligibility inquiry to check into the patient’s insurance coverage.

2. Point of care

The next step in the process begins when the patient arrives for their appointment. This could include when a patient arrives for an initial consultation, an outpatient procedure, or for a follow-up exam. This could also include a Telehealth appointment.

At any of these events, the provider may charge an up-front cost. One example of this is a co-pay, which is the set amount patients pay after their deductible (if they are insured), however, there are other kinds of payments that fall into this category, too.

3. Claim submission

After the point of care, the provider completes and submits a claim with the appropriate codes to the payer. In order to accomplish that, billing staff must collect all necessary documentation and attach it to the claim. After submitting the claim to the payer, the provider’s team will monitor whether a claim has been been accepted, rejected, or denied.

[ Note: Medical coding refers to the clerical process of translating steps in the patient experience with reference numbers. The codes are normally based on medical documentation, such as a doctor’s notes or laboratory results. These explain to a payer how a patient was diagnosed and treated, and why. This information helps the payer decide how much of an encounter is covered under any given insurance plan, and therefore how much the payer will pay. ]

4. Insurance payment or denial

Once the payer receives the claim, they ensure it contains complete information and agrees with provider and patient records. If there is an error, the claim will be rejected outright and the provider will have to submit a corrected claim.

The payer then begins the review process, referred to as adjudication. Payers evaluate claims for accurate coding and documentation, medical necessity, appropriate authorization, and more. Through this process, the payer decides their financial obligation. Any factor could cause the payer to deny the claim.

If the claim is approved, the payer submits payment to the provider with information explaining details of their decision. If the claim is denied, the provider will need to determine if the original needs to be corrected, or if it makes more sense to appeal the payer’s decision.

Following adjudication, the payer will send an explanation of benefits (EOB) to the patient. This EOB will provide a breakdown of how the patient’s coverage matched up to the charges attached to their care. It is not a billing statement, but it does show what the provider charged the payer, what portion insurance covers, and how much the patient is responsible for.

5. Patient payment

The next phase occurs when the provider sends the patient a statement for their portion of financial responsibility. This stage occurs once the provider and payer have agreed on the details of the claim, what has been paid, and what is still owed.

The last step occurs when a patient pays the balance that they owe the provider for their care. Depending on the amount, the patient may be able pay it all at once, or they might need to work with the provider on a payment plan.

The above example represents one way the lie cycle of a medical bill can play out. Some of the ‘phases’ are often repeated. Because of the complexity of healthcare payments and the parties involved, there is not always a ‘straight line’ from patient care to complete payment. That’s why we call it the revenue cycle, and there are companies that provide systems for its management.

One of EZClaim’s partners, Waystar, aims to simplify and unify healthcare payments. Their technology automates many parts of the billing process laid out above, so it takes less time and energy for providers and their teams, and is more transparent for patients (Click here to learn more about how Waystar automates manual tasks and streamlines workflows.) When the revenue cycle is operating at its most efficient, providers can focus their resources on improving patient care—and that’s a better way forward for everyone!

For more information of how Waystar works together with EZClaim, click here.

[ Article and image provided by Waystar ]

———————————-

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support, and can help improve medical billing revenues. To learn more, visit their website, e-mail them at sales@ezclaim.com, or call a representative today at 877.650.0904.

Nov 10, 2020 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

To adjust to the ‘new normal’, here are some of the latest best practices for medical offices to implement.

In the current state of the world, filled with struggles brought on by COVID-19, many providers and practices are attempting to weave new procedures and workflows into their daily activities—to adjust to the ‘new normal’. This includes implementing virtual visits, exploring automation and paperless options, streamlining eligibility verifications, and strategizing on denials management.

An EZClaim partner, TriZetto Provider Solutions, has provided information about the latest best practices for medical offices. Their in-house experts offer some creative ways of how your practice can become more efficient and navigate through the pandemic with the following articles:

• Eligibility Woes: The Impact of COVID-19 on Insurance Coverage

• Adapting denials management to protect and retain revenue

• Healthcare Huddle: How to Manage Telemedicine & New Challenges during the New Normal

EZClaim’s medical billing software can ensure that you are equipped with the right solutions to manage costs and maximize revenue flow. Want to learn more? Well, visit their website, e-mail them at sales@ezclaim.com, or call a representative today at 877.650.0904.

Oct 13, 2020 | HIPAA, Live Compliance, Medical Billing Software Blog, Partner

New HIPAA compliance requirements are coming!

In an effort to make the HIPAA Privacy Rule as easy to understand as possible, the Office for Civil Rights (OCR) has come up with a list of rules that clearly explain what Business Associates are now “directly liable” for. As OCR Director Roger Severino explains, “We want to make it as easy as possible for regulated entities to understand, and comply with, their obligations under the law.” The list consists of ten rules that, if failed to follow, can result in penalties and monetary fines.

[ Note: Check out our previous post to access this list ].

Immediate Requirements:

As we enter the fourth quarter of the year, you may be wondering what immediate requirements should a Business Associate complete before the end of the year?

One of the most important rules also includes information about Business Associates, and their need for proof of satisfactory assurance when the covered entity requests this of them. Satisfactory assurance is crucial, because it ensures the Business Associate is HIPAA compliant, and therefore, must also be in the form of a contract.

The Satisfactory Assurance contract is oftentimes outlined in the form of a questionnaire, and requires the Business Associate to disclose the date of completion for various compliance requirements.

These include distribution and completion of workforce HIPAA training, implementation and distribution of policies and procedures, Business Associate documentation, and completion of an annual HIPAA Security Risk Assessment.

Are You Prepared?:

If a Covered Entity requests this proof from your organization, would you be able to successfully complete it without outdated completion?

If you are uncertain that your organization would be able to easily and efficiently provide that documentation, you may be facing thousands of dollars in fines for each vulnerability!

HIPAA Compliance Myths:

False: The security risk analysis is optional for small providers: All providers who are “Covered Entities” under HIPAA are required to perform a risk analysis. In addition, all providers who want to receive MU, and MIPS incentive payments must conduct a risk analysis.

False: Our office uses the Cloud, so we don’t need a risk assessment: Even if you have a fully HIPAA compliant cloud vendor, your patient data (ePHI and PII) still must go through all your systems to get to the cloud. So, you are still required to perform technical, administrative, and physical security risk analyses.

False: Our EHR makes us compliant, so we’re fine: While your EHR may provide excellent privacy and security features, it definitely doesn’t exempt you from the HIPAA security requirements.

Live Compliance helps their clients meet the ever changing and complex HIPAA State and Federal regulations. They protect the information they are entrusted with, and ensure their clients pass any Health and Human Services audits. If you are unsure or need assistance, call Jim Johnson with Live Compliance at (980) 999-1585.

Live Compliance is a partner of EZClaim, a medical billing software company. For more details about their solutions, visit their website at ezclaim.com.

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing:

So, what can I do to ensure this doesn’t happen to me or my organization? Well, Live Compliance makes checking off your compliance requirements extremely simple by providing: