Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner

In the wake of the COVID-19 pandemic, Telehealth adoption has exploded, and there are six revenue cycle metrics to track.

Many patients are prohibited or reluctant to venture out for on-site care. The combination of relaxed regulations and expanded payment parity for appointments has made virtual meetings easier and more attractive for providers, who are turning to these technologies to stay engaged with patients—and maintain cashflow. Dr. Robert McLean, a former president of the American College of Physicians, recently said, “this crisis has forced us to change how we deliver health care more in 20 days than we had in 20 years.”

A new industry report predicts that the number of Telehealth visits in the US will surpass one billion by the end of the year, and speculates that nearly half of those visits will be related to COVID-19. At Waystar, we have been closely monitoring claim trends and are seeing this growth firsthand. In fact, the volume of Telehealth claims on the Waystar platform has grown by more than 100 times since mid-March. On two particular days in late April, they accounted for more than 15% of our total daily claim volume. Before COVID-19, they would have accounted for less than one percent!

For many providers, this shift will require new revenue cycle strategies to meet growing patient demand without overwhelming clinicians and administrative teams—or already strained operating budgets. It’s important to remember this is still very much an evolving care delivery model with the opportunity for errors on the part of both payers, providers, and administrative staff. For this reason, revenue cycle professionals should diligently monitor claims to ensure proper adjudication, identify learning opportunities, and uncover areas for operational improvement.

Below, we’ve listed six core Telehealth-related metrics you should regularly track to ensure billing accuracy, maximize payer reimbursement, and reduce claim rejections and denials. For more on how to best navigate the evolving telemedicine landscape, check out our resource hub here.

To report on Telehealth-related claims, you’ll first need to identify and isolate claims containing Telehealth procedure codes. See CMS’ Telehealth code list to identify the specific procedure codes and modifiers that apply to your organization.

Payer Analysis:

1. Payer Telehealth claim rejections by volume and/or billed amount

2. Payer Telehealth claim denials by volume and/or billed amount

If your Telehealth claims are being denied or rejected, do you know which specific payers are doing so at the highest rate? Drill down to discover the specific reason codes payers are attaching to rejections and denials so you can better understand payer-specific rules and avoid these oversights in the future. In some cases, you may identify trends that warrant a call to the payer to correct.

Provider Analysis:

3. Telehealth claim volume by the provider

Review this claim volume by individual provider. If you notice providers within your organization generating a much lower volume of Telehealth claims than peers, perhaps they could benefit from additional training on Telehealth technology and use cases.

Ensuring Billing Accuracy:

4. Telehealth claim rejections by biller/team

5. Telehealth claim denials by biller/team

Are certain billing personnel or teams producing higher denial or rejection rates than others? Keep a close eye on these trends and remember most of this is new for everyone. If some team members are seeing more rejections or denials than they should, it could be a great opportunity to hold training and collaborate on strategies for success.

Maximizing Reimbursement:

6. Telehealth claim volume by procedure code

Which Telehealth codes are you using? Each code reimburses at a different rate, so choosing the wrong ones could leave money on the table. Be sure to read up on CMS’ requirements (check out their fact sheet and code list) to ensure you’re choosing the appropriate code(s) on each Telehealth claim.

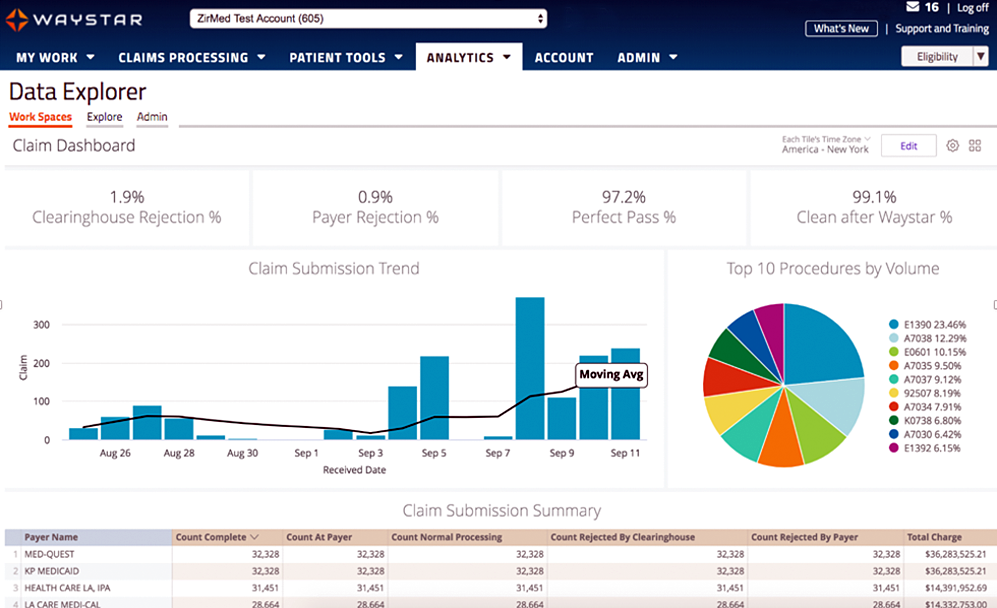

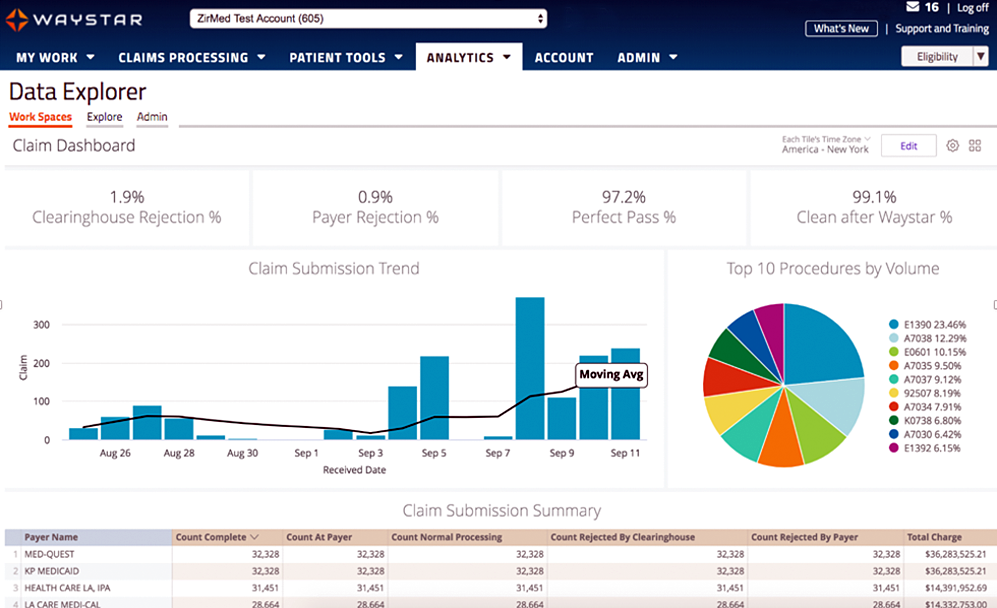

Waystar Analytics

You have all the data you need to drive informed decision making and improve financial performance—you just need the right analytics tool in your corner. Our new Waystar Analytics solution offers a pre-built Telehealth dashboard that can help you easily interpret, share all the metrics above, and track these revenue cycle metrics. Click here to learn more about Waystar Analytics and how it can deliver the insights you need during this time of transition.

[ By Waystar ]

Aug 11, 2020 | Medical Billing Software Blog

The most important thing a medical practice can do for their financial health is collecting payments from patients. So, because patients are not usually savvy when it comes to the nuts and bolts of their contract, they become frustrated when you send them a bill and, beginning on January 1st, your office staff get inundated with the question, “Why do I have a balance?”

“Approximately 68% of patients with bills of $500 or less did not pay off the full balance during 2016—up from 53% in 2015 and 49% in 2014.” Source: Patients May be the New Payers, But Two in Three Do Not Pay Their Hospital Bills in Full, TransUnion Healthcare, June 26, 2017

So, let’s make sure your office is equipped and able for collecting payments from patients for the services you rendered, rather than them becoming a part of this scary statistic.

Let’s begin with the basics: Make sure that your staff understands these key terms, and is comfortable explaining them to your patients.

Deductible: The deductible is the amount the patient has to pay for covered services before the insurance plan pays. Some insurance plans will apply an office visit to the deductible, others will not. Family plans typically have an individual and family deductible.

Copay & Coinsurance: These are both the portion the patient will be responsible for after their deductible has been met. Copays are a set, flat fee. Coinsurance is a set percentage that the patient will pay.

Maximum Out-of-Pocket: This is the limit of what a patient will pay for covered services within a plan year. Again, on family plans, there may be an individual max and family max.

Now, keep in mind that your staff will not know the details of your patients’ plans, nor should they be expected to! In the ever-changing world of health insurance, patients need to become better consumers. So, just being able to explain these key terms and why they create a patient balance will help them become better insurance plan shoppers!

Use your tools. Look into using Integrated Eligibility (available through your billing software and your clearinghouse). This will allow your staff to check remaining deductible balances, copay, and coinsurance amounts with the click of a button. These results allow practices to confidently collect at the time of service rather than spending time and money on sending statements and working to collect after the visit.

In addition to that, create a plan and stick to it. Use this time to review the efficiency of your patient collections plan. Are you using an outdated plan or policy? Have you considered offering payment plans to patients with an HSA card kept on file? Make sure that your employees understand how important patient collections are to the practice, educate them on the plan, and support them when they hold patients accountable to the patient collections policy.

For more information on how EZClaim can help you with this journey, schedule time with our sales team. Or, if you ready to get started right now, then download your FREE 30-day demo today!

[ Written by Stephanie Cremeans of EZClaim ]

May 12, 2020 | Medical Billing Software Blog, Partner, Trizetto Partner Solutions

If you are a member of the MEDICAL BILLING COMMUNITY, the norms of the day-to-day have changed. With the recent COVID-19 pandemic and the ‘stay-at-home’ order, you may find yourself with either more time on your hands and/or an increase of claims with new patients. During this time, we want to offer you a couple of suggestions so that you can make the best use of the additional time you have, and also help you improve your billing processes.

The first thing to consider is to review your Accounts Receivable (AR)—to collect payments due you to INCREASE YOUR INCOME. According to the American Medical Association (AMA), claim denial rates range between 0.5% and up to 3% or more, and that 90% of claim denials are preventable. Some of the most common claim denial reasons can be rectified by correcting claim management workflows, including claim submission and patient registration procedures. The following are a few of the most common oversights for claim denial.

- Use EZClaim software to check automatically for missing information, including absent or incorrect patient demographic information and technical errors

- Make sure you do not have duplicate claim submissions

- Check that claims do not have services previously adjudicated

- Review for claims with services not covered by the payer

- Make sure the time limit for claim submission has not expired

Secondly, revisit and resubmit open claims. Surprisingly, 31% of providers still use a manual process to resubmit. Our partner, TriZetto Provider Solutions (TPS), has an Advanced Reimbursement Manager Pro (ARM) that has two great tools that can improve your ability to tackle collecting and repaying underpaid and overpaid accounts. Below are some key features that can be automated by their software, and will help to improve your billing processes:

- Identify common errors and payer trends

- Analyze contract performance

- Customize and assign work into queues

- Quickly access information from interactive dashboards

- Automate the appeal process

Thirdly, know that EZClaim and our partner TPS have worked together to bring you the most powerful medical billing software tools to solve claim denials. Our partnership not only simplifies the billing process but also helps resolve denied claims in an efficient way. In addition to that, our customer support team is available to help you learn best practices with these tools, and support you however you need it.

Finally, if you are frustrated with your current medical billing solution, investigate how EZclaim’s medical billing solution may work for you. You can either schedule a one-on-one consultation with our sales team or download a FREE TRIAL to check it out the software yourself. For additional information right now, contact EZclaim’s sales team at 877.650.0904 or send an e-mail to sales@ezclaim.com.

May 12, 2020 | Electronic Billing, EZClaim Premier, Features

A recent medical billing webinar on Telehealth that EZclaim hosted is now available to review.

On April 30th, EZClaim hosted a Telehealth Updates Webinar for our clients with guest speaker Sandy Giangreco Brown – Director of Coding and Revenue Integrity Health Care at CliftonLarsonAllen, LLP

We had one of the largest viewing audiences 101 active attendees in the session. Sandy shared informative billing codes and direct links to update hands-on information for billers actively coding Telehealth sessions. For those of you who missed it, we have provided on our website the recorded session ezclaim.com/webinars and can provide the presentation slides too! Just send a request to sales@ezclaim.com

We continue to get views of this presentation and look forward to hosting more hot topics with the CLA Team.

With the onset of COVID-19 came a great opportunity for clinics and hospitals to offer Telehealth and Communication Technology Based (CTSB) services. The Centers of Medicare and Medicaid Services, or CMS, have provided many updates to the available services that can be provided and billed to the patients to help practices not only stay afloat financially but also and most importantly, to keep their staff safe and provide excellent care to their patients!

There were new guidelines released even after this webinar on 4/30/2020 (which can be found here – https://www.cms.gov/files/document/se20016.pdf, and now includes audio-only Telehealth for services such as psychotherapy, tobacco cessation and medical nutrition counseling as well as diabetes self-management training. CMS is also increasing the payments for the Audio Only services from $14-$41 nationally to $46-$110.

As of April 30, 2020, in order to bill Telehealth, RHCs are now required to bill the G2025–CG–95 from January 27, 2020, to June 30, 2020. Then from July 1, 2020, to the end of the PHE, they will be billing the G2025 with an optional 95 modifier, per CMS SE20016 Medicare Learning Network Transmittal.

FQHCs will need to report three (3) codes for their Telehealth Services:

- G0467 (or other appropriate FQHC specific payment code)

- 99214–95 (or other FQHC PPS Qualifying Payment Code)

- G2025–95

CLA is on the frontlines and closely monitoring and analyzing activities related to Telehealth and other virtual health regulations

CMS Telehealth fact sheet, Frequently Ask Questions:

As your practice adjusts to Telehealth going forward, EZclaim’s medical billing solution can help you simplify patient billing and help you get paid for Telehealth visits. (Our recent medical billing webinar on Telehealth may just help you better understand the current situation).

So, to help you investigate how EZclaim’s medical billing solution may work for you, either schedule a one-on-one consultation with our sales team or download a FREE TRIAL to check out the software yourself. For additional information right now, contact EZclaim’s sales team at 877.650.0904 or send an e-mail to sales@ezclaim.com.

[Contributed by Sandy Giangreco Brown – Director of Coding and Revenue Integrity Health Care, CliftonLarsenAllen LLP]

Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

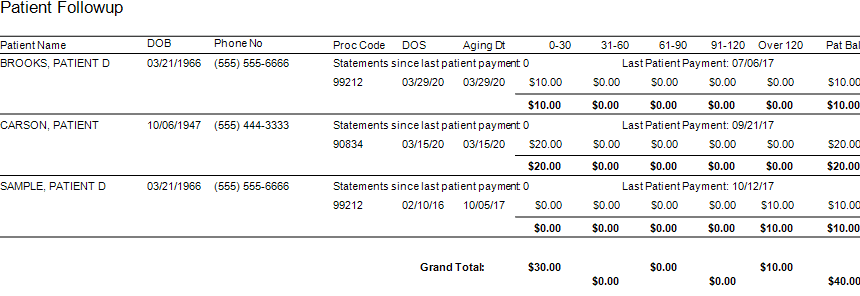

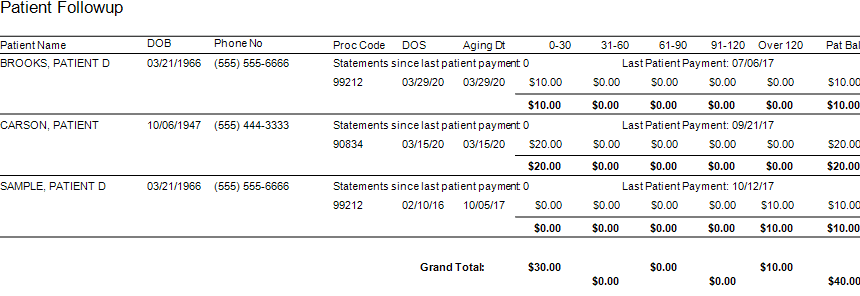

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]