May 12, 2020 | BillFlash, Features, Medical Billing Software Blog

Telemedicine was already growing in popularity prior to the onset of the Coronavirus pandemic. So, as the adoption rate increases, EZClaim clients may have questions about sending telemedicine charges and getting paid for Telehealth visits.

Telehealth challenges can range from issues with technology to getting paid. With Telehealth becoming the norm for many doctor-patient visits, it is important to have a thoughtful approach in place regarding collecting patient payments. To stay in business, you have to get paid for the work you are doing. So, establishing a process for Telehealth consultations is vital to your business, and it should be a top priority to build a successful program from beginning to end.

The answers to the following questions will help set the baseline for how to collect patient payments for

Telehealth visits:

- What is my process for charging for copays?

- How and when do I collect outstanding balances?

For example, if you collect payment before an in-person visit, you should collect payment before a Telehealth visit, too. There is no need to re-create your process completely. Just change what is needed to match your current in-office routine.

Sending Charges Before a Telehealth Visit

A simple way to send pre-visit charges to patients is to provide them with a link that takes them directly to the payment site. EZClaim’s medical billing solution is integrated with BillFlash LinkPay, which enables customers to provide payment for the upcoming visit. So, before the Telehealth session begins, the practice simply sends a link to their patient via an e-mail or text, making the appointment confirmation and the payment processing part of the check-in process. After the payment transaction is complete, it will immediately show up on the practice’s BillFlash report. LinkPay is designed to be easy to use and doesn’t require patients to remember a login or a chart number.

Here’s how EZClaim enables the process through BillFlash:

- Prior to Telehealth visit, the patient is sent a link to pay through LinkPay, and another link to join the Telehealth call

- The patient pays the required amount through LinkPay, which is immediately confirmed and processed

- The patient joins the Telehealth session

- Results and follow-up are completed electronically

- Insurance billing is completed

- The patient receives a paper statement or eBill notification for any remaining balance

- The patient is directed to pay the remaining balance online at MyProviderLink.com

Automate What Can Be Automated

With so many changes taking place in healthcare, a great way to help protect the financial stability of your practice is to automate what can be automated. This saves your staff time and decreases your cost of doing business.

One way to do this is to set up automatic payment plans for patients, particularly for those who have been hit hard by the economic impact of COVID-19. A payment plan is a good way of keeping the revenue flowing in, and it shows your patients that you are compassionate and willing to help them through these unprecedented times.

BillFlash also securely stores payment information, so patients will not need to re-enter their information every time they pay a new bill.

As you continue to adjust to Telehealth going forward, BillFlash can simplify patient billing and payments significantly and help getting paid for Telehealth visits.

So, for a LIMITED TIME (during May 2020), EZClaim customers can try BillFlash statement and eBill services for FREE for 30 days. Click on this link for more details about BillFlash or try it out for the next month.

For additional information, call BillFlash at 435-940-9123, or contact EZclaim’s support team at 877.650.0904 or support@ezclaim.com.

[Contributed by James Easley VP, Marketing NexTrust Inc.]

Apr 13, 2020 | Medical Billing Software Blog, Trizetto Partner Solutions

On January 13th we posted part one on this topic of Eligibility in healthcare, in that, we touched on deductibles, co-pay, and max out-of-pocket pay. Now in part two, we review the impact of price transparency in healthcare and its importance to the healthcare team decisions.

Consumers are the most important member of the healthcare team and are better collaborators in their care when they know all the variables and their required responsibilities in the process.

The individual consumer’s healthcare team includes, along with themselves, the physician and their staff, the pharmacist, an insurance adviser, and possibly some gatekeepers as well. The communication of clear symptoms when a patient is diagnosed is the responsibility of that team along with building an understanding of the financial responsibility that goes with any medical solution. While providing answers, options and solutions is a provider’s responsibility, so is providing a cost for the provided care. Therefore, price transparency can be achieved when the cost for that care is presented in a clear and concise fashion so the patient can understand what they owe, why they owe it, and when it is due.

Ensuring your staff is educated on discussing the financial responsibility with the patient from the first appointment and forward will strengthen the healthcare partnership and assist in the collection process. Understanding the steps that occur post the upfront estimate can be beneficial to the team. This discussion can be bolstered by ensuring bills are clearly marked with the statement, “this is a bill”, also clearly listing what the patient is being charged for when the bill is due and offering details on the methods of payment that are accepted. This clarifies what insurance will cover for the patient and their own out-of-pocket cost, prompting them to share any concerns and constraints with payments upfront.

Estimating patient responsibility is one part of the reimbursement process that is used for transparency for patient billing. The estimates can be provided using a spreadsheet of prior reimbursement and your most commonly billed CPT codes. If you would like an automated and more accurate option then look into a software tool like the Patient Responsibility Estimator by our solutions partner, TriZetto Provider Solutions (TPS). Giving this to the patient at the time of checking in will assure they have a rough idea of the costs and allow the office to collect upfront if needed.

For more information on how EZClaim can help you with this journey, schedule time with our sales team. Ready to get started? Download your FREE 30-day Trial today!

[ Contribution by Brenda Smelser with the DMC ]

Apr 13, 2020 | Medical Billing Software Blog, Revenue, Trizetto Partner Solutions

Because of COVID-19, some practices are doing triage from the car before they will allow a patient into their offices. Practices should also take a ‘cue’ from this by instituting protective measures for their finances.

I went to the doctor for a regular visit last week, which seemed anything but regular. I sat in the car and called to let them know I had arrived. They verified my demographics and insurance information over the phone; me in the parking lot, them in the office. The MA came out with her PPE and took my temperature, found me to be fever free so I could enter the building.

My nurse practitioner came in for our visit. We went about our appointment as usual except this time she took my superbill upfront herself and handed it to the check-out staff member. We scheduled a Telehealth visit instead of a traditional office visit. At the checkout desk, I said “I’m pretty sure I have a balance from the last visit, can I take care of that today?”. I loved where their heart is at, but I was sad to hear her say “You do, but we aren’t worried about that today. Just pay when you get the next statement.”

With so many things in chaos right now, so much thrown at you, and out of your control – let us not forget about the protective measures you can put in place for your practice. This is the time to get some vitals and triage from the car, before blindly allowing the chaos into your business. So, what should you be tracking?

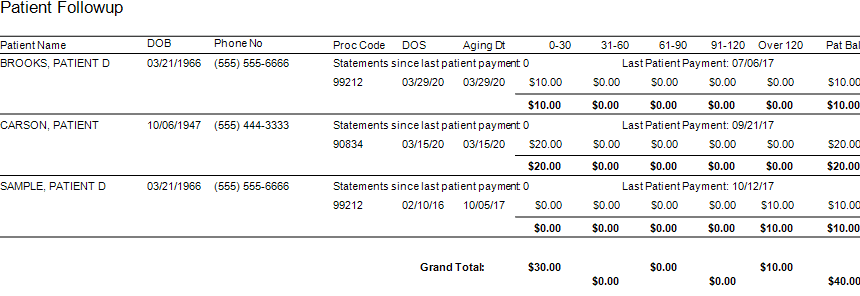

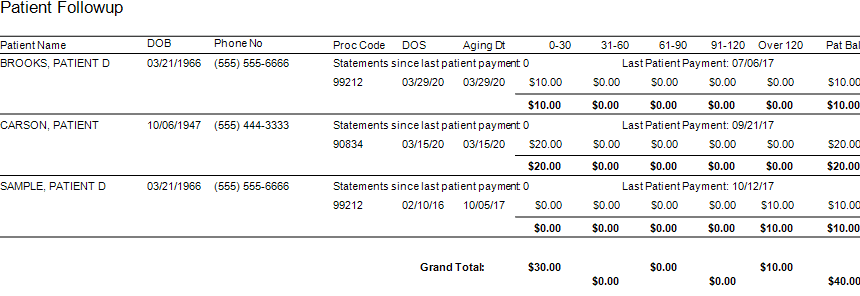

Start with basics – look at the aging balances. More than likely, you have money on the table! In EZClaim, you have the option to run full aging, but the more efficient option is running the Insurance Follow Up report and the Patient Follow Up report. Just running these reports will let you know where there is money that needs to be collected. In addition – it just may show you that it is time to reevaluate policies and procedures in your office related to patient balances and insurance follow-up. Here is a peek at what these two reports can do for you.

Patient Follow Up Report: This report will show you balances that are outstanding with your patients. While this may not be the easiest time to ask patients to pay their balances, there are steps you want to consider:

- Consider what you will do with lingering patient balances. The Patient Follow Up report will show how many statements have been sent since the last patient payment. If you have sent several statements is it worth continued efforts?

- Contact your patients to see if they can pay with an HSA or FSA account

- Offer to set up a payment plan

- Write off the balance as a bad debt or a one-time professional courtesy

- Consider sending the account to collections

- Use technology to your advantage. Take this time to consider enabling online payment options.

- Create or revise patient payment policies and train your staff on these policies

Insurance Follow Up Report: This report will show your balances that are outstanding with insurance companies. Some of the useful features of this report include:

- Ability to see the aged balances by the payer. This lets you get the biggest bang for your buck. Look for payers that have a large percentage of balances in the oldest buckets and work those first.

- All the information you need for calling the insurance is right there on the report. You will have easy access to the date of birth, member ID number, and claim totals on the report.

- During your research, you will find common themes. Use these themes to update your office procedures and train your staff to eliminate errors so that claims get paid quicker.

EZclaim billing software can help you manage your office’s finances. Visit our website to find out more about our solutions: https://ezclaim.com/

[ Contribution by Stephanie Cremeans with EZClaim ]

Apr 13, 2020 | BillFlash, Partner

Medical billing managing collections during COVID-19 will be different than it was in the past. It has already changed a lot about how medical practices operate, and in a short amount of time. One thing that hasn’t changed, however, is that practices need to get paid in order to continue operating. This includes sending patients to collections when necessary.

Managing late or unpaid bills during economic uncertainty may require a different approach than you’re used to. Before you send patients to collections, make sure you take these steps first.

- Be upfront about payment expectations from the beginning

-

- You should already have a strategy in place regarding informing patients how much they owe for services. Stick to it. Many people are hoping for leeway on certain bills due to the economic impact of COVID-19, but gently remind your patients that for essential healthcare services to continue, practices need to keep revenue flowing, and that means billing will continue as usual.

- Set up payment plans

-

- If a patient is unable to pay a bill in full, help them set up a payment plan. BillFlash PlanPay lets you set up scheduled, automatic payments to be paid over a set period of time. This is the best option for both you and the patient because:

- The patient has a more manageable bill

- Your practice is more likely to be paid in full

- Setting up a payment plan shows your patients you’re willing to work with them. That’s usually all they need to be assured that you care.

- Send out multiple reminders

-

- Use whatever resources you have—email, phone, text, mail—to contact patients about balances they owe. Be courteous in your reminders, but firm. Most patients want to pay their medical bills. Often all they need is a simple reminder and an easy way to make the payment.

- BillFlash helps you manage all of this during the pre-collections phase to help ensure you are paid as quickly and completely as possible.

If none of these steps work, then it’s time to get collections involved.

What to Include in a Collections Letter

Include all the facts of the visit. This includes:

-

- Date of service

- Service provided

- Amount patient owes

- Payment options

Tone of the Letter

The right tone in your letter can do more to ensure payment and a continued relationship with the patient than anything else you include. You need to convey a sense of urgency, but without being overbearing and intimidating.

A few tips to keep in mind:

-

- Empathize with the patient. Simply saying “We understand you may be experiencing financial difficulties at this time” is more likely to get a response than a curt “final warning” threat.

- Explain why it is important for the patient to pay anyway. Example: Like any other business, our practice relies on revenue to thrive. In order to continue to provide these valuable healthcare services, patients need to pay their bills in full and on time.

- Offer a payment plan. Give patients one more opportunity to pay their bills in smaller chunks over a period of time to avoid having their accounts sent to collections.

We’re all experiencing difficulties during this global pandemic. The only way to get through it is to work together. Being upfront with patients about payment expectations and being willing to work with patients who have fallen on hard times will help all of us through this global health crisis.

BillFlash Collections Services can help you in managing collections during COVID-19, and simplify and streamline all your other collection processes for you, saving you the headache of exporting, importing, and working with a disconnected agency.

As an EZclaim ‘preferred’ partner, BillFlash is fully integrated with the EZclaim Premier billing application. For more details, view this informational video: https://www.rcm.billflash.com/ezclaim For more information about the EZclaim billing solution, view our website: https://ezclaim.com/

Jan 13, 2020 | BillFlash, collections, Partner, Revenue

As Patient Payment Responsibility continues to increase, sending patients to collections efficiently & effectively is more critical to the financial health of your practice than ever before. Here are some helpful tips to optimize your patient collections process.

- Communicate your collection policy upfront

- Integrate your collections process with your billing

- Consider offering discounts for self-pay patients

- Accept multiple forms of payment

- Offer multiple payment options

- Require patients to make “good faith” payments

Practices that employ the following practices can help prevent sending patients to collections or make the collections process much more efficient and effective.

1.Communicate your collection policy upfront

Prior to patient appointments, clearly communicate your collection policy. This helps the patient plan ahead to pay in full in the specified time period. This is especially important for patients that must meet a deductible or coinsurance amounts towards the out of pocket expenses. When patients are aware in advance, they are more likely to make some of their payment upfront. In addition to pre-visit communications, specify your collections with signs in your office, intake forms, information documents, and on your website.

2. Integrate your collections process with your billing

The current process to send patients to collections is tedious, time-consuming, and prone to error and miscommunications. That’s because staff must constantly and manually pull lists of patients eligible for collections and send all the necessary patient information to the agency. Plus, all the complex back and forth communications, followed by posting accounting for the payments.

Leveraging an automated patient billing system like BillFlash, you can create rules based on aging and minimums that queue up patients eligible for collections and send all the necessary information to begin the collections process. Practices can manage the entire collections process right in the patient billing system including setting rules, approving accounts for collections, and reports. To learn more, call NexTrust BillFlash at 435-940-9123 or visit collections.billflash.com

3. Consider offering discounts for self-pay patients

While insured patients receive discounts through their insurance provider, self-pay patients are responsible for their full payment. As an incentive to pay bills in a timely manner, offering self-pay patients a discount to pay in a timely fashion could reduce accounts sent to collections, improve the patient payment experience, and help improve your cash flow.

4. Accept Multiple Forms of Payment

Limitations in accepted payment methods and payment options can be a liability for your practice in getting paid quickly, and sometimes, getting paid at all. You can remove these barriers by incorporating payment systems that make it easy to accept all card types as well as payment plans. The BillFlash Billing and Payment system lets you offer these payment options to your patients simply. Patient billing and payments can then be synced with EZClaim because of the existing integration with BillFlash.

5. Offer Multiple Payment Options

Patients may find themselves in collections because out of pocket expenses are often much higher than they expected and can sometimes be thousands of dollars. Offering various payment methods and payment plans improves the patient experience and overall satisfaction.

Limitations in accepted payment methods and payment options can be a liability for your practice in getting paid quickly, and sometimes, getting paid at all. You can remove these barriers by incorporating payment systems that make it easy to accept all card types as well as payment plans. The BillFlash Billing and Payment system lets you offer these payment options to your patients simply. Patient billing and payments can then be streamlined because of the existing integration with BillFlash.

6. Require patients to make ‘good faith’ payments

If a patient is not paying their balance in full, requiring them to pay a portion of the payment is a helpful first step in keeping their commitment to fully meeting their financial responsibility. These small steps not only make the debt more manageable for patients but creates payment momentum for future payments so that at 90 or 120 days they owe much less and are less likely to be candidates for collections.

With increasingly more patient payment responsibility, the risk for patients being sent collections can rise as well. So, helping your patients avoid collections and optimizing your collections process when collections become necessary, can bring big financial returns

Call NexTrust today at 435-940-9123 or email at sales@billflash.com or go to collections.billflash.com to learn how collections are now integrated with automated patient billing and payments to improve the financial health of your practice.

Make sure you never miss an article from EZClaim and our partners, follow us on Facebook and/or LinkedIn!