Feb 9, 2021 | Administrative Safeguards, Cloud Security, Live Compliance, Medical Billing Software Blog, Partner

Ransomware hackers target medical billing companies, and it CAN AFFECT your entire company! (Ransomware is a type of malicious software designed to block access to a computer system until a sum of money is paid.)

Often out of one’s control, ransomware hackers target medical billing companies because of the tremendous value of the data. BUT, there are steps that CAN BE TAKEN to protect you, your company, and your patients and/or clients.

NetWalker Ransomware, for example, gained notoriety for targeting hospitals and healthcare providers with e-mails claiming to provide information about COVID-19. (The e-mail usually has an attachment that downloads the ransomware from a remote server when clicked on.) The thing is, this is very lucrative for identity thieves since medical records information sells anywhere from $1-$1000!

As the number of healthcare providers taking advantage of Telehealth continues to increase—now outnumbering in-person visits—the number of ransomware attacks continues to increase as well. This means Billers and Providers must be aware of the programs that are used on their machines and ensure necessary steps are taken to safeguard against hackers and attacks.

How can you protect yourself and/or your organization?

- Carefully monitoring where you store and enter your passwords can be extremely beneficial to help minimize the risk of a hack and keeping personal or patient information protected.

- Routine password changes and monitoring where you store and enter your passwords can be extremely beneficial to help reduce the risk of becoming a victim to a hacker. Passwords should be long, unique in characters, capitalization, and alphanumerical.

- Have you had an accurate and thorough Security Risk Assessment and/or penetration testing? If you haven’t completed an accurate and thorough security risk assessment, you could also be penalized under ‘willful neglect’ (this category alone is $50,000 per violation!) in addition to the higher risk of ransomware attacks.

- If you believe you might have revealed sensitive information about your organization, report it to the appropriate people within the organization, including network administrators. They can be alert for any suspicious or unusual activity.

- The strength of your passwords directly impacts your online security.

Live Compliance can help. They aggregate breaches which enables you to assess where personal data has been exposed. Dark Web scanning is built right into their Portal, and it allows you to keep an eye on employees whose information was involved in a breach, where the breach took place, and then suggest the next steps to take.

At Live Compliance, they make checking off your compliance requirements extremely simple and to ensure this doesn’t happen to you or your organization:

- Reliable and effective compliance

- Completely online, our role-based courses make training easy for remote or in-office employees

- Contact-free, accurate Security Risk Assessments are conducted remotely. All devices are thoroughly analyzed regardless of location. (Conducting an accurate and thorough Security Risk Assessment is not only required but is a useful tool to expose potential vulnerabilities, including those such as password protection.)

- Policies and procedures curated to fit your organization ensuring employees are updated on all workstation use and security safeguards in the office, or out of the office—all updated in real-time

- Electronic, prepared document sending and signing to employees and business associates

So, don’t risk your company’s future on ransomware hackers. Contact one of EZClaim’s partners, Live Compliance, especially since they are offering a FREE Organization Assessment to help determine your company’s status. E-mail them, visit their website at LiveCompliance.com, or call them at 980.999.1585.

For more information about EZClaim’s medical billing software, which provides a best-in-class product with correspondingly exceptional service and support, e-mail, visit their website, or contact them at 877.650.0904.

[ Article contributed by Jim Johnson of Live Compliance ]

Jan 11, 2021 | Medical Billing Customer Service, Medical Billing Software Blog, Medical Billing Software Customer Service, MIPS Reporting, Revenue

It goes without saying that 2020 will go down in the history books as unprecedented for us at EZClaim. Still, we worked hard to stay positive and navigate the storm by offering resources to you, our clients, the content that matters to you. As an end-of-year bonus, and a ‘kick-off’ for 2021, we reviewed the blogs and social posts you read and reacted to the most and thought we would share them.

So, here are the best blog posts of 2020:

#1: How to Improve Medical Billing Revenues

As a medical billing company, we work hard to understand how we can help our clients increase their revenue and improve their billing process. Those who do this best are experts in the medical billing and coding industry. So, it makes complete sense that your interest peaked on our article concerning improving revenues. Enjoy reviewing our number one article of 2020! [ Click to read the post ].

#2: What Will Be New for E/M Coding in 2021?

Last year brought about a long list of changes to billing and coding, as well as, the medical industry as a whole. From the obvious boom in Telehealth, to the updates in evaluation and management services, those working in the industry were impacted immensely. Based on these shifts in industry and the impact on you, our clients, we thought a look into what was coming in 2021 would be useful—and so did you. You read, reacted, and shared the value of this content with others. Now we are sending you a reminder that this was our number two article for the year. [ Click to read the post ].

#3: Collecting Payments from Patients. Find Out How.

No matter how chaotic things get, there is still a practical side of our industry that needs to be addressed. That is why we worked to keep the focus on the basics, speaking about the ‘bread and butter’ of our industry, collections. In this practical article, we focused on the keys to educating the patient and how doing so will help keep you ahead of the collection as a whole. [ Click to read the post ].

#4: Reports – Nuisance or Necessity?

At the end of the day, you want to go home and no one wants to be stuck in the office doing double-duty on reports. You know as well as we, that getting reports done correctly the first time is key to reducing stress and going home happy. That is why we distilled some of the keys in running reports that would make your life more straightforward. The fourth article on our list will do just that by helping you make sure the dates, details, and destination of your reports are in the right place. [ Click to read the post ].

#5: Why Do I Have A Balance? – Patient Payments

Saving the best for last, especially as we approach tax season, we come in with our final of our best of 2020 by talking about balances. Every practice ends up spending those final hours of the year figuring out where those dollars and cents went. In this article, we gave you tips on deductibles, co-pays, and max out-of-pocket that helps your bottom line. Closing out 2020, don’t miss a few keys to help you balance the books. [ Click to read the post ].

These are EZClaim’s best blog posts of 2020, but these were not the only blog posts we did. So, if you would like to explore the other blog posts we did, click here for our blog page.

————————-

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail support, or call a sales representative today at 877.650.0904.

Oct 12, 2020 | Partner, Trizetto Partner Solutions, Webinar

Reserve your place for a webinar that will inform you on how to increase your revenue with a proper medical billing verification strategy.

With increased patient financial responsibility, it’s extremely important to proactively check your patients’ benefits coverage and provide payment estimates to avoid any unexpected costs. By enhancing your medical billing verification strategy and providing patient financial transparency upfront, it increases the likelihood that you’ll rake in more revenue this season.

Join EZClaim and TriZetto Provider Solutions, a Cognizant Company, for a webinar on Thursday, October 29, 2020 at 1 p.m. ET, to discover strategies your practice can catch falling revenue through seamless integration and automation.

During This Webinar We Will Discuss:

• Patient Responsibility Estimation: Quickly obtain patient financial estimates at the point of service to help increase patient revenue, decrease billing costs, and improve patient satisfaction through price transparency.

• Integrated Eligibility: Connect to payers through a single application to get the most up-to-date information on patient coverage, co-pays, deductibles, and more. Proactively verify patient eligibility, for up to 50 patients at a time directly from your EZClaim Premier program.

• Insurance Eligibility Discovery: Submit a real-time eligibility request using minimal data and identify a patient’s insurance carrier in a matter of seconds. Maintain groups of your common payers and easily locate active patients and full eligibility benefits on our website.

RESERVE YOUR PLACE NOW!

ABOUT THE PRESENTERS:

EZCLAIM: EZClaim is a medical billing and scheduling software company that provides best-in-class customer service and support. To learn more, e-mail them at sales@ezclaim.com or call a representative today at 877.650.0904.

TRIZETTO: TriZetto combines innovative, proven products with an exacting commitment to serving our customers, in order to provide you with the tools you need to effectively manage your reimbursement cycle.

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog, Partner

In the wake of the COVID-19 pandemic, Telehealth adoption has exploded, and there are six revenue cycle metrics to track.

Many patients are prohibited or reluctant to venture out for on-site care. The combination of relaxed regulations and expanded payment parity for appointments has made virtual meetings easier and more attractive for providers, who are turning to these technologies to stay engaged with patients—and maintain cashflow. Dr. Robert McLean, a former president of the American College of Physicians, recently said, “this crisis has forced us to change how we deliver health care more in 20 days than we had in 20 years.”

A new industry report predicts that the number of Telehealth visits in the US will surpass one billion by the end of the year, and speculates that nearly half of those visits will be related to COVID-19. At Waystar, we have been closely monitoring claim trends and are seeing this growth firsthand. In fact, the volume of Telehealth claims on the Waystar platform has grown by more than 100 times since mid-March. On two particular days in late April, they accounted for more than 15% of our total daily claim volume. Before COVID-19, they would have accounted for less than one percent!

For many providers, this shift will require new revenue cycle strategies to meet growing patient demand without overwhelming clinicians and administrative teams—or already strained operating budgets. It’s important to remember this is still very much an evolving care delivery model with the opportunity for errors on the part of both payers, providers, and administrative staff. For this reason, revenue cycle professionals should diligently monitor claims to ensure proper adjudication, identify learning opportunities, and uncover areas for operational improvement.

Below, we’ve listed six core Telehealth-related metrics you should regularly track to ensure billing accuracy, maximize payer reimbursement, and reduce claim rejections and denials. For more on how to best navigate the evolving telemedicine landscape, check out our resource hub here.

To report on Telehealth-related claims, you’ll first need to identify and isolate claims containing Telehealth procedure codes. See CMS’ Telehealth code list to identify the specific procedure codes and modifiers that apply to your organization.

Payer Analysis:

1. Payer Telehealth claim rejections by volume and/or billed amount

2. Payer Telehealth claim denials by volume and/or billed amount

If your Telehealth claims are being denied or rejected, do you know which specific payers are doing so at the highest rate? Drill down to discover the specific reason codes payers are attaching to rejections and denials so you can better understand payer-specific rules and avoid these oversights in the future. In some cases, you may identify trends that warrant a call to the payer to correct.

Provider Analysis:

3. Telehealth claim volume by the provider

Review this claim volume by individual provider. If you notice providers within your organization generating a much lower volume of Telehealth claims than peers, perhaps they could benefit from additional training on Telehealth technology and use cases.

Ensuring Billing Accuracy:

4. Telehealth claim rejections by biller/team

5. Telehealth claim denials by biller/team

Are certain billing personnel or teams producing higher denial or rejection rates than others? Keep a close eye on these trends and remember most of this is new for everyone. If some team members are seeing more rejections or denials than they should, it could be a great opportunity to hold training and collaborate on strategies for success.

Maximizing Reimbursement:

6. Telehealth claim volume by procedure code

Which Telehealth codes are you using? Each code reimburses at a different rate, so choosing the wrong ones could leave money on the table. Be sure to read up on CMS’ requirements (check out their fact sheet and code list) to ensure you’re choosing the appropriate code(s) on each Telehealth claim.

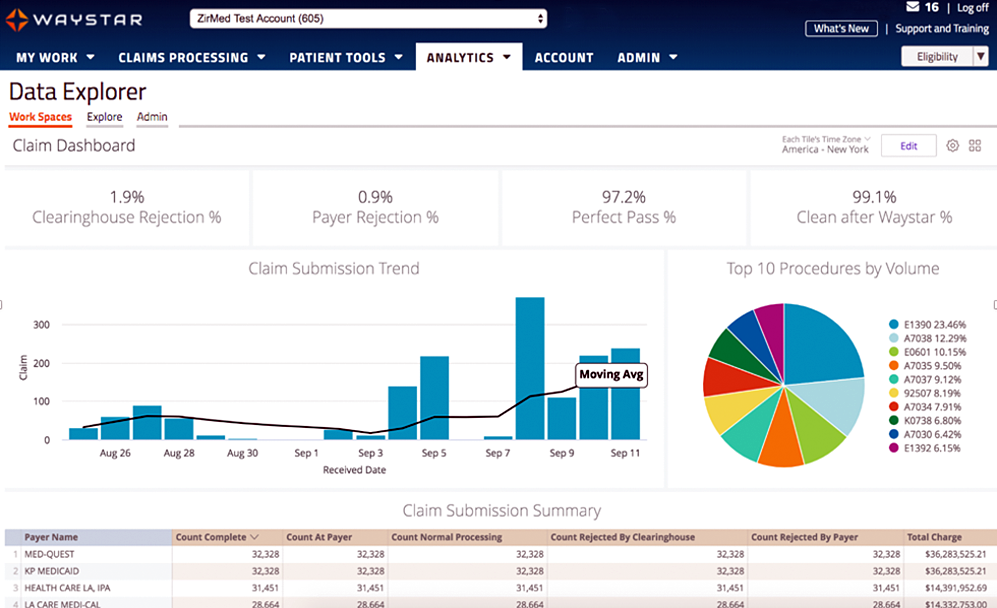

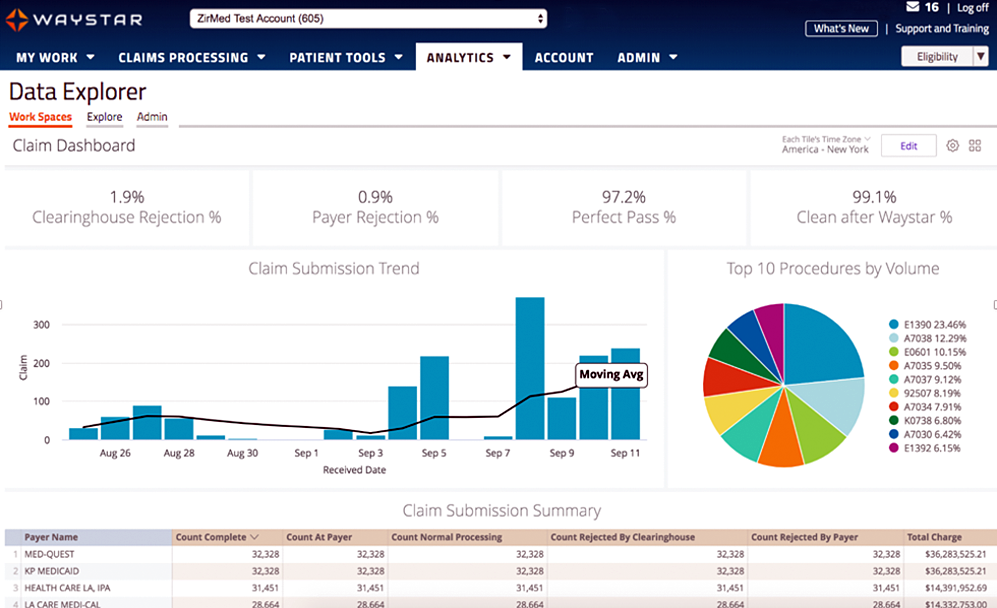

Waystar Analytics

You have all the data you need to drive informed decision making and improve financial performance—you just need the right analytics tool in your corner. Our new Waystar Analytics solution offers a pre-built Telehealth dashboard that can help you easily interpret, share all the metrics above, and track these revenue cycle metrics. Click here to learn more about Waystar Analytics and how it can deliver the insights you need during this time of transition.

[ By Waystar ]

Sep 10, 2020 | Electronic Billing, Medical Billing Software Blog

So, it looks that there will be a lot new for E/M coding (Evaluation and Management) in 2021, and practices should start to get ready for it.

Well, it seems the only constant in the world of medical billing changes, and 2020 would only compliment that cliché. While the chaos of COVID-19 forced many unexpected changes—how you see your patients and bill for services—a bigger change is in the works for 2021. This change will complement the “Patients Over Paperwork” initiative from CMS and the AMA, which has been developed to eliminate “Note Bloat.” So, since the new year will roll out changes to E/M visits, now is the time to make sure that all parties are prepared for this long overdue and welcome change to medical billing.

Evaluation and management services have been long overdue for an overhaul. The 1995/1997 guidelines were in place well before electronic medical records, and with the growth of EMR’s, the process to document for a specific level required a lot of tedious, unnecessary documentation. (A cursory look at some of the proposed updates for E/M CPT coding and documentation requirements will verify that!)

PROPOSED CHANGES:

• History and Examination: While the elements of history and examination that are pertinent to a specific visit shall be recorded, they will no longer be used to ‘score’ the level billed

• Code Selection: It will be based on MDM or time

• Medical Decision Making: It will still utilize the CMS Table of Risk. However, the wording and explanations are being updated to provide more concise language. For instance, definitions will now be included to clearly identify subjective wording like “self-limited and stable chronic illness.” The clinical example will likely be removed, and the terms are more clearly defined. We will see this same type of clarification in the MDM table. For example, the 2021 guidelines will specify that the amount and/or complexity of data to be reviewed must also include analysis.

• Time-based Code Selection: It will also be easier. The guidelines will give specific amounts of time rather than the generic estimate that we currently see attached to E/M codes. Another major advantage to the codes selected based on time, they will now include non-face-to-face services. There will also be additional add on codes—in 15-minute increments—if the time has been exceeded for the 99205 or 99215.

While changes are daunting, this change will be rewarding from a documentation standpoint. So, if you need help with training your team on these new updates, there are FREE videos available on the AMA website, or you can enlist the help of an independent consultant like RCM Insight.

One way of keeping up with these changes is to use EZClaim’s medical billing software, which is continually updated. For more details, visit their website, ezclaim.com, contact them, or just give them a call at 877.650.0904.

[ Written by Stephanie Cremeans of EZClaim ]