Jul 22, 2021 | BC Medical Billing, Medical Billing Software Blog

After Pandemic Impact and Outsourcing Revenue Cycle Management

The impact of the COVID-19 pandemic will be felt in every industry for many months to come. For medical providers, they are facing some of the most challenging financial times they will or have known. Therefore, we understand that it is crucial for providers to re-access their business and look for ways to cut costs with minimal impact on their practice or their patients.

To compound the issues providers are facing, there has been a wave of changes in recent years with new coding and telemedicine requirements that are making it difficult for provider offices to remain independent. Add on the constant rise in the cost of living and expenses while insurance reimbursements continue to decrease, and the issues get worse and worse.

Many have decided that outsourcing to a complete revenue cycle management company could help alleviate some of the undue burdens, cut costs, and keep providers compliant with their coding and billing. Ultimately this allows providers to continue to focus on patient care, which is their goal. As providers, you understand that revenue cycle management is a crucial part of your physician’s office. If not managed properly, it could result in an office leaving thousands of dollars on the table in unclaimed revenue. Over the years, our free audit services have allowed providers to have a free, transparent, and unbiased assessment of how their accounts receivable department functions. We are always amazed at how many providers do their billing in-house, and sometimes even when they outsource, are not aware of how much money they have sitting in their accounts receivables. Getting this knowledge is the first step to increasing revenue and efficiency.

In-house medical billers and third-party outsourced revenue cycle management companies should be giving provider offices monthly aging reports to assess their financial forecast. Each accounts receivable bucket over 60 days should hover at approximately 1 0% or less of the entire revenue balance. If account receivable buckets are higher than 10%, providers may be leaving money on the table, and the account may not be getting worked as providers think they are. In efforts to avoid unpaid claims and a spike in accounts receivable, outsourcing your revenue cycle management to a third-party medical billing company, such as BC Medical Billing, could help providers in countless ways. Many practices recognize that keeping their revenue cycle management optimized is key in delivering regular practice operations; however, they are not always sure how to achieve that. Outsourcing may be the solution!

Outsourcing alleviates the practice from managing a new medical billing employee, paying a salary and benefits, completing training and onboarding protocols, and managing the lost time from a learning curve. Many providers feel that it is not a wise use of the back office executive personnel’s time to worry about finding coders in-house and then wondering if the charges are captured and billed correctly. Instead, the business office should be focusing on how to grow the providers and the physician practice.

Our free audits will help you determine if you have found the right solution for you. If not, we are always there to assist and always increase the provider’s revenue.

ABOUT EZCLAIM:

As a medical billing expert, EZClaim can help the medical practice improve its revenues since it is a medical billing and scheduling software company. EZClaim provides a best-in-class product, with correspondingly exceptional service and support. Combined, EZClaim helps improve medical billing revenues. To learn more, visit EZClaim’s website, email them, or call them today at 877.650.0904.

[ Contribution from the marketing team at BC Medical Billing ]

Jun 22, 2021 | BC Medical Billing, Partner

The impact of the COVID-19 pandemic will be felt in every industry for many months to come. For medical providers, they are facing some of the most challenging financial times they will ever know. Therefore, we understand that is it crucial for providers to re-assess their business and look for ways to cut costs with minimal impact on their practice of their patients.

To compound the issues providers are facing, there has been a wave of changes in recent years with new coding and telemedicine requirements that are making it difficult for provider offices to remain independent. Add on the constant rise in the cost of living while insurance reimbursements continue to decrease, and the issues get worse and worse.

Many have decided that outsourcing to a complete revenue cycle management company could:

-

- help alleviate some of the undue burdens

- cut costs

- keep providers compliant with their coding and billing

Ultimately, this allows providers to continue to focus on patient care which is their goal. As providers, you understand that revenue cycle management is a crucial part of your physician’s office. If not managed properly, it could result in an office leaving thousands of dollars on the table in unclaimed revenue. Over the years, our free audit services have allowed providers to have a free, transparent, and unbiased assessment of how their accounts receivable department functions. We are always amazed at how many providers do their billing in-house, and sometimes even when they outsource, are not aware of how much money they have sitting in their accounts receivables. Getting this knowledge is the first step to increasing revenue and efficiency.

In-house medical billers and third-party outsourced revenue cycle management companies should be giving provider offices monthly aging reports to assess their financial forecast. Each accounts receivable buckets over 60 days should hover at approximately 10% or less of the entire revenue balance. If account receivable buckets are higher than 10%, providers may be leaving money on the table, and the account may not be getting worked as providers think they are. In an effort to avoid unpaid claims and a spike in accounts receivable, outsourcing your revenue cycle management to a third-party medical billing company, such as BC Medical Billing, could help providers in countless ways. Many practices recognize that keeping their revenue cycle management optimized is key in delivering regular practice operations; however, they are not always sure how to achieve that. Outsourcing may be the solution!

Outsourcing alleviates the practice from managing a new medical billing employee, paying a salary and benefits, completing training, and onboarding protocols, and managing the lost time from a learning curve. Many providers feel that it is not a wise use of the back office executive personnel’s time to worry about finding coders in-house and then wondering if the charges are captures and billed correctly. Instead, the business office should be focusing on how to grow the providers and the physician practice.

Our free audits will help you determine if you have found the right solution for you. If not, we are always there to assist and increase the provider’s revenue.

Apr 5, 2021 | Medical Billing Software Blog, Revenue, Support and Training, Trizetto Partner Solutions

In the world of healthcare revenue cycle management, there are numerous scenarios that can put a stranglehold on your revenue if you’re not prepared. With the COVID-19 pandemic causing varying degrees of change in inpatient volumes and visits, and telemedicine coming further into play, physicians and their practices are having to quickly navigate the nuances of their financial well-being. A practice may be buttoned up from the time the patient walks in the door, but what happens after the visit will determine when the practice will get paid. This element of the revenue cycle starts with coding. Here are five medical coding challenges that will ruin your bottom line.

1. Coding to the Highest Specificity

Missing data on a claim relative to the patient’s diagnosis and procedure can easily cause a rise in denials once received by the payers, resulting in potentially thousands of dollars in write-offs. Medical coders are responsible for coding patients’ claims to the highest level of specificity, ensuring the appropriate CPT, ICD-10-CM, and HCPCS codes are applied based on the patient’s chart from the day’s services.

COVID-19 and telemedicine are frequently bringing on new codes and code sets, all with different variations and modifiers to make the matter even more complex. Medical coders spend a lot of time researching and learning new codes, but every year – and throughout the year – changes and updates are made. Payers don’t only want to know the diagnosis and the treatment; they want to know the cause as well. The Coronavirus Aid, Relief, and Economic Security Act passed in March of 2020 allows for an additional payment from Medicare of 20 percent for claim billed for inpatient COVID-19 patients, however, it was later indicated that a positive COVID-19 test must be stored in the patient’s medical records in order to be eligible for this payment. Being able to stay on top of codes specific to the patient’s diagnosis at treatment is more difficult than ever before.

2. Upcoding

While code specificity is important, so too is ensuring the claims do not contain codes for exaggerated procedures, or even procedures that were never performed, resulting in reimbursement for these false procedures. This seems logical enough, but upcoding can easily occur as a result of human error, misinterpretation of a physician’s notes, or lack of understanding of how to appropriately assign the thousands of ICD-10-CM codes in existence. To add to the pressure, the Office of the Inspector General issued a plan with objectives to prevent fraud and scams, and remedy misspending of COVID-19 response and recovery funds.

Much like under-coding or not providing enough data on the patient’s visit can create issues, upcoding can be a major contributor to financial loss for a practice. Questionable claims can be denied and sent back for corrections and appeals, but upcoding can have more serious ramifications outside of paper-pushing between coders and payers.

Whether it’s making sure the codes are in accordance with the care provided, understanding the code sets that apply for each procedure, or comprehension of the medical record, refraining from upcoding will help ensure a sturdy and compliant revenue stream.

3. Missing or Incorrect Information

There’s a common theme to coding challenges, and that’s having the sufficient information necessary. This information typically is pulled from a patient’s chart or record of a visit, which is often completed by the attending physician. However, even when a claim is submitted, providing required information relative to the procedure to the payer is critical as well. Situations such as failure to report time-based treatments (such as anesthesia, pain management, or hydration treatments) or reporting a code without proper documentation can result in denials.

Furthermore, information in a patient’s electronic health record may also contain inaccurate information. Keystrokes and other human errors can cause these situations to flare up, and it takes a diligent, thoughtful coder to read between the lines and ensure claims have the appropriate information.

4. Timeliness of Coding

The Medical Group Management Association (MGMA) suggested in their 2018 Setting Practice Standards report that a Primary Care Physician should maintain a claim submission rate of 3.11 days after the date of service, but it is becoming increasingly difficult for practices to sustain anything close to this rate. Constant changes to code sets, an increased focus on submitting claims with sufficient and compliant information, and the requirement to code claims to the highest level of specificity, can easily delay the submission by days or weeks.

Nevertheless, delays in coding and submitting claims can cause major lags in payment and substantial loss in revenue. Insurance payers have statutes of limitations that require claims to be submitted anywhere from 120 to just 60 days after the date of service. Simply put – the more time spent coding the claim, the later it will be submitted, thus increasing the odds that the claim will be denied. Expert coders are aware of this and do everything in their power to get coded claims out the door.

5. Staffing Shortages

However, finding experts well versed in coding claims quickly, accurately and in compliance with the False Claims Act is not always an easy task. As you can imagine, the increasing need for care within the senior population is causing a rise in claim volumes, and trying to find a team of coders who know the ins and outs of complex ICD-10-CM coding can easily cause a bottleneck in the revenue cycle. Health executives expressed their struggles to find talent back in 2015, and some forecasts expect a decline in commercial payments by 2024 to further hamper a C-suite’s ability to manage labor costs. The ramifications of incorrect coding are still a key topic of discussion to this day.

The time has come for practices to begin looking outside of their organization for coding support. How is your practice planning to tackle the coding conundrum? When choosing a partner for your medical coding needs, you need to pick an expert to help your practice stay on target. TriZetto Provider Solutions, a Cognizant Company, has available highly-trained, AAPC & AHIMA certified coders with the experience of getting the details right the first time and understand the importance of coding to the medical practice.

For more information about TriZetto Provider Solutions, a partner of EZClaim, visit their website, contact them, or give them a call at 800.969.3666.

ABOUT EZCLAIM:

EZClaim is a medical billing and scheduling software company that provides a best-in-class product, with correspondingly exceptional service and support. Combined, they help improve medical billing revenues. To learn more, visit EZClaim’s website, e-mail them, or call them today at 877.650.0904.

[ Contribution of the TriZetto Provider Solutions Editorial Team ]

Aug 11, 2020 | Features, Medical Billing Customer Service, Partner

Which is the BEST kind of Medical Billing Software? “All-in-One” or “Specialized”?

When considering WHICH medical billing solution they should use, practices wonder which is best, an “all-in-one” solution or specialized software. Well, the following are a few important pros and cons to consider when making a choice between these solutions.

ALL-IN-ONE:

An “all-in-one” system tries to provide a single, comprehensive solution that offers functionality for the major areas of the practice—Practice Management (PM), Electronic Medical/Health Records (EMR/EHR), and Revenue Cycle Management (RCM)—accessed from one central point. It has features like clinical notes, patient information, and history, diagnosis and treatments, scheduling, appointment reminders, reports, patient educational resources, as well as a medical billing section.

PROS:

• Most of what a practice need is included in the system

• There is no need to be concerned with multiple integrations or vendors

CONS:

• Tends to have a higher ‘entry’ cost

• Usually designed for the “middle-of-the-road,” therefore sometimes doesn’t properly address specific needs of a practice

• Sometimes, the practice is left paying for additional customizations to fit their particular needs

SPECIALIZED SOFTWARE:

Specialized medical billing software, on the other hand, is particularly programmed to maintain billing details of tests, procedures, examinations, diagnoses, and treatments conducted on patients. However, many specialized software providers extend their scope to include features like practice management, scheduling, and other administrative and clinical functions (that are generally a part of EHR software systems) by partnering with other specialty software companies—creating a “best-in-class” solution.

PROS:

• Integrating multiple “best-in-class” software packages—each taking a much more focused approach—creates an offering with much more in-depth capabilities

• Usually are more ‘nimble’ in responding to industry and regulatory changes

• More ’scalable’ in supporting the growth of a practice

CONS:

• Most of the time the practice has to deal with multiple vendors

CONCLUSION:

Where “all-in-one” solutions offer a wide breadth of capabilities across the business, they usually also lack focus, depth, and sophistication. “All-in-one” solutions are usually only efficient in one area, with the other areas tend to be ‘compromised’ and not fully developed. Then, when it comes to flexibility, they tend to be slow to adapt to changing practice needs.

Specialized software, however, typically offer a more efficient experience, with each ‘component’ streamlined and designed with a specific purpose in mind. Their focus on limiting the software scope makes them flexible and easy to use.

EZClaim—a leading software package in medical billing and practice management—has made it easier for the medical practice to have the benefit of a “all-inclusive” solution. They have created the best of both worlds by taking on the responsibility of integrating the “best-of-breed” into a harmonized “best-of-class” offering that allows the practice to pick and choose for their specific needs. The seamless integration of partner products and services ensures the practice does not have to give up robustness and flexibility for a simplified “all-in-one” solution, and it further enhances the practice’s workflow.

As a specific example, one of EZClaim’s partners is TriZetto Provider Solutions (TPS), a provider that seamlessly blends claims processing with revenue management and analytics software, so the practice can get paid faster, and more accurately.

Today, the practice can get the benefit of all the power and ease of use of EZClaim’s medical billing software and all the access and security that is needed when dealing with personal records by using TPS—which includes patient access, claims and denials management, patient financials, and advisory services.

The powerful integration between EZClaim and TPS efficiently adds functionality to the practice. Now the practice can gain deeper insight into the claim lifecycle, and take the proper steps to improve the overall health of the practice. The right ‘integrated’ solution makes all the difference!

So, if your practice needs more confident billing, after payments, and more informed decisions, but the power of EZClaim and TPS to work for your practice with the integrated suite of revenue cycle solutions.

In addition to TPS, EZClaim has tightly integrated a variety of of ‘components’ to be able to offer an “all-inclusive” best-in-class solution for a medical practice’s needs: Electronic Health Records (EHR), Clearinghouse, statement and payment services, HIPPA compliance, claims scrubbing, appointment reminders, and inventory management. It has partnered with a variety of providers like QuickEMR, BestNotes, and PracticeFusion [ Click here for an entire list of EZClaim’s partners ].

It is important to note that an “all-in-one” solution does not usually include the Clearinghouse portion that TPS offers. The powerful integration between EZClaim, TPS, and EZClaim’s EMR partners, efficiently adds functionality to ANY practice!

If you are considering the best course of action to meet your practice’s needs, consider using EZClaim by downloading a FREE TRIAL or contact one of their product specialists today to explore all the options for how to best solve your practice’s operational challenges, and grow your business.

For details and features about EZClaim’s medical billing software, visit their website.

Mar 10, 2020 | Health eFilings, Partner

There are many commonly misunderstood aspects and nuances with the MIPS program, particularly in how points are earned. For a healthcare practice, it can be challenging to know exactly what to do to earn points, optimize the score, and protect their Medicare reimbursements. But, at the same time, the stakes have been raised every year and the final ruling of the program is even more complex than it has been in the past, further increasing the stress, burden, and financial risk for a healthcare practice.

The approach a practice takes to report for MIPS will greatly impact the results. Many do not understand or have awareness of, the different reporting methods available to them. Many Providers erroneously still think that a registry is the only reporting option available to them or that they are required to use a registry. Or, they think that their EHR covers their reporting obligation or that an EHR’s reports satisfy the MIPS requirements. These misperceptions and erroneous assumptions are detrimental to the financial interests of any practice.

There is a third reporting methodology that has been established and authorized by CMS, called CEHRT, or Certified EHR Technology (software). The CEHRT methodology assists CMS with their need for more valid data submitted through technology and to refocus Providers from merely using technology towards Providers leveraging technology to improve outcomes. Reporting via a CEHRT using software that has been certified by the ONC is a superior approach because it optimizes the points that could be earned and therefore, maximizes Medicare reimbursements for the practice.

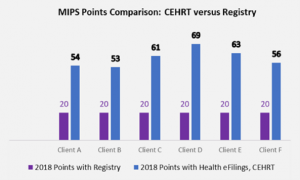

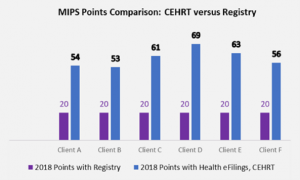

Recently an RCM company CEO approached us at Health eFilings with the decision to use six of her clients to conduct a side-by-side comparison of the registry and Health eFilings (CEHRT) methodologies for reporting. In this manner, she intended to validate for herself whether a CEHRT or registry would generate the greatest ROI for her clients. The results of using Health eFilings’ MIPS Accelerator service, on average earned almost triple the points versus a registry for the same year for the same clients.

“Due to limited understanding and guidance, we weren’t aware of the differences of the reporting methodologies available for my clients. We believed there was greater opportunity, but the current registry methodology we had chosen didn’t demonstrate that for our clients.”

Katy, RCM Company CEO

This side-by-side comparison highlights not only that a CEHRT is a superior method of reporting as Health eFilings was able to leverage technology to facilitate the ease, accuracy, and completeness of tracking and reporting, but it also maximizes a Provider’s MIPS score. Additionally, given the levels of Medicare reimbursements for these practices, the higher score resulted in their earning a positive payment adjustment, which significantly improved their bottom line. And, take note that if the Registry were to perform the reporting for the 2019 reporting period, these practices would not earn enough points to avoid the penalty of negative 7%.

Health eFilings with its proprietary ONC certified software has many advantages over any type of registry:

- Automatically extracts data from any EHR or billing system

- No staff or IT time required to comply

- Benchmarks performance versus peers based on CMS standards

- The proprietary algorithm evaluates 9 million combinations to select the best quality measures to optimize the score

- Earn 10% in bonus points for the Quality category

- eCQM deciles earn more points than registry deciles

- Almost all eCQM’s have a CMS benchmark versus less than 25% of registry measures

- Electronically submits the data to CMS

And, important to note that it’s NOT too late to comply for the 2019 reporting period as Health eFilings is able to support new clients, but time is of the essence. Reach out NOW if you or your client hasn’t reported for 2019—there is NO REASON to accept the 7% revenue hit.

Now EZClaim and Health eFilings want to ensure you can partner with the only complete, end-to-end MIPS compliance solution that saves you significant time and money. To learn more, click the following link: https://healthefilings.com/ezclaim

[ Article was written by Sarah Reiter, Vice President of Strategic Partnerships with Health eFilings ].